02/09/2026: Ideas For the Upcoming Week

Last week was brutal. There’s no getting around that. If you look at the SPY (which I mostly do), things don’t look terrible. We had 3 days of red, followed by a nice bounce off the 100 daily MA on Friday.

If you look at the QQQ, it’s a very different story. We completely broke structure and fell below the 100 daily. The QQQ still in the short term remains in a definite down trend. We’re lower than Jan 21st low and lower than the 100 daily. I think there’s a good chance on the QQQ we could hit this 612 level around the 100 daily and then retrace back downwards from there. That’s probably my best guess.

What happens to the SPY from there is likely a drop below the 100 daily.

Back to the SPY… but this time on the weekly. We bounced off the 21 daily on Friday. That 21 weekly MA is pretty much around the same level as the 100 daily MA meaning that 678 level is absolutely key to whether I have a bullish or bearish bias going forward. Until we break that level, I’d say we’re still in a bullish market…though it doesn’t necessarily feel like it.

With my paid service you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet and theme tracker. Currently there’s about 250 stocks on there but I’m adding new ones every week as I work my way through the themes I’m most bullish on.

Access to my paid chat where I send 5-20 messages per day.

Real time buy, add, trim, and sell alerts.

Give it a go. I suspect you’ll find it far more valuable than $24 a month.

Defensive

AMZN dropped massively post Q4 earnings because of huge CapEx spend. There are two main schools of thought here.

Bears argue AMZN are needing to spend huge amounts in CapEx just to maintain growth and that a “forever CapEx cycle” is going to be the reason FCF always stays low.

Bulls argue that this $200B CapEx is warranted and will pay huge dividends in the future when they focus on maximizing shareholder value. This is exactly the side I sit on. Just 3-6 months ago, huge CapEx was rewarded by the market. It was essentially a race to secure compute scarcity and for those that had the capital to spend, it ultimately was securing their dominance for years to come. Just a few months later in a slightly risk-off period, the market has started really questioning these numbers.

Here’s a quote from UBS analysts which I mostly agree with:

“Similar to its megacap Internet peers, Amazon provided 2026 CapEx guidance well ahead of expectations at ~$200B (vs UBSe $150B and cons $146B). As its methodology for AWS demand forecast likely has not changed (and still functioning well), our base case forecast now contemplates that segment growth rate in 2026 should double to 38% vs 2025’s 19%, while Performance Obligations/backlog should also correspondingly ramp to ~$400B by year end.

If this level of capital intensity holds into 2027, growth should maintain in the mid-30% level to essentially double the segment revenue and Operating Profit in two years. 2027E GAAP EPS should reach ~$14 and AMZN shares are hence trading at ~14x – which is a significant discount relative to its megacap peers, despite a superior EPS growth profile (41% 2-year CAGR to 2027E).”

AMZN dropped down to $200 for a brief period on Friday before bouncing back up to $210. I’m a happy buyer anywhere between $186 and $212 and I’ll likely be leaning into this position more over time.

Neutral Risk

If you haven’t seen it yet, SOFI’s CEO Anthony Noto did a 50 minute interview with Future Investing. Here’s a link to it (full credit to Tannor for organizing that).

I think it was one of the most bullish SOFI interviews I’ve ever watched and it gives me a lot of confidence (along with Q4 earnings) to keep holding my position that I have an average cost of $8 in. Anthony Noto was an open book in the interview which is always nice to see from CEO’s.

“In Q1, our revenue growth is 35%…I would be incredibly disappointed if our first quarter was the fastest quarter of the year.” - Anthony Noto

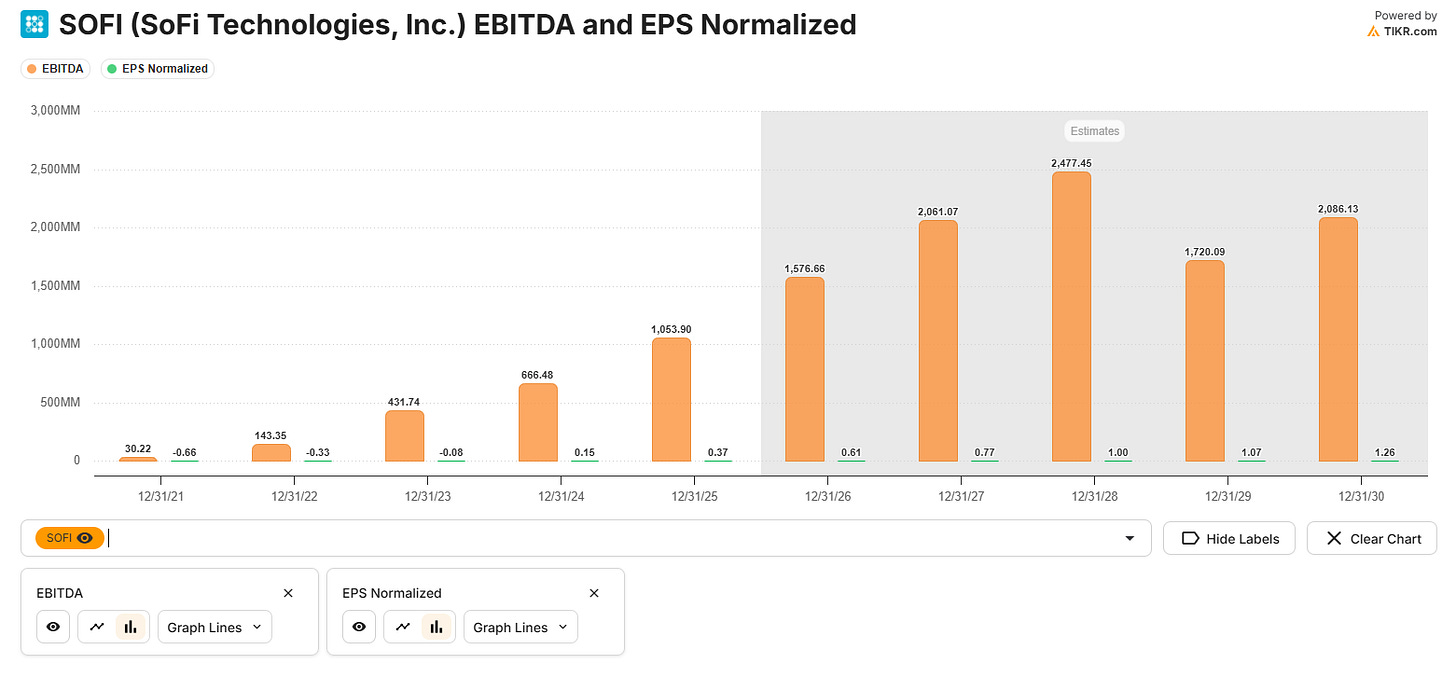

Most recent earnings came in with FY25 revenue at 38% YoY, EBITDA at 60% YoY, and net income at $0.39 EPS, up 2.1x. Noto also discussed their crypto and blockchain push with SoFi USD stablecoin, SoFi pay (cross-border payment on blockchain, and crypto trading.

They also guided for $1.6B in EBITDA in FY26 which is just over 51% growth from FY25. That means we’re trading at 16.5x 2026 EBITDA for 51% growth. That’s incredibly good.

It gets better though - management guided to an EPS CAGR of 38-42% through to 2028. For that growth, SOFI currently have a multiple of 34x whilst peers like HOOD have a multiple of 32x though they’re growing EPS at 1/3rd of the growth rate that SOFI is (though with better margins).

I’ve been fairly reluctant to add to SOFI above $25 especially with my cost basis of $8, but I think here at $21 SOFI is finally fairly cheap again and I’d consider building out my position slightly more than it is now.

Higher Risk