12/08/2025 - Ideas For The Upcoming Week

5 Charts

Hi all 👋

The SPY ended the week very flat +0.34% with a bearish looking candle on Friday. Fortunately, our portfolio beat the SPY quite comfortably this week aided by PATH’s earnings but many more as well.

At the weekly candle it’s still clear we’re struggling to make a higher high above the end of October’s high at $690. I wouldn’t be surprised at all if we see a red week this week based purely on the technicals. We have the FOMC policy meeting on December 10th with markets pricing in a 25bps cut. I think no cuts could cause a selloff in the SPY especially rate sensitive stocks in our portfolio like RKT, and UPST. Lower December liquidity could amplify these moves.

If you look at Big Tech again like GOOGL, momentum is slowing. Here’s GOOGL on the weekly. Last week looked more like a consolidation rather than strong momentum.

AMZN, one of my largest positions had 4 consecutive red days.

Overall, I think December is going to be one of those months where I play things a bit more careful. I won’t be that aggressive with entries and I’ll make sure to wait until there’s levels I really want. The only one I haven’t done this with has been PATH but I wanted to make sure I built a nice position before earnings which ended up popping the stock up +25%.

So with this in mind, here’s some of the best plays I see in the market today. Similar to last week, I’ll break it down into defensive, neutral, and aggressive.

Defensive

Last week I spoke about healthcare. This week I’ll talk oil.

There’s been some mixed narrative on oil on X and other articles I’ve read. Wall Street have been generally very gloomy on oil forecasts with Goldman predicting sub $50 Brent by mid 2026 based on surplus of 4 million barrels per day.

However, if you dive into it more, the WTI price relative to M2 money supply (broad measure of US money supply tracked by Fed) is at levels lower or similar than previous bargains (2009 crisis, 2016, and 2020). We’re at a ratio of ~0.00265 which is below 2009 low of 0.0039 and slightly above 2016 and 2020 dips. I think there’s every chance we could see oil ~$50 but if you’re getting increasingly bearish on the US tech world, I think DCA’ing into XOM, or OXY here could be a nice play. They also offer nice dividend yields in the 2-3% range.

I remain bullish on healthcare and AMZN that I spoke about last week as well.

Neutral Risk

PATH

PATH reported on Wednesday. You can see my Deep Dive and Earnings Review here.

The earnings report played out more or less how I expected. We didn’t see any material proof of Maestro in the numbers, but we did see some very nice fact-based evidence that Maestro was working extremely well. PATH now sits at quite a key resistance level which I suspect we will pullback away from until we see some more good Maestro news. I think any small dips in PATH in the $12-$18 range offer a nice area to start building your position.

UPST

I also included UPST last week, but again I think this offers some nice opportunity this week at current valuations especially with FOMC meeting on Wednesday which could send UPST +5% or so on rate cut news. UPST has generally moved ~4-5% on rate cuts news historically and I don’t see this week being any different.

Remember:

Founder just purchased $3.9M worth of stock.

Institutions are massively increasing their stakes.

43% expected EBITDA growth for 20x NTM EBITDA

Cheap.

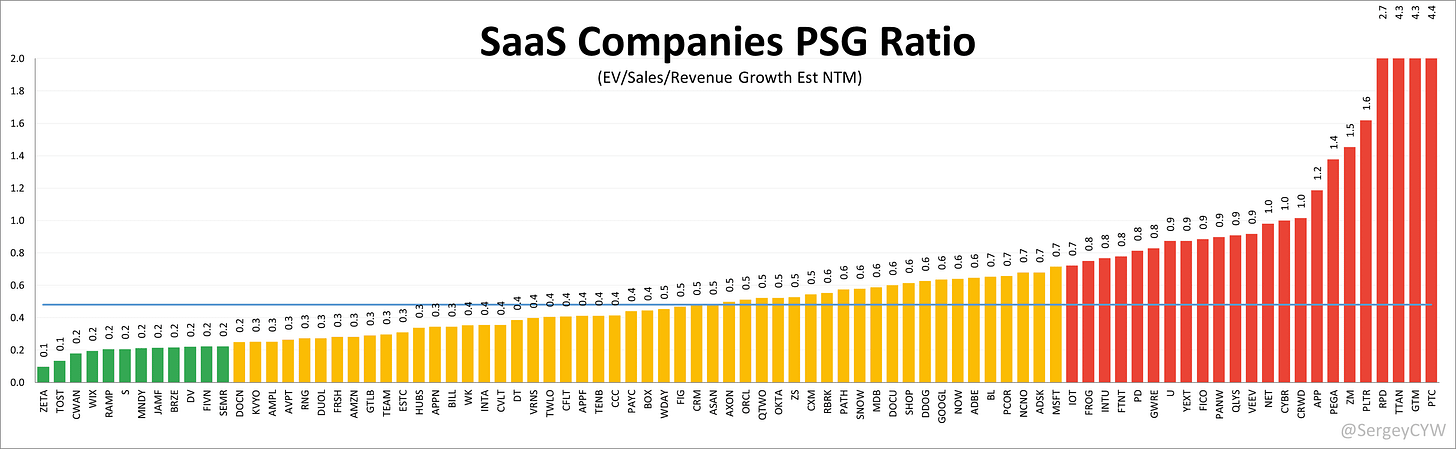

ZETA

Full credit to SergeyCYW for making this chart he posted on X. It’s got a list of SaaS companies based on PSG (Price/Sales/Growth) which offers a nicer perspective than just P/S and it’s what I base a lot of my Spreadsheet on for Paid Subscribers. I have a list of many stocks based on sales/EBITDA/EPS all relative to growth metrics and then from there I make label them as attractive or not.

Consider joining us for $16 a month. 2026 prices will be going up.

Anyway, look at the cheapest stock on the list - ZETA.

Aggressive

Here’s 2 higher risk plays that I’d like to build positions in soon.

SMR

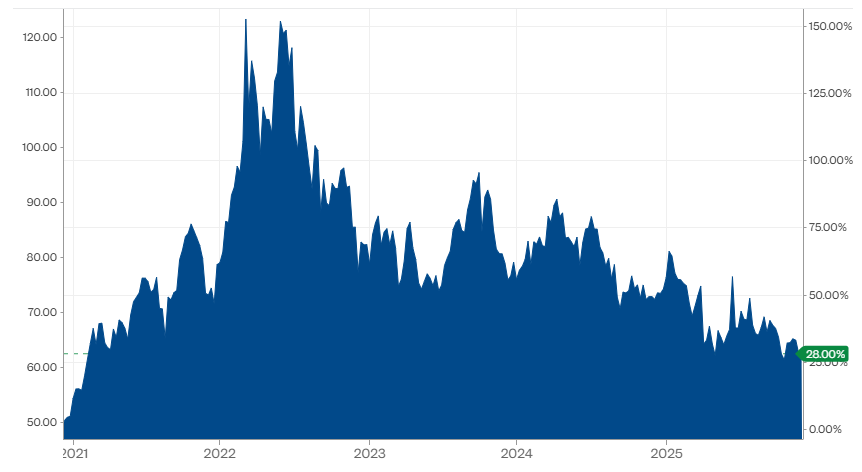

SMR remains very high risk since it’s still not building SMR’s (likely won’t for over a year). SMR is therefore purely a play on whether you think they’ll be successful in building small nuclear reactors to overtake large players like CEG. I think a good way to play this is wait for price to come back down to the key support line and then start building a small position around that zone as soon as we see some rejection of the support. We’ve already seen one nice bounce there so I think if we get 1-2 more then this key support at $17 could be a nice short term bottom.

ABAT

ABAT is another high risk play, but it’s a nice long term play on battery demand and general electrification. If you look at ABAT from a big picture view, you’ve got:

A company in a niche I am bullish on long term.

Soaring revenue

Stabilizing costs

Lithium ion batteries have had a lot of money invested into them. I don’t see in the next 5-10 years demand here going down because of alternate technologies, but this is of course a risk.

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Concerning oil (and other raw materials): i wonder whether it makes more sense to look at picks and shovel because these companies usually earn money independently from the raw material‘s price.