The Next Monster? Stock 1 Out Of 16 In My Portfolio

Why I own it, when I bought it, and what I'm looking for moving forward

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

Celsius Holdings CELH 0.00%↑

Company: Celsius Holdings

Ticker: CELH 0.00%↑

Website: Celsiusholdingsinc.com

Current stock price: $79.72

52-week high: $96.11

52-week low: $28.69

Market cap: $18.83B

Headquarters: Boca Raton, Florida

I’ve mentioned Celsius Holdings quite a lot on my X @MMMTWealth but for one reason or another I haven’t spoke too much about it here…Until now.

I first bought CELH not too long ago. It was around December 2023 in the low $50s so I’m currently sitting at an unrealized gain of 54%, though at one point (mid March) I was up around 88.2%. Admittedly, I did slightly trim my position in late March in the high 80s, but not by much. I’ll be holding this stock for a few years at least, unless anything drastic changes.

There’s a possibility that CELH 0.00%↑ could overtake MNST 0.00%↑ over the next 10-15 years, and if it does this will be one of the best investments I’ll likely make in my lifetime.

🔑Key Summary

Celsius is disrupting the traditional energy drink market with 80% of new customers previously not drinking energy drinks.

The Celsius brand has become one of the most popular brands across the US with a very wide demographic (50% females and 50% males).

The Pepsi partnership has been huge for CELH and will be perhaps the main reason why CELH will have success internationally.

The valuation currently is relatively high, especially when compared to competitors such as Monster, but CELH growth rates warrant a more premium valuation.

In this article, you’ll get insights on the following:

Business

Sector

Moat

Fundamentals

What I’m tracking

Valuation

Opportunities

Risks

One-Pager

▶The Business

What does Celsius do?

They produce, market, and sell healthy energy drinks, or as some people describe them, “functional beverages”.

But the Celsius brand is more than just a beverage company.

They have managed to create a brand centered around being a healthier, zero-sugar alternative to the traditional energy drinks like Monster and Red Bull. It’s a brand that embodies a set of core values focused on health, activity, and fitness.

How does CELH get their products to market?

In the earlier days before 2020, Celsius were essentially fighting for warm shelf space and trying to grow their distribution through small regional operators, but most of their success came from DTR (direct to retailer). Lots of early companies have to start this way, but it’s not the most ideal method, especially since beverage companies need to be in the coolers.

The next step for Celsius was in 2020, when they partnered with Anheuser-Busch. This helped CELH massively get into the larger retail chains and with cooler space. During this 2 year partnership, the number of stores selling CELH went from ~10k to ~150k, a 10x increase over 24 months.

And finally, in August 2022, Pepsi PEP 0.00%↑, announced they were investing $550m, a 8.5% stake into CELH, as well as taking over distribution. Not only are Pepsi one of the biggest brands on the planet, but they’re also the largest beverage distributor around the world.

This is where the huge growth opportunities came for CELH.

Today, thanks to a great product, genius marketing, and Pepsi’s distribution, Celsius have managed to boast an incredible customer base.

Convenience stores like 7 Eleven, RaceTrac, and QT

Grocery stores like Publix, Harris Teeter, Kroger, Aldi, and Dollar General

Vitamin & Drug stores like CVS, The Vitamin Shoppe, and Smoothie King

Fitness stores like Dick’s, LA Fitness, and Golds Gym

Ecommerce stores like Amazon and Walmart

Mass market stores like Target and Costco

📈Sector

Grand View Research estimates that the U.S. functional beverage market can expect annual growth of 7.2% until 2030.

Though not an industry with huge growth potential, Celsius is attempting to break up the current oligopoly in the energy drink market.

I’m sure you’re familiar with Monster and Red Bull. They’re currently the largest energy drinks companies in the world and have been for some time, though Celsius is making some moves to make this a three-way race.

Here’s a snapshot of the Monster investors presentation in January 2024 showing energy drink market share:

Monster is trending slowly downwards and Red Bull is flat. Celsius is really the only company here trending upwards.

This upwards trend started exactly around December 2022, just 3 months after the Pepsi partnership began.

To put this industry into more perspective, the coffee industry is currently valued at ~$550 billion, which is around 5x the current energy drink market.

However, the energy drink market is growing twice as fast as the coffee industry. This isn’t all too surprising. People are steadily replacing their daily coffee’s with beverages like Celsius, which actually contain around 1.5-2x the amount of caffeine per drink. If you then consider the amount of new products and innovation present in products like Celsius compared to a coffee, there’s no reason that the energy drink market can’t continue to grow at 2x the coffee industry over the next decade.

But at the end of the day, CELH aren’t really competing directly in the traditional energy drink market as we may think. Here’s what John Fiedly (CEO) said:

“We see that Celsius has a much broader opportunity when you look at the TAM versus say, traditional energy, we’re seeing consumers, consumer consumption increase outside of that energy need state. We’re seeing the product being paired with sandwiches and smoothies and bowls and a variety of opportunities for fast casual. So I think it’s a little bit too early for us to really know how big that opportunity is.”

Simply put, they’re redefining the energy drink market.

🏰Competitive Advantage

This is always a key question. If you don’t believe a company has a moat, or don’t understand what the moat is, then there’s no reason to invest.

Let’s talk about why CELH has competitive advantage:

The beverage industry is a saturated market and therefore companies who are able to develop a strong brand can usually differentiate themselves in the market. This is exactly what Celsius have managed to do.

Looking at Red Bull and Monster, they have very similar brands with a consumer base centered mostly around males. They’ve stated that it’s approximately 70% males and 30% females who purchase those drinks, but in all honesty I’ve not seen many women drinks either of those drinks, so I wouldn’t be surprised if it’s weighted even more heavily towards males.

Celsius have managed to create a very different brand equally split between males and females. Their demographics are much wider than competitors, hence why 80% of their customers are essentially new to the energy drink market. Only around 20% are taken from other brands like Red Bull and Monster.

The demographic is built around:

Health conscious males

Health conscious females

Teenagers who love the taste, brand, and social media trend

Elderly population who love the taste

This is one of the main reasons why Celsius managed to earn the #1 energy drink on Amazon.com during 2023 (by the way that’s another huge competitive advantage).

Finally, their partnership with Pepsi and the contacts and distribution channels this provides to Celsius is a huge advantage. Pepsi continues to expand the Celsius presence in retail and convenience stores which CELH was unable to do with Anheuser Busch, but they’ve also secured distribution to foodservices. This includes bars, restaurants, airports, education, healthcare, and stadiums for example which accounts for 12.5% of CELH revenue today.

🔢Fundamentals

▶Growth

For a company like Celsius who’s focus is currently on disrupting the market, gaining market share, and international expansion, simply looking at revenue growth is a key indicator.

Analysts predictions back in 2021 for 2024 Celsius revenue was $438 million. 2023 revenue was $1.32 billion with estimates now at $1.86 billion for 2024. That’s just over a 4x increase in estimates in 3 years.

This is mainly thanks for Pepsi’s huge impact on the company which opened up many new channels that CELH previously did not have access to.

Of course more consecutive years of triple digit revenue growth (particularly solely in the US) is unlikely and growth rates no doubt will slow down. However, international expansion has begun this year mainly in Canada, UK, and Ireland.

There’s no doubt that a $2+ billion revenue year in 2024 is highly feasible. That’s only a 52% increase which in my eyes is quite realistic for a company like CELH.

It’s worth also noting that currently (as per latest numbers) only 4.5% of total CELH revenue comes from outside the U.S. For reference, these figures for Red Bull and Monster are upwards of 45%, highlighting the opportunities that international expansion presents for CELH over the next decade or so.

▶Capital Efficiency

One of the best metrics to look at. The higher the ROIC the more money you can expect to make as a shareholder.

December 2023 figures for CELH were strong.

37.6% ROIC

21.3% ROE

▶Profitability

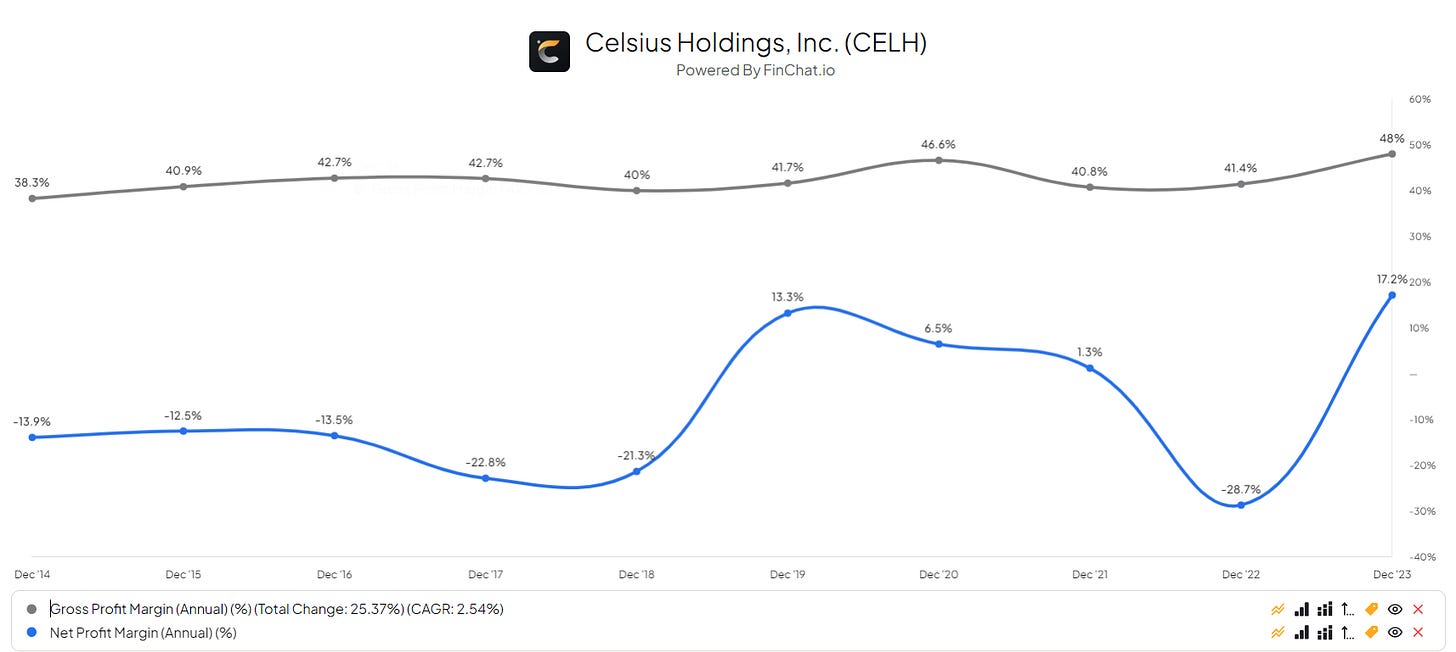

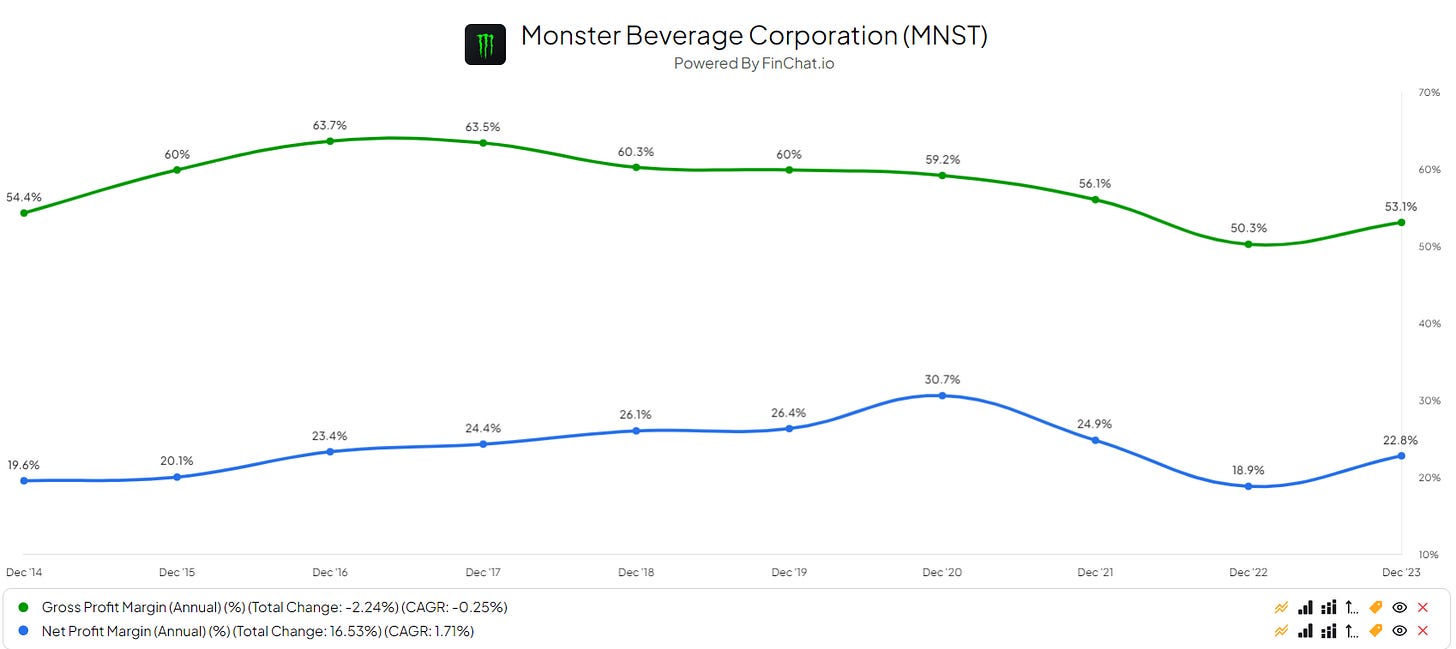

CELH have managed to expand their gross margins by around 660 bps as a result of reduced raw material costs as we’ve slowly recovered from the pandemic. There’s no reason CELH can’t keep expanding gross margins at the same rate they did earlier in the decade, though 660 bps annually isn’t likely.

Monster MNST 0.00%↑ on the other hand have seen declining margins over the last 5-6 years. For CELH, there’s clearly still work to be done on the margin expansion which will only naturally improve with scale.

📈📉Valuation

As of today, CELH has an EV of $18.65 billion.

Current CELH December 2024 analyst estimates are:

$1.875 billion revenue

$396.58 million EBITDA

$175.91 million FCF

$1.1015 EPS

This means the stock is currently trading at:

9.95x EV/Sales

47.09x EV/EBITDA

106x EV/FCF

To be honest, I think these estimates are very conservative, and analysts have been playing catch up the whole time with CELH. I don’t think $2+ billion revenue is unrealistic at all. With a 49% gross margin, 22% EBITDA margin, and 18% net margin (all ~100bps above today) you’ve then got:

$2.0 billion revenue

$440 million EBITDA

$360 million net income

This gives you:

9.33x EV/Sales

42.38x EV/EBITDA

51.8x EV/Net Income

Let’s compare this to Monster which has an EV of $54.06 billion.

Monster December 2024 estimates are as follows:

$7.984 billion revenue

$2.470 billion EBITDA

$1.734 billion FCF

1.8227 EPS

This means MNST is currently trading at:

6.77x EV/Sales

21.89x EV/EBITDA

31.17x EV/FCF

It’s evident that CELH is not cheap. However, these kind of multiples are normal for companies with fundamentals like CELH. MNST is only growing revenues by 12% whilst CELH has been growing revenues in the triple digits for three years.

I can’t sit here and say CELH is cheap. Maybe it was back in December but it’s not now. But what I will say is that quality stocks have premium valuations, and I believe CELH encompasses this.

🔑Opportunities

Just a short section here on what the major opportunities are for Celsius and what I’ll be keeping my eye on.

The international expansion will be key. The high multiples currently likely are pricing in some solid success firstly in Canada, and then the UK and Ireland.

Over the next 3 years or so, I’d like to see this chart look noticeably different. There’s no reason we can’t see international sales hit around 10% of revenue by 2026 (this is assuming a fairly similar growth trajectory to what we saw in the US).

🤞Risks

Of course investing in any rapid growth disruptor like CELH arguably carries more risk than a mature company.

Valuation risk

As we touched on in the valuation section above, CELH has a premium valuation. On top of this the stock is volatile and we’ve regularly seen pullbacks of more than 15%. There’s the clear risk that we see another large pull back especially after the recent good performance and a risk of a more wider market pullback.

International Expansion Risk

The US consumer has loved CELH but this does not guarantee that the European population will feel the same way. I’m not worried about the distribution network as Pepsi is one of the best in the world at this, but there’s a clear risk that the product simply isn’t liked as much on the other side of the pond. If Celsius wants to maintain it’s high multiples and high growth, success in the expansion is important.

📜One-Pager

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Great Article!

Are you willing to post your portfolio performance on this blog?

Thanks.

Interesting write-up!