Recent Buy: My High Conviction Growth Stock 📈

Growth prospects I don't see very often

It’s #SundaySpecial

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

Right, Let’s Talk SoFi Technologies

In my portfolio (which currently holds 16 stocks), I like to hold a good mix of mature, quality stocks which I believe will be consistent, solid, compounders over time and higher risk, high growth stocks that offer the potential to become “multi baggers” and return substantial amounts to shareholders.

This investment is the latter.

🔑Basics

Company: SoFi (Social Finance)

Ticker: SOFI 0.00%↑

Website: Sofi.Com

Current Price: $7.03

52-Week High: $11.70

52-Week Low: $4.45

Headquarters: San Francisco, United States

Investor Relations: investors.sofi.com

Q4 2023 Presentation: Q4 2023 Investor Presentation

🏢Company Background

Everything I read online about SoFi and it’s business operations is confusing, suggesting few people actually know what SoFi does.

“The important thing is to know what you know and know what you don’t know.” - Warren Buffett

Here’s a simple overview of the business:

SoFi was founded by 4 students at Stanford.

SoFi started as a peer-to-peer lending network where alumni at Stanford would make low interest loans to the current students. Essentially, it skipped banks by connecting borrowers (students at Stanford) to investors/lenders (alumni). This is where the name SoFi comes from…Social Finance.

This business grew pretty rapidly, and so SoFi created a digital platform where this peer-to-peer lending could happen on a larger scale. They also expanded outside of just student loans by adding personal loans and home loans.

Their pitch then grew to the “one-stop shop for all your financial needs.” To better serve lenders and borrowers, and automate transactions, they acquired Galileo, a financial services software which they now offer/license out to other financial institutions.

And finally, in March 2021, SoFi acquired Golden Pacific Bancorp which allowed them to incorporate financial services into their offerings.

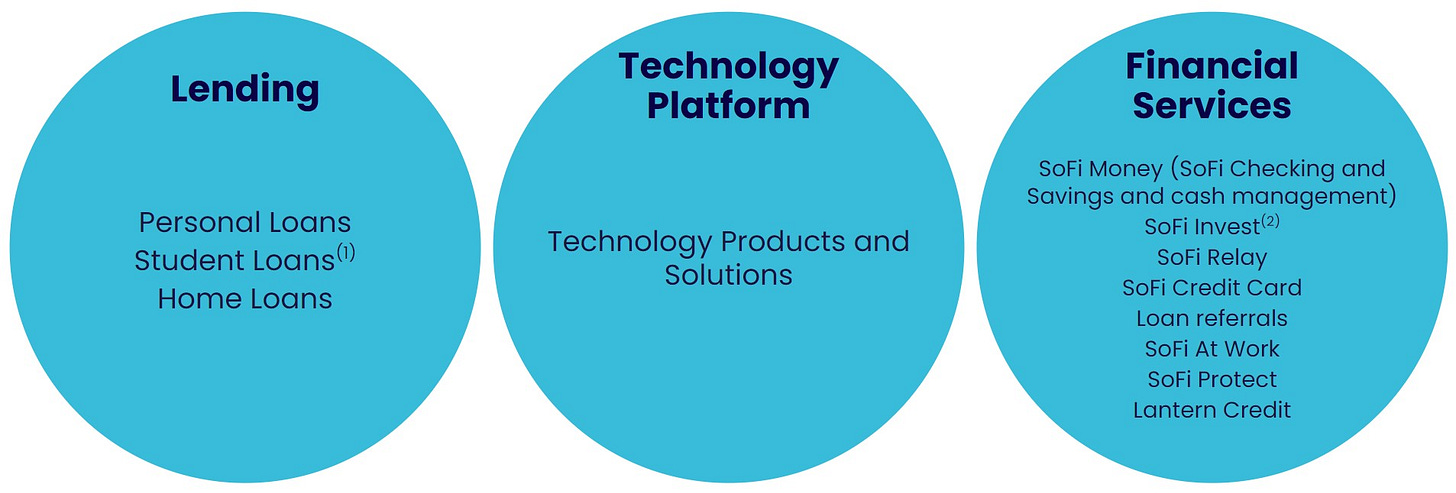

So, to sum it up, SoFi now makes money by:

Lending

Selling tech software

Offering financial services

🏰Economic Moat

SoFi CEO, Anthony Noto, has consistently said that SoFi will become the “all-in-one financial app.” If this comes into fruition, then this is the moat. Why?

They’d be taking market share from competitors and become the go-to for all financial needs (high switching costs).

There would be opportunities for cross-selling (scaling/increased market share).

There would be greater user engagement and greater value for members (network effects/high switching costs).

Customer acquisition costs would decrease (cost advantage).

In theory this is perfect, but let’s check the data to confirm this is actually the case.

Members

Perhaps the easiest metric to look at is member growth. SoFi added 585,000 new members in Q4 ‘23 now totaling over 7.5 million members.

Deposits

But are the new members moving their direct deposits to SoFi?

This is important since the bank where you send your primary deposit tends to be your primary bank where you keep most of your money.

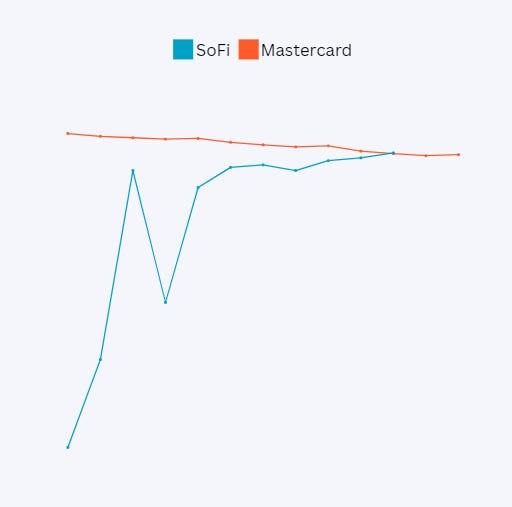

Check out this graphic made by Vadim Kotlarov which highlights the trend up til June ‘23.

Note that this trend has continued and deposits were a record $3B in Q4.

But you could argue that more deposits were made just because SoFi has offered a higher APY, just like every other neo-bank out there. It’s clear here though that competitors like Ally, Lending Club, and Discover all peaked in Q4 ‘22.

The exception is SoFi which has continued to see deposit growth accelerate.

They didn’t increase APY. They didn’t offer higher one-time sign up bonuses. They didn’t increase marketing spend.

They simply just outperformed the competition because of something innately good about the product(s) they offer. That’s evidence of a growing moat.

Customer Acquisition Cost

Of course this isn’t a perfect trend, but it’s evident that this figure isn’t trending upwards. If CAC can stay low, whilst new members continues to climb, it’s further evidence of a growing moat.

SoFi are continuously becoming more efficient at acquiring new customers which is mainly due to two factors:

Increased brand awareness

Improved marketing and product efficiency as a result of analytics, and technology.

Products

The amount of new products are also consistently increasing (45% YoY) to accelerate the member growth, but also to increase cross-selling.

Over the last quarter SoFi notably added:

Alternative asset investing (previously only attainable for the wealthy)

IPOs

Expense management solution in partnership with Mastercard

📊Fundamental Analysis

💸A look at the numbers

As explained above SoFi has a:

Lending division

Technology division

Financial services division

➡Lending

SoFi’s lending revenue reached $353.1m in Q4, with net interest income at $262.6 (this is compared to $183.6m in prior year, a 43% increase).

On an annual basis, we have seen net interest income increase from $531.5m to $960.8m, a 81% increase.

▶Technology Platform

SoFi are attempting to further diversify so they are not solely reliant on the lending division. Here’s a piece from the latest earnings call: “We continue to diversify our revenue with financial services and the tech platform contributing 40% of fourth quarter adjusted net revenue, up from 34% in the year ago quarter.”

Subsequently, the technology division has managed to reach revenue of $352.3m in 2023, compared to $315.1m in 2022, a 11.8% growth.

Management expect a 25% compound annual growth for the technology platform through to 2026.

➡Financial Services

This is where the big growth is happening for SoFi. The financial services division grew 115% on a quarterly basis and 160% over the full year.

Management expects a growth rate of 50% through to 2026.

All in all, SoFi’s numbers are pretty amazing. They’re consistently overdelivering, consistently winning market share, and consistently impressing me.

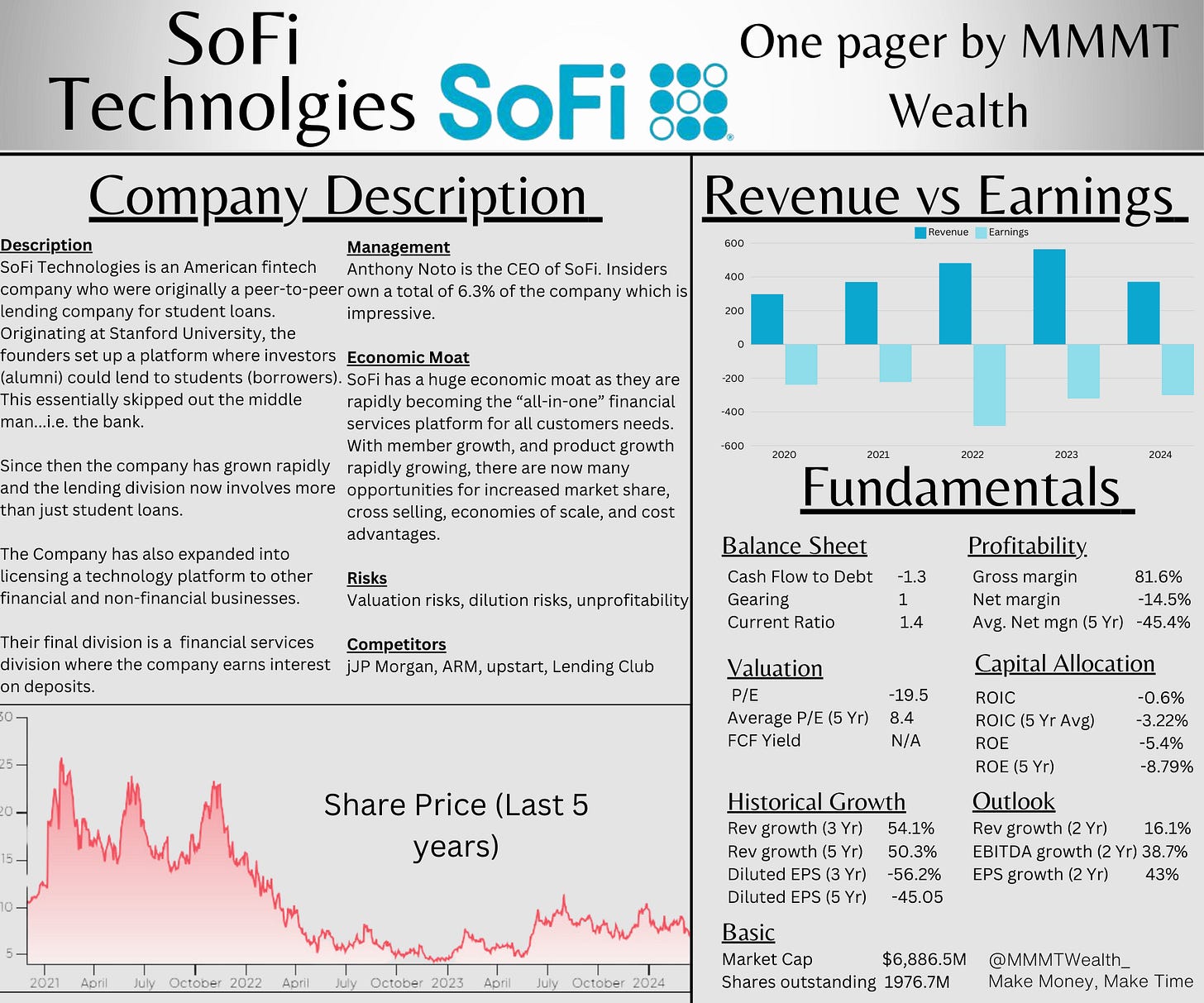

📜One-Pager

📉A Quick Chat On The Convertible Loan Note Offering

I bought SOFI 0.00%↑ the week of the announcement of SoFi’s $750m convertible loan note offering which led to a 15% plunge in the stock.

For long term investors like myself, this 15% drop was exactly what I was looking for as a buying opportunity.

And what made this drop even better? The market was completely wrong about this convertible loan note offering. It’s actually good news.

SoFi will use the proceeds of the deal to redeem the 12.5% Series 1 Preferred Shares that cost ~$50m per year, in exchange for debt that will cost ~$9m per year.

And plus, they’ll use a small portion to buy call option of their own stock. This won’t be a significant, market moving amount but anyhow it highlights confidence in the underlying business and an attempt to stop the dilution (see risks section below).

🚀Opportunities

▶Lending

Despite the lending division not forecast to growth at the same rate as the other two division, granted it’s already way bigger, there are incredible opportunities here.

Have a read of this:

“Because we are a bank, we charge an APY that helps us fund out loans at about a 200 basis point margin. We could bring the APY down when the Fed funds goes down, leave our loans where they are at, expand that spread to 300 basis points, or leave it where it’s at and gain massive market share. Because no one else can actually fund the APY where we can.” - Anthony Noto, CEO

They have options, which many companies at SoFi’s growth stage do not.

➡Technology Platform

The technology platform offers:

Low cost innovation

Licensing income

Regarding the licensing income, which is of course where the revenue comes from, management have said that the pipeline is extremely impressive and they’ve recently won a regional bank deal and a top 5 US bank deal (many people believe it is Citi, but there’s no confirmation on this so I won’t speculate).

Clearly these deals won’t produce instant growth, but over the next 18-24 months this should be a division with healthy margins (estimated at +30%) and strong growth YoY (estimated at +25%).

🤞Risks

With all the positives I’ve spoke about so far, we need to touch on the high risk nature of this investment.

Firstly, the company isn’t yet consistently profitable. In fact, they’ve lost money for the last six years.

Expectations are that SoFi breaks even in 2024 with the average analyst estimate at $0.05 EPS, though some analysts still predict a loss making year.

This is the downside to a fairly high marketing spend, and offering 4.6% APY on savings accounts. Naturally you win business, but naturally margins become razor thin.

Secondly, SoFi pays management and employees like they’re a small tech start up meaning they have extremely high levels of stock-based compensation.

SBC was 19% of revenue. That’s enormous to say the least.

For context, the average SBC at financial companies is 2.3% of revenue (4% at tech companies), meaning SoFi’s SBC is around 5x the normal range.

There’s been about 18% dilution over the last 2 years, making it almost impossible for shareholders to maintain their share in the company’s growth.

I’d be fine with this dilution, as long as the company was making money. On the other hand, SoFi are making acquisitions with their cash pile, but I’d like to see profitability fairly soon, otherwise it is very difficult for a shareholder to realize good gains with this dilution.

🔢Valuation

It’s never easy to value a company that has delivered just one quarter of profitability. But let me paint a picture:

In 2024, management expects an EPS of $0.07-$0.08 EPS. This would mean that SOFI 0.00%↑ is currently trading between 88-100 PE.

That’s not pretty on the face of it and looks discouraging for a value investor. However, growth investors know that if a company’s growth continues, the stock will likely continue whilst the P/E ratio declines. This is very common.

The company expects 20%-25% compound annual revenue growth up until 2026, which would drive between $0.55-$0.80 in GAAP EPS.

Since management have a track record for over delivery, let’s take an EPS of $0.75 for 2026. We then find that the current price is 9.4x of 2026 earnings.

Management also state they see 20%-25% EPS growth beyond 2026. Taking 20% growth beyond 2026, this would give a PEG ratio of 0.47.

Find that attractive? I certainly do.

Over the next year or two a huge part of the growth will come from the tech platform and financial services business collectively.

It’s completely up to you how you define a “fintech” company, but I’m sure that SoFi is more than just a bank, assuming that ~50% of its business will come from non-lending.

This means SOFI 0.00%↑ should be valued focused on a tech multiple, not a bank multiple.

🎯Conclusion

I have full conviction in SoFi. It’s growth so far, and it’s growth outlook is not something I’ve seen much of.

I hope this article allowed you to quickly understand actually what SoFi do, why they have a moat, why they’re outlook is strong, and why they’re undervalued today.

Of course, SoFi has some risks which may cause some headwinds, but if you’re a long term investor, SOFI 0.00%↑ is a special one for your portfolio.

By the way, Oguz from Capitalist Letters wrote a great article on SoFi last week. If you give that a read as well as this article, you’ll have a great understanding of SoFi moving forward.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Hey Oliver, you know my investment philosophy - I follow institutional investors and invest in what they invest. Here's my take on SoFi.

Percent of Shares Held by Institutions is 38,5 (check here: https://www.nasdaq.com/market-activity/stocks/sofi/institutional-holdings). A little too low, if you ask me. I usually go for 80%+. This is not to say SoFi won't grow. It may grow. But if institutions aren't seeing a rosy picture, why should I?

One more thing that makes me uneasy is Sales (check here: https://www.nasdaq.com/market-activity/stocks/sofi/financials): For a total 2023 revenue of $2,9b, SoFi spends $2,1b on sales. Too much, I think. On the other hand, it doesn't appear to invest much in R&D so it keeps some of the revenue.

This doesn't contradict your thesis. By all means, invest in SoFi, if you're convinced the company has a bright future. SoFi's technical patterns aren't 100% convincing but it does appear to have completed a bottom. A good sign, which means SoFi can resume a long-term uptrend.