Hims & Hers - Very High Confidence In The Future

Earnings Report & Deep Dive

Hi fellow investors👋

Introduction

HIMS is an online healthcare marketplace that essentially connects patients with healthcare providers. It gets rid of all the waiting times, insurance admin, and general awkwardness of going to see you’re doctor especially for more taboo health issues such as sexual health, mental health, weight loss, and dermatology.

This means HIMS users can access quality healthcare from the comfort of their own home, something which I’m shocked isn’t more commonplace today. Healthcare really is one of the few trillion dollar industries that has yet to be really disrupted by tech:

Office spaces are now at only ~60% occupancy because hybrid working is so common.

Digital banking is an everyday occurrence now. Nobody needs to go to physical banks branches unless there’s a more complex issue.

E-commerce now represents ~17% of all U.S. retail sales.

Online education platforms like Udemy & Coursera make accessing top quality degrees from home easy.

NFLX, DIS, and AMZN have basically made traditional movie theatres a rare outing.

ABNB and BKNG have removed the need for attending travel agencies.

Disruption to the healthcare segment is the next big trend and I’m confident HIMS will lead this revolution.

Ignoring the big picture industry-wide trend, HIMS are executing incredibly well. I’ll of course get into all this throughout this article…but to sum it up here:

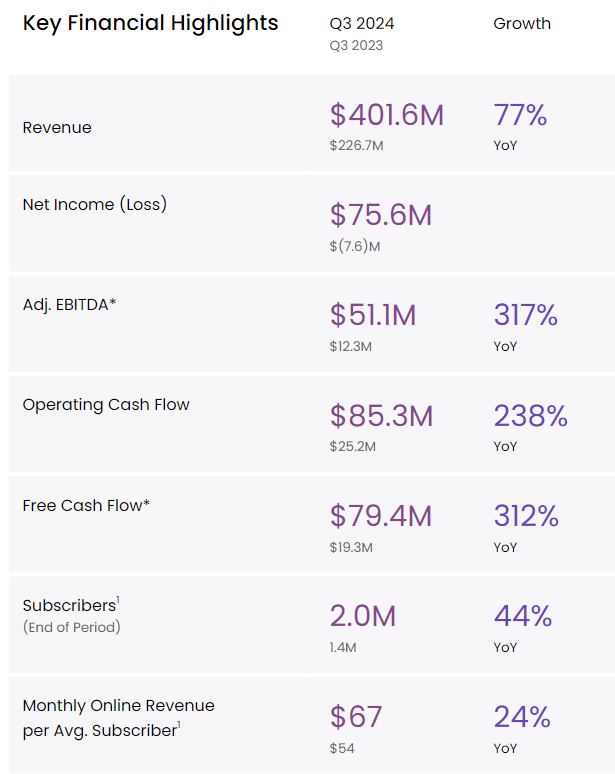

Revenue growth is 77.2%. Net Margin is 18.8%. EV/Sales is 4.0x. They have huge recurring revenue. They have unlimited opportunities. They’re an incredible company trading VERY reasonably.

When I Bought

I first bought HIMS in June 2024 at around $19 and also added to my position at around $14.50 when the stock dropped again in late August. As you can see it’s quite a volatile price chart which is expected for a high growth company tackling a tough regulatory environment and disrupting a multi-trillion dollar industry.

Earnings Writeup

Numbers

Revenue soared to $401.6M, compared to $315.6M in Q2. This is a 27.2% increase QoQ, a 77.2% increase YoY, and these numbers beat revenue estimates by 4.9%.

Subscribers growth was 44%, with HIMS crossing the 2 million subscriber mark for the first time.

Of these 2 million subscribers, more than 1 million are now using a personalized solution. This is 175% YoY growth for personalized products.

Gross margin fell to 79.2% (or 350 basis points), but this was expected due to higher costs relating to the high demand for weight loss offerings.

Adjusted EBITDA rose 317% to $51.1M which beat estimates by…31%(!)

The balance sheet still shows no debt. HIMS now also holds $255 million in cash & cash equivalents.

Subscriptions

HIMS have now crossed the 2M subscriber mark which is 44% YoY growth for them.

Before I jump into why this growth is so brilliant, let me just show you how impressive this growth of a subscriber base is.

The only subscriptions growth stories that are even remotely comparable to this level of growth at HIMS (that I can think of) are Robinhood Gold membership which is now at ~2.2M subscribers with growth rates of 42% YoY.

Uber One is probably the only one that blows HIMS and HOOD out the park with their Uber One membership of 25M subscribers growing at 70% YoY. But I think that’s quite a different story with the huge base they already have and cross-selling capabilities being currently way more advanced than HIMS.

Other than those two examples, I can’t think of many that match this level of growth HIMS is seeing. And there’s good reason for it that basically comes back to my core investment thesis for HIMS that I’ll summarize for you in 4 bullet points:

The process of booking an appointment with your primary physician nowadays is arduous…to say the least. HIMS removes all of this. There’s no 3-4 week wait to see a doctor. There’s no administrative burden of insurance claims. There’s no journeys to the doctor. It’s convenient and within “hours”.

In traditional healthcare there’s no interaction with your physician after you see them…until when you see them again. HIMS allows consumers a much deeper interaction with physicians. Data suggests almost weekly communication between patient and physician in the first 4 weeks after initial consultation. Of course this would not be possible at scale in traditional brick-and-mortar medical practices.

Low-income households normally find it very difficult to access quality healthcare for reasons such as lack of insurance, transportation difficulties, and high cost of medical services. HIMS removes this. About 20% of HIMS subscribers are now from households with a household income below $50k.

Network effects are beginning to take over. As subscriber count continues to grow, more and more physicians will come to the platform to grow their customer base. Subsequently, wait times decrease further and quality of care increases further.

One of the bear cases for HIMS has been that they have had to spend ridiculous amounts of money to get the above points across to the masses through huge marketing spends. However, it’s difficult to continue to make this argument.

Only 2 years ago marketing as a percentage of revenue was close to 100%. It’s now 45% and coming down pretty significantly towards the 30% goal that management have.

Of course this is still high but now the numbers are making much more sense to continue to spend big on marketing. Monthly retention is over 95% and they currently have a marketing payback period per customer of under 1 year. If I’m being honest, I don’t fully understand why this was a bear case, and if it still is, why it is a bear care.

When you have 2M subscribers and you’re TAM is upwards of 100M, why would you not spend heavily on marketing if:

You can afford it.

It’s bringing in customers.

It’s declining as a percentage of revenue.

Churn is low.

Cross-selling is increasing with more products and personalization.

Customer acquisition costs are coming down.

If I was part of HIMS management, I’d obviously track the marketing spend as a percentage of revenue, but I wouldn’t be in any hurry to get it to this 30% benchmark.

Personalization

The main bull case for investors of HIMS has been and will continue to be personalization. Historically, personalized healthcare has only been feasible to the wealthiest subset of Americans. HIMS have the opportunity to change this whilst also making a boat load of money from the trend.

Personalized care is important for two reasons; customers stay on the platform longer because they receive more value, and secondly, more customers join the platform because of the prospect of personalization.

HIMS now have over 50% of subscribers on personalized subscriptions, and 65% of all new subscribers are with personalized plans. There’s considerably higher value for customers and a considerably higher value for HIMS. Win win.

I think HIMS are still very early in the entire personalization journey. Data shows 175% YoY growth of personalized subscriptions and this growth is happening in the very early days of HIMS where:

The full set of conditions treatable by HIMS is nowhere near maturity.

MedMatch (HIMS GenAI algorithm essentially geared towards personalization) is still learning with every bit of data it receives.

The amount of multi-condition bundles HIMS are offering is currently quite limited. They combine dermatology and sexual health for HERS at $49 a month.

When more bundles are feasible, when MedMatch becomes even stronger, when more conditions are treatable, & when user retention sky rockets because of higher value, is when HIMS will really start to reap the rewards of personalization.

As I said, early days in the personalization journey.

GLP-1

When I talk about HIMS I don’t love spending too much on GLP-1 drugs because it’s not a huge part of my long term investment thesis. However, shorter term I’ve loved the volatility of the GLP-1 regulatory environment because it’s given so many opportunities to add to a position on a 15%-20% drop.

The volatility has basically all come from regulatory changes and worries about supply chains for GLP-1 drugs meaning they may no longer be on the shortage lists, and hence be much harder for HIMS to sell.

I don’t know exactly what will happen with the supply chains and shortage lists, but what I do know is that I have good trust in management and their data is suggesting that there are growing shortages. They said that 80,000 people on their platform have reported not being able to get hold of GLP-1 drugs. This data alone crushes all short-term bear cases on HIMS success in the GLP-1 market if this data is accurate.

Looking into 2025, management have stated several times that they will offer Liraglutide which has considerably less FDA and regulatory difficulties compared to the more popular Ozempic drug.

Liraglutide received FDA approval back in 2010 so has been in the market considerably longer than Ozempic. This makes regulatory hurdles a lot easier. On top of this you’ve got the side effects which from current knowledge are much worse in Ozempic because of the longer half-life. This of course leads to much more scrutiny, and higher monitoring by the FDA which ultimately has led to swings in the HIMS stock price…!

As I said before, I’m not fully focused on the GLP-1 noise because it will pass. What I do know for sure is that the TAM for weight loss drugs is pretty staggering and one way or another HIMS will have success in this market. It’s just a question of when…and exactly how.

The main reason I do like to track the GLP-1 environment a lot (despite what I say about it not being too important for the long-term thesis) is because it’s becoming an extremely good cross-selling tool. The more consumers that look into weight loss drugs, the more will see that HIMS offer a cheaper substitute, the more sign up. Subsequently, as the technology helps the platform become stickier with cross selling opportunities and high retention rates, this is where this weight loss trend will become extremely good for the wider business.

Opportunities

There’s tons of opportunities ahead for HIMS I think. To be honest, I think HIMS is really just getting starting and I hope I’m conveying that message to you throughout this article.

Here’s the big opportunities over the next 3-5 years. Some they have already started on…and some I’m sure will begin soon.

Verticalization

I talk about it below a bit in the “503A pharmacy” section, but HIMS are on the way to taking full control of their entire supply chain and this process begins by their acquisition of Medisource and their 503A pharmacies. HIMS are still in the hyper growth stage and on the way to 10M subscribers so short term I’m not too worried about margin expansion.

However, long term there’s huge margin expansion opportunity if HIMS can take control over their entire process from manufacturing to end consumer. Not only do they have the ability to expand margins, but there’s the possibility of potentially passing on any savings to consumers or saving cash for much acquisitions or innovations.

Currently, I view HIMS as an extremely good marketer with an extremely good product. Their soon going to possess an extremely good supply chain too.

Pricing experiments

Just a brief follow up on the point above, but I think it’s important. With efficiencies will come opportunities. HIMS management have said that they will be testing various prices once that efficiency is unlocked.

Whether they drop prices short term to bring in more subscribers and widen the gap between their competitors, or slightly raise prices and see if that effects growth rates I’m not sure. But there will be opportunities here that I don’t think they’ve had previously.

Technology Efficiencies

It’s important to realize that HIMS tech (namely MedMatch and Clever Routing) are in their early days meaning they’re going to become a lot better. MedMatch is a machine learning algorithm that essentially assists with personalization by helping physicians choose the best treatment for each individual.

Improvements here will happen with:

Time

More patients

More conditions

More treatments

As I spoke about above, more personalization will lead to a “stickier platform” with a higher retention rate and more long term value for HIMS and the consumer.

Clever Routing has not been spoken about as much as it’s a bit newer but it’s also an incredible piece of tech that is all geared towards efficiency. It works in the following ways:

Picking the right healthcare provider for each case. A more complex and urgent case will need more expensive treatment (i.e. a doctor) vs a less complex treatment may require cheaper treatment (i.e. a nurse).

Schedules and coordinates patient physician meetings and follow-up appointments based on patients conditions and treatment plan.

Internationalization

I left this one until the end because I think it’s the least likely in the next 3-5 years. HIMS are currently fully focused on the US market but they’ve made acquisitions internationally showing that this is a future long term plan for management.

10M subscribers is a short term goal. I think long term they get much more.

503A pharmacy

With HIMS $250M cash flow and rapidly growing FCF, they’re investing in 503A and 503B pharmacies through their Medisource acquisition (503B). A quick summary on what these are:

503A: Pharmacies that have medications specifically for individuals based on prescriptions from physicians.

503B: Outsourcing facilities that compound drugs in bulk for healthcare providers, hospitals, and other facilities who need large quantities.

503B’s are generally much more efficient and profitable than 503A’s due to the scale and efficiency factor of large quantities of the same drug. However, what is important is that utilizing both 503A’s and 503B’s will be a lot more profitable than using a third party as they’ll now be able to have much more control over the entire supply chain.

Vertical integration, margin expansion, and huge efficiency gains are all in the near-term pipeline for HIMS.

Risks

Lawsuits

The big risk is of course with GLP-1 and the related lawsuits from the likes of Novo Nordisk. Technically, generic weight loss drugs like what HIMS sell should be paused by the FDA for exclusivity periods to limit generic competition and help boost the branded products (like Wegovy) which go through the rigorous FDA regulatory environment, extensive clinical trials, and high costs of patents.

Exclusivity periods basically allow pharma companies to recoup costs and earn profits on the years of testing. Novo are arguing that HIMS aren’t honoring this by perhaps coming in too early.

I’m no lawyer and I don’t know what’s going to happen here but a short term lawsuit doesn’t in anyway change my long term HIMS thesis.

Competition

The other risk for HIMS is competition, especially from the likes of AMZN (if and when they decide to fully go into this sector).

Here’s my 2 quick thoughts on this risk:

It’s not a winner takes all market. So IF AMZN do decide to invest heavily into telehealth, again it won’t massively affect my long term HIMS thesis.

Personalization takes time to master. HIMS are crushing it here. If AMZN enter it’ll still take a long period to compete on personalization. Of course, they’ll be masters at scaling, supply chain, innovation etc but think about what the end consumer wants - personalized health care.

Valuation

I’m confident in saying that HIMS at $26 is a good deal for someone looking to invest in some high growth stocks.

I look at this in a couple ways. Here’s the first:

I’m fully aware this isn’t a like for like comparison and most of these are software stocks whilst HIMS is a telehealth company. Potentially for this reason, HIMS shouldn’t necessarily trade in the 15x-20x multiple range.

However, they’re growing revenue the 2nd fastest out of these basket of stocks.

HIMS also has an EBITDA margin of 6.66% which is higher than CRWD.

So we’re basically saying that HIMS has very strong margins (for their stage in the lifecycle), is growing quicker than other companies except NVDA, yet doesn’t trade at a reasonable multiple because they aren’t a software company?

Second, let’s take a look at these basic EBITDA calculations:

Subscriber count could hit 10M by 2030-2032 period. Management have been vocal that this is a goal but this would require a 35% YoY growth in subscriber count. That’s lower than the 44% they are hitting today but still quite high.

Average monthly revenue could hit $130 by 2030. This is based on a 15% YoY growth which I think is entirely reasonable with HIMS cross-selling capabilities and the number of opportunities they have, plus general inflationary increases of course.

10M subscribers at $130 a month average is $15.9 billion in revenue.

Management have also said that they’re shooting for 20% EBITDA margins by 2030. A 20% EBITDA margin on $15.9 billion is $3.18 billion in EBITDA.

The current EV/EBITDA multiple for HIMS is 23.6x but as I’ve said previously I think the multiples are way off. For the sake of being conservative though, let’s stick with a 20x EV/EBITDA.

That would then be a ~$63.6 billion market cap. Or 10x from today.

There’s no fancy DCF model involved here. It’s simple EBITDA projections with a conservative multiple and we have a 10x opportunity.

That’s it for the day

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Can you share how you conclude that churn is low (if you do)? Can't quite make out whether you're making the argument for why marketing spend may/can be higher and citing the low churn, or whether it's merely a hypothetical.

This corp is very hyped. not sure why. Going to review your writing and hopefully get the answer 🔥