NU Deep Dive Part 1

Business, LatAm, Competitive Advantage, Risks

Hi investors 👋

Want to see my previous deep dives I’ve written recently?👇

Introduction

This deep dive is on NU ( $NU ), a company that I’ve owned for about a year and one that I added to recently when the stock came back down to the $10-12 range. All of this post will be free, and the majority of Part 2 (opportunities, financials, and valuation) will be for paid subscribers.

If you do find my work valuable, please do consider becoming a paid subscriber. It’s cheap at just $12.50 per month and will hopefully allow me to transform this into a full time gig which is where I can begin to add even more value to you all.

NU Deep Dive: A Portfolio Company (Top 5 Position)

Company: Nu Holdings

Ticker: NU

Stock Price Today: $11.59

Stock Price High: $15.09

Market Cap: $55.2B

Headquarters: Sao Paulo, Brazil

Outline

Introduction (Part 1)

Business Overview (Part 1)

LatAm (Part 1)

Competitive Advantage (Part 1)

Risks (Part 1)

Financials (Part 2)

Opportunities (Part 2)

Valuation (Part 2)

Business Overview⬇️

NU is a fintech firm that was founded in Brazil in 2013. Revenue is generated via fees (on transactions, payments, loyalty programs etc) and interest payments. The interest earning portfolio now sits at $11.2 billion, up 75% YoY FXN and this is where the vast majority of income comes from.

I’ll cover lots of areas of the business in Part 1 and Part 2 of my Deep Dive, but a brief overview would go something like this:

NU acquires customers very cheaply, and benefits massively long term from cross-selling to various other products meaning revenue per customer grows along with profit per customer because costs are so low. The average customer now has just over 4 products each which tends to happen within the first 12-18 months of signing up. This is probably one of the reasons why analyst revenue targets look something like this 👇

LatAm🪧

LatAm is going through a digitalization period currently and NU have timed their entry into the fintech market perfectly. The LatAm environment is a key bullish catalyst for my NU investment thesis so I wanted to spend a nice amount of time at start of this article discussing it.

LatAm currently has:

A 50% underbanked population rate

A younger tech savvy population with 40% under the age of 30

Only 20% of the population have access to credit cards

A very high smartphone penetration rate above 90%

It’s the perfect place to operate if you do it well (which NU do) but it doesn’t come without big risks.

NU currently operate in 3 countries 👇

Brazil

Mexico

Colombia

Brazil

Last quarter NU reached 101.8 million customers which is a 16% growth YoY in the customer base. These 101.8 million customers in Brazil make up about 58% of the adult population in Brazil.

The importance of having 58% of Brazilians as customers cannot be overstated. It’s very impressive for any company to have 58% of a company on their platform. It makes it even more of a feat that NU has done it in 11 years.

During its short history, it has grown into the 4th largest financial institution in Brazil and the 5th largest in Latin America overall and it continues to climb quickly up these rankings as it added more Brazilian customers in 2023 than the top five legacy banks combined.

Even more importantly than just pure growth rates, active accounts has risen 22% making NU the largest institution in Brazil for the number of active accounts. 61% of these active customers use NU as their primary banking account which shows the quality of the business. With active customers who use NU as their primary bank, the company benefit from more consistent deposits, higher ARPAC, and more data. Just 2 years ago, only 50% of customers used NU as their primary bank so this is an encouraging trend.

I’ll touch on some of the reasons for this growth below, but it’s important to understand that Brazil’s overall banking market has been:

Very profitable for companies over the last decade (ROE’s of +20%)

Very bad for customers who deal with high fees, and high rates on lending.

NU has come in and completely changed number 2 whilst keeping number 1.

Here’s a breakdown of the specific fintech numbers and reasons for those numbers in Brazil:

Growth Rates: The Brazil fintech market is projected to grow at a CAGR of 19.30% through to 2034.

Reasons For Growth:

Regulatory environment: The openness of the Brazil government to work with companies like NU on regulations has been very good. For example, the Pix System has been key to drive digitalization in financial services. Cash has decreased. Credit card acceptance has increased. Very simply, Pix is a real-time payment system managed by the central bank that NU integrates on to the platform making digitalization even smoother.

Demographic: A very nice demographic with ~ 45% of the population (93 million people) below 30 years old who are much more tech savvy. A younger population are much easier to acquire as customers than older customers who dislike change, and tend to be less open to tech alternatives. There’s also a growing population, hence more customers for NU to win.

Costs: Much lower cost and more accessible than tradition banks like Itau, Bradesco, Banco de Brasil. Although high interest rates are mostly a headwind on NU growth, it’s a tailwind relative to traditional banks who cannot lower costs. Fintechs use AI and more complex credit models to reduce overall costs which are then passed on to the consumer.

Infrastructure: 4G is now readily available across most of Brazil, including rural areas.

Wealth: There’s is growing wealth across Brazil slowly with a slow shift from cash saving to higher yielding investments.

E-commerce: Fintech boom goes hand in hand with e-commerce boom.

Competition: PicPay, C6 Bank, Banco Inter, Mercado Pago, Inter & Co.

Risks: The Brazil macro environment is not in a good place for NU’s growth, hence the stock price today.

P.s. this section is very important. To be honest, in my opinion it’s the only reason NU is trading where it is now. I’m going to spend a lot more time here and go into some detail.

Interest Rates Specific

Interest rates fell slightly in 2024, but they’re back up again now to 14.25%.

Higher interest rates mean a much lower loan demand and more defaults. However, this isn’t the first time that NU has weathered this kind of environment successfully. In fact, interest rates were at similar levels in 2016-2017, 2023-2024, and again now in 2025.

Here’s NU’s growth in those periods:

The positive sign here is that there’s a lot of room to cut interest rates which will help NU’s growth prospects as borrowing will becoming more attractive. The risk however is twofold. Either:

Interest rates will remain elevated for a long time.

That deposit costs will fall slower than interest rates leading to somewhat of an interest rate mismatch and compression on net income margins.

Here’s the general consensus on Brazilian interest rates currently in 2025:

The consensus is that interest rates will again rise in May, though this will be a smaller hike making 15% by end of the year likely.

I want to evidence that NU has gone through a period of high interest rates times already between Q2 2022 and Q4 2023 where NIM and Risk-adjusted NIM increased.

It was only at the 18 month mark when rates started to come down slightly that NIM started to reduce. The last 2 quarters of 2024 were also a troubling time for higher interest rates and NIM contraction. The main point I want to address here is that although history may not repeat itself, NU management (and investors) should have confidence that they can weather the storm coming up if interest rates remain higher.

NU will struggle with high interest rates. But so will every other credit focused business in LatAm and globally. However, NU are in a unique position because of the strength of their platform that they can offer larger loans with lower interest rates relative to competitors meaning although market wide demand may reduce, demand for NU should reduce much less than others.

Currency Rate Specific

The other side of the challenge for NU has been a weak BRL as you can see from the chart below.

The positive news is so far in 2025 we are seeing some strength with the BRL climbing up to the $0.17 range which is where it was at 1H 24. This could lead to much more positive looking results that are announced in USD. The negative of this is of course higher interest rates are the main reason the BRL has increased so all that’s happening is one side of the macro picture has improved slightly whilst the other side has been affected probably a lot more.

It’s a very difficult balancing act. As aforementioned, NU has so far managed this extremely well…but their toughest test is upon them - consistent growth in an extended period of weakness.

Balance Sheet Optimization

Balance sheet optimization is the main area to look at for NU as this will likely be the main driver for NIM expansion long term, rather than FX currency headwinds which shouldn’t affect the company long term. Balance sheet optimization incorporates the following:

Higher yielding assets: In Q4, the overall yields in the portfolio dropped in Brazil as secured lending has taken preference which has lower yields (but higher margins). Secured lending includes payroll loans, investment backed loans, and FGTS loans. However, the cost of capital is also much lower so generally the risk adjusted returns are better.

Lower funding costs (Competitive advantage section): These have increased in 2024 with high growth in Mexico and Colombia.

Better credit underwriting: (Competitive advantage section): NU’s Gen AI models appear to be very strong. They have the strength to play with the models to increase or decrease risk whenever they see an opportunity or challenges ahead.

A recession in Brazil is very likely. A stagflation in Brazil is also likely and would be much more of a headwind for NU. Low growth, weak economic indicators, and persistent inflation suggest a potential stagflation in 2025 and 2026. Whatever happens in Brazil, whether it’s a recessionary period or a stagflation, NU will be affected and for me this is by far the biggest risk NU faces at the moment.

NU have proven they can perform well in periods of macro uncertainty like 2020, but that period didn’t last that long. We will likely see a much worse period coming up and they’ll be a lot of “first times” for NU I suspect.

How will they manage credit risk? How low will they allow net income margins to go to keep originations still strong?

As I’ll discuss quite a bit later on, NU are in a special position relative to competitors because they have incredible unit economics allowing for low costs to serve. Combining this with the data, and related Gen AI models they have, they are able to pass on loan interest rates that are consistently +20% lower that competitors. Therefore, although NIM may get pressured in this upcoming environment and NU will struggle, competitors will struggle a lot more.

A key metric to track success/risk here is NPLs (non-performing loans) which focus on late payments between 15-90 days, and 90+ days. Here’s the current NPL metrics:

You’ll see that generally these are trending upwards. First of, this isn’t actually a bad thing.

The +90 day delinquencies is basically lagged as there’s no time limit meaning even those from a very long time ago will end up being added to this metric.

Lower delinquencies is of course lower risk but it doesn’t mean the value add is higher. Management are finding the risk “sweet spot”. You’ll notice that the 15-90 day rates have come down over the last 3 quarters as per the higher macro wide risks at the moment and a favorability of lower risk customers at the moment.

Also you need to note that NU’s underwriting model isn’t as mature as it could be. It’s still figuring it out and achieving these results already. There’s three main things that give me confidence here though:

The credit underwriting models that NU have built factor in that the future will be far worse than the past. This reduces the risk massively.

The balance sheet is healthy. The total loan portfolio currently sits at $20.7 billion but the vast majority of this lies in credit cards and personal loans which are mostly short term (6 months or less). This is great for managing and rebalancing risk as NU can quite easily reduce their overall risk exposure if they need to.

Over time, NU will naturally grow the secured loan portfolio more than the unsecured loan portfolio. This has higher margins, and of course much more stability. This is a big focus in Brazil at the moment.

It’s a nice metric to track, but I think a focus should be more on risk-adjusted NIM out of these 3 metrics we have just looked at.

Summing up Brazil

In the US, it’s a bit easier as there’s a lot more tried and tested historical data of what has worked and what hasn’t. The cyclical swings also aren’t as high and as unpredictable as we are likely to see in Brazil over the next 24 months or so making investments into these regions much more inherently risky, hence the higher risk (but also higher reward).

If management can keep NPLs steady, and keep growing risk-adjusted NIM YoY over the next 12 months with high interest rates and political instability, they’ve done very well.

Mexico

In Mexico, NU passed 10 million customers (12% of the adult population) just 5 years after entry there. Initial growth has been incredible and NU have managed to essentially double their customer base in the last 12-18 months making Mexico the high growth area right now. NU’s growth strategy in Mexico and Colombia is all around deposit growth which is a low ARPAC strategy, but it sets a great base for long term success. It’s exactly what NU did in Brazil a few years ago and ARPAC amongst mature customers is over double the newer customers.

The figures for deposit growth are quite mind boggling in Mexico. They have increased 4.3x over the last 12 months reaching $4.5 billion. The reason NU can win here is because the costs to serve and cost to acquire customers are so low. Even for customers who have very small amounts of money to deposit, NU can still turn them into a profitable customer. Traditional banks or other fintechs with weaker unit economics need customers to have larger pools of money for them to be profitable, and therefore often turn them down.

Another reason customers are flocking to NU in Mexico is because of the 14.25% savings yield rate they can offer. Stori and Openbank (2 other Mexican fintechs) offer similar yields of 15% and 12.5% respectively, however, Stori is much smaller with just 3 million customers in Mexico. They have some big investment but I don’t suspect they’ll be able to seriously compete with NU from a big picture perspective, nor do I suspect they’ll be able to weather the storms as well as NU can over the upcoming macro difficulties.

Traditional banks like BBVA or Santander currently offer ~3.90% +- 100 bps so they aren’t any competition to the yield that NU can offer customers. It’s important to note that this high yield isn’t a long term strategy. It’s an incentive to get customers in the door, increase digitalization, increase data, and go from there.

Although still early, I think Mexico is an even better market for NU than Brazil. There’s ~130 million people there and the GDP per capita is higher, yet digitalization and financial services products are actually much newer meaning the runway for growth and disruption is even bigger for NU. There’s also the US/Mexico remittance market which could be an opportunity for NU. That’s valued at approximately $700B.

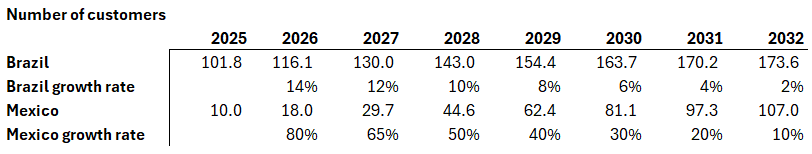

I suspect the growth will look something similar to this where NU hit the 100 million customer mark ~2031 in Mexico.

Growth rate: 42.2% CAGR through to 2032.

Reasons for growth: Very similar to Brazil but the rate of growth has been quicker because of lower digitalization and more underbanked population. Digital payments have increased by 75% since the pandemic in Mexico but in Brazil this figure is far less as the country was already much more digitalized.

Competition: Oyster, Bitso, Arcus, and Belvo.

Risks: Currently having a negative effect on NIM.

And to back up my claim that Mexico is a better market than Brazil for NU, here’s the above (accurate as at Q1 24). NU have massively outperformed in Mexico compared to Brazil and yet still the runway ahead is huge because the vast majority of the country is still underbanked. It’ll be interesting to see how prolonged these growth rates last in Mexico, and also how quickly they can turn it into a very profitable country, but I think one thing for sure is Mexico is on the path to be as successful, if not more, than Brazil.

The main issue with Mexico at the moment is that it’s having a negative impact on NIM, mainly as a result of higher funding costs because of the deposit strategy. This is also the same in Colombia. It’s a fine balancing act between growth and profitability, but as an investor here’s what I see:

I see a huge opportunity in a underbanked area (Mexico) of LatAm for a company that has already proven their skills to grow rapidly (and profitably) in a country where the macro environment is even harder (Brazil). Management would be naive to not be aggressive here. They’ve continuously said that long term profitability is the aim and if that means accelerating growth in areas with high potential in exchange for NIM contraction, then all be it.

In terms of other macro issues, I don’t want to repeat myself from what I’ve already said in Brazil but:

Mexico has slightly lower interest rates.

Mexico has slightly lower inflation.

Peso is slightly less volatile than BRL.

All the risks for Brazil apply, but generally Mexico carries slightly less risk than Brazil.

Colombia

“Today, 1 in 2 adults in Brazil are already NU customers, and we hope to replicate this milestone in Colombia soon” - Cristina Junquiera (Chief Growth Officer)

Colombia is NU’s newest market but it’s another exciting one where they have just reached 2.5 million customers following the launch of Nu Cuenta.

It took quite a while for NU to secure licensing to operate in Colombia but they started fully operating there in January 2024. The huge opportunity here is that ~75% of Colombians still predominantly use cash again making the runway very strong, just like Mexico. The savings yield that NU offer in Colombia is 13% which is just ahead of fintech and traditional banking competitors.

Its’s harder to have a vision on the Colombia market for NU because it’s so nascent but what we do know is:

Just like Mexico, Colombia will be a drag on margins for a period. Growth first then margin expansion. As with pretty much all businesses. The timeline on profitability in Colombia is unknown, but I suspect it’ll be in the 5-8 year time frame. Wide guess I know.

Regulatory approvals will be much more difficult in Colombia. The country is far behind Brazil, and also behind Mexico in terms of their fintech regulations.

Competitive Advantage 📈

Multi-Country

Firstly, LATAM is a very difficult place to operate. The high interest rates, currency fluctuations, asset yields, and everything else we have discussed here so far makes building a successful company in any LatAm country a big challenge. What makes this even harder is building a single core platform like NU has in different LatAm countries.

Brazil, Mexico, and Colombia all have different demographics, different risks, and different regulations. It’s not like a country expanding across states in the US, or expanding from US to Canada. It’s a much more challenging approach and so far NU has managed to do this with:

High growth

Profitability

This challenge itself is a competitive advantage as the barriers to entry are so high to compete in this environment.

First Mover Advantage

On top of the above, NU have a big first mover advantage in the fintech industry. Barriers to entry to compete successfully are already high as explained above, but to then combine this with catching up other companies is even more challenging. NU are in a perfect position where there’s no fintech close to them in size, and they’re already very profitable. Competitors who started later are naturally more focused on high marketing, fast customer acquisition, and although this is promising short term, long term it’ll be telling that NU has far superior economics.

They’re also growing at 50% YoY.

ARPAC is also growing rapidly, especially as customers become more mature. The longer a customer is with NU for the higher the ARPAC tends to be and the less likely they are to switch to a competitor. A first mover advantage here is huge in an environment where disruption is fast.

Unit Economics

Low Costs To Serve

NU has incredibly low costs to serve customers which is a huge competitive advantage in itself because:

They become more profitable and can withstand periods of macro weakness a lot better than some peers.

They can pass cost savings on to customers better than peers.

Currently, NU’s cost to serve customers is extremely low at $0.80 and management believe this will consistently stay below $1 per month per active customer which is 85% lower than traditional banks and also pretty much all fintechs. I know no fintechs with costs this low. This is one of the lowest costs of all fintech providers globally making their growth spend (CAC which I’ll discuss next) extremely worthwhile as ARPAC is currently $11.1.

More importantly, ARPAC has been proven to increase over time up to ~$25 for more mature customers. The incremental contribution profit therefore becomes extremely large here when that ARPAC figure rises.

I think now is a good time just to highlight that the ARPAC figure of $11.1 is being weighed down by the high growth in Mexico and Colombia (and to some extent still Brazil). Newer accounts have a much lower ARPAC and there’s consistently a lot of new accounts each quarter so this ARPAC growth will start to look better and better YoY I suspect.

Low Costs To Acquire

NU also has very low costs to acquire - in the region of $6-8 per customer which is still below the monthly ARPAC figure of $11.1. This is through word of mouth and referrals mainly (which highlights the product quality in itself). Compare this to the likes of SOFI which has a CAC of +$40 (which is lower than the industry average) and you’ll realize just how special the unit economics are for NU.

Management estimate that the LTV to CAC is ~30x which shows just how strong the cross-selling is at NU, as well as how cheap they can acquire customers. When you build a product in an environment where you’re product is essentially required to push forward as a nation, marketing that product becomes easy.

The very best products don’t require high marketing for prolonged periods of time.

Low Costs To Fund

I don’t think this can be considered a direct competitive advantage over peers, but it was originally an advantage competitors had over NU until more recently. NU no longer has to rely on expensive debt and instead can fund with deposits which is considerably cheaper.

There has been a funding cost increase in Q3 and Q4 because of high growth rates in Mexico and Colombia which have resulted in some credit funding there. This has a negative impact on metrics like NIM which I touched on earlier, but generally NU are strong here.

Costs of Risk

This came down in the year and it should continue to come down YoY as NU’s models improve which will naturally happen with more data (which will in turn naturally happen with more customers using more products).

This is a huge advantage over traditional incumbents who have very outdated underwriting models whilst fintechs like NU utilize Generative AI from tons of data points across different product categorizes to paint a much more detailed picture of a customers/borrowers true profile. This means NU creates far more value whilst taking on much less risk.

Churn

As per latest numbers, monthly voluntary churn is just 0.06% meaning once customers do sign up, they tend to stick around for a long time. One of the reasons for this is obviously the lower costs that NU can offer compared to all competitors currently, but it’s also the cross-selling capabilities. With every new product a customer signs up for, the switching costs, and stickiness only increase.

Ability To Navigate Difficult Periods

A recession will no doubt hurt NU. I’ll discuss in Part 2 how I see this panning out for the stock price but fundamentally NU will have to do a lot right to not get affected too much.

The positive side to this is NU have much better operations than any bank in LatAm and I suspect they’ll weather the storm more. This should weed out the weaker competitors leaving NU with endless opportunities long term to take advantage of. If you’re investing for the long term (3+ years) I think NU will play out very well. If you’re investing shorter term, these competitive advantages may not be as clear today, and nor will the stock price returns.

TradeUP

TradeUP x Oliver: Score FREE NVDA stock!

TradeUP, the U.S. trading platform powered by Tiger Brokers (NASDAQ:TIGR), is bringing MMMT readers an exclusive stock giveaway!

Here’s the deal:

Open up a TradeUP account through exclusive link or using promo code OLIVER

Deposit or transfer $1,000+ and maintain your balance for 30 days.

Get 1 FREE NVDA stock.

Plus, enter a prize draw for 2 to 5 extra shares, with individual stock values reaching up to $1,800! (Every draw guarantees a winner).

Offer ends 03/31/2025. Don’t miss out.

https://www.tradeup.com/gift?invite=OLIVER&group_id=CG9000000534&f=BCS®ion=USA&lang=en_US

Risks📉

I’ve already spoke about the macro wide risks above, mostly all in Brazil because that’s where most of the issues lie. In Mexico and Colombia, the issues are similar but just slightly less intense so you can more or less apply the risks there to Mexico too.

This section will be a brief overview of the micro risks that NU has to deal with.

Credit Risk: LatAm has a population with bad credit which is why NU will transition to fully prioritize secured lending but the unsecured lending portion is still large today. So far, NU have done an incredible job of managing risks here with delinquency rates being much lower than the LatAm market, but we also haven’t seen NU operate for a prolonged period in a very difficult macro market.

Stock-based compensation: Dilution is actually below 2% which isn’t too bad for a company in NU’s growth stage.

Ownership: David Velez owns just over 75% of the total voting power. That’s a lot. He is good though.

Competition: We need to touch on competitors, but as I said before, NU has completely changed the financial landscape in LatAm to the extent that I don’t think there’s any competitor out there with unit economics like NU. The main one that I see people prefer is Inter & Co (INTR). They’re about 1/3rd the size of NU (in terms of customer numbers) and growing at ~2x the speed of NU (not taking into account FX) whilst also having a much lower NPL rate of 4.2%. On some metrics I think INTR are better, but they don’t have anywhere near the unit economics that NU has built. In 2023, NU and INTR had similar net income margins, but since then NU has reached 38.4% whilst INTR has reached 20.4%. I think in terms of quality of operations, NU still has an edge here and revenue, net income, and customer growth numbers all back this up. I’ll discuss the valuation relative to INTR in Part 2 as well.

That’s all for today

I do hope you enjoyed this NU Deep Dive Part 1. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Part 2 out soon!

Thanks for making this public. But, I would like to point out as an ML engineer that Gen AI has nothing to do with credit underwriting. It is tabular data and they probably use mostly Decision Trees and maybe some Neural Networks. My point is that it is totally wrong to assume that everything is solved by Gen AI today. Nope. Not even applicable or even if it can be “forced” to the problem it will not be that efficient from any aspect (speed, resource usage, etc.).