Optics: The Next Big Theme & The Best Stocks Today

LITE COHR CIEN AAOI & many more

Hi all👋

Optics stocks have performed incredibly well lately but this could only be the start of their move over the next 5+ years.

Historically, data centers have relied on copper cabling. Reliable, cost effective, and fairly efficient for short distance data connections. However, as the need for bandwidth has exploded, copper has become somewhat of a bottleneck.

It’s ultimately basic physics. At these ultra-high speeds electrical signals travelling through copper lose a lot of strength because of coppers resistance. Either, copper cables need to get much thicker and heavier, or their useful length would need to be less than 1.5 metres.

Unfortunately, that’s completely impractical in most large data centers today. And further, to fix this signal loss, we’d need more chips (which means far more power just to transfer data, let alone process it). In huge AI clusters with tens of thousands of GPUs, this extra power drain becomes completely inefficient creating a massive bottleneck.

And this is exactly where optics comes in.

The next wave of AI is essentially about finding these huge bottlenecks. The power grid, energy, PCB shortages, optics… etc.

Here I’m breaking down the optics ecosystem into optical components, silicon photonics, and foundries.

I’ll also be discussing some higher beta, higher reward (but higher risk) plays for my paid subscribers over the next few days. The ones I have in mind are:

$763M market cap

$581M market cap

The Second Wave of AI

In my spreadsheet for paid subscribers (please see link below), I’m building a huge list of stocks ranked by valuation in the most exciting niches.

I currently have ~150 stocks in robotics, drones, space, nuclear, quantum, and data centers all ranked by revenue growth to multiple, EBITDA growth to multiple, and EPS growth to multiple to gauge if they’re worthy of diving into them more.

I’ll soon have optics, PCB shortages, and many more in 2026.

All of the stocks I talk about here are currently appearing as attractive from a revenue growth point of view as per my spreadsheet.

So far, I’m up 110% on ONDS, 240% on SOFI, 140% on SVM, and 116% on LMND. The next wave of AI will likely introduce us to even more spectacular gains.

Join us here for $16 a month. Less than the price of 2 coffees

Heads up: prices are going up in 2026.

You get:

Access to my portfolio (core and swing trade) and exact dollar amounts

Buy, sell, trim, and add alerts right when I make any changes to my portfolio

Access to my daily notes

Access to my watchlist

Access to my Investing Universe

Access to my valuation models

Optical Components & Transceivers

Lumentum Holdings | LITE

Coherent Corp | COHR

Applied Optoelectronics | AAOI

Viavi Solutions | VIAV

Ciena | CIEN

CommScope | COMM

Optical components are the fundamental building blocks of photonic systems. Think lasers, modulators, waveguides, amplifiers etc.

Transceivers are integrated modules that combine these optical components to convert electrical data signals into optical signals.

Ultimately, these optical component companies act as the “interconnect” between GPUs (NVDA/AMD) and the networking infrastructure facilitating high bandwidth and low latency…perfect for AI training and inference.

This fixes the copper bottleneck where traditional interconnects generate huge heat and power consumption.

Lumentum | LITE

Business Overview: LITE operate in both optical components and transceivers and they’re arguably one of the biggest names. Originally, they were fully focused on optical components but they bought Cloud Light in 2023 and now operate very well in the transceiver market as well.

LITE are probably the most “pure play” on communication out of all stocks in this article, though COHR are slightly bigger today. You’ll note they’re in quite direct competition with COHR (below) but have slightly different niches.

Numbers:

Revenue growth: 58% (estimated in FY26)

EBITDA growth: 154% (estimated in FY26)

Net Income margin: 8.9%

Valuation:

NTM EV/Sales: 9.7x

NTM EV/EBITDA: 35.2x

NTM P/E: 56.2x

Note: I won’t be diving into the valuation more than this here. I will be saving most of the valuation work for my paid subscribers who will have access to my Spreadsheet.

Coherent | COHR

Business Overview: COHR is the main player in developing the actual light sources (lasers). They supply the core laser chips and photonic engines that go inside transceivers. They’re heavily focused on Indium Phosphide.

They also are a key player in transceiver manufacturing after they acquired Finisar years ago.

Numbers:

Revenue growth: 15% (estimated in FY26)

EBITDA growth: 25% (estimated in FY26)

Net Income margin: 9.7%

Valuation:

NTM EV/Sales: 5.2x

NTM EV/EBITDA: 21.3x

NTM P/E: 36.4x

Applied Optoelectronics | AAOI

Business Overview: AAOI compete with COHR, but they’re smaller and more aggressive on price and speed. They’re recently won big contracts with MSFT and are growing extremely quickly.

Numbers:

Revenue growth: 65% (estimated in FY26)

EBITDA growth: 93% (estimated in FY26)

Net Income margin: NEG but expected to be POS in FY26.

Valuation:

NTM EV/Sales: 3.8x

NTM EV/EBITDA: 51.4x (only just EBITDA profitable so not a good metric)

NTM P/E: 183.6x (not a good metric either)

Viavi | VIAV

Business Overview: VIAV doesn’t manufacture the transceiver itself. Instead, they make the testing equipment that everyone else uses to ensure the optics work at high speeds before shipping. Ultimately, less explosive in terms of growth, but a key player in the chain.

Numbers:

Revenue growth: 28% (estimated in FY26)

EBITDA growth: 49% (estimated in FY26)

Net Income margin: 9.7%

Valuation:

NTM EV/Sales: 3.2x

NTM EV/EBITDA: 15.3x

NTM P/E: 27.0x

Ciena | CIEN

Business Overview: CIEN develops optical transceivers and DSPs using WaveLogic 6 to maximize bandwidth. They recently acquired Nubis in September 2025 extending their reach into shorter-reach data center optics.

Numbers:

Revenue growth: 16.7% (estimated in FY26)

EBITDA growth: 48.5% (estimated in FY26)

Net Income margin: 8.0%

Valuation:

NTM EV/Sales: 5.9x

NTM EV/EBITDA: 37.6x

NTM P/E: 58.6x

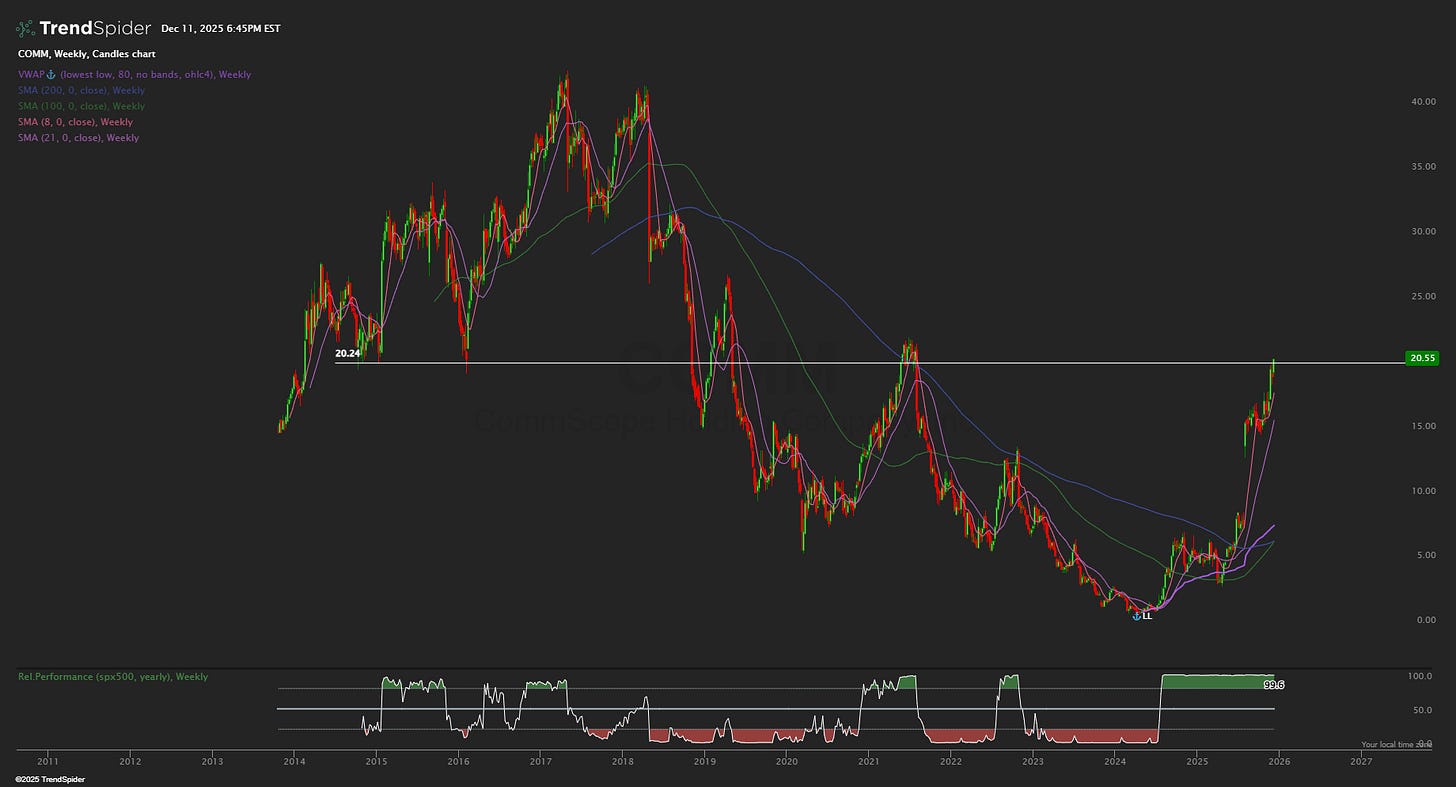

CommScope | COMM

Business Overview: COMM is a leader in network infrastructure providing the fibre optic cabling, connectors, panels, and active optical cables that link transceivers and switches in data centers and telecom networks.

Numbers:

Revenue growth: 13.0% (estimated in FY26)

EBITDA growth: 90.4% (estimated in FY26)

Net Income margin: 7.3%

Valuation:

NTM EV/Sales: 1.9x

NTM EV/EBITDA: 8.1x

NTM P/E: 9.8x

My favorites of this group? AAOI & COMM

Silicon Photonics & Co-Packaged Optics

Broadcom | AVGO

Marvell | MRVL

MACOM Technology Solutions | MTSI

Credo Technology | CRDO

This is where the most aggressive innovation is happening… right at the chip level. Silicon photonics integrates optical components (lasers, modulators) directly onto silicon chips.

Co-packaged optics embeds these photonic elements right next to or on the same packages as electronic chips shrinking the distance data travels from inches to millimeters.

These companies essentially are cutting the energy demand by 50-65% vs pluggable optics, solving the massive power bottleneck in AI clusters.

Broadcom | AVGO

Business Overview: AVGO are essentially the platform leader. They don’t just sell the CPO technology, but they also sell the switch it attaches to. If you want the world’s fastest switch, you effectively have to buy their optical architecture as well.

“We’re driving growth and we begin to feel like this thing never ends. And it’s a real mixed bag of existing customers…demand for our latest 1.6 terabit per second switches that enables optical interconnects for scale out is just very, very strong.

When you talk about silicon photonics… I could see a point in time in the future when silicon photonics matters as the only way to do it.”

Numbers:

Revenue growth: 35.7% (estimated in FY26)

EBITDA growth: 34.7% (estimated in FY26)

Net Income margin: 52.4%

Valuation:

NTM EV/Sales: 25.5x

NTM EV/EBITDA: 38.7x

NTM P/E: 48.9x

Marvell | MRVL

Business Overview: MRVL dominate the Digital Signal Processors (DSP) market. These are the specialized chips that sit inside optical modules to translate digital data into analog light signals.

Numbers:

Revenue growth: 41.9% (estimated in FY26)

EBITDA growth: 63.4% (estimated in FY26)

Net Income margin: 23.9%

Valuation:

NTM EV/Sales: 8.5x

NTM EV/EBITDA: 22.1x

NTM P/E: 71.1x

MACOM Technology Solutions | MTSI

Business Overview: MTSI are championing a new technology called LPO (Linear Drive Pluggable Optics). MTSI argue that MRVL’s DSP chips aren’t always needed and say they can boost the signal enough to work without a DSP. This makes them much cheaper uses far less power than traditional optics.

Essentially, they’re operating in a middle ground between today’s plugs and the future innovators in CPO.

Numbers:

Revenue growth: 15.9% (estimated in FY26)

EBITDA growth: 32.0% (estimated in FY26)

Net Income margin: 27.2%

Valuation:

NTM EV/Sales: 12.3x

NTM EV/EBITDA: 37.9x

NTM P/E: 45.0x

Credo Technology | CRDO

Business Overview: CRDO is a contrarian innovator. They stayed with copper longer than many, but have now pivoted to optics through MicroLEDs (via an acquisition of Hyperlume). This makes them the de facto standard for inter-rack connectivity for connections up to 7 meters.

Numbers:

Revenue growth: 172.9% (estimated in FY26)

EBITDA growth: 300% (estimated in FY26)

Net Income margin: 29.7%

Valuation:

NTM EV/Sales: 19.1x

NTM EV/EBITDA: 39.2x

NTM P/E: 47.9x

My favorite? I think all of these are expensive. I’d need a macro pullback to consider an investment. If we get a 15-20% pullback, AVGO would be the first one I’d add in this list though.

Photonic Foundries & OSAT

Photonic foundries are specialized factories that make the building blocks for light-based tech. Outsourced assembly and test (OSAT) providers take these raw chips and package them into ready-to-use parts adding connectors or protection for example to make them work in real devices.

This is the manufacturing heart producing the photonic chips that then go downstream.

Fabrinet | FN

Business Overview: FN is an OSAT provider that packages and tests photonic modules turning raw silicon photonic chips into finished, high-reliability transceivers for AI data centers.

Numbers:

Revenue growth: 27.9% (estimated in FY26)

EBITDA growth: 30.9% (estimated in FY26)

Net Income margin: 10.7%

Valuation:

NTM EV/Sales: 3.8x

NTM EV/EBITDA: 30.5x

NTM P/E: 36.7x

GlobalFoundries | GFS

Business Overview: GFS is a major foundry that manufactures silicon photonics integrated circuits from the ground up.

Numbers:

Revenue growth: 6.0% (estimated in FY26)

EBITDA growth: 6.3% (estimated in FY26)

Net Income margin: 14.5%

Valuation:

NTM EV/Sales: 2.9x

NTM EV/EBITDA: 8.6x

NTM P/E: 22.8x

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Solid breakdown of the copper bottleneck problem and the optics value chain. The AAOI Microsoft contract is getting attention but what's intresting is the co-packaged optics shift with AVGO locking customers into their switch ecosystem. MTSI's LPO approach skipping DSPs entirely is a clever mid-market play, though it remains to be seen if eliminating teh DSP layer holds up at ultra-high speeds beyond 800G.