A Big Hello and Day 1 of #WisdomWednesday

Economic cycles, the stock I bought recently, and a little motivation to level you up.

Right Substack, a big hello to you all!

As I’m writing this post right now, I only have 2 email subscribers (my father and my girlfriend). So hello to them too.

A brief introduction to who I am:

My finance background

For those of you who don’t know me, I’m Oliver (you can call me also call me Olly), and I’m a chartered accountant working for a Big 4 Accounting firm in the financial services sector.

Most of my clients are private equity, asset management, and some VC firms. I’m 25 years old, and over my brief working career so far, I’ve learnt the ins and outs of personal finance and investing.

I became mildly obsessed with the financial markets pretty quickly and spent all my free time studying the great investors, reading financial statements, valuing companies, and ultimately great picking stocks.

Then I started creating content on X back in March. It’s been a long process so far but I’ve got my content strategy pretty set now, and I’ve been seeing some exciting growth of late.

Here’s my X by the way - MMMT Wealth X Profile

My non-finance background

Outside of investing and finance, I’m an avid tennis and padel player.

Born and bred in the UK, I went to college in America from the age of 18-22 to get my degree, and compete for my university in North Carolina on a tennis scholarship.

More recently, at the old age of 25, I’ve decided to slow down on the tennis and take up the new and growing racket sport that is Padel. Has anyone ever played it?

I’m addicted. I spend 5-6 days a week playing.

I also coach a few hours of tennis a week.

Right…the important stuff.

I started Make Money, Make Time back in March 2023 with the aim of helping thousands of people reach financial freedom and retire well before the age of 65…because who wants to work till 65 right?

My Substack plan:

Every Wednesday I’m going to release #WisdomWednesday. It’s going to include:

1 KEY investing lesson

1 investment idea related to the investing lesson

1 graphic (created by me)

1 in-depth twitter thread

1 quote

1 motivational paragraph with personal finance tips

Once I build my loyal following, I’m going to introduce a paid feature which will include deep dives into companies, my portfolio, and investing recommendations.

Sound good?

If you have any other ideas as to what will add value to you, leave a comment and I’d be willing to consider the options.

Enough about me. Let’s get this party rolling.

It’s #WisdomWednesday!

1 Key Investing Lesson

Finding the right sector

Today’s macro-environment is arguably more complex than previous cycles. Nevertheless, some sectors are overvalued and some sectors are undervalued and that will always be the case.

Our job? Find the sectors that are undervalued with a promising outlook.

Let’s start by looking at the outperforming sectors at each stage of the market cycle.

Right now, as I said, it’s complex. But most points suggest that we are in the late-peak economic cycle.

Although the risk of a recession is much lower than originally anticipated 6 months ago (Goldman Sachs are only predicting a 15% chance of recession), there is a high likelihood that we go through a period of slow growth.

Use the above graphic to invest accordingly.

1 Investment Idea

Silver mining stocks are undervalued

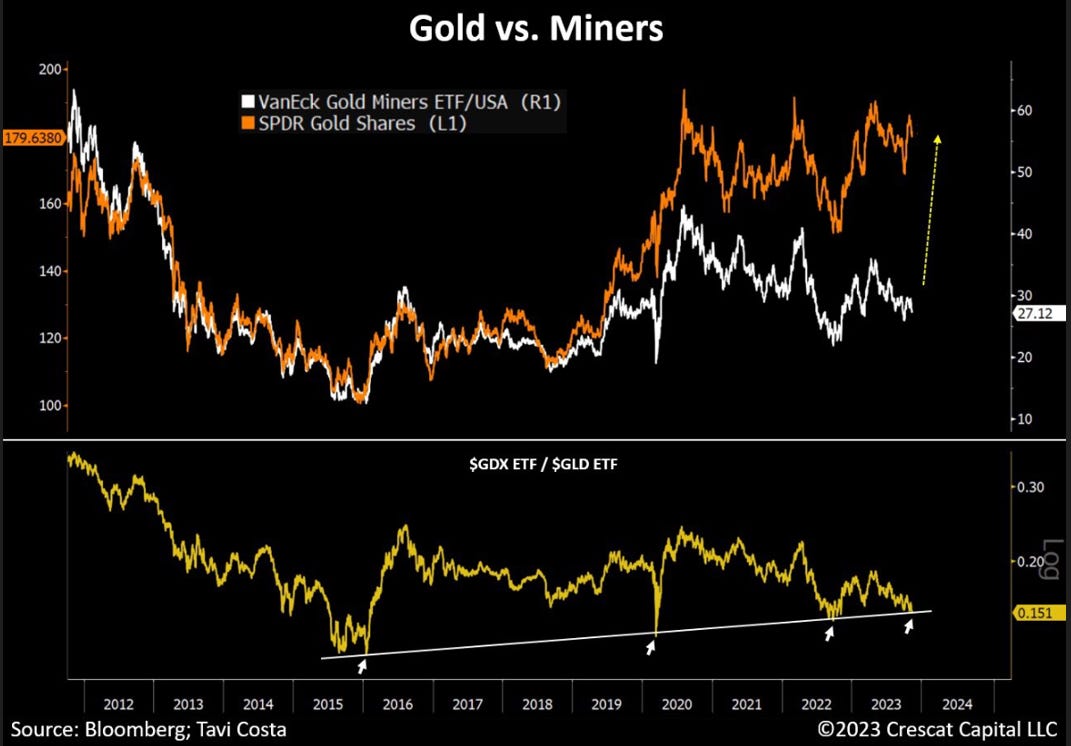

There is a growing gap between gold and mining companies as you can see above.

Gold and Silver are also on the edge of a major breakout, which could likely mark the beginning of a new long-term cycle for precious metals.

Although there are many loss-making mining companies out there due to the complex capital intensiveness of the business, there are periods in history when this industry proves to be an exceptionally profitable industry.

If we are indeed on the verge of a secular move in precious metal prices, miners are one of the most undervalued companies in the markets right now.

I know there’s a lot of ifs in there, but ultimately investing is about putting the risk to returns in your favor and that’s exactly what I’m doing here.

Taking all this into account, I then dived through about 30 of the best gold and silver mining stocks. I decided to buy….

Silvercorp Metals Inc ($SVM).

This article won’t dive into why I did this, but there will be an upcoming article on this, so stay tuned! and subscribe so you don’t miss this deep dive.

1 in-depth X (Twitter) Thread

To link in with my discussion above about economic cycles, today’s X thread looks into the worlds greatest investors (Buffet, Ackman, Dalio, Griffin, Drunkenmiller etc…) and highlights if they are bullish or bearish right now.

Check it out here.

1 Quote

Choosing my first quote to kick off this newsletter took way longer than it should have. But I wanted it to be a quote that resonated with me most. This one isn’t as investment related as most of the future quotes will be, but it perfectly summarizes why I’m out here creating content, and adding value to people’s lives.

So here it is:

“The key to success is to find something you love to do, and then do it the best you can” - Warren Buffet

Ultimately, I’ve always had an entrepreneurial vision. I’ve always wanted to build something from the ground up by myself. And that’s this brand I’m building on here and X.

It’s early days, but I’m loving it, and I promise I’m going to do it the best I can.

1 Personal Growth Paragraph

The real purpose of wealth is freedom. Not 000’s in the bank account

Wealth does not mean money.

Here I quote Naval Ravikant:

“The purpose of wealth is freedom.”

Here’s how to apply this to your life:

The initial understanding

After graduating University, I turned to the finance sector in the hope of earning the big bucks down the road. Although the money is solid, I realized that I began to lose myself completely in the process.

My happiness became completely dependent on my managers. At any one point they could demand I do something before the end of the day. This would mean I’d be tapping away on Excel until 10pm, missing my evening activities, and my quality time with my loved ones.

When we rely on others for our happiness, all we are doing is outsourcing our freedom.

This is why I’m here, as a solopreneur, building a life where my time is completely reliant on my choices.

The broken American dream

The American dream essentially teaches us the opposite of this.

It teaches us that there is a land of opportunity and if you work hard, stay disciplined, and commit yourself for a period of time, you will succeed.

Reality:

We need to show up to a job we likely do not enjoy and continue to push through it for 40 years because it may eventually, when you retire at 65, lead to some form of wealth and freedom.

Staying disciplined and pushing through something you hate isn’t freedom and it never will be.

Realism: Money fuels wealth

The unfortunate reality of all this is that to have this level of freedom, you need money in the first place.

Without money you have to always think about money. Subsequently, all your decisions are driven by money, and you therefore cannot be creative, take any risks, or ultimately have any freedom.

With money in the bank account, wealth equals freedom like this:

Options

Travel when you want

Family time

Work done on your own deadlines

I initially thought that to live a life like this, you need multi-millions in the bank. That likely is the case if you believe in the American Dream and let consumerism walk all over you.

If you’re willing to not buy dumb stuff, stay away from debt, buy smart assets, and don’t need luxury items to gain happiness, the number is much lower and many people can reach it.

That’s it for the day

I hope you enjoyed my first post here. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spend more than 50 hours per week researching stocks so that you don’t have to.