5 Quality Stocks Outside The US 🌍

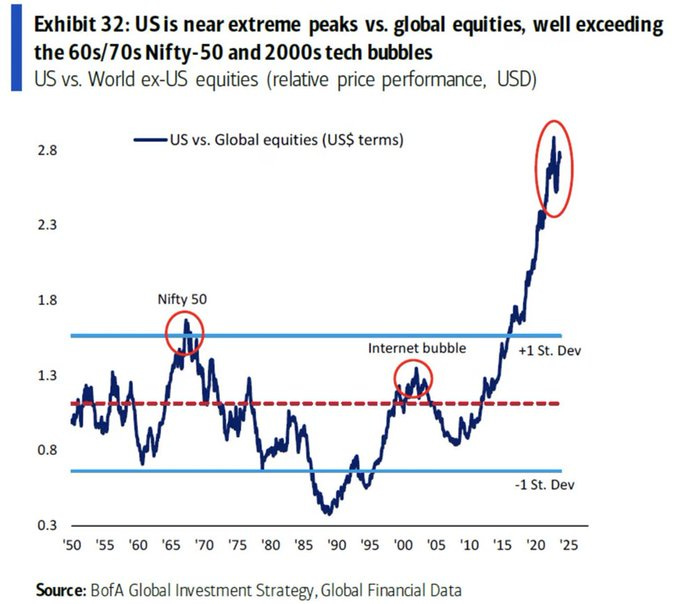

Now is not the time to be investing in the most concentrated market in history.

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

It’s #WednesdayWisdom!

Before I dive into this article, let’s start with this quote:

“Never bet against America”

No prizes if you guessed who said this…

Investing Elsewhere

The US market has, and will continue to be, the single greatest wealth building machine for the average human. The S&P index averages ~10% annually which would turn a $10,000 investment 20 years ago into $136,000 today.

However…

As a value investor, I invest in quality companies with a solid margins of safety. With the market where it is now, up 25.2% over the last year, and just hitting all time highs, it’s becoming ever more difficult (though entirely possible), to find these good deals we look for.

But it’s not necessarily the valuations that worry me, or the “AI bubble” we are in because quite frankly we likely aren’t in a “bubble”, at least not if history is anything to go by.

Ray Dalio doesn’t think so either. He came out with this recently:

What concerns me more about the S&P right now is the concentration. The largest 10 stocks relative to the broader market is at the 86th percentile relative to history.

Granted there’s reasons for this such as the fact the largest multinationals have the capital investment requirement to build out AI infrastructure. Super Micro Computers SMCI 0.00%↑ is probably the exception to this thesis, but broadly speaking it holds true.

Historically, a steep rise in market concentration has always reversed. The S&P 500 equal-weighted index outperforms the market cap-weighted index.

Anyhow, let’s talk opportunities.

Let’s not speculate on how overvalued or “bubbly” the US market is and instead focus on the fact that much of the world is currently as cheap as the US market was at the very bottom of the global financial crisis.

Why?

Dominance of American technology

Underinvestment in commodity-led economies

China’s debt crisis

…

We’re due a reversion to the mean.

This presents one of the greatest opportunities to invest in foreign markets.

Here’s 5 Quality Foreign Stocks 🌍

1. Evolution AB (EVO)

Description

Evolution Gaming (Swedish) creates live casino games for online gambling operators. The gaming operators then market these products to the end users.

They specialize in live dealer games like roulette, blackjack, and poker with their focus on live-streamed gaming being their biggest differentiator to other players in the market.

Investment Case

Large international opportunities and room for growth, particularly in Asia and North America once more licenses are obtained.

Very strong, and continuously improving financials. Compared to FY22 EVO has seen a 23.50% revenue increase and 25.70% EBITDA increase.

611% increase in free cash flow over the last 5 years and zero debt.

Key Graphic

Here’s the net profit margin and FCF margin for EVO over the last decade.

2. Grupo Aeroportuario del Sureste (ASUR)

One-Pager

Description

Grupo Aeroportuario del Sureste (Mexico) manages, operates, and develops airport facilities in the southeast region of Mexico.

The company operates airports located in Cancun, Cozumel, Merida, Huatulco, Tapachula, and a few others.

Investment Case

Revenue growth comparable to some well-known software companies averaging a quarterly YoY growth of 19%.

Extremely profitable with net margins approaching 40%.

Consistent levels of passenger growth combined with a market leading commercial business strategy.

Key Graphic

From Q4 2023 investors presentation highlighting the passenger growth in ASUR’s airports vs the rest of Mexico.

3. Transense Technologies (TRT)

Description

Transense Technologies are a British company who offer world-leading sensor technology and measurement solutions.

The Company operates two divisions:

SAWsense: A patented technology to accurately measure torque, temperature, force, and pressure.

Translogik: Tools used in tire inspection and data capture used mainly be fleet managers, tire suppliers, and service centers.

Investment Case

Promising project pipeline including further opportunities with Parker Meggitt in Aerospace, expanding relationship with General Electric, and potential to dominate the eVTOL market.

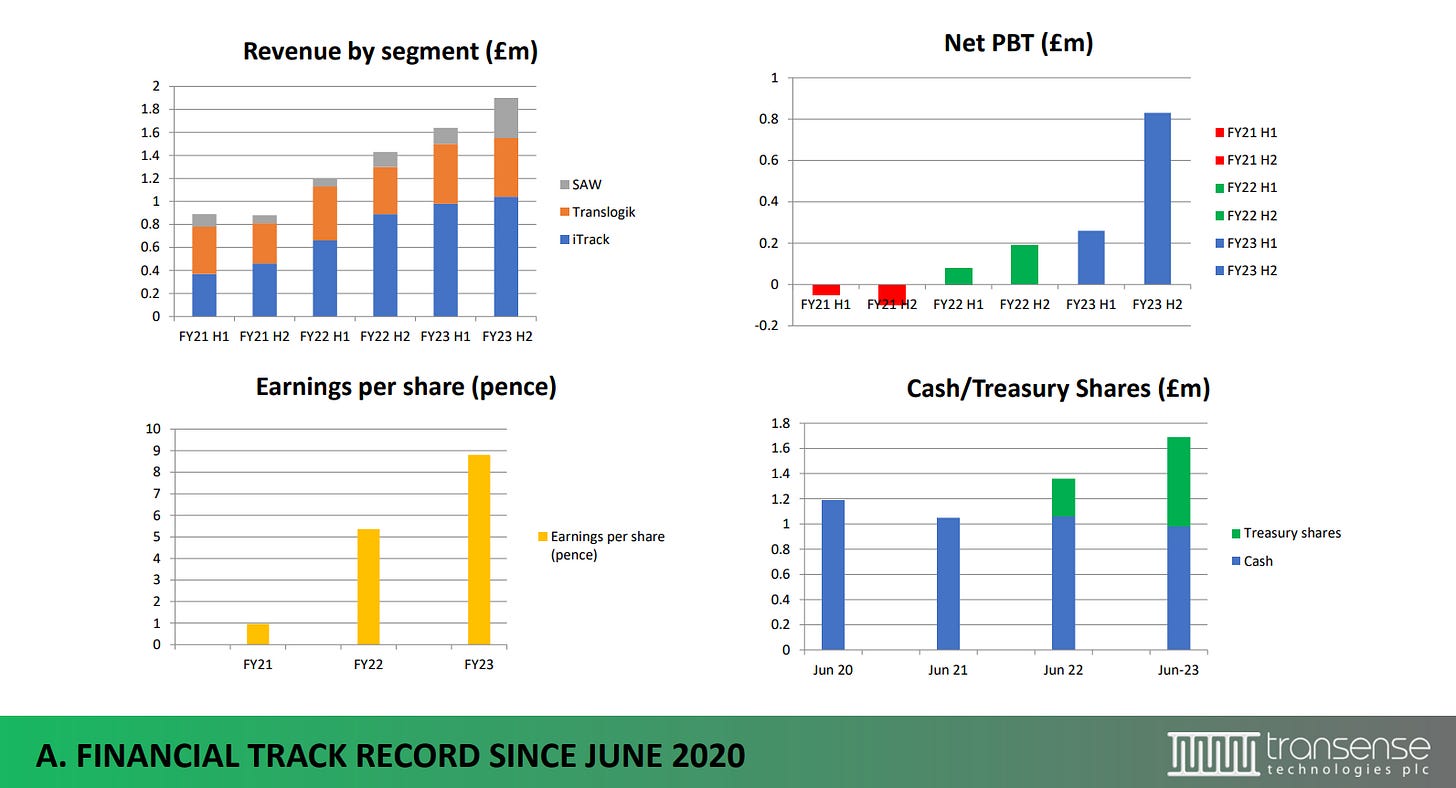

Very positively trending financials in all aspects including revenue, margins, ROE, and ROIC.

Active management with a 22% inside ownership increasing investment into multiple new opportunities to strengthen the pipeline.

Key Graphic

Financial record since 2020 taken directly from Transense investor presentation.

4. Fortnox AB (FNOX)

Description

Fortnox (Swedish) operates a cloud-based platform for financial administration such as offering solutions for bookkeeping, billing, quotation, salary, stock, time reporting, receipts, and travel.

Clients mainly include accounting firms, associations, and schools.

Investment Case

Consistently increasing growth in terms of net customers quarter on quarter with the biggest growth coming from 23k new accounting firms.

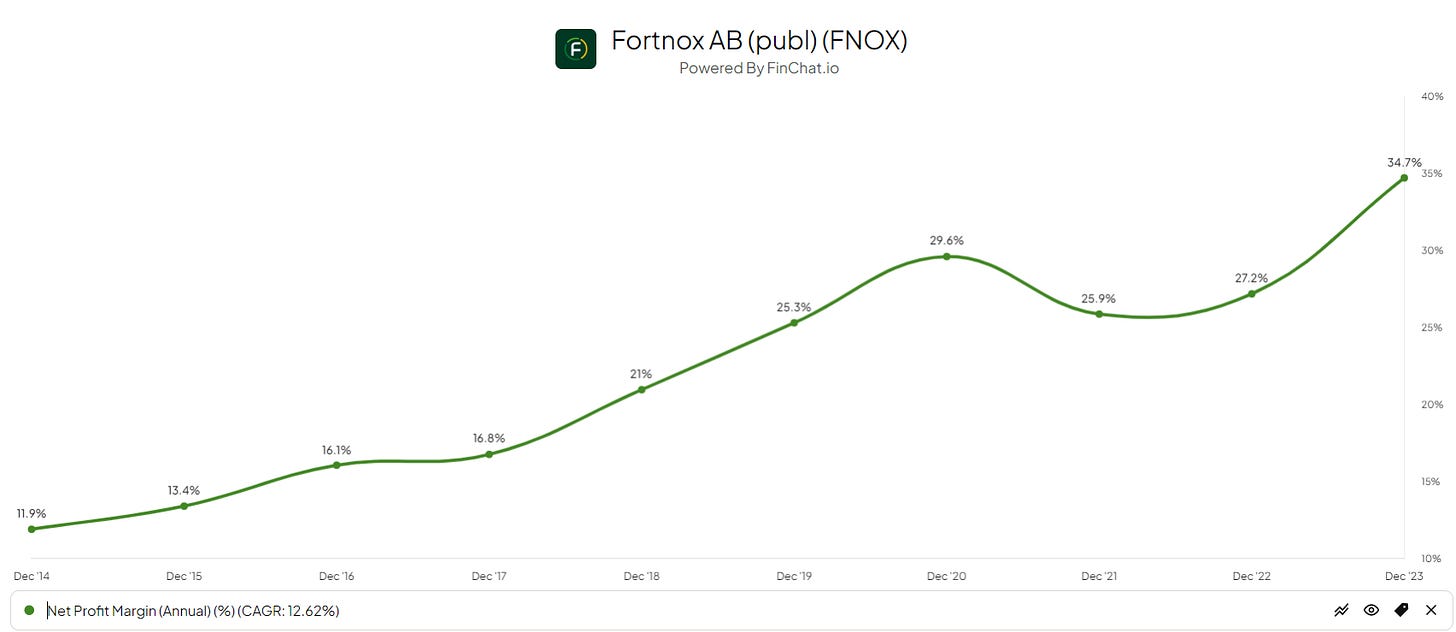

A very strong subscription based service providing stable profits at growing margins.

Key Graphic

Consistent revenue growth including 2024 and 2025 estimates.

5. Melexis NV (MELE)

Description

Melexis (Belgium) is a global producer and supplier of micro-electronic semiconductor solutions. In addition to this, Melexis offers sensor ICs (integrated circuits), and sensor IC systems for the automotive industry, motorcycle and e-bike industry, and healthcare industry.

Melexis’ product is also used in a variety of other industries.

Investment Case

Melexis have boasted solid organic growth in non-automotive industries, creating potential for a diversified product base, although automotive still makes up ~91% of total sales.

5-yr significant growth in both gross margin and net margin.

An extremely innovation focused management team.

Key Graphic

Here’s the Melexis goals between today and 2030, and the key growth drivers.

1 Graphic

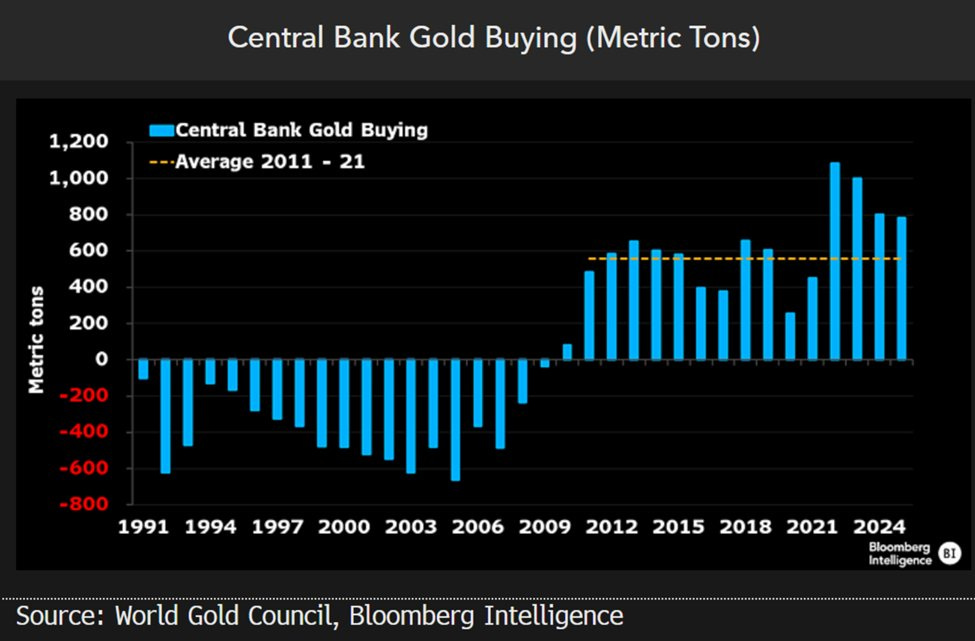

Don’t be surprised if gold has a very bullish 2024-2025. Want to see the best investment for this?👇

1 X Post

I summed up the current state of the market on Monday of this week. You can follow me on X here!

1 Quote

An extremely relevant quote by Peter Lynch to sum up this article.

“Go where the puck is going to be, not where it has been.” - Peter Lynch

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

This is like a painkiller to me. I think the US market is way overvalued and all the companies here represent some good opportunities for us who want to avoid the US market for now.

Great read, Oliver. I agree that the US stock market has grown a little too fast recently. I'm happy with my profits but thinking of moving part of my capital into different asset classes.