3 Small Caps I'm Watching Closely

Hi all👋

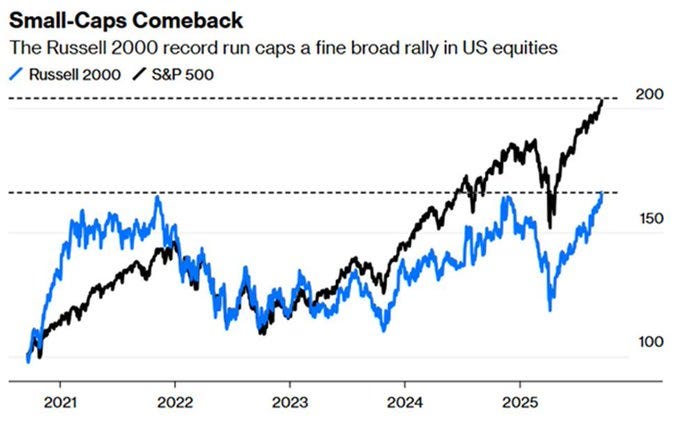

After 2-3 years of high interest rates, and a very limited return of the Russell 2000 relative to the S&P 500, I think it’s time to start seriously considering some quality small caps as a good investment over the next period.

Over the last 2-3 months I’ve so far had 3 stocks in my “small cap” portfolio which is shared to paid subs move over 100%. They’ve been:

ONDS: +173%

SES: +124%

ARBK: +116%

You can view my swing portfolio, core portfolio, watchlist, investing universe, and daily notes all for just $16 a month here 👇

Small caps have historically traded in line with interest rate cycles because they have higher leverage and shorter-duration debt, meaning interest rate costs fall more when rates are cut.

The caveat to this thesis relies on the US avoiding a recession which many currently fear. These higher beta small cap stocks with no free cash flow are the most sensitive to a recession and a good portion of them likely won’t survive a material period of macro weakness so caution is recommended here.

1. Redwire | RDW

Introduction

I’ve mentioned RDW a couple times to my paid subs but yesterday after the 10% drop due to a board shake up and the retirement of the current CFO and a big sale of shares from Bain Capital (10 million shares), I’ve began looking into the business much more seriously.

RDW are a company in the space niche building products such as sensors, RF systems, in-space propulsion systems, solar arrays and much more. During this bull run we’ve seen a lot of capital flooded into the space niche, with many companies that have moved +200% (RKLB, PL) and some laggards (RDW). Ultimately, the question here comes down to whether these laggards have lagged for a particular reason that is justified.

In my opinion, RDW’s selloff is a slight overreaction which does present us with an opportunity to at least dive into the company more.

Numbers

The last earnings report was not good. So take these numbers with a pinch of salt because a lot of the figures were driven from one-time factors such as the Edge Autonomy acquisition, delays in US government budgets, and unfavorable Estimate at Completion costs.

Revenue growth DOWN 20.9%

Gross profit DOWN 246.8%

Gross profit margin: -31%

Investment Thesis

Defence player through Edge Automation acquisition. Although a risky acquisition through share dilution and cash, the Edge Automation acquisition hopefully should diversify revenue further and smooth out lumpy contract timing.

Rising government and commercial demand for space infrastructure could put RDW at the center of a big tailwind over the next 5-10 years.

Valuation

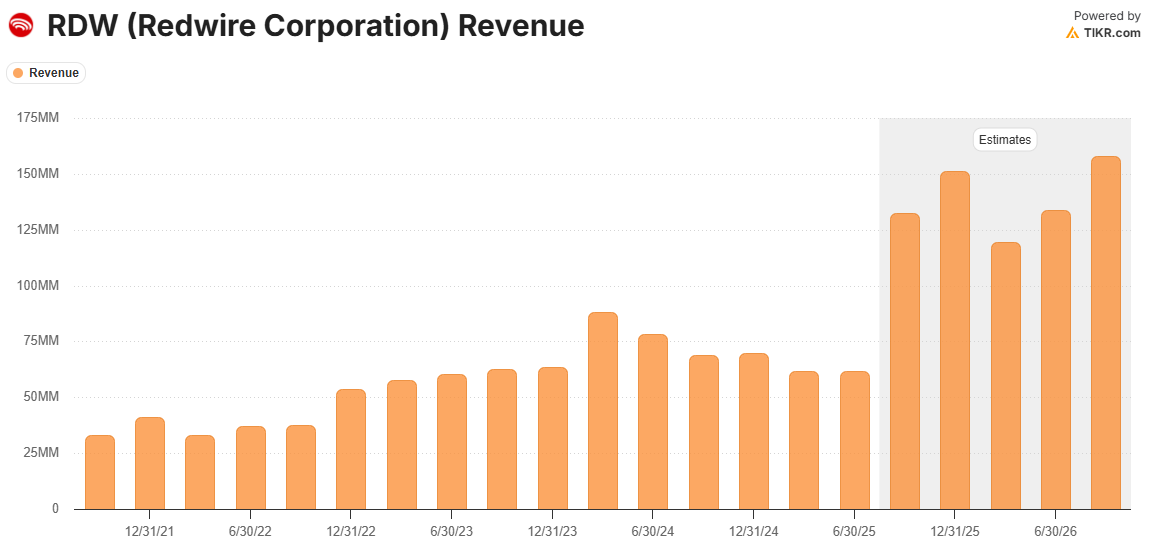

Currently RDW trades at 3.4x NTM sales and 38.6x NTM EBITDA. Gross profit was a fair way to value RDW until the recent quarter, but I think at the moment the best way to look at them is via revenue.

We need to take analyst estimates lightly here because a huge amount of RDW’s revenue is driven by US government and defense contracts - particularly through NASA and the Department of Defense - where project timing and funding cycles are ultimately a lot less predictable.

Anyhow, analysts are expecting 39% revenue growth in FY25, 39% in FY26, 16% in FY27, and 69% in FY28 so these numbers for a 3.4x NTM sales multiple seem very attractive.

Other space peers are trading at:

RTX: 3.0x sales for single digit growth estimates.

NOC: 2.5x sales for low single digit growth estimates.

RKLB: 44x sales for similar growth metrics to RDW.

SIDU: 12.3x sales for negative growth estimates.

Based on the above, it’s easy to suggest that the selloff for RDW has been an overreaction. Of course, more goes into it than just this but for now it gives us a good reason to dive much deeper into RDW.

Note

There’s no getting around this being a risky play, even at today’s levels which is why I’m more hesitant and am doing a lot more due diligence before investing.

We still have a company where:

Share count has more than doubled since February 2025

Net debt is $155M.

A very poor earnings miss in Q2.

Cash burn at $88M in Q2 and negative FCF.

StocksGuide are offering 30% off until Monday 13th October. Give it a try through this link!

2. Harrow | HROW

Introduction

Paid subscribers will know that we initiated a position in HROW a few weeks ago. Even though I own HROW, I’m still tracking it very closely as a potential add. I’d love to make my position size a lot larger over time.

I also wrote a recent article specifically on HROW so I’ll leave that here below:

Numbers

The numbers for HROW are impressive, especially for a company with a $1.55B market cap.

31% revenue growth.

116% EBITDA growth in FY24.

75% gross margins.

25% EBITDA margins.

Investment Thesis

HROW offers a high growth investment outside of US tech which is arguably a little overvalued in places right now.

The TAM for HROW is huge since the US has an aging population and the demand for ophthalmic procedures (cataracts, glaucoma, retina therapies) is only increasing as we spend more and more time in front of screens.

HROW has a nice balance of compounding drugs (more stable) and new drugs in the pipeline which have huge upside.

Valuation

Here’s the main reason I am very bullish on HROW.

HROW have a goal of $250M in quarterly revenue by FY27 so if we’re conservative and assume $1B in revenue in FY28, we have a company set to grow revenue at 52% per annum trading for 4.9x NTM sales.

Further, EBITDA margins are 26% today but if we align with analysts at +40% in FY28 then we potentially have $400M in EBITDA in FY28 which gives us an EBITDA CAGR of 76% per year. The NTM EBITDA multiple today is 16.5x meaning we have a growth rate 4.75x the NTM EBITDA multiple. That’s incredibly cheap.

3. Aehr Test Systems | AEHR

Introduction

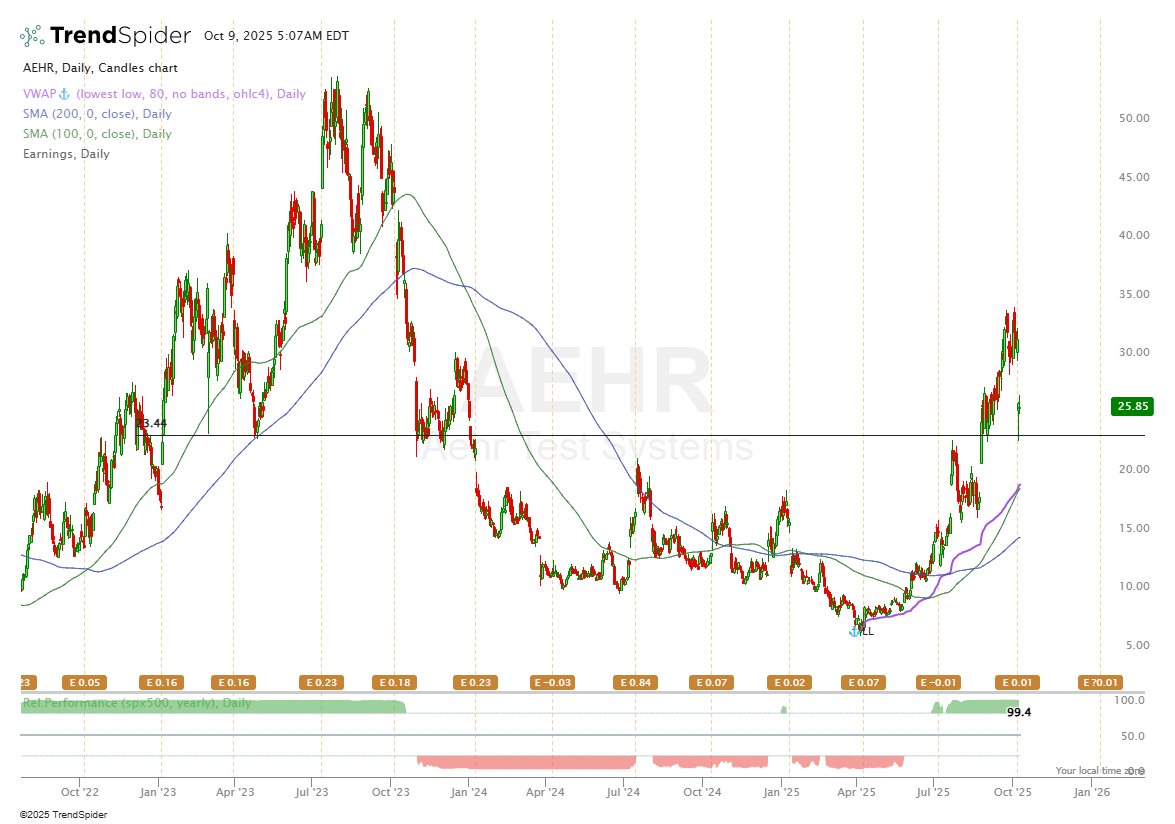

AEHR has been on mind for a long time, but I’ve never dived into it. I’ve tracked it go from ~$7 in April all the way up to $35 but have never looked too deeply into the valuation so I thought it was worth it today.

AEHR basically design and manufacture semiconductor test and burn-in equipment. This is technology that allows them to screen chips for defects and ensure long-term reliability before being shipped off to customers.

Chips must withstand high voltages and temperatures (particularly in EV’s for example) so any slight defects could have huge costs and recalls down the road. Essentially, this means that AEHR provides the reliability for the next-gen chips.

Numbers

Revenue growth: -15%

Gross profit margin: 30%

EBITDA margin: -11%

Investment Thesis

Before I begin here, let me make it clear that AEHR are going through a relatively difficult period in their business.

They’re looking to expand into newer markets, but this comes with the downside of lower margin products. The wafer level business which has historically been core to AEHR is becoming a smaller and smaller chunk of the business.

Tariff uncertainties hit smaller cap businesses with less pricing power more than bigger players. AEHR is just a $774M business.

Here’s the tailwinds for the business though:

They’re diversifying nicely away from SiC wafer-level burn-in and into silicon photonics, GaN, optical I/O, memory, and logic, all of which benefit from more complex and high performance devices needing more robust testing.

Ultimately, the big picture tailwind is that as chips become more powerful and dense and continue to operate at higher voltages, the demands for reliability go up. This makes AEHR’s job even more important.

Last quarter (Q1 26), AEHR reported a backlog of ~$17M which based of FY25 revenue of $58M is a very strong pipeline showing strong demand.

Valuation

AEHR are likely to be EBITDA profitable in FY26 with ~$10M in EBITDA, but it’s very difficult to value AEHR based on this today. Gross profit was $20.9M the last 12 months, and the EV is currently $762M meaning the EV/GP is 36.5x which isn’t cheap.

From a sales growth point of view, AEHR trades at 12x NTM sales for pretty substantial growth estimates in FY26 and FY27 of ~30%. For me, I think AEHR is still slightly too expensive today but if it can come down below $20 I’d be very interested.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Thanks Oliver. That‘s why i‘m here.