02/02/2026: Ideas For The Upcoming Week

I waited until this evening to release my ideas for the week article because my bias on Sunday night wasn’t clear enough. We kept kind of holding the 8 daily MA, but price action was looking pretty weak. Today has been a strong day and we’re once again above the key moving averages for the time being so it’s hard to currently make a bearish argument.

The bearish news is that earnings reactions last week for MSFT and AAPL weren’t great. AAPL had some very strong earnings but we only saw a 0.7% move after hours whilst MSFT dropped ~5% AH on some slightly negative Cloud growth numbers.

All in all, last week was weird and very difficult to gauge where the markets want to go and what narrative to follow. In these instances, it’s best to play it slightly safer and not be too aggressive, though the SPY is currently above all relevant moving averages again, my gut feeling is slightly more to the bearish side. I never let my gut dictate my investment decisions as price action always dictates that. I like to remain impartial with a rules based approach rather than letting emotion drive my investing.

Ultimately, people have been calling for a bear market for 3+ years on X…that’s letting your emotions and gut dictate investment decisions. I’m sure those same people will be part of the “I told you so” crowd if we do get a pullback after missing out on some of the biggest winners in stock market history over the last 12-24 months.

This is the last few hours my prices for my paid service will be at $16. After that any NEW subscribers will be paying 50% more than my current rates. If you subscribe before midnight tonight you’ll lock in the $16 a month (or $160 a year) forever.

With my paid service you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet and theme tracker. Currently there’s about 250 stocks on there but I’m adding new ones every week as I work my way through the themes I’m most bullish on.

Access to my paid chat where I send 5-20 messages per day.

Real time buy, add, trim, and sell alerts.

Give it a go. I suspect you’ll find it far more valuable than $16 a month.

Defensive

Classifying NVDA as a defensive stock is something I never really thought I’d do but at these prices I think it is.

In times of potential fear, the best way to ultimately play defensive is to position yourself away from speculative names and into huge FCF generating machines. Those FCF giants don’t necessarily have to be in more “defensive” themes like healthcare for example. The new Fed chair is expected to be bullish on AI (how can he not be) so a stock like NVDA which I currently own is one that I won’t be scared to rotate more heavily into if the time comes to play less aggressively.

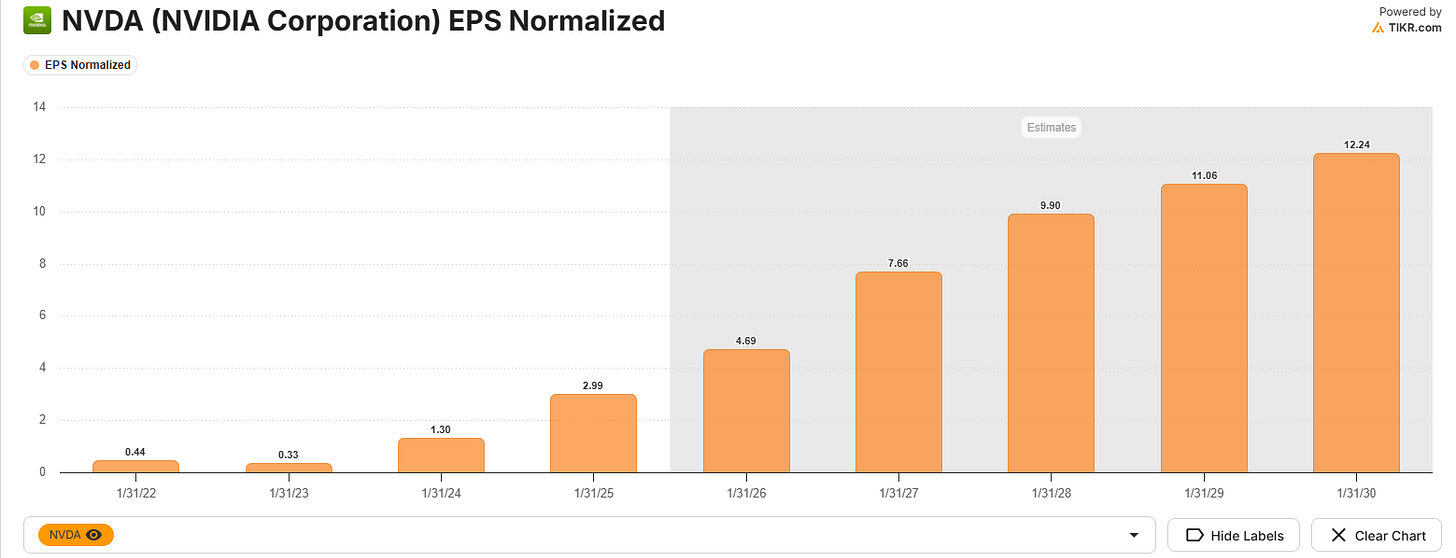

Here’s the analyst estimates from Tikr.

I think it’s very important to reiterate this:

The stock in the Mag 7 currently trading at the lowest Fwd PE is META at 23.3x. For that multiple, you get a 5% expected EPS growth in FY26. NVDA has the next lowest EPS multiple at 26.4x, but for 57% expected EPS growth in FY26.

NVDA currently trades at a PEG of 0.70x whilst the next lowest is META at 1.2x PEG. If this isn’t a simple sign of a nice margin of safety for NVDA I don’t know what is.

Neutral Risk

I spoke about HROW last week so I was adamant to mention it again, but I think the opportunity here is great and it remains one I am watching very closely at the moment for a nice entry which I think could potentially be around here at $45.

HROW CEO today:

“Our team delivered another year of strong growth in 2025, supported by positive demand trends across our key revenue-driving products, as well as meaningful progress with other parts of our portfolio, all of which we look forward to discussing further in early March.”

Management today reaffirmed that FY25 revenue will be between $270M-$280M which is why the stock is up ~10% today. There were some clear worries amongst investors that FY25 revenue could be weaker than expected but management’s guidance affirmation today is a great sign.

A reminder that management have also guided to a $250M quarter in FY27. With that being said, it’s fair to assume a $1B (or very close to) revenue in FY28. At 35% EBITDA margins, it’s fair to then assume $350M in EBITDA by FY28 which would be a 72% CAGR in EBITDA.

That kind of growth rate is deserving of at least a 30x multiple (currently 16x). $350M * 30x (I think this is a very fair bull case) puts us at $10.5B EV which is a 483% increase from today.

A very fair and not too aggressive bull case over the next 3 years.

Higher Risk

Keep reading with a 7-day free trial

Subscribe to Make Money, Make Time to keep reading this post and get 7 days of free access to the full post archives.