TSLA Q3 Earnings Report

Very positive.

Hi fellow investor👋

Today we’re looking at Tesla’s Q3 earnings. Let’s get into it.

Tesla Earnings

One of the most anticipated earnings day of the year is always Tesla. The last few reports (except April 2024) have been largely quite a disappointment for TSLA…but this quarter was one of the strongest in the last 2 years. They absolutely crushed it.

The previous earnings call had a big focus on the future (Optimus + Robotaxi) but Elon & co really owned this quarter. They provided good results on what is happening now at TSLA. Automotive growth. Automotive margins. Semitruck. Regulatory approval. Energy business.

There was no sugar coating the results with a future promise of Optimus robots in 10 years, granted they obviously wanted to show the numbers of this time.

Here’s what I took from the report and the earnings call:

Demand

Revenues increased 8% YoY up to $25.18B.

Automotive revenue was up 2% compared to Q3 23, but 15% up from Q1 24.

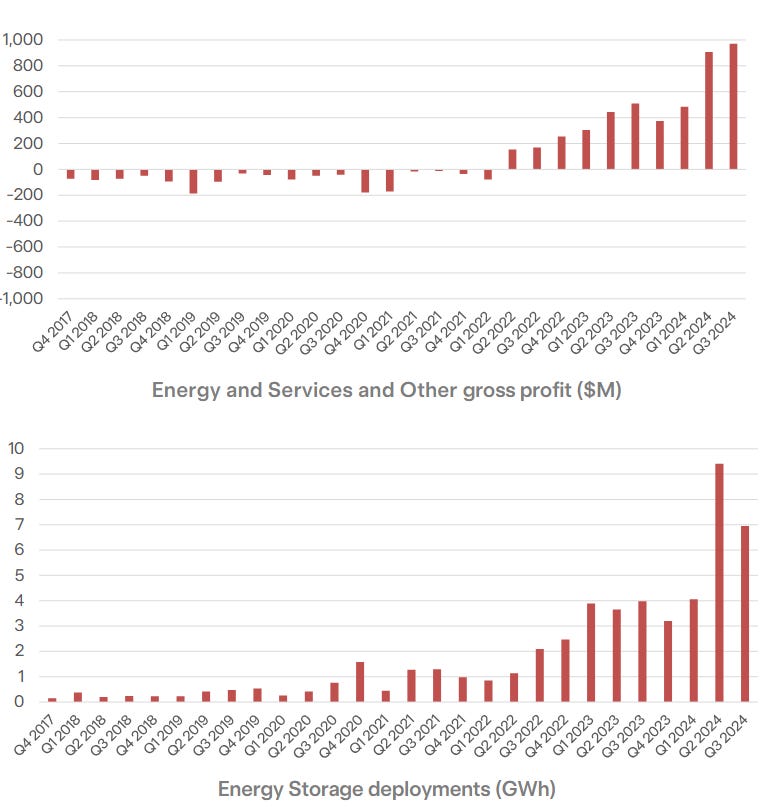

52% YoY growth in Energy generated and 29% growth in Services

Profitability

Operating income reached $2.7B (10.8% operating margin).

Adj. EBITDA margin increased 243bp YoY up to 18.5% attributable to lower raw material costs, efficiency gains, and various other one-time charges.

Energy business reached a 30.5% gross margin and the Services business grew gross profit over 90% YoY.

Automotive

The automotive vehicle sector had the best quarter in a long time compared to estimates, though admittedly past performance and difficult macro conditions meant that expectations were very low. Automotive revenue increased 2% YoY to $20.02 billion and remained fairly flat on Q2 numbers.

The positive part of this auto report was the Q3 auto gross margins which increased to 17.1% (from 14.9%). The cost savings came from lower raw material costs, freight, and various other one time charges which led to a COGS per vehicle of $35.1k. Elon also mentioned that the cybertruck posted positive gross margins for the first time.

During the call, Elon also gave a little reminder that all other EV companies are failing to become profitable like TSLA is managing. Whether this is completely true or not is difficult to fact check, but what we do know for sure is that other auto manufacturers with EV sectors (Volkswagen, Hyundai, GM etc) do not give specific information on margins for their EV vehicles. There’s likely a good reason for this.

We do of course have numbers for Rivian which are pretty shocking in terms of profitability. BYD is the only EV manufacturer with a positive net margin aside from TSLA, but I think it’s fair to have a couple of doubts about whether those numbers are actually true given the China situation and given all other EV makers aside from TSLA are struggling.

To put it simply, all US EV manufacturers are having a very difficult road to profitability and TSLA is the one exception to that.

It is worth noting that $3.61 billion of the $20.02 billion auto revenue did come from deferred revenue from FSD. From an accounting perspective, this is absolutely fine but investors need to realize that the auto gross margin perhaps wasn’t as strong as originally anticipated. That completely depends if you think FSD should be thought of in the realm of the auto business. Of course it is, but the way I think of TSLA currently is:

EV

FSD (future)

Energy

Optimus

AI / Software etc

Anyway, I’ll talk more on FSD below in the next section.

One final bit I’d like to briefly touch on is the $25,000 car that Musk has mentioned a lot since 2020. From an investor point of view, I think there was a lot of hope around this production because it would mean you’d massively increase the TAM, and secondly it would mean TSLA would be head and shoulders above of competition in terms of manufacturing an EV for anywhere near this price. Unfortunately, from this management report I think this was a vision that Musk had that has almost no chance of materializing now.

I’m mixed on this. Here’s why:

They’re very confident on FSD: One of the reasons Elon & Co are not focusing efforts on a $25k vehicle anymore is because I believe they’re very confident in their ability to solve FSD. Why would they put their focus over the next 2 years on reducing the cost of a vehicle down to $25k (which I’m beginning to think is not possible) when FSD is heading in the right direction.

Very obscure responses about the $25k option: When asked about the $25k vehicle, Elon’s response was about robotaxis. I explained why this is in my point above, but I think most investors maybe believed the hype that a $25k vehicle would be commonplace. Elon said it’ll be “with incentive sub $30k”. This means we are talking about a $37-$38k vehicle when you consider the various incentives available.

Overall, I think the auto business is performing considerably better than Q2. There was massively slowing demand and very tight margins in Q2 but it seems these are looking slightly more positive after Q3. Obviously it’s no clear long-term trend but we’ll take what we can get at the moment from the auto business.

It’s the core of TSLA today and it’s the most important numbers to look at today. That’s because there is lots of actual data showing how performance is. But no investor is realistically invested in TSLA because of the auto business today.

The FSD/robotaxi business, the energy business, and Optimus are why people invest in TSLA so let’s touch on those.

FSD/Robotaxi

TSLA are definitely closing in on the 99.99% FULL-self driving capabilities but it’s still not possible to gauge when exactly robotaxi will be a reality. Every quarter, Elon just seems to make up a new regulatory approval date, and mass production date and investors seem to believe him every time.

However, forgetting all this hype…I think FSD is moving in a very good direction.

First of all, from memory I don’t think TSLA has spoke about specific FSD revenue for a long time. In the earnings report, they specifically spoke about how FSD for Cybertruck and Actually Smart Summon (TSLA’s autonomous FSD features) contributed $326 million of revenue in the quarter with $821 million in current deferred revenue.

From my calculations, I also think the FSD take rate has be slightly higher than what we may originally have thought. Some data has suggested a take rate of just 2%, but Musk claims (and I now agree) that take rates are much higher. I think we are currently around the 12% mark. These are some numbers I played around with assuming 70% is recognized at all and a take rate of 12% gets us close to the $207m addition to FSD deferred balance.

A 12% take rate is higher than I think some analysts predict and much higher than the consensus 2-3 years ago. If this number can reach 20% by the end of 2025, then that’s huge revenue potential.

In terms of FSD performance, V13 is coming soon. We’ve seen a lot of improvements recently, but improvements are going to become much harder to come by now as miles per intervention increases. This simply means a lot of more miles are going to have to be complete to find these next improvements. Elon did state that he expects TSLA FSD to have longer miles between intervention than humans by Q2 2025. Whether this is realistic or not, it’s hard to tell but just a reminder than Elon has rarely got his timelines right.

I think there’s also some time to go before TSLA FSD vehicles start to feel smooth, like if a human were driving the vehicle. I’ve read a lot of reports suggesting that although safety is improving, it still feels jolty and very robotic (unsurprisingly). If it does feel this way, I do have my concerns that demand may not be as high as expected.

Just a quick note on FSD approval - this will continue to be out of TSLA’s hands and therefore an added risk. Musk says Texas will be a lot easier and quicker to navigate than California but I don’t really want to comment on any of this properly until we actually get some news from someone other than Elon.

Energy

The energy business is rarely spoken about but the last 2 quarters has shown that it’s a seriously good business with very high margin revenue (30.5% gross margin). Revenue increased 52% YoY ($817 million) to $2.43 billion, deferred revenue amounted to $1.73 billion, and total performance obligations amount reached $6.61 billion. So as Elon said, the energy storage business is “growing like wildfire”.

Investors now are taking the energy business extremely seriously. There’s absolutely huge potential here as production continues to ramp up in Shanghai and Lathrop, California. What I do believe is that we will see quick success in China as production increases there. Contracts will be made quicker. They have experience from California. All in all, China will be easier for the energy business. I have high expectations.

Whether the energy business will be competing with similar numbers to the auto business over the next 24 months, I’m not sure but I don’t think it’s unrealistic to pose that question.

Optimus

We didn’t get too much information on Optimus in this quarters management call which to be honest I was quite happy about. We got information about the current business with a few comments here and there about how Elon still believes Optimus will be the most valuable part for TSLA. Very tough to comment on it all but I’ll give you a link to my thoughts that I wrote after Q2.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.