LMND: Here's Why It's So Undervalued

My Valuation Model

Hi all 👋

Normally these valuation focused articles are solely for paid subscribers, but I’m going to open it up today for everyone to show you a small portion you a paid subscriber gets and also because it’s on LMND, my biggest current holding. The actual Google Sheet will only be for paid subscribers but I will share my results here in this article for you.

Do consider becoming a paid subscriber. You get access to:

My spreadsheet where I write daily notes on the market and the opportunities I’m seeing).

Access to all my deep dives.

Direct access to ask me questions.

My exact and timely buys, sells, adds, and trims.

My valuation models.

Before we get to LMND’s valuation model, let me run you through the Q1 earnings figures 👇

LMND offers a nice mix between insurance and tech. They offer renters, home, pet, life, and auto insurance predominantly in the US, but management insist they are a tech company built from the ground up unlike a lot of their competitors.

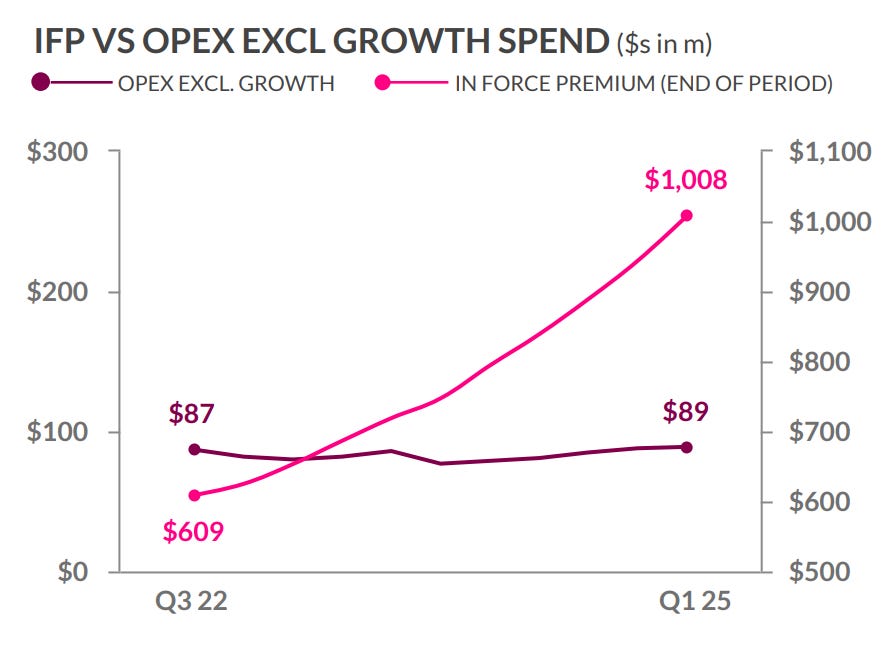

This tech focused insurance company therefore has massive benefits when it comes to insurance (mainly insurance agents and incorrect premium costing due to outdated models). The lower costs that LMND can therefore offer compared to peers has allowed top line growth to accelerate, whilst keeping all operating expenses (excluding sales and marketing) very stable. This is proof of a very good business model.

Demand/Revenue

LMND beat guidance and estimates on the IFP (in force premiums) as well as guidance and estimates on gross earned premium.

LMND also beat on revenue estimates now growing revenue by 26% YoY which is back on their track to 30% YoY growth.

The main revenue growth avenue over the next 3 years or so is with auto insurance which has been somewhat of a disappointment to many investors since it was first mentioned back in 2021. However, what investors have failed to understand is that car insurance is vastly more complex than renters or pet for example which have relatively simply underwriting models, fewer variables, fewer claims, and less severity (most of the time). By contrast, car insurance involves a fine blend of telematics, behavioral data, vehicle characteristics, location specific data, driver history etc. The list could go on for much longer.

This makes car insurance a very difficult market to crack especially with legacy players like GEICO, Progressive, and State Farm spending billions in advertising per annum to win those sticky customers. However, LMND’s approach of developing models that allow them to offer prices below the traditional incumbents, as well as cross selling to the millions of customers they already have makes complete sense. It’s a slow burner, but I see success. And because success in the car market is so difficult, the competitive advantage once you’ve carved out a share of the market there is huge.

But how can LMND undercut legacy players?

Telematics and data. But proper telematics and data as we know it today.

The GEICO’s and Progressives use “telematics and data” of course, but their version of it is an outdated underwriting model, and old software programs somehow bundled together. LMND’s AI native business does it properly, and long term when the models start to win, LMND will win.

“It’s not that legacy competitors don’t have more data than we do. They certainly do. But when you have the digital infrastructure that we have, you’re able to connect the dots in a way that is far more meaningful.”

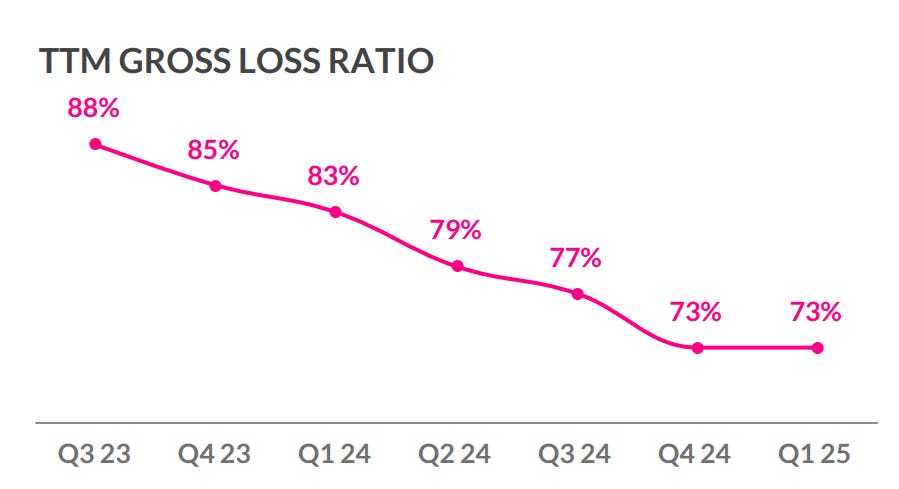

Once the LMND car loss ratios come down to an appropriate level, which they will, I think the auto business is a big winner. The TAM is basically infinite and even a 0.5% share of the market will make a material difference to LMND.

Profitability

Profitability for the quarter was solid, despite the losses from the LA wildfires.

Beat gross profit margin estimates (43.5%). Bet loss ratio estimates. Beat EBITDA estimates (-35.4%). Free cash flow positive.

An important thing to understand re profitability is that LMND finances the majority of its growth via synthetic agents. This basically finances the cost and means growth spending is not a cash drain. This allows LMND to grow faster and more aggressively whilst not draining liquidity. This also explains why the cash flow statement is positive whilst the income statement is negative.

Guidance

LMND have been reiterating the same guidance for a while now which is:

30% YoY growth.

FCF positive in 2025 (already happened).

EBITDA profitable in 2026.

Net profitable in 2027.

There’s many stocks that I can name that hit inflection points over the last 24 months and had massive run ups. LMND will be the same. Once institutions start to realize LMND is a profitable company, the big money flows there.

Valuation

I like creating models, but I tend to not make them overly complex because I don’t feel like we need to. The more complex we make it, the more assumptions we make and ultimately all it comes down to is making an assumption that turns out to be directionally correct, rather than exactly correct (which rarely happens).

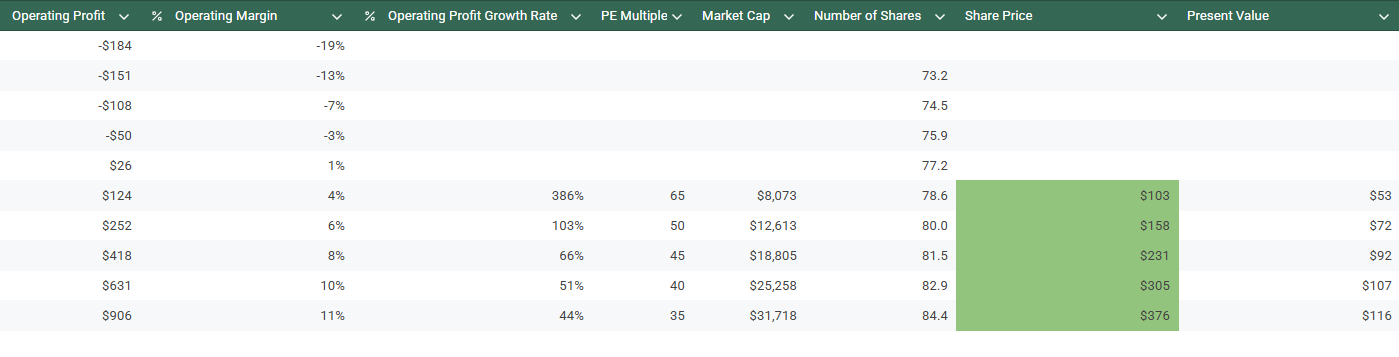

My model gives me a $376 share price in 2033 (PV of $116) meaning there’s 817% upside through to 2033 based on my fairly conservative model. This model will be shared directly with paid subscribers on my spreadsheet but here’s a screenshot:

My model has taken into account the following:

IFP

Gross profit

OpEx Excluding CAC

CAC (harder to model)

Operating profit

Operating profit margin (suggests profitability by 2028/2029 which in slightly behind management guidance so I feel I’m not being too aggressive)

Operating profit growth

Multiple

Share price

Present value

Peer Valuation

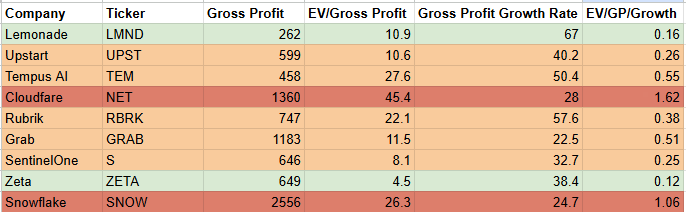

I screened for high growth companies with similar profitability metrics to LMND. Most of these are gross profitable but not net profitable (or very low net income margins). I didn’t include revenue growth rates mainly because this valuation worked best simply with gross profit.

You can see here LMND has the fastest gross profit growth rate (by quite some distance) and the second lowest EV/GP/Growth ratio making it by far the best valued company in this lineup.

Before we get comments saying these aren’t like for like companies, I completely agree. I wouldn’t suspect the likes of SNOW and NET to be valued anywhere near as low as LMND. They’re very high growth cyber and data plays that are deserving of higher multiples. UPST is a good comparison though I believe using tech to disrupt the lending market, just like LMND is using tech to disrupt the insurance market. RBRK I don’t know a whole lot about but based on these metrics they’re fairly attractive too. GRAB is a portfolio company of mine but hopefully this chart alone summarizes why LMND is a much bigger position.

Conclusion

I’ll share my valuation model with paid subscribers as soon as this article is released. I believe it’s very conservative yet still gives huge upside from today which is exactly why I’m continuing to load up on this stock.

Next up I have OSCR and DLO Deep Dives.

That’s all for today

I do hope you enjoyed this look into LMND. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Thanks for the great write up Oliver. Did you compare LMND to other insure tech firms like ROOT OSCR? What are some of the key risks with LMND?

Thanks for this. I see Zeta screens also quite cheap, have you done some DD on them. Looks good on the surface