A Nike (NKE) Comeback Play Or A High Growth On (ONON)/ Hoka (DECK) Play?

There's one standout for me🥇

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

👟Footwear Industry

The footwear industry is booming, and the competition is ever-changing as some brands gain popularity and some brands become almost obsolete. For an investor, this creates opportunities if you can spot trends early enough.

With a constant rise in the health conscious consumer, and major sports events this year including the Olympics, brands are going to be fighting for small percentages in market share which could be worth billions in revenue.

The global footwear industry is growing at around 4.3%-5.3% depending on different articles, but just using my gut instinct I feel the athletic footwear industry is growing substantially quicker than this.

With carbon plates, various geometry and air flows, marathon runners crushing previous records just from new models of shoe, the sky is really becoming the limit within the athletic footwear industry. It’s a new era of innovation that we haven’t really seen before.

And what’s more there is a merging of sportwear and fashion at the moment so even the less athletic consumers are purchasing these higher end sneakers for everyday use.

The 3 companies I like most in this industry are:

Nike NKE 0.00%↑ (the current market leader)

Deckers (with Hoka) DECK 0.00%↑ (market disruptor)

On Running ONON 0.00%↑ (market disruptor)

Outside of these companies, there’s not many where I believe the growth prospects make it a worthwhile investment due to the competitiveness of the industry.

Here’s a rundown (and ranking) of these 3:

🥉Nike (NKE)

"We know Nike is not performing in line with our potential. It’s clear we need to make some important adjustments.” - John Donahoe (CEO)

The iconic “swoosh” is arguably the most recognizable logo worldwide. How’s that for brand power? A simple tick that has become the home of the worlds greatest athletes such as Michael Jordan, Serena Williams, LeBron James, and Christiano Ronaldo.

However…there’s an argument to be made that Nike has placed too much reliance on legacy rather than innovation over the last 3 years.

Things at Nike haven’t been going as smooth as they did a few years back with shares falling 24% over the last year making it now just a 7% gainer over the last 5 year period. For a company with Nike’s brand power, that’s for sure a cause for concern.

With competition and innovation intensifying in the market, some people are writing NKE 0.00%↑ off.

I can’t go as far as saying Nike will obviously bounce back. But you’d be brave to bet against Nike.

▶Most Recent Earnings

Beat revenue estimate by 1.1%.

Beat GAAP EPS by $0.06 resulting a $0.77 EPS which included $0.27 in restructuring charges for the quarter.

Gross margin missed estimates by 30 bps but this was actually a slight increase on previous quarters driven by improved pricing.

$10.6 billion in cash & cash equivalents and $8.9 billion in total debt.

🔢The Longer Term Trends

Revenue

Here’s Nike’s total revenue (orange) and footwear revenue (blue).

With regards to the footwear division, performance footwear grew in the high-single digits with the more expensive franchises such as Kobe and Ja (basketball), Metcon and Motiva (fitness), Vomero and Structure (running) all growing in double-digits.

This is all ahead of the Paris Olympics too where management expect big catalysts for growth when they launch their newest innovations, particularly the Air brands with the “Air for Athletes” campaign expected to be the boldest Nike campaign in years.

Here’s some more specific numbers:

NIKE Stores saw 6% increase in revenue

NIKE Digital saw a 4% decrease in revenue

Wholesale saw a 3% increase in revenue

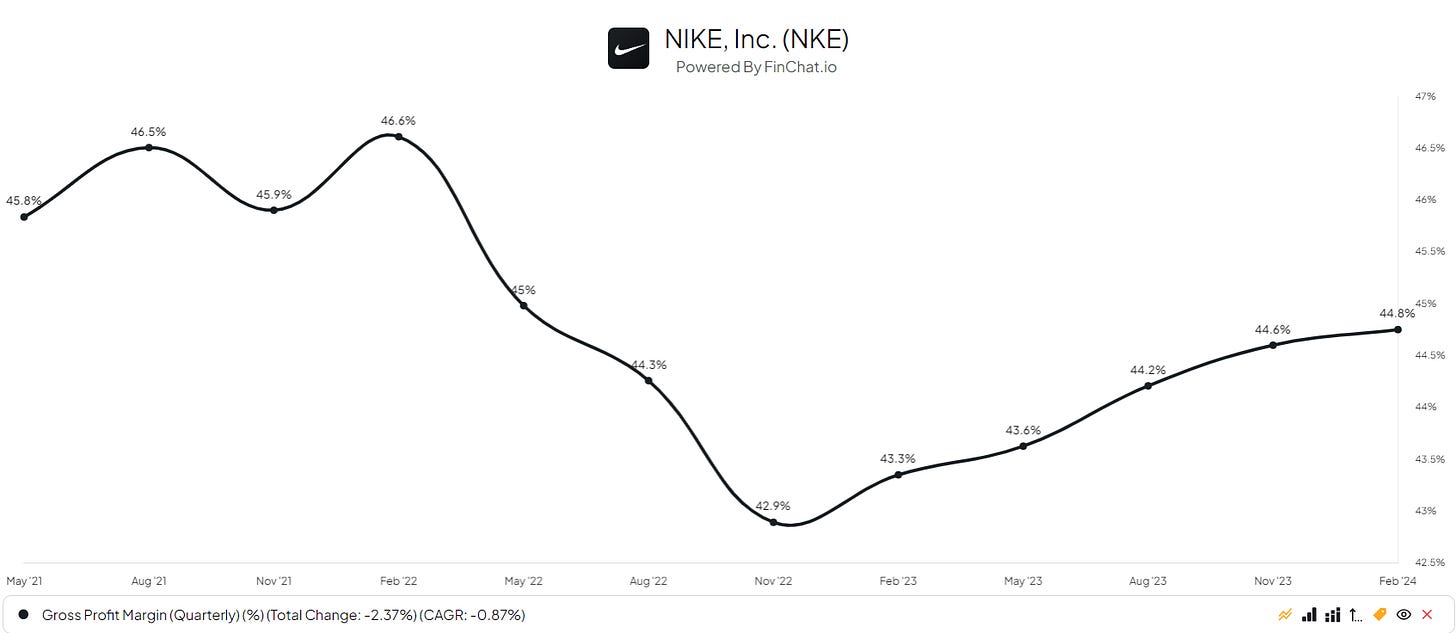

Margins

Here’s the operating margin and net profit margin for Nike from 2014 to present. For a company of Nike’s size and scale you’d generally hope to see a more stable graph.

However, the 2021-2022 (just after margins recovered) has seen another drop due to the inflationary increase in raw materials and commodity prices that Nike clearly struggled to pass on to the end consumer.

Net margins fell fairly drastically from 15.3% in Aug’21 to to 8% in May’23, a 730bps drop.

Here’s the quarterly margin graph which looks even worse:

However, the positive to take in respect to margins is that gross margins have been trending upwards since late 2022. Last quarter alone saw a 150 basis point increase in gross margins (which actually also includes a 50 bps reduction from restructuring changes).

📈📉Valuation

5-Year average P/E: 39.06x

Current P/E: 24.7x

As of today, NKE has an EV of $144.21 billion.

Currently, YE estimates are:

$51.68 billion in revenue

$6.84 billion in EBITDA

$5.68 billion in FCF

$3.7145 EPS

This means the stock is currently trading at:

2.79x EV/Sales

21.08x EV/EBITDA

25.3x EV/FCF

This is with 6.71% EBITDA expected growth in 2024.

🎯Investment Case

Nike continues to work through quite a difficult period of competition which they haven’t really faced yet, especially in the footwear sector. They’ve relied on their brand image and history too much so far, but now they’re being forced to innovate. The positive to take from this is that Nike probably possesses the best resources out of all competitors to innovate the best. They’ve brought forward their multi-year innovation cycle, are well positioned for the Olympics, and have scheduled an Autumn Investor Day which is the first in seven years. These events are exactly what NKE needs to show consumers that Nike’s next wave of innovation is underway.

Management is currently undergoing a restructuring with the aim of $2 billion in cost savings over the next three years. It’s essentially streamlining operations across the supply chain, product assortment, organizational structure, as well as increasing automation. This is another catalyst and further signs that management are taking solid action to reverse the negative sentiment over the last 2-3 years.

Nike has an aggressive share repurchase program. In the last quarter NKE repurchased ~$886m of shares and have managed to decrease shares by 13% over the last 10 years. Although many companies in this stage of the life cycle are managing to repurchase shares consistently, it’s for sure a nice addition to the investment

🤞Risks

The EV/EBITDA multiple of 21.08x is high considering EBITDA expected growth is very minimal compared to HOKA and DECK (see below).

Market share is decreasing rapidly not just in the footwear industry but in the apparel industry too with the likes of Lululemon, Adanola, Set Active, Gym Shark, and Tala etc. The moat is simply not as strong as it once was, though I’m not saying they don’t possess the capabilities to bounce back.

🥈Hoka / Deckers Outdoor (DECK)

“We are creating remarkably distinct, relevant, and breakthrough product concepts that are deeply rooted in consumer insights and brand DNA.” - Dave Powers, CEO

It’s important to note here that Hoka is owned by Deckers Outdoor Corporation, also owner of UGG, and therefore whilst I’ll provide commentary on specific Hoka numbers, much of this commentary will be on DECK as a whole. That’s the investment opportunity at the end of the day.

Hoka is my choice of shoe and I absolutely love them. But, this article isn’t about shoes. It’s about investment opportunities so I’ll do my best to type this out and not constantly touch on the warm hug my feet are currently being given by my Hoka Clifton 8s.

▶Most Recent Earnings

Revenue increased 16% on a QoQ basis to $1.56 billion with direct-to-consumer revenue increasing 23% to 55% of total company revenue.

Total Hoka revenue increased 22% to $429 million and total UGG revenue increased 15% to just over $1 billion for the quarter.

Gross margins increased 500 basis points to 58.7%.

Diluted earnings per share increased to $15.11 (a 44% increase).

🔢Longer Term Trends

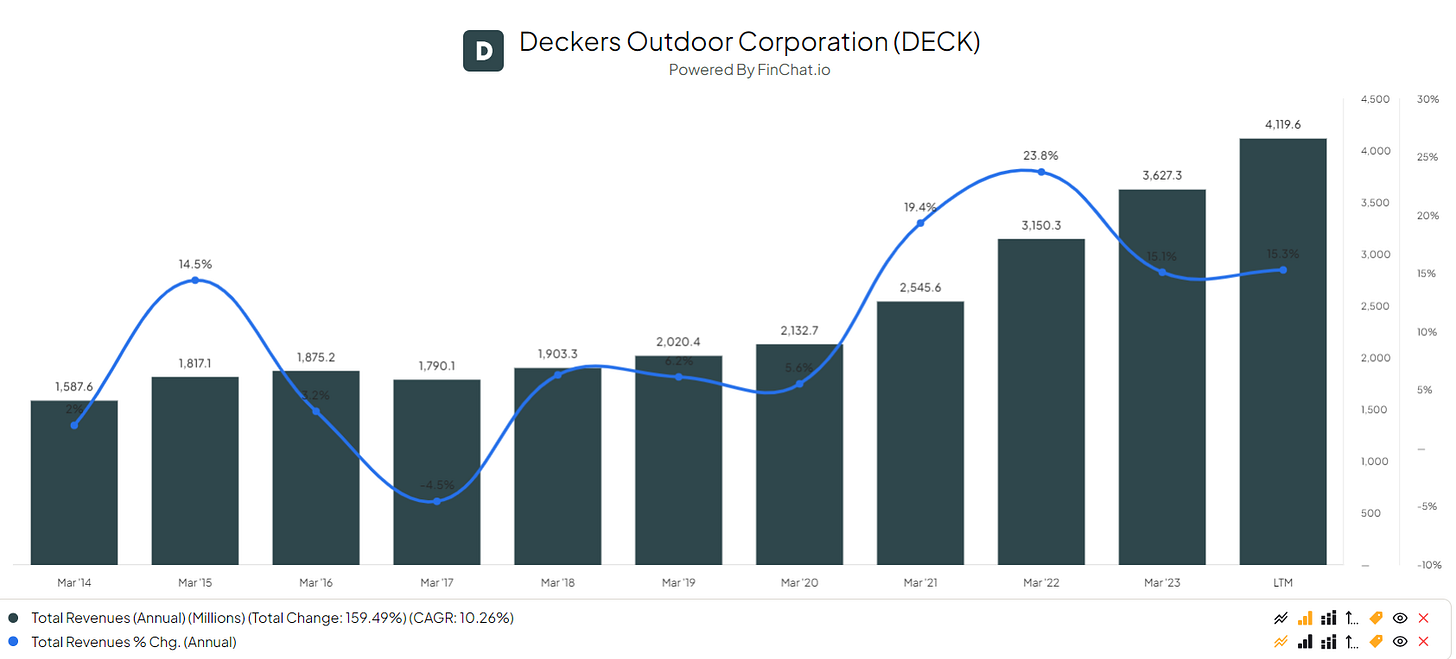

Revenue

Revenue growth for Deck has been incredibly impressive the last 3 years, mainly around the time Hoka started to gain some serious brand awareness.

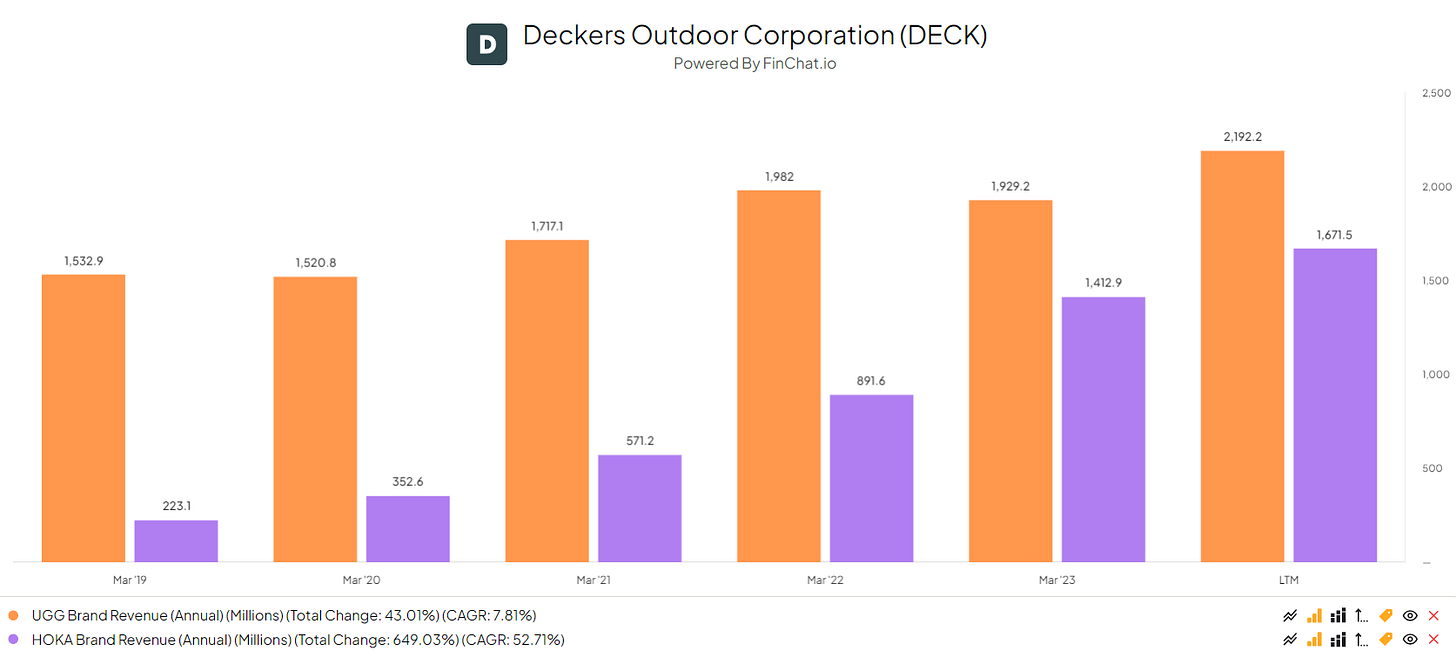

Here’s the breakdown of Hoka vs Ugg revenue:

Ugg has been steadily growing year on year, whilst Hoka has seen rapid expansion. It’s unlikely Hoka’s growth rate will remain at what it currently is, but if it does it won’t be long before Hoka becomes DECK’s main revenue source.

The most important metric for me (along with revenue growth) is further direct-to-consumer growth sales. Here’s what DECK is currently looking like:

Direct-to-consumer sales increased 23% vs last year where they now represented 55% of the quarter’s revenue (vs 52% in prior year). HOKA has seen the most rapid increase in direct-to-consumer sales increasing 38% from prior year vs UGG at 20%.

Of course wholesale is still important, but I’ve seen DECK do a good job at being selective with who they wholesale partner with. In UGG’s early days, the management team gave their product to everyone, with a lack of diligence and attention to pick those wholesalers who could tell the story of the brand the best and showcase the sheer level of technology and innovation that goes into designing these shoes.

More recently, DECK have done a great job at increasing direct-to-consumer sales, and been even more selective with wholesalers. Although this may reduce revenue growth in the shorter term, maintaining brand strength is a priority.

From an international perspective, DECK (mainly the HOKA brand) are extremely focused on their Asian expansion. International growth rates are currently growing at faster rates on a percentage term than domestic growth rates, albeit much smaller dollar amounts but nevertheless this is a positive sign. In particular, direct-to-consumer international growth was 50% this year.

Margins

The strong performance across direct-to-consumer over the last 2-3 quarters has led to much stronger gross margins, as a result of growth to the global average selling price.

Comparing these gross, EBITDA, and net margin graphs to NKE and ONON and there’s a clear winner here with DECK. Whilst this margin expansion over the last quarter is well above normalized levels and is likely not something to happen again to the same degree, any further growth (100bps expected) should be taken positively by investors.

With freight costs back on the rise, the Olympics marketing spend, and added investment into talent, margin growth expansion to the levels seen here is almost impossible over the next year or two so that needs to be understood by investors.

📈📉Valuation

5-Year average P/E: 19.0x

Current P/E: 29.4x

As of today, DECK has an EV of $19.17 billion.

Currently, YE estimates are:

$4.21 billion in revenue

$917.67 million in EBITDA

$701.24 million in FCF

$27.09 EPS

This means the stock is currently trading at:

4.55x EV/Sales

20.89x EV/EBITDA

27.34x EV/FCF

This is with 34.9% EBITDA growth expected in 2024.

🎯Investment Case

DECK have done an incredible job of increasing direct-to-consumer sales which is extremely beneficial for the company. Not only does it increase margins and average selling price per shoe, but it also provides DECK with added data and insights to their customer.

Whilst UGG still has lots of room to grow globally, HOKA is DECK’s primary growth engine with considerable opportunities available internationally and domestically. Aside from geographical expansion, HOKA is still a new brand with an exciting innovation pipeline and many new products on the horizon.

DECK also owns a couple of smaller brands, one of which is Teva. Although on a revenue basis this is much smaller, management are beginning to prioritize innovation into Teva to create a "new sneaker brand” (hasn’t come to market yet) made for all day wear with technologies you’d find in a performance running shoe like HOKA. Although we don’t know much about this, there’s for sure potential in the future.

🤞Risks

DECK are mainly focused on HOKA, UGG, and a little bit on TEVA currently, all of which operate solely in the footwear industry. Unlike ONON, who are attempting to become a key player in the apparel industry, DECK are not attempting to do this. Whether this is a good choice or not is currently up for debate. Of course this allows them to put full focus into footwear innovation, but are they leaving a lot of apparel revenue on the table? I guess we’ll know the answer in a few years.

Another question I have that I currently don’t know the answer to is whether or not management’s lack of recent acquisitions is a good play or too passive. They have had very successful acquisitions of HOKA and UGG, but are currently focused on adding growth and value to those investments instead of adding to the wider portfolio.

Dave Powers, the CEO of 11 years is leaving later this year. The Chief Commercial Officer, Stefano Caroti is taking over. Any new big change of management particularly after a very successful stint for Dave Powers leaves some unknowns.

🥇ON Running (ONON)

“We observe very strong growth, incredible increase in brand awareness, and significant gains in market share nearly everywhere around the globe.” - Martin Hoffmann (Co-CEO)

I first came across ONON back in 2020 or so when I heard Roger Federer invested a big stake into this new running shoe company. At first I didn’t think much of it, but over the last 12-18 months I’ve seen gyms packed with people wearing On’s.

Although the stock has had a wild ride, and is still below IPO prices, the fundamentals of the business are going from strength to strength at pretty astonishing rates. Clearly the IPO price was far overvalued, but nevertheless the stock is still trying to find its footing which isn’t easy amidst the macro headwinds at play currently.

Nevertheless, ONON is my favorite investment out of the three listed here by quite some margin. Let’s delve in:

▶Most Recent Earnings

Revenue reached CHF 1.79 billion, a 46.6% increase YoY but this was heavily impacted by the strength of the Swiss Franc. Without FX translation, ONON revenue grew 55%. This did miss estimates by just over 1% though.

Missed EBITDA estimates and a miss on EPS.

Beat EBITDA margin estimates and guidance by 50 bps with EBITDA margin now at 15.5% (compared to 13.5% last year).

CHF 494.6 million in cash & cash equivalents with no debt (very well financed to invest into future growth).

Since the fairly hefty IPO valuation, ONON 0.00%↑ has returned -8.7% to shareholders since October 2021. However, YTD performance has been ~20%. The stock is still on a fairly bumpy ride, but nothing massively has changed fundamentally (to the downside just for clarification).

🔢The Longer Term Trends

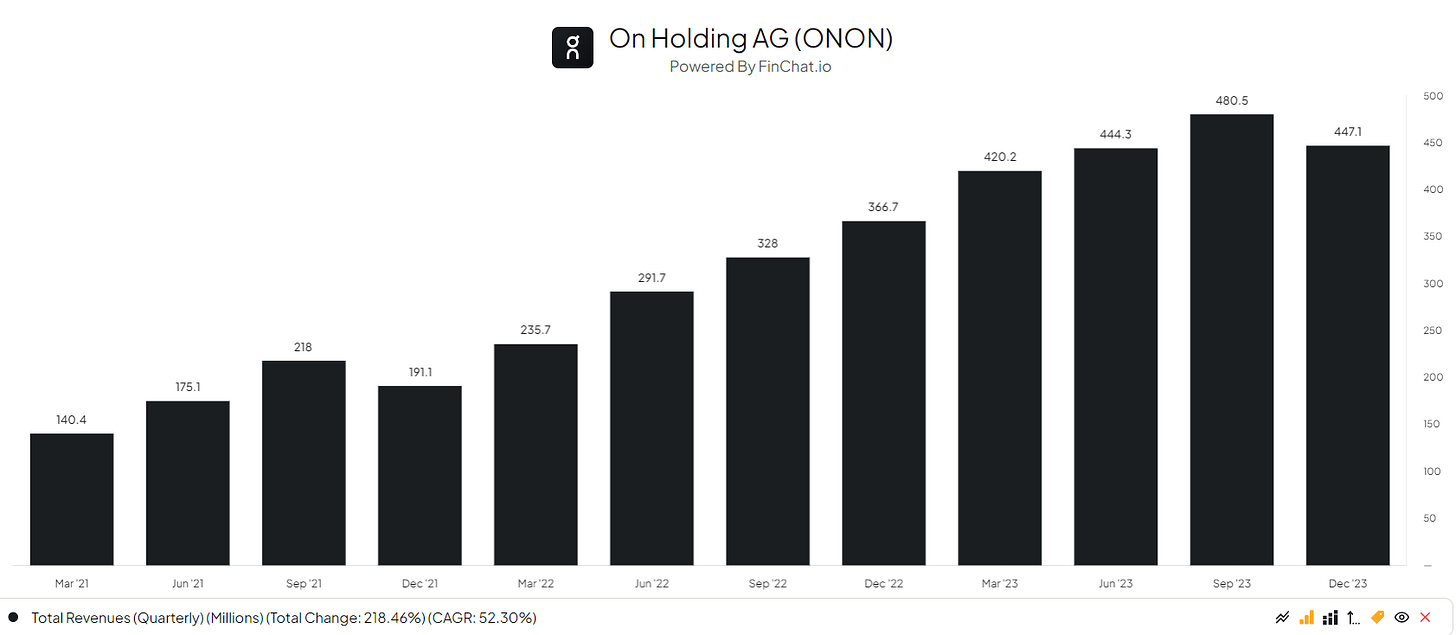

Revenue

On passed the $2 billion mark (CHF 1.79 billion) in revenue at 2023 year end. Comparing this to Nike who are doing upwards of $51 billion, On are of course nowhere near, though rates of growth are aiming to be sustained at the 30% range. It’s important to note here than back in October 2023 management shared aspirations to grow at 26% CAGR, but 2024 growth expectations have already increased up to 30%.

This rate of growth is because On have created a strong position in the premium footwear market. They’ve become known for their innovative designs and sleek look, allowing them to ride the wave of consumer preferences for high-quality athletic footwear.

Though On is currently predominantly a running footwear brand (95% net sales), the apparel industry is twice as large as footwear and presents a huge opportunity for On over the next decade or so. In Q4 alone, apparel growth saw 60.1% growth and 110% growth across direct-to-consumer channels.

When you look at the numbers, apparel sales as a percentage of total revenue fell from 2022 to 2023, but that’s mainly because footwear is simply growing at astonishing rates. Management have an aim to grow apparel to 10% of annual revenue globally. In Q4 they managed to do this in the Asia Pacific area.

And just from a non-biased, personal perspective, the apparel is really nice. On have partnered with the number 1 women’s tennis player in the world, Iga Swiatek, and the USA number 1 men’s tennis player, Ben Shelton.

Some more specific numbers:

Direct-to-consumer represents 36.4%

Wholesale represents 65.4%

I’d like to see these numbers get closer to 50/50, though the current ratio isn’t necessarily bad for a company in On’s stage of growth. Direct-to-consumer offers much better margins, but it also allows On to gather more data and paint a better picture of the On consumer.

On have also been opening new retail stores which management say are performing very well. In Q4 2023 alone six new stores were opened in London, Miami, Paris, Beijing, Chengdu, and Guangzhou with plans in New York, Portland, and Berlin upcoming.

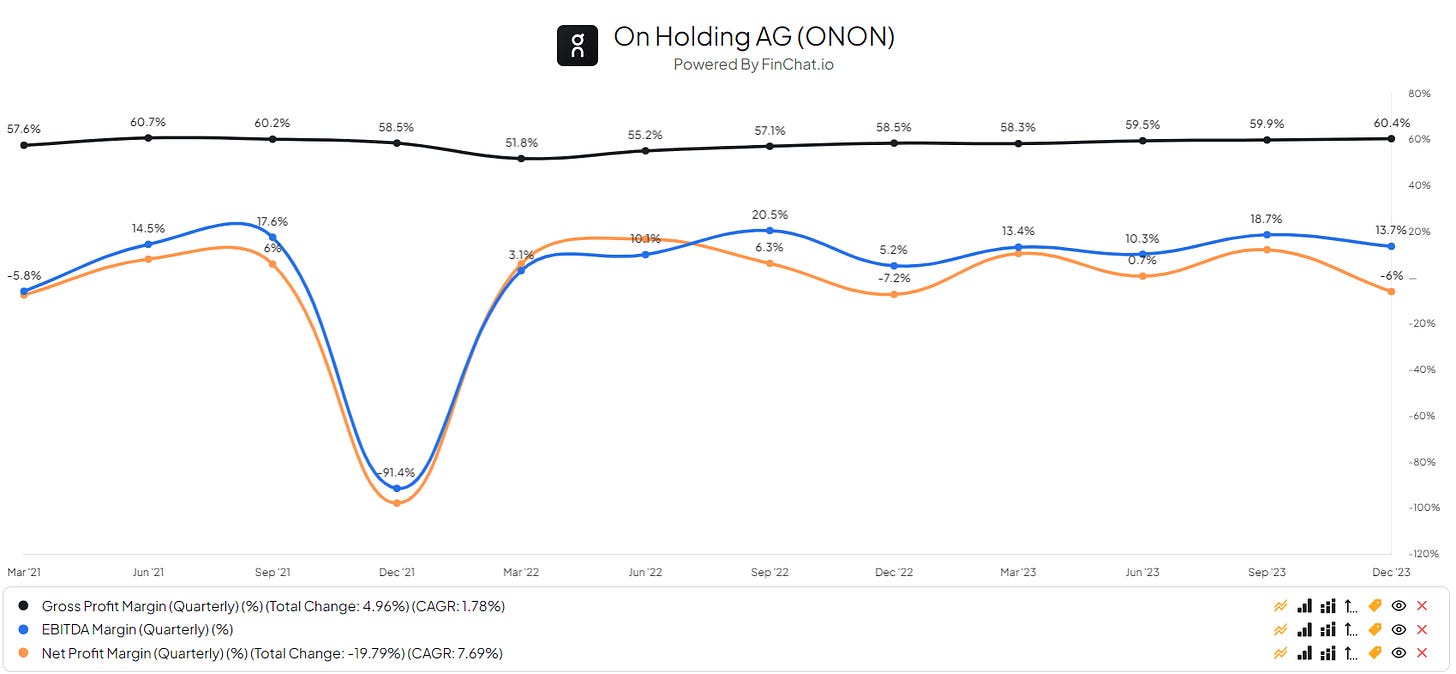

Margins

Management anticipate a gross margin of 60%, which is the main step needed to achieve the mid-term goal of an adjusted EBITDA margin of 18% by 2026. It’s also very nice to see a 500 bps increase in gross margin especially just from one quarter. I don’t expect (and nor do management) much more gross margin expansion over the short term.

The adjusted EBITDA margin has decreased slightly but this is the counter to increased marketing expenses and more campaigns. I’m not too concerned about this, especially with the upcoming Paris Olympics where big campaigns are needed.

Also, the EBITDA and net margin expansion will naturally come with increased growth in direct-to-consumer sales, something management are laser focused on.

📈📉Valuation

2-Year average P/E: 90.45x

Current P/E: 92.4x

As of today, ONON has an EV of CHF8.82 billion.

Currently, YE estimates are:

CHF2.27 billion in revenue

CHF369.2 million in EBITDA

CHF110.9 million in FCF

CHF0.7265 EPS

This means the stock is currently trading at:

3.88x EV/Sales

23.89x EV/EBITDA

79.53x EV/FCF

This is with 36.2% EBITDA growth expected in 2024.

🎯Investment Case

On is currently is riding a wave of huge momentum, something which the likes of NKE do not currently have. With momentum comes opportunities, especially in an exciting Olympics year.

On are a very early stage, high growth company, and extremely successful company. However, the upside potential is still huge. Over the last couple of years management have learned a lot, gathered insights and data, developed more conviction, and have a much more solid forecast on estimated returns on planned investments. Ultimately, brands like NKE are in very different life cycles to ONON and the upside potential for On is naturally a lot higher, especially since they’re showing all the positive signs already. They’re showing more and more strength in ultimately converting sales towards the DTC business which for me is the most important metric at the moment. I’m not concerned at all about the revenue growth prospects to be honest. The downside risk for me is the need for margin expansion, and that’s why direct-to-consumer is so important.

Apparel is only ~4% of On’s net revenue (but growing at impressive rates on a YoY/QoQ basis). With recent releases of tennis and gym/training apparel I think there’s huge potential for management to reach this 10% apparel to revenue figure sooner than they estimate. They’ve got some very high profile partnerships, particularly in the tennis world, and as someone in the tennis world, I know there’s a lot of excitement about the On apparel. I’ll be watching these figures closely over the next year as this could easily turn On into a multi-multi billion dollar company over the next 5 years.

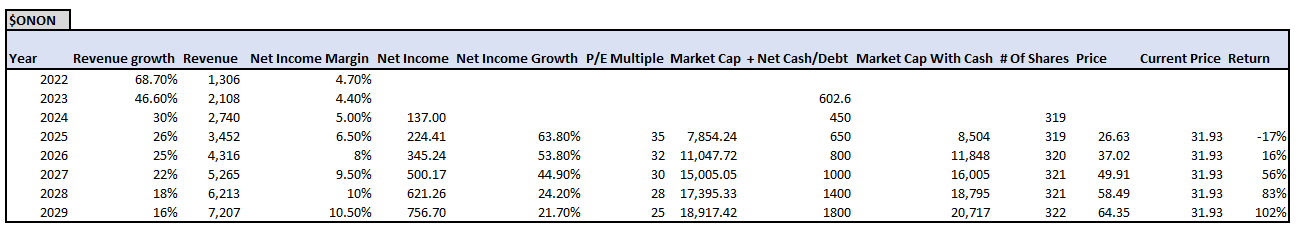

Here’s my investment model:

With a 102% potential return over the next 5 years, that’s just over 20% per year, well over the S&P 500 8-10% annual average. I also think I was maybe a tad conservative on the net income margins finishing up in 2029 with 10.5% net margin. DECK are currently at 17.6% net margin and NKE were in the high 12% range before struggles over the last 2 years.

🤞Risks

With the momentum that ONON has managed to gain comes high expectations. In today’s more volatile stock market this normally means missed expectations lead to bigger drops than perhaps are warranted.

Analysts are beginning to price in solid growth of the apparel which is of course a risk. The apparel is still so new and may not be welcomed by consumers as well as the footwear is. There’s definitely some early mixed reviews on the clothing.

As mentioned above with DECK, brand decline is very quick. Much more mature brands with history such as NKE can lean into their history and heritage whereas newer and high growth companies like ONON and DECK are unable to do this. If there’s a consumer sentiment shift towards ONON, there may be trouble. But I somehow doubt this will be the case.

How would you rank these 3 quality stocks?

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Do you own Nike?

As always, great analysis, Oliver. Nike is a great company. It survived the pandemic quite well, which means it did many things correctly. And frankly, my Nike running shows were great. I'd buy them again.