My Thoughts on Alibaba and PayPal 💭

A big earnings week summarized

It’s #SundaySpecial!

PYPL 0.00%↑ and BABA 0.00%↑ both reported earnings this week and there was a boatload of interest surrounding these stocks, leading to high volatility and big moves.

These are two stocks I hold in my portfolio and so I’ve followed the earnings pretty close this week.

Let me give you my thoughts on both:

Before I do, if you haven’t subscribed yet, what are you waiting for?

PayPal

Firstly, here’s the One-Pager:

Summary Of Earnings

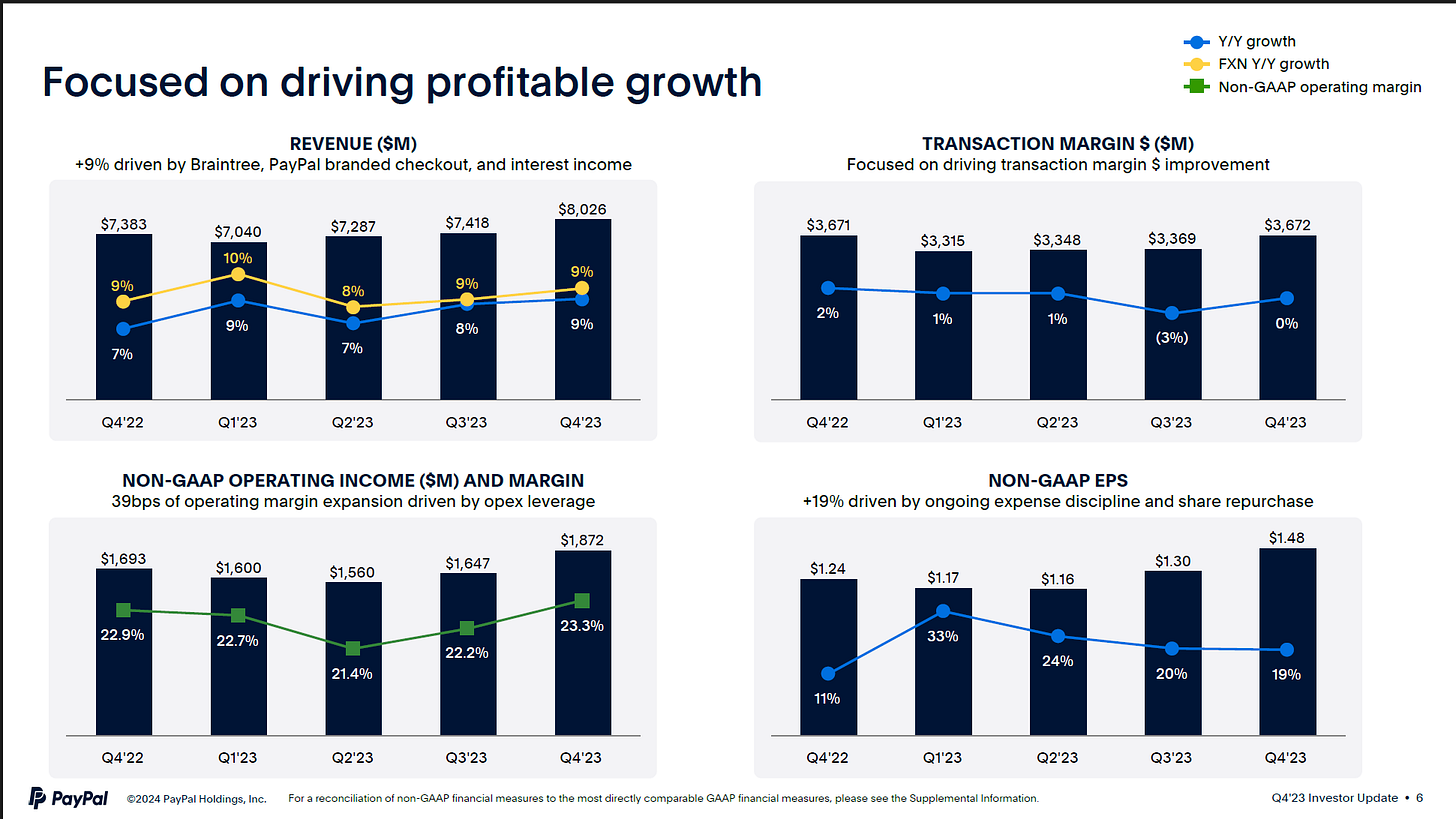

PYPL 0.00%↑ had a very good earnings report:

Beat on revenue at $8B vs $7.88B (estimates) ✅

Beat on EPS $1.48 vs $1.36 (estimates) ✅

Gross margin inversion - 45.8% vs previous quarter 45.4% ✅

However, the guidance PayPal gave was very weak (especially for a “growth” company) which led the stock to drop 8% post earnings report 📉

This was perhaps the biggest surprise to me as they were essentially forecasting 0 growth after increased revenue, innovations, 2.5k layoffs, and a variety of other operational improvements.

My Thoughts on PYPL 0.00%↑ Now

I invested in PYPL 0.00%↑ a couple of months ago as the company is fundamentally very solid, and I didn’t believe the market sell off the last 12 months was reflective at all of the business.

And an earnings report where they beat expectations only justified this bullish case.

The most confusing part of the report was the guidance which I think needs to be unpacked.

Here’s what I think:

PayPal want to buyback a record amount of shares. I believe they knew there could be a stock selloff with the lower and more conservative guidance they offered. This would only help them with their share buyback program.

Today’s “FOMO” market reacts strongly to share buybacks and PayPal can currently buyback around 16% of the company putting it at ~78% institutional and inside ownership. That’s around the institutional/inside % ownership when the stock was at record highs.

This opinion could be completely wrong, and I’m absolutely fine if it is.

At the end of the day, the above is all opinions, so let me get on to the facts.

Here’s why I’m bullish on the fundamentals of PYPL 0.00%↑

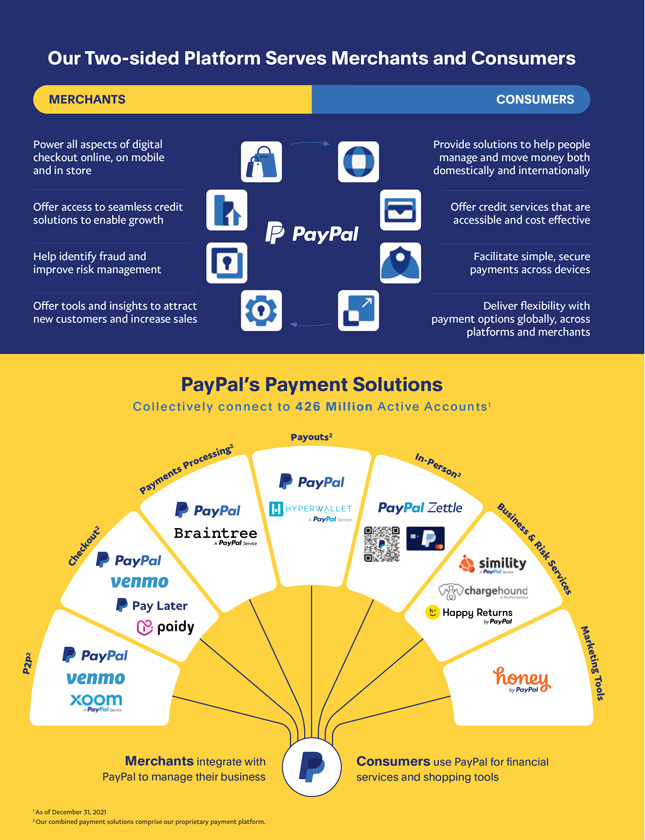

Competitive Advantage

Always come back to competitive advantage.

PayPal continues to dominate, and the risk from competitors thesis of bears is massively overblown. Their dominance overseas is incredible with PayPal being the only U.S. fintech company in China where they are the top online payment processor.

PayPal is in 200 countries, has 5000 patents, and has 25 years of regulatory licenses. The large user base, brand, and innovations under new management all contribute to this economic moat too.

Revenue Growth

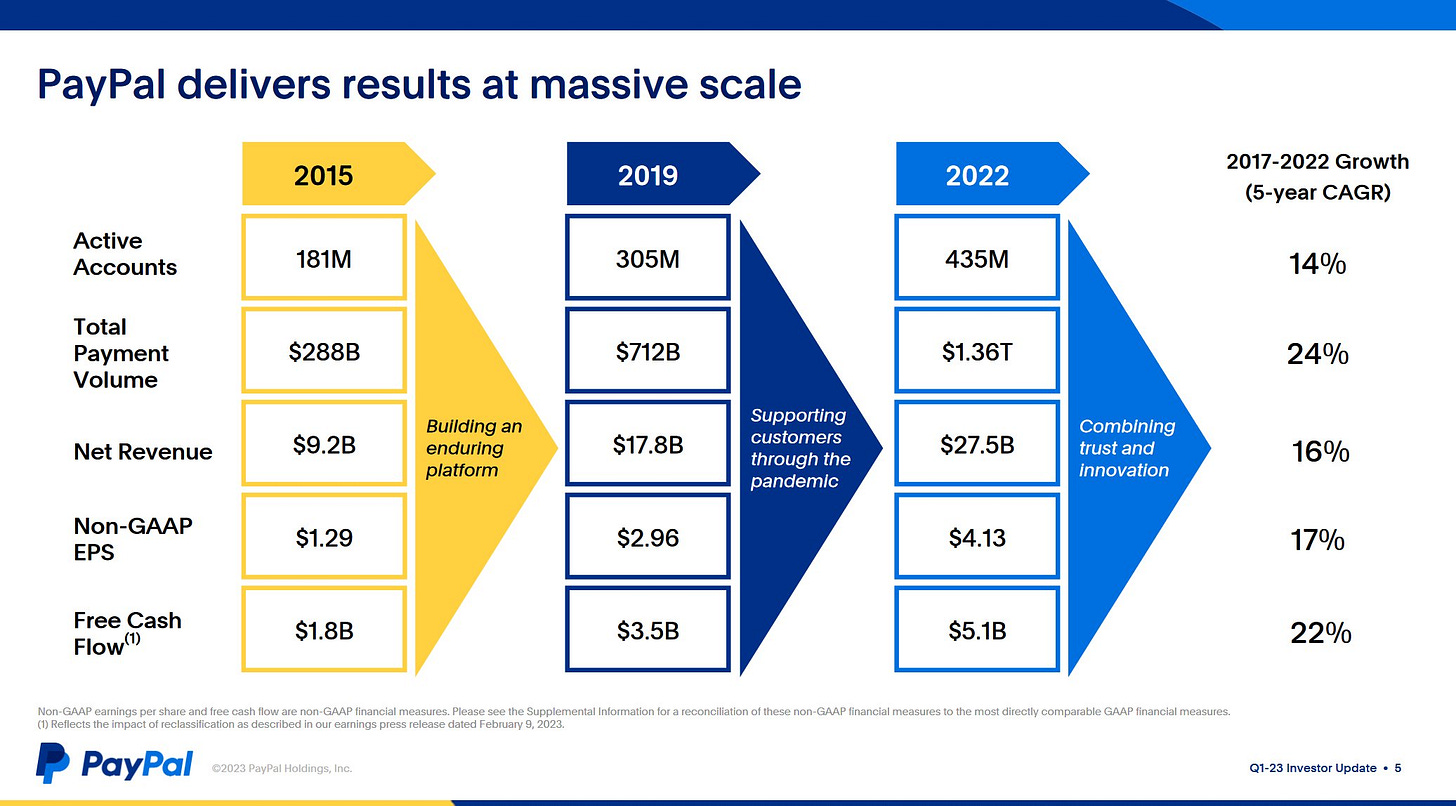

PayPal has Venmo and Braintree, on top of their core operations. Here’s the growth since 2015:

+250 million active accounts

+$1.52 trillion in payment volume

+$18.3 billion in revenue

+$3.3 billion in free cash flow

Competitors like Apple Pay and Google Pay have not even cracked the tip of the iceberg with PayPal.

Projections are $40B in revenue by 2030. That’s an estimated +$10B from 2023.

On top of these, PayPal now offer the first major backed USD Stablecoin to ~430 million customers in $PYUSD. $PYUSD is up 570% in the last 3 months alone and is nearing a $300,000,000 market cap.

Is this another addition to the already huge free cash flow? I’m no expert on stablecoins, but I do know it’s currently a $10 trillion industry. If $PYUSD can follow in Tether’s path then there’s even less of a bear case for PayPal.

Efficiency / cost cutting

Alex Chriss has come in to the business and already significantly improved efficiency by re-strategizing to focus on where PayPal has an advantage.

The 9% reduction in workforce and labor costs will also improve margins further further. This will be reflected in the next earnings report where I’m predicting subsequent strong results.

Management

Admittedly, the old management at PayPal wasn’t good and that was one reason that held me back from investing at an earlier date.

But today, Alex Chriss and his fellow management has strong skin in the game as they hold a significant stake in the company.

Why does skin in the game matter? See an article I wrote on this exact topic below:

Alex has something to prove. He’s motivated, has a proven record of increasing shareholder value (at INTU 0.00%↑) and I like the innovative changes and freshness he has brought to PayPal.

FCF

Approximately 7.5% of PayPal’s market cap is in FCF per year. This is impressive and enables them to invest heavily in growth, reduce debt, or aggressively buyback shares (see below👇)

I always love to see these divergences between PE Ratio and FCF Yield before buying a company.

Share Buybacks

Briefly mentioned earlier, but PayPal has been engaged in stock buybacks at $4.4B a year. At current valuations of 2017 lows (🤯) they can buyback 7% of the company. However, they are able to buyback 20% of the company and with the free cash flow, I’m confident they’ll buyback a lot more than 7%.

Why are share buybacks bullish?

They reduce the number of shares outstanding, which increases earnings per share, which increases the value of remaining shares.

Want to know more about share buybacks? See my article here:

Jim Cramer

Jim Cramer is now bearish on PayPal…you know what that means…😂

Here’s the prices Jim recommended PayPal at…

Well, that’s a rundown on PYPL 0.00%↑ for you. I’ve tried to outline all my most bullish points as concisely as possible.

Let me know your thoughts on PYPL 0.00%↑ in the comments.

Alibaba

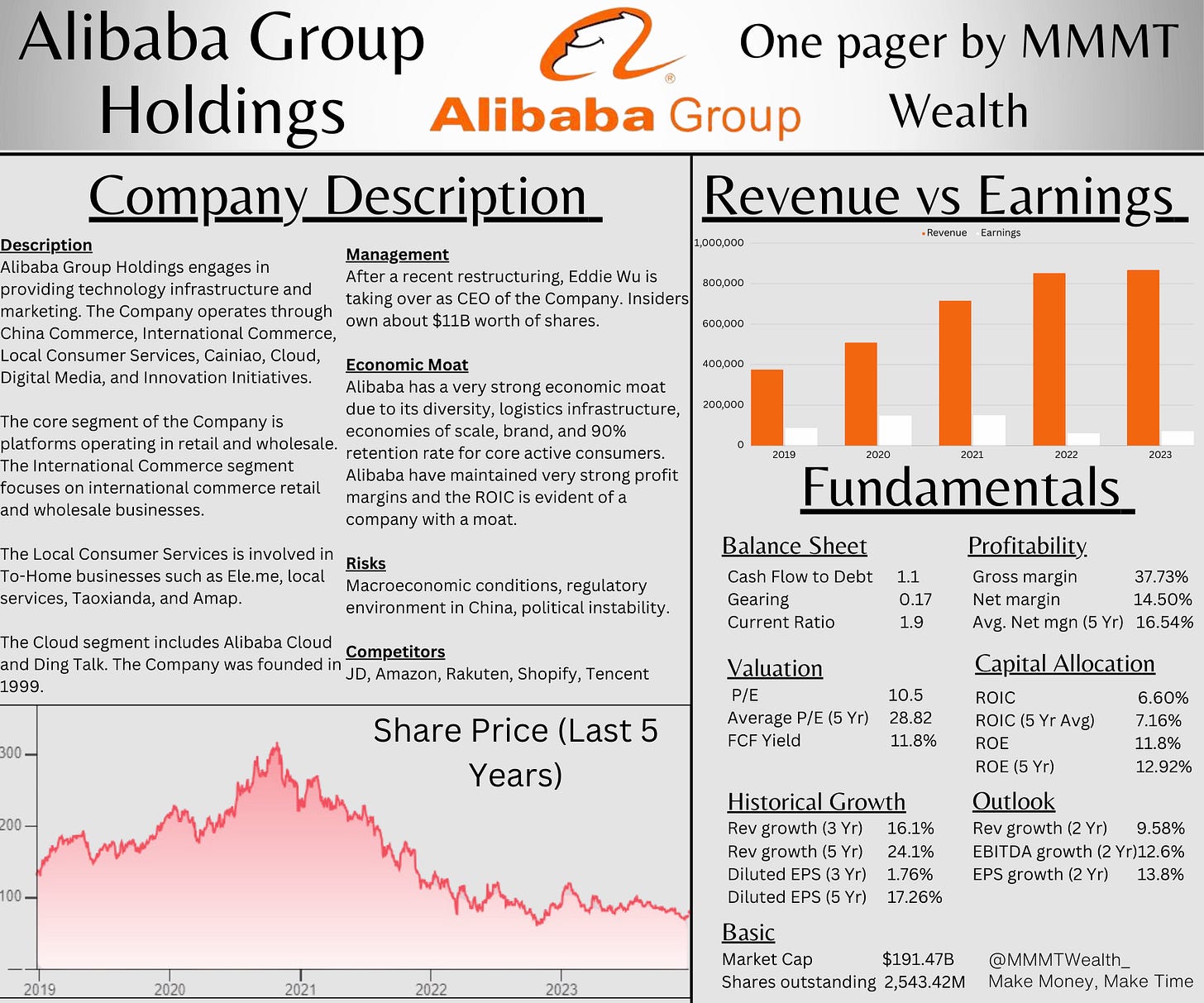

Here’s the BABA 0.00%↑ One-Pager:

Summary of Earnings

BABA 0.00%↑ earnings were decent:

Revenue CNY260.35B vs CNY261.25B (estimate) ❌

EBITDA CNY59.57B vs CNY57.27B (estimate) ✅

Adjusted EPS CNY18.97 vs CNY18.67 (estimate) ✅

BABA 0.00%↑ also announced a $25B share buyback.

Solid earnings that didn’t change my opinion on Alibaba at all.

My thoughts on BABA 0.00%↑

I’m not going to repeat myself much because only recently I wrote an article on why I bought BABA 0.00%↑. Check it out here:

Is Alibaba Too Cheap To Ignore Now?

As primarily a value investor, I’m looking for opportunities where there is limited downside, and large upside. “If you buy stocks with a sufficient margin of safety, the probability is with you” - Bruce Berkowitz Well, with Alibaba the upside potential is huge, but the downside potential is still larger than I’d hope for.

I also think BABA 0.00%↑ is a much simpler analysis than PYPL 0.00%↑ at current levels, purely because the only reason Alibaba is trading at this level is the China risk.

In the article above, I give my view on that risk and why I believe BABA 0.00%↑ is so undervalued.

Today’s BABA 0.00%↑ current multiples are:

EV/Sales: 0.99x

EV/EBITDA: 4.32x

EV/FCF: 4.92x

Conservative multiples should be:

EV/Sales: 2.5x

EV/EBITDA: 10x

EV/FCF: 13x

There’s no doubt Alibaba is massively undervalued when looking at the company fundamentally.

The only question is how you view the China risk.

That’s all for today!

I hope you enjoyed this article. If you did, please do give it a like, share, comment, restack etc! It all helps me in my goals to get this newsletter out to thousands of people.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to.

You can also follow me on X here!

Alibaba may be undervalued. Again, this doesn't mean it'll resume growth. Technically, the stock is still in a downtrend. It attempted to complete its bottom but failed. Not a good sign.

PayPal is a solid company that appears to be close to its fundamental value. I don't see strong institutional accumulation, though. They might be just supporting the stock to protect it from tanking big time. In my opinion, opening a position in PayPal at this point is low risk. However, this doesn't mean it'll resume an uptrend soon. We just don't know and can't forecast. I'd love to see strong institutional accumulation but I can't see it. This can mean the current bottom formation can last for several quarters (not predicting).