📈2 Compounding Machines

Stocks I'd happily buy now and not look at for the next decade

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

It’s #WednesdayWisdom

Today is all about compounders.

Those stocks you find early that just grow and grow and grow over time. I’ve got two of them for you, likely one’s you haven’t heard of before.

📈Characteristics of a Compounder

Owning “compounders” is the main aim for investors. It allows you to find companies where you can sit back and watch your investment consistently beat the market year after year.

But defining a “compounder” is difficult.

You can think of it qualitatively:

Compounders are those companies that have a predictable future and long term growth prospects due to the sustainability and longevity of their competitive advantage.

And you can think of it slightly more quantitatively:

Compounders are those companies which can consistently growth their intrinsic value by +15% annually for a period of 10 years plus. However, intrinsic value is of course quite subjective.

Therefore, I also think of it as those companies that reinvest their excess free cash flow back into the business at sustainable rates of return. If ROIC holds constant, invested capital and FCF will subsequently compound at ROIC.

As per this example:

Now let’s dive into two companies which I believe are some of the best compounders in the market.

▶Compounding Machine #1 - Dino Polska

First up in the list of compounding machines is a Polish grocery store. In terms of revenue and number of stores, Dino Polska is one of the fastest growing grocery networks in Poland, however they don’t compete directly with the larger discounters and supermarkets. This is key to their strength.

They target smaller communities in more rural areas. With 80.1% of Poland’s population living outside urban areas, this clearly is a good strategy.

➡Business Model & Strategy

Dino Polska’s business model is based on a very standardized store design that supplies proximity customers with fresh products everyday. They strategically place their stores in less urbanized areas such as towns, villages, and suburban districts.

Here’s some bullet point facts about the business model:

Currently operates 2,406 stores (growing at 22.2% annually since 2014).

Each store offers approximately 5,000 products (95% are brand-name products).

Products are primarily sourced directly from manufacturers as opposed to wholesalers (leads to higher margins).

There are currently eight distribution centers (each center caters ~300 stores).

Important note

Unlike most retail or grocery stores that lease the buildings, Dino Polska own 95% of their stores. They’ve managed to do this through Krot-Invest, a company solely dedicated to the construction of Dino Polska stores.

In Poland, owning real estate (from year 7 and beyond) is cheaper than leasing measured in NPV terms. This gives Dino Polska a financial competitive advantage over peers.

Plus, they also have full control, less negotiations and less lawsuits, more standardization, and easier forecasting of costs. All in all, owning the real estate is a massive advantage.

🎯Strategy

Dino Polska focuses on three areas:

Continued rapid organic growth in store count

Continued growth in LFL sales revenue

Consistent improvement in profitability

Competitive Advantage

💲Price

Dino Polska’s management have a price-benchmark policy in that they benchmark the prices for 500 of Dino’s top selling products to those offered by larger discounter grocery chains.

51% of Polish grocery shoppers indicated price as the key consideration for choosing their grocery store. This is key because Dino has been able to create a strong relationships with the neighborhoods in which the stores are located. The Dino Polska brand has become associated with low prices, convenient locations, and yet still fresh and quality products. This type of brand power leads to customer loyalty.

✔Convenience

Consumers strive for four things: price, quality, selection, and convenience.

Given the small store designs of ~400m by 400m, catchment areas are just 2,500 people living within a 2km radius for the vast majority of stores. This is considerably lower than competitors who require much higher sales volumes just to achieve the similar profit levels. These larger stores typically have catchment areas of 10,000 to 30,000 people which generally requires much higher advertising costs to reach the same level of store profitability that one Dino Polska store can record.

And plus, Pole’s tend to have a much higher frequency of grocery trips than other EU nations and the USA. Poland has the 3rd most overcrowded living conditions in the EU, leading to a likely smaller kitchen/refrigerator space, and subsequently the need to do smaller, and more regular grocery shops. Of course, consumers therefore want to limit the distance they travel as much as they feasibly can.

🏰New Entrants

It’s relatively difficult for a new entrant to replicate Dino’s business model. There’s four main reasons for this which are the building blocks to why Dino Polska is such a compounder:

Dino have managed to build extremely quickly. They’ve grown store count at ~22.1% annually which is very difficult to do. Even if a new entrant is able to grow at this rate over the next 10 years, by this time Dino Polska’s network could easily be +10,000 stores.

Dino’s 2,400+ stores would cost +$1.5Bn to rebuild today. This upfront capital massively limits any new entrants. Of course, larger conglomerates would likely have this type of funding, but there’s few large conglomerates that have a business model similar to Dino’s.

In Poland, Dino has a very strong brand offering low prices in very desirable locations. A new entrant would firstly struggle to undercut Dino’s already low prices. Secondly, the most desirable real estate locations have already been taken by Dino Polska. New entrants in the same market would have to accept the less desirable store locations and therefore would have much less success even if they managed to replicate the business model well.

Lastly, and arguably most importantly, Dino Polska management and founder have 23 years of experience. The knowledge and expertise they possess is a key advantage.

📈Opportunities

Dino Polska currently is more focused on Western Poland.

There’s no evidence to suggest that Eastern Poland has less attractive prospects than Western Poland. It just appears simply that their growth strategy, and distribution centers have focused mostly on central and Western areas. Therefore, there is massive expansion opportunity and with current growth rates, Dino could likely hit 11,000+ stores in the next 9-10 years.

Note that this estimate does not include any international expansion. The domestic growth opportunity in Poland is still so large, and therefore, if any, international expansion I’d imagine would still be around a decade away. Nevertheless, neighboring nations like Czech, Slovakia, and Lithuania are obvious candidates for any international expansion. They too have modest GDP per capita’s and large populations living outside the most urbanized areas.

🔢Graphs and Fundamentals

Here’s the current price chart:

The stock recently saw a decline from February onwards. From a technical point of view (though I focus very little on price charts), the price is currently sitting at a nice support level from 2021 and 2022 highs.

Here’s ROE and ROIC showing a nice 10-year gradual trend upwards.

Gross and net margins are solid, especially compared to competitors. 2021 onwards has seen a slight decline in margins which is a shorter term concern with the rising food inflation levels which is fairly difficult to pass along to already stretched consumer wallets.

Over the longer term, food supply chains should normalize as Russia-Ukraine conflicts subside so as long as Dino Polska can weather the shorter term storm, which they appear to be doing, I don’t believe this is any worry. In fact, compared to peers, Dino are managing to maintain a sufficient margin very well.

Finally, here’s a quick indication of just how impressive (and quick) Dino’s growth has been. The business model is extremely scalable and repeatable.

🔑Conclusion

As we touched on at the beginning of this article, a compounder fundamentally is a company with a sustainable competitive advantage that leads to high ROIC and high FCF. Dino Polska does this, very well.

Management has successfully created a business with strong structural barriers meaning that it’s close to impossible (and if so very timely) to replicate the business model. If you align this with a wider industry pivot towards smaller, and more convenient/accessible grocery chains which we are seeing in Poland, you’ve got all the characteristics of a compounder that is only just getting started. With a growing domestic total addressable market and international expansion likely over the next few years, Dino Polska has all the qualities of a stock that I’d be happy to hold on to for the next 20 years.

▶Compounding Machine #2 - Duratec Limited

Duratec is an Australian-listed micro-cap (market cap is AUD$300m) company that isn’t very well known outside of Australia. The company has consistently grown revenues since 2010, boasts a 20% ROIC, and has guidance of EBITDA growth +60%.

➡Business Model & Strategy

Headquartered in Western Australia, Duratec provides maintenance services to owners of larger assets such as bridges, pipelines, ports, plants, and high rise buildings. The company works in both the public and the private sector across a huge range of industries. For example:

Governments need to build new military bases and airports.

Mining companies need new processing plants.

Private companies need new buildings.

Governments need new transportation links.

There’s constant capital expenditure on new infrastructure assets across Australia. Duratec comes in post initial expenditure to ensure that assets function well for the period which they are expected to last.

One of the greatest parts about Duratec is the diversity of work they are able to take on. The industries can be broken down into four main segments, though in reality these can all be broken down much further:

Defense: The Australian Department of Defense is a huge client for Duratec and essentially makes up the vast majority of this segment.

Natural Resources: Australia is a huge mining nation with companies such as BP, and Rio Tinto being big players in the nation. Jobs such as acid protection, concrete repair, abrasive blasting, and coating.

Industrial & Utilities: Power, marine, electrical, transport, and water all fall under this category.

Buildings: Buildings require ongoing maintenance to ensure structural integrity and aesthetics.

There’s considerably lower concentration risk here than you see in other typical engineering & construction businesses. Duratec’s top 5 projects constitute less than 40% of the order book. Though this may appear to be concentrated, peers in this industry have concentrations of 60-70%.

🏰Competitive Advantage

Duratec has an incredibly strong competitive advantage. Let’s discuss why:

✔Less Cyclicality

Although Duratec doesn’t compete directly in the engineering and construction industry, one of the main risks in this sector is simply the cyclicality. Some industries, for example mining, go through boom and bust periods. When commodity prices rise, CapEx rises. Alternatively, when commodity prices fall, companies in this sector can quickly face huge losses.

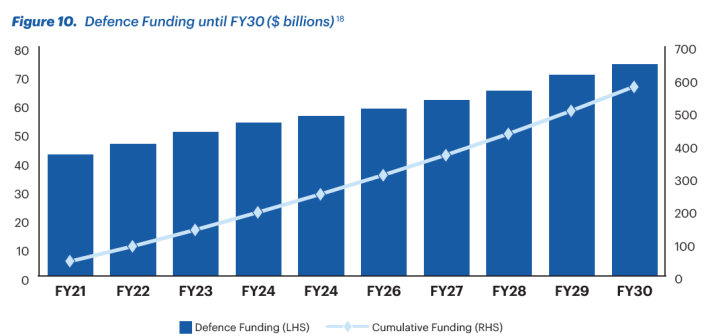

However, given 100% of Duratec’s work is strictly asset remediation, maintenance CapEx, even in cyclical industries, is far more stable. On top of this with the defense industry being Duratec’s main sector, the Australian Department of Defense publishes a 10-year forecast. This 10-year forecast shows consistent and steady increases to maintenance CapEx, of which Duratec is the main beneficiary.

👑MEnD Consulting

Duratec owns MEnD Consulting - a firm of 30 specialized engineers that provide inspection and engineering services through drones, proprietary 3D software, and engineering expertise. But what’s this got to do with Duratec?

MEnD acts as a powerful lead generator for Duratec. 80% of MEnD clients become Duratec clients with every 1$ of MEnD revenue becoming at least $25 of Duratec revenue.

And since MEnD is one of the only consulting firms in this niche to offer drones, 3D modelling, and asset inspection all in one, they win a lot of work.

Here’s the Executive Director on MEnD:

“Ultimately this is what sets us apart. It’s what makes us successful, what gives us margin and reputation. And it’s also one of the hardest things to replicate by any other contractor by a longshot, to be able to come fly drones and our 3D modelling. Some companies can fly drones, some companies can asset concrete and some can fix concrete. But to bring all of this together and get on site for the bigger companies. To me, there’s nobody else that can do it. For somebody to catch up in that space, I think would take years.”

👨💼Management Aligned With Shareholders

Management own 32% own of the company, and senior managers (below the top management) own 7% of the company meaning just under 40% of the company is owned by employees. Their interests are too aligned with share price growth.

👜An Industry Based on Reputation

It’s very challenging to develop a strong reputation in this industry. For new entrants, in order to win big clients, they need a proven track record of successful large projects which they of course do not have. It took Duratec 12 years to reach the size they are today, suggesting how difficult it is to make inroads in this industry.

🔁Repeatable Business

This is arguably the biggest reason of them all. 80% of Duratec’s annual revenue comes from existing clients. This is:

Reliable business for Duratec

Advantageous for the client who have a strong relationship with Duratec

Makes it more difficult for new entrants to win business off Duratec

🚀Opportunities

As mentioned earlier, The Department of Defense issues a 10-year forward looking infrastructure budget. They’ve estimated $23.8B of maintenance spend in 2029. This is up from $12.6B in 2020.

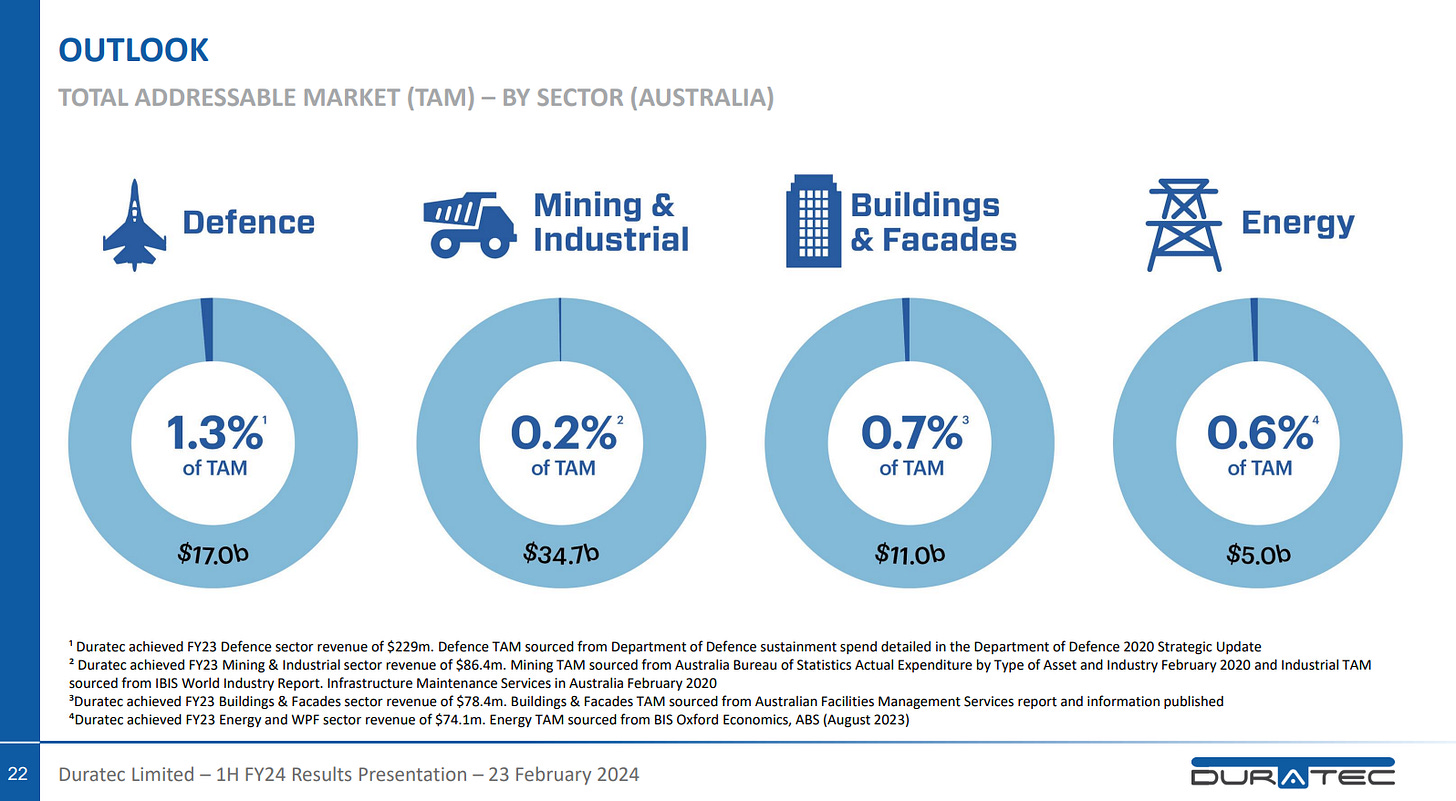

For other sectors here’s the current revenue compared to the TAM (Total Addressable Market)

🔢Graphs and Fundamentals

From a technical standpoint, the stock has seen a decline in 2024 with a recent bounce of the $1.17 level seen in 2023. Again, this has a very small weighting in my decision to invest or not but it’s of course nice to see.

The following graphs and numbers on the face of it don’t look as attractive as I believe the company actually is. The post-lockdown period from 2H 2022 onwards reflects a much more normal return to operations, and thus better results. The following figures and graphs are from 2019 onwards.

ROIC and ROE has seen a slightly bumpier ride than we’d like to see. However, the main reason for this as you can see is the 2021-2022 period of COVID lockdowns which delayed project completions whilst still incurring ongoing expenses.

Secondly, there has been limited margin expansion since 2019, which again is not ideal. However, there’s reasons for this which I deem are shorter term, rather than long term issues for Duratec. Factors include:

High input price of steel

Cost inflation

A short term inverse relationship between project size and gross margin.

However, in the shorter term this is a key risk for me. If inflation persists, margin expansion is unlikely to occur at all. In response, Duratec has introduced inflation-adjusted pricing clauses into their contracts which is of course a good sign.

And finally, revenue and net income has seen some incredible growth. Combine this with the total addressable market and opportunities moving forward for Duratec and we are looking at some very impressive numbers.

🔑Conclusion

To me, Duratec is one of those smaller cap businesses with little coverage, and little attention outside of Australia. For investors, that’s exactly what we like to see. COVID was clearly a difficult period for the business with rising costs of goods, and a subsequent decrease in margins.

However, I believe that they managed to weather the storm fairly well, especially for a small-cap company. This shows strength, a competitive advantage, and a differentiation to peers in the construction industry.

Duratec’s revenue growth has been huge, and within the defense sector, their biggest sector, the revenue for the next 10 years is fairly well known due to the DoD’s 10-year budget. CapEx will continue to boom in Australia, and with this becomes inevitable maintenance.

Duratec are extremely well positioned as a leader in their niche, and again have all the great characteristics of an early stage compounding giant.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Dino Polska was in my radar for so long. Great insight on such a great little known, high quality growth company.

Thanks, Oliver. Interesting companies. Although I'm in Europe, I had no idea there're such nice compounders.