A Secular Trend: 5 Quality Cybersecurity Stocks📈

How you can best ride the cybersecurity wave

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

It’s #WednesdayWisdom!

🚀Cybersecurity Market

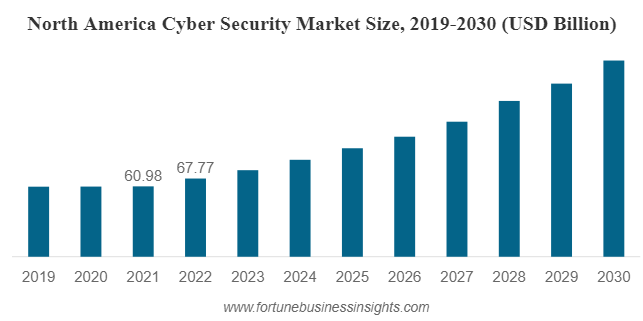

The cybersecurity market is one of the most rapidly growing, yet still stable, and future proof industries out there. It’s one of those industries I believe you need to have some of your portfolio allocated towards.

It’s essentially a never-ending battle between companies/governments and their cyber adversaries. With cyber attacks predicted to have an estimated $10.5 trillion impact on the economy throughout 2024, organizations are continuing to place cybersecurity as more and more of a priority each year.

These adversaries are no longer just individual hackers. They’re highly sophisticated organizations, multibillion dollar enterprises with hierarchies and R&D budgets using AI and machine learning to attack companies. The scope of the threat is growing, and with that the continued growth of cybersecurity companies is becoming more and more inevitable.

🎯5 Quality Cybersecurity Stocks

1. ZScaler ZS 0.00%↑

Business Description:

Zscaler is a dominant player in network security. They compete directly with Cloudfare and Palo Alto (see below).

ZScaler operates the Zero Trust Exchange (ZTE), its latest cloud security platform that essentially does what it says on the tin; never trusting a device or end user.

The ZTE automatically vets all traffic as it moves within a company’s networks and grants permissions based purely on client policy. ZTE is rapidly replacing firewalls and VPNs.

Fundamentals:

Revenue 3-Yr CAGR: 52.4%

Net Margin: -7.3%

ROIC: -12.2%

ROE: -18.6%

FCF Margin: 28.2%

Investment Case:

Dollar based net revenue retention at 117%. This highlights a high customer retention rate, and pricing power (two signs of a growing moat).

Margins are improving significantly with operating margin jumping from 12.6% in Q2 ‘23 to 19.6% in Q2 ‘24. FCF Margin has also jumped over 300bps.

ZScaler are winning clients and just recently announced 50% of YTD bookings came from new customers. They’re winning clients quickly, whilst also easily retaining existing clients. Just in Q2 ‘24 they have won a Fortune 100 healthcare company, a Fortune 500 financial services company, and a federal agency.

$1m+ customers annual recurring revenue rose 31%

Graphic:

2. Palo Alto Networks PANW 0.00%↑

Business Description:

Palo Alto competes across endpoint, cloud, and network use cases, fairly similar to ZScaler.

They have a network security suite called Strata, an endpoint security suite called Cortex, and a cloud security suite called Prisma.

Fundamentals:

Revenue 3-Yr CAGR: 25.8%

Net Margin: 6.4% (LTM 30.2%)

ROIC: 2.1% (12% LTM)

ROE: 44.9%

FCF Margin: 38.8%

Investment Case:

Very well positioned to capture market share in AI related attacks with AI offerings ramping up rapidly. Although, arguably they are slightly behind competitors like CrowdStrike when it comes to GenAI.

Prioritizing “platformization” - the ability to cross-sell more products to clients by placing Cortex, Prisma, and Strata all in one unified platform.

Nancy Pelosi bought PANW 0.00%↑ 👀

Graphic:

3. CrowdStrike CRWD 0.00%↑

Business Description:

CrowdStrike also competes directly with Palo Alto, and ZScaler in that they’re a cloud-native endpoint cybersecurity company. The core of the business is endpoint detection and response (EDR), which essentially is replacing anti-virus.

However, they are also rapidly expanding into offering applications in cloud security, log management, forensics, and data analytics, all part of the all-in-one “Falcon Platform”, allowing for pretty impressive cross-selling.

Fundamentals:

Revenue 3-Yr CAGR: 51.7%

Net Margin: 2.9%

ROIC: 0%

ROE:4.7%

FCF Margin: 32.3%

Investment Case:

Consistently beating competitors in big deals. Most recently they received a 7 figure deal beating Palo Alto Networks. Also they have recorded wins against Microsoft in several log management deals which has essentially led to 30% growth in deal count and +1m deals that have rose 30% also. Signs of a very strong product.

Charlotte AI has recently become more widely available, and as per management, 80% of beta users believe the product could increase their efficiency with the platform to a “great extent”. There’s big potential for this to be another revenue stream over the next 3-5 years.

Margin increases have been very impressive; Gross margin reached 78%, highlighting stable price increases and cost efficiencies. Meanwhile, FCF margin reached 32.3%.

Graphic:

4. SentinelOne S 0.00%↑

Business Description:

SentinelOne competes with CrowdStrike and Palo Alto in the endpoint security market, however, they specialize currently in smaller and medium business clients.

Just as above, SentinelOne are rapidly expanding into the cloud security and data analytics markets, with the core business operation currently being Endpoint Detection and Response (EDR). Essentially, SentinelOne has a very similar product pathway to CrowdStrike, however the latter is just slightly further ahead at bringing products to market.

And for this reason, it’s currently trading much cheaper than CrowdStrike 💸

Fundamentals:

Revenue 3-Yr CAGR: 88.3%

Net Margin: -54.5%

ROIC: - 24.3%

ROE: -20.8%

FCF Margin: -11.2%

Investment Case:

Very attractive pace of margin expansion that is considerably more than other hyper-growth software companies (I’m talking about the likes of GitLab, Snowflake, Datadog etc). They’re rapidly approaching FCF and EBIT breakeven points. This shows the pricing power that SentinelOne possesses.

SentinelOne has arguably the strongest AI capabilities of all competitors since they have essentially been an AI company since inception. They are close to releasing a security assistant called “Purple AI” that will directly compete with CrowdStrike’s “Charlotte AI”.

Graphic:

5. Fortinet FTNT 0.00%↑

Business Description:

I’ve spoke about Fortinet before in my newsletter, and it’s been a solid piece of my portfolio for the last 18 months or so.

68% of the Fortinet business is in Secure Networking with the main product being a network firewall, Fortigate. 21% of the business is related to SASE (Secure Access Service Edge), directly in competition with Palo Alto, SentinelOne, and CrowdStrike. The final 11% of Fortinet is made up of SecOps, which focuses on helping Fortinet clients identify, prevent, detect, respond, and repair damage from cyberattacks.

Fundamentals:

Revenue 3-Yr CAGR: 26.9%

Net Margin: 21.6%

ROIC: 20.7%

FCF Margin: 36.2%

Investment Case:

Fortinet boast a huge installation base with everything being built on the same operating system meaning clients can simply turn on the SASE function. This gives me a lot of confidence that Fortinet can continue to bring in clients, and easily cross-sell them to the SASE function.

76% of Fortune 100 companies are clients of Fortinet, as well as 69% of Global 2000. This highlights the quality of the product, as well as Fortinet’s competitive advantage in the industry.

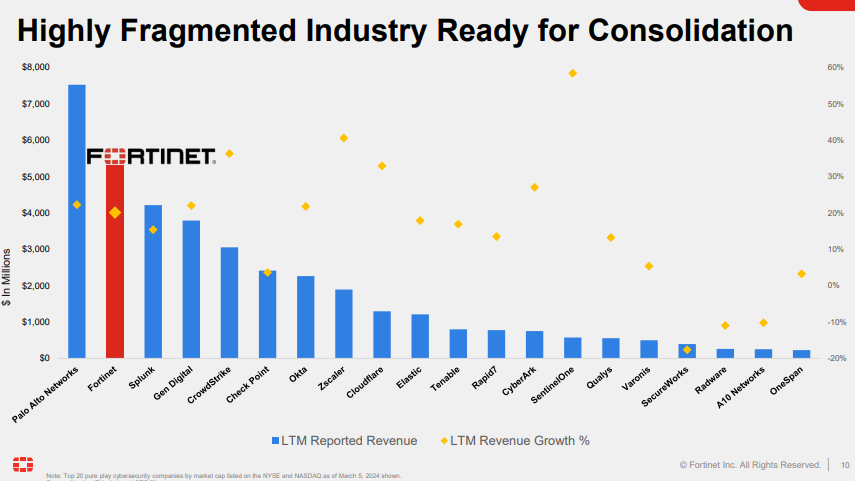

Fortinet has the most diversified business out of all companies in this article. See below graphic for breakdowns:

Graphic:

📜One-Pager: Fortinet

The only cybersecurity stock in my portfolio is currently Fortinet. I am continuing to research SentinelOne more and more and I’ll keep you updated if, and when, I decide to purchase that company.

Here’s the Fortinet One-Pager:

1 Graphic

Here’s the 10 largest companies in the world!

What do you think this list looks like by 2030?

Note: This was created about 3 weeks ago. Numbers may not be completely accurate to today’s valuations.

1 X Post

Sometimes you can find quality stocks just by some very simple and quick screens.

Of course, a lot more research should go into stock picking, but you can screen out lower quality stocks in a matter of minutes.

You can check out this post here on my X:

1 Quote

Here’s Mr. Pessimist (me) coming back to your inbox again.

Just a reminder than greed and optimism is very heightened. I hope by now you know what this means.

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy.” - John Templeton

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Crowdstrike really is the best in class. Love that company.