The AI Application Layer: The Disruptors (LMND, ZETA, UPST, TEM & More)

The AI Trade for the past few years has been the hardware story. It’s been all about the enablers…the chip designers (NVDA), the fabricators (TSMC), the power providers (VRT). It’s been all about who built the physical infrastructure of the new economy.

I do think there’s still a lot of room to run here, especially in some of the bottlenecks of this AI buildout…optics is probably the main one with companies like CRDO estimating 300% EBITDA growth in FY26. You’ve also got the other layers within this buildout:

Advanced packaging

Liquid cooling

Grid buildout etc

However, the issue is the market is front looking and a lot of the stocks within these themes have already ran. AMR for example is up 88% over the last year, AMAT is up 75%. That’s no reason to not consider the investment thesis today in 2026, but I do lean towards stocks that have yet to have a big wave up.

I think a lot of these opportunities lie in today’s article.

Soon the value will shift towards compute utility. The big winners won’t be the companies building the data centers, or part of that ecosystem, but it will be the companies that can use AI to disrupt the most inefficient legacy companies within huge multi-trillion-dollar industries with +80% gross margins.

We’re calling this the “AI Application” layer within our spreadsheet for paid subscribers. All the stocks mentioned in this article will be on the spreadsheet and ranked by the criteria I use (both fundamental and technical).

In Phase 2 AI, whoever utilizes the model wins the margins.

The LLM build out is great and there’s been huge profits that have been made here but ultimately these buildouts don’t matter if nobody sees it. The layer of AI that wins is the layer closest to the user within the companies that deploy this intelligence to disrupt the inherent cost and performance inefficiencies within legacy industries.

Here’s a brief structural thesis for this “AI Application” megatheme that is so important.

The Macro

History suggests that technology cycles move in two very clear phases and this AI revolution is no different.

Phase 1 (Installation)

Capital is poured into physical infrastructure. Think railroads in the 1850s, Internet Fiber in the 1990s, and GPUs now. This is the asset-heavy, inflationary period.

Phase 2 (Deployment)

The infrastructure becomes a commodity utility, and value ends up accruing towards the companies that build businesses on top of the infrastructure.

This is the phase I believe we are currently heading into and the one that will last for the next 5+ years.

The Framework

I view the long term potential of the AI application layer through these three requirements:

Asymmetric Data

Cognitive Agency

Economic Capture

Asymmetric Data

In Phase 1, the moat was hardware. Who has the most GPUs? Who has the most powerful GPUs?

In Phase 2, the moat is data.

The difference for example between GPT-5 and Claude will be quite marginal. The alpha/differentiator is therefore not in the model itself, but in the data that is fed into the model.

The issue here is many companies have tons of data. Most of the time though it’s messy data - unstructured, siloed etc. The edge is looking for these AI Native companies (LMND, ZETA etc) that are built from the ground up with AI and data behind the core of everything they do. They aren’t plugging in old messy data into these huge LLMs. They’re plugging in clean data which gives them the edge over these traditional incumbents.

Cognitive Agency

Phase 2 relies on not waiting for human input. It anticipates the intent and executes the workflow autonomously.

Economic Capture

This is the main part. Today, it’s all about charging for the outcome, rather that charging for the service/process.

Here’s a couple real time examples to show you what I mean:

ZETA doesn’t just sell marketing software, they take a cut of the attribution.

LMND doesn’t just sell a policy but it captures the underwriting profit.

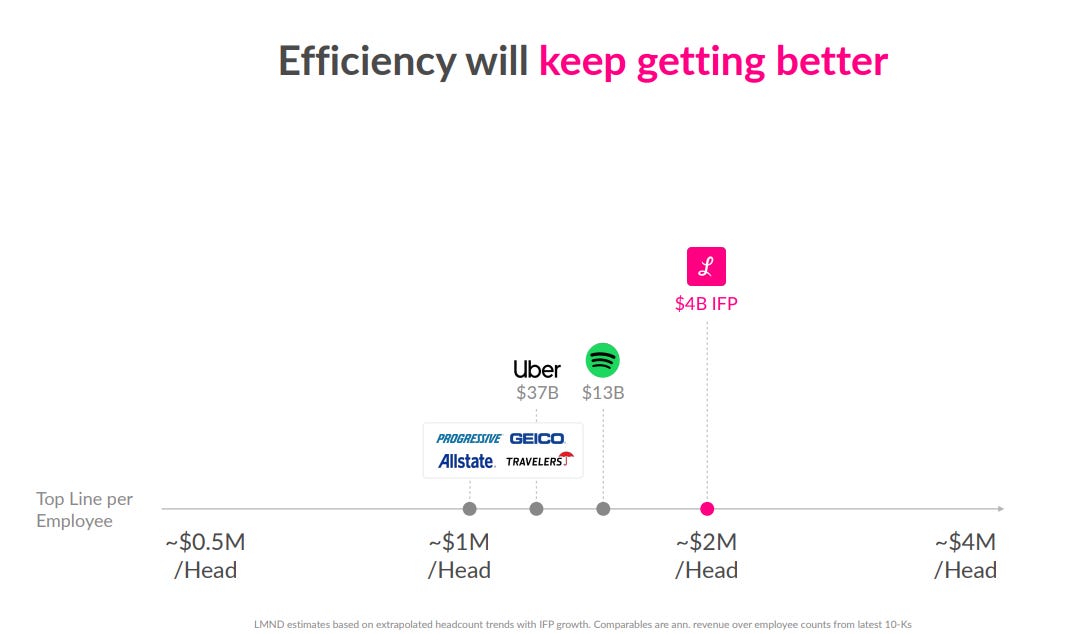

It comes down to this: Is the company able to decouple revenue growth from headcount growth? I want companies that can scale revenue exponentially whilst OpEx doesn’t.

Incumbents vs Disruptors

I have a bias myself but I’m going to talk about both here for the sake of completion and ensuring that I cover all bases. Of course, my bias could also be wrong myself, hence why it’s important to cover both.

I think so far I’ve made it clear that Phase 2 is happening and that Phase 2 is where the next big gains are made.

Now the question is how do we play Phase 2?

The “Safer” Play

Many argue that this is the “safer” play. I don’t think it is but I also see the arguments and perhaps they could be correct in some industries and wrong in some industries. The argument basically stems from the big get bigger argument. Companies like UnitedHealth (UNH), and Elseiver (RELX), and Intuit (INTU) and Progressive (PGR).

These companies will simply adopt AI agents into their existing workflows. They have the customers already. They have the capital and they have the brand.

For me personally, the issue stems from the data side. I own a big amount of LMND so my research on this one is more than other industries but a big part of my bull case sits on the fact that PGR and other legacy incumbents have:

Poor data. They aren’t AI native companies. The business wasn’t built with AI in mind so the way they perform tasks and input data isn’t centered around how LLM’s best use that data.

They have many different tech agents trying to “talk to each other” but this is nowhere near as efficient as a company like LMND which was built solely with AI in mind. Everything they do is centered around how they can make the cleanest, and most efficient AI models.

Perhaps the most overlooked part is how difficult it is to change the culture within multi-billion dollar legacy incumbents with thousands of employees. These employees are used to certain processes and believing that it is possible to simply slash this in exchange for an AI driven business is naive.

The Higher Beta “Disruptors”

This is my preferred approach. If you look at my portfolio you’ll note that my positions are geared around this view.

A traditional insurer cannot fire 20,000 claims adjusters over the course of a year due to a cultural or business shift. LMND never hired them in the first place.

Incumbents will use AI to make their current processes 10-20% faster. Disruptors make these processes essentially obsolete.

The bigger picture issue from an investors point of view is that investing in disruptors is inherently more risky. It’s a zero-sum game. For UPST to win, a traditional bank has to be beaten. For LMND to win, they have to take market share from the big players.

I respect the moat of these incumbents (and will include them in my spreadsheet), but my high conviction calls are on the disruptors. The market is still valuing a lot of them as unprofitable tech stocks rather than disruptors to multi-trillion-dollar industries.

The Plays

Bucket A - The Disruptors

Here’s my list:

Tempus AI | TEM

CS Disco | LAW

Schrodinger | SDGR

Recursion Pharmaceuticals | RXRX

GitLab | GTLB

Doximity | DOCS

Lemonade | LMND

Upstart | UPST

Opendoor | OPEN

Zeta Global | ZETA

SoundHound AI | SOUND

UiPath | PATH

Freshworks | FRSH

Samsara | IOT

Monday. com | MNDY

There’s no need for my to dive into every name. What I will be doing however is adding them all to my spreadsheet and going from there. The names that show up as attractive deserve further research which will come.

I will list my 5 favorites here though with a bit of narrative on each.

Lemonade | LMND

Introduction:

You all know by now this is my biggest position by quite a distance. I’ve owned the company for the majority of 2025 and built up a big portion of my position in 1H 2025 with an average cost of $38. I see this one ultimately ending up as a 3-5x position as per my model.

LMND have now crossed the 3 million customer milestone. I won’t dive into this too much as I’ll leave this for a deeper dive post earnings, but as per my rough calculations, LMND are adding ~1,300 customers per day. If the average premium per customer increases by ~2% QoQ which I think is very conservative…my model gives an IFP growth of 31% YoY. That’s very strong for an “insurance company”.

Numbers:

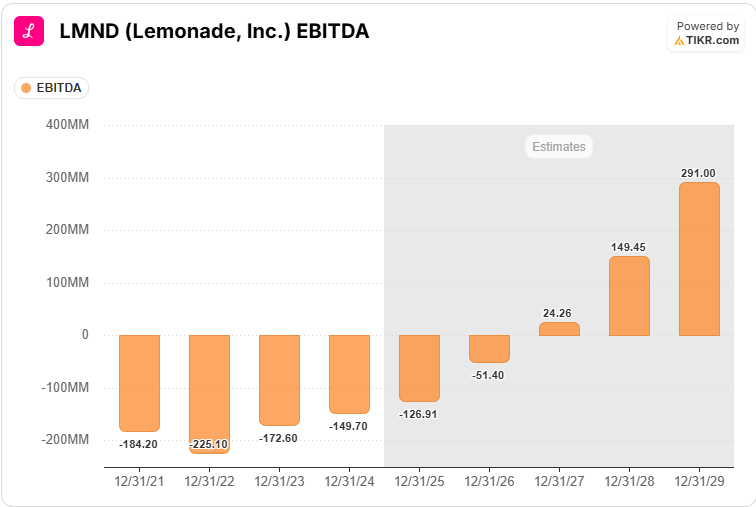

2026 expected revenue growth: 59%

2026 expected EBITDA growth: 62%

EBITDA profitability: Expected in 2026

Valuation:

If IFP growth continues at 31% through to Q4 2026 then we should be at $1.6B in IFP. This should translate to $304M in revenue plus other income for a top line near $350M representing 113% revenue growth over 6 quarters (although partially driven by reduced reinsurance ceding). Assuming a conservative 66% gross loss ratio and 72% net loss ratio, LMND would be at $148M in profit after insurance losses.

If we factor in ~$25M in other insurance expenses, LMND are on track for $123M in Q4 2026 gross profit. On a trailing basis, this would put gross profit growth at 51% with total FY26 gross profit estimated at $386M. At current levels, that means we’re pricing LMND at just 15x FY26 gross profit. Given gross profit is accelerating at over 3x this multiple, I think the valuation even today remains undervalued.

Zeta Global | ZETA

Introduction:

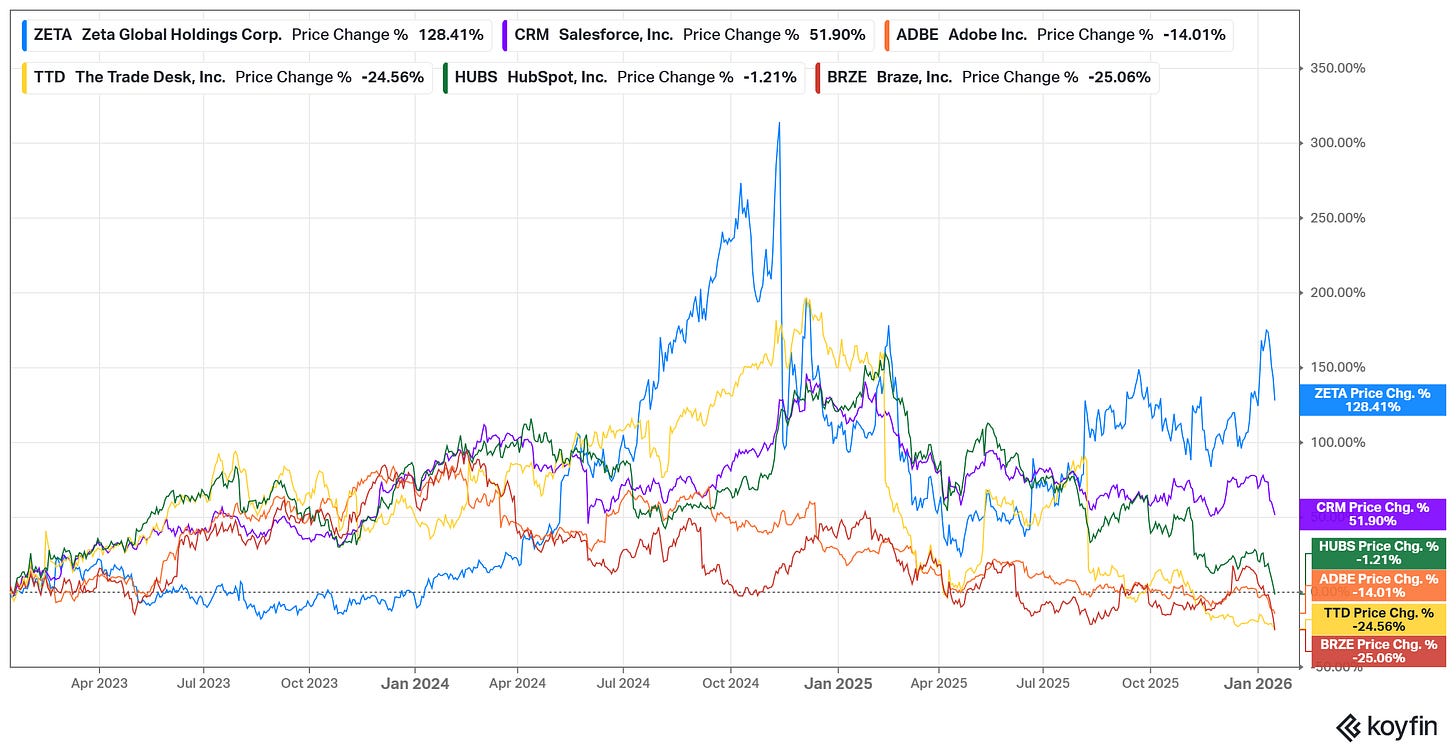

ZETA is a truly exceptional, and underrated company. It’s now my 5th largest position at 4.8% of my portfolio and I’d be very happy to add at these levels. ZETA operate in the marketing industry competing with legacy giants like CRM, ADBE, and others like TTD, HUBS, and BRZE. Out of those ZETA’s stock price has destroyed peers over the last 3 years and if you take a look into the numbers it shouldn’t be any surprise.

Revenue growth is the fastest, EBITDA growth is the fastest, and forward estimates are by the far the best. So if you’re looking for a company that is so far dominating a total market with a total forecasted 2035 TAM ~$2T (when you take into account digital ad spend and MarTech software), then ZETA is the play. ZETA currently have ~5% of the core enterprise market whilst legacy players like ADBE and CRM hold above 20%.

Big picture, if ZETA hit 2026 revenue targets (including Marigold acquisition), then they’re still capturing less than 0.2% of the potential global digital marketing spend.

Numbers:

2026 expected revenue growth: 34%

2026 expected EBITDA growth: 39%

EBITDA margin: 22%

Valuation:

ZETA is expected to hit $383M in EBITDA in FY26 but that’s based on analyst expectations of 34% revenue growth. I think we hit ~38-40% because of the $190M Marigold acquisition that I think analysts are currently not factoring in as much. This would put FY26 revenue at $1.8B. Taking into account 40% revenue growth and peer P/S multiples, ZETA should be trading at 5-6x sales (currently trades below 3x).

$1.8B in revenue * 6x sales gives us $10.8B market cap. Dividing that by 253M shares gives a $42 share price which is 100% today. That’s my 2026 target…. If we make this a 3-5 year hold I think a 3-5x becomes very feasible.

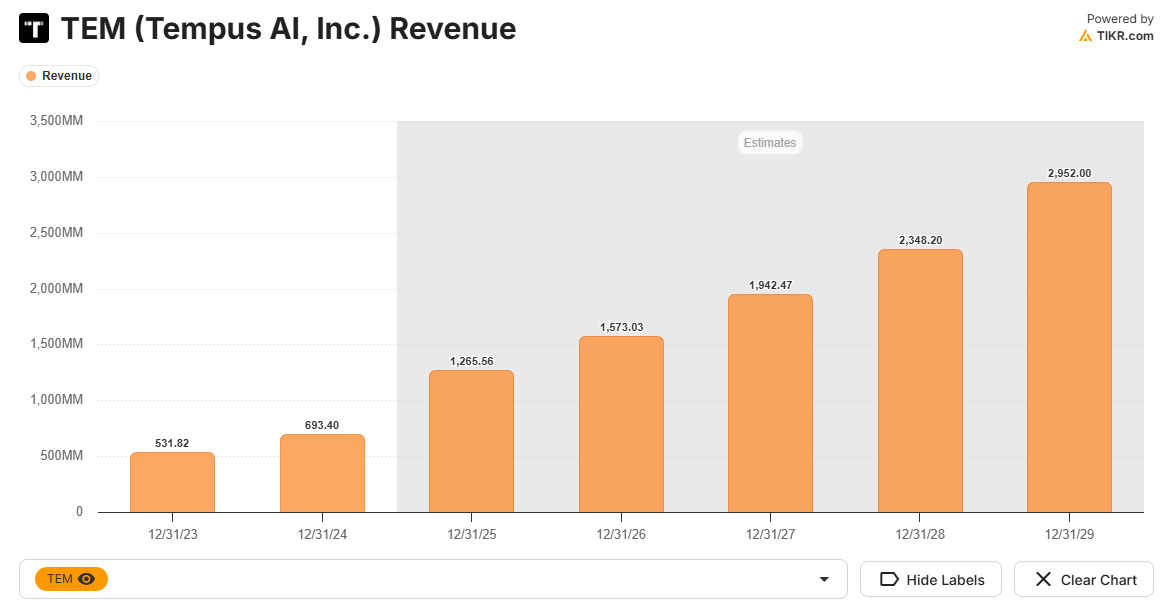

Tempus AI | TEM

Introduction:

TEM is only a small position for me so far but it needs to become a lot larger. Structurally we’re in a downtrend, but we’ve been holding the 200 daily MA for the last few days which has been a positive. If we start to break this level for another leg down, I’ll start to consider making TEM a much larger position quite quickly.

TEM ultimately are disrupting the “Standard of Care” model by replacing it with AI driven precision medicine and diagnostics. They’re shifting the healthcare industry from a reactive, biology-first driven industry towards a proactive, data-first software industry.

Numbers:

2026 expected revenue growth: 24%

2026 expected EBITDA growth: 20,000%

EBITDA margin: 4.5%

Valuation:

TEM currently generate ~$1.27B in revenue and management have explicitly stated they expect to sustain 25% revenue growth for at least 3 years putting 2028 revenue ~2.5B. A sustained 25% growth in a market where TAM is ~$800B is deserving of high multiples.

This isn’t a TEM deep dive, but with 126% NRR, a powerful data flywheel, serving over 70 data licensing clients for clinical and genomic data for drug development, and 68% growth in data & applications segment, I think a 10x sales multiple is fair for now.

At scale, I think TEM can quite comfortably operate at +20% net margins. It’s difficult to forecast when TEM can hit scale but if they can hit 20% margins by 2030, we hit $750M in net income (based on $3.75B in revenue). $750M multiple by a very conservative 25x earnings multiple gives us $19B market cap which is ~52% higher than today. I think that’s an absolute base case.

Upstart | UPST

Introduction:

My average cost for UPST is $58 which means I’m currently in a 17% drawdown making this the worst performing stock in my portfolio so far.

Traditional credit scoring is very rules based, “rear view” mirror approach. UPST replaces these rules with a huge machine learning model that analyzes non-traditional variables and ultimately approaches ~44% more borrowers than legacy peers effectively profiting on finding the “safer” applicants that FICO scores label as high risk.

The TAM is absolutely massive - above $3T.

Mortgages alone offer a $2.3T opportunity, with auto loans ~$700B, and personal loans ~$100B.

Some recent big news for UPST is around Trump’s plan to cap credit card interest at 10%. The bullish reaction to this is that major banks will likely stop lending to anyone who isn’t a very low risk borrower because they won’t be able to profit. This creates a huge opportunity for UPST in that rejected application pile.

However, the risk here is that UPST if the 10% cap is applied to all consumer credit (including personal loans), then the economics of the UPST’s business model essentially could become obsolete. A tricky one to decipher for now.

Numbers:

2026 expected revenue growth: 23%

2026 expected EBITDA growth: 43%

EBITDA margin: 26%

Valuation:

I personally think if rates drop in 2026 which is highly likely and if Trump’s credit card cap is actually bullish for UPST, then we are very undervalued today and $48. We currently trade at a Fwd revenue multiple of 5x but have previously been consistently above 10x when UPST was a much more business.

From an EBITDA point of view, UPST are set to grow very nicely, even at 23% revenue growth. We have an estimated 43% EBITDA growth in FY26 on a 20x NTM multiple. That is currently too cheap.

I suspect we hit $2.5B in revenue by FY29 on a 30% EBITDA margin which gives us $750M in EBITDA. That would equate to a CAGR of 34% which should warrant a 20x EBITDA multiple which would put UPST’s EV at $15B which offers a 2.5x from today.

UiPath | PATH

Here’s my Deep Dive on UPST. It explains concisely what I think on UPST and the ultimate huge opportunity ahead:

Bucket B - The Incumbents

Here’s the list of incumbents that will be going on the spreadsheet. I’ll also be adding an article that is far more geared to an argument that incumbents beat disruptors.

Palo Alto Networks | PANW

UnitedHealth Group | UNH

Elevance Health | ELV

Cencora | COR

Equifax | EFX

Fair Isaac Corp | FICO

Duolingo | DUOL

Carvana | CVNA

SAP | SAP

ServiceNow | NOW

Workday | WDAY

Salesforce | CRM

Adobe | ADBE

HubSpot | HUBS

Verisk Analytics | VRSK

Autodesk | ADSK

Our Takeaway

I can’t look into the future, but if I were to regret not investing heavily in a certain theme in 5-10 years, it would probably be these AI application disruptors. The market so far completely agrees with me too and almost every trending indicator I look at also agrees.

UNH is down 35% over the last year whilst OSCR is up 10%.

PGR is down 17% over the last year whilst LMND is up 141%.

HUBS is down 56% over the last year whilst ZETA is up 8%.

I bet this trend continues, and I bet it continues very aggressively over the next few years.

Such a great read 🤌🤝👏

Great analysis but what worries me is that both the railroad and fiber optic build outs were immediately followed by severe corrections. My theory is 2026 will be similar to 1999 with a final blow off of IPOs.