5 Charts For The Week

An eventful week ahead?

Hi all 👋

Friday created some more opportunities with a potential new tariff class as Trump announced 100% additional tariffs on Chinese exports on “virtually every product”.

In retaliation to this, Beining:

Expanded controls on rare earths, battery making materials.

Imposed new fees on US owned ships.

This all led to $19B liquidated in the crypto markets, the biggest liquidation ever, and the NASDAQ falling 3.6%.

Panic hit the markets and then on Sunday, Trump tweeted this:

And JD Vance de-escalated tension with China saying Trump is willing to be a reasonable negotiator with China and that Trump appreciates the friendship he has developed with China’s Xi.

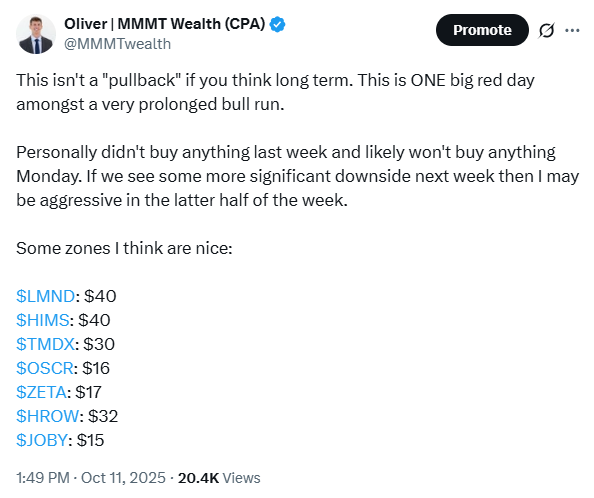

I personally thought something like this would happen, hence why I continuously said on Friday and Saturday that this was not a real pullback. Take the political mayhem out of this, and realize that the markets are still only a couple of bps away from ATH’s and one red day does not mean we are in a pullback.

With all this being said, I think we open green on Monday.

In fact I actually wanted a pullback. I’ve got cash on hand ready to deploy as paid subs know.

Remember that I run a paid community on my Google Spreadsheet for just $16 a month. You get access to:

My portfolio (exact $ amounts)

My watchlist

My daily notes

My Investing Universe (+200 stocks analyzed by revenue growth, EBITDA growth, and EPS growth)

Anyhow here’s 5 charts for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

1. GXO Logistics | GXO

GXO is an underrated robotics/automation play in the warehousing automation space which will likely be one of the first large markets to be completely automated by robotics. It makes this stock a slightly more defensive play which is nice given the macro today, but also it has some great high growth characteristics to ride the robotics wave.

They trade for just 0.83x EV/sales whilst set to grow revenue at 12% in FY25 which in itself is attractive. From an EBITDA point of view, they’re set to grow slightly slower in the short term but estimates in FY28 and beyond show growth rates likely to increase. For that, we get a stock currently trading at 12x EBITDA.

I don’t think the valuation is that attractive today which is why GXO is one I’d wait on to fall to the level outlined in the chart, but I also think there’s so many tailwinds for a company like GXO, even during a recessionary period.

I’m watching GXO closely today.

2. Joby Aviation | JOBY

Paid subs will know that I’ve been very excited to try initiate a position in JOBY over the last couple months, but I’ve also been extremely picky about my entry. The last thing I want to do is chase a high growth stock that still has no revenue and is still in the regulatory testing phase. For these kinds of stocks, we need very good entries.

Please see the blue dots here for where I would average down on a JOBY position. Each level down would be a bigger buy for me.

3. Harrow | HROW

HROW is already a position in my portfolio and for good reason. You can see my HROW analysis here:

Harrow (HROW): High Growth Outside Tech

Hi all 👋Make Money, Make Time is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Management expects to hit $250M by Q4 2027 meaning we can expect $1B in revenue in FY28.

EBITDA margins are currently ~26%. Analysts expect +40% in FY28 (reduced interest costs, higher branded revenue mix etc). If we assume EBITDA margins hit 40% in FY28, then HROW is incredibly undervalued today at $37.

They could hit $400M in EBITDA in FY28 which means EBITDA will have grown 76% CAGR over 3 years. That’s EXTREMELY good considering NTM EBITDA multiples are 16x.