10 Charts I Love for 10 Quality Companies

Best opportunity is at the end.

Hi all👋

This week I’ve given you 10 quality companies and 10 charts that sum up one or two of the reasons I love each company. Some of these companies I have spoke about a lot and own, some are new mentions.

I’ve left the best opportunity until the very bottom so make sure you read all the way through.

Resources used:

Just before we start I’d like to take a second to let you know the 3 sites I use normally use to create these visuals, and find these stocks.

StocksGuide: This is a new company that has the best and easiest to use screeners on the market (most of them are all already built in to the site). There’s also tons more features. Check them out.

Koyfin: Koyfin has arguably the most comprehensive data on the market.

FinChat: FinChat has tons of data, and probably the nicest visuals.

All these sites are very valuable and each offer their own strengths.

1. Palantir (PLTR)

Introduction

Thankfully, I own PLTR and have benefitted massively from this incredible company over the last 5 months. Thanks Alex Karp.

Numbers

Revenue Growth: 27.2%

EV/Sales: 36.6x (!)

Net Margin: 19.78%

Chart

I like this chart because it shows something quite important. PLTR are growing their customer count rapidly and will continue to do so for a long time, but they’re still not fully focused on cross selling or upselling (because they don’t really have to yet).

Back in Q1 2023, total revenue was approximately $525.2 million with 391 customers…averaging $1.34 million per customer.

In Q2 2024, total revenue was $678.2 million with 593 customers…averaging $1.14 million per customer.

The opportunity ahead for PLTR is massive. They’re still growing customers at +40% (+80% in the commercial business) and they’re not even really fully focused on upping that revenue per customer yet.

2. SoFi Technologies (SOFI)

Introduction

Another company I own that has finally started to wake up. I’ve been writing about SOFI for a while now. You can see my initial deep dive here from March 2024.

Numbers

Revenue Growth: 20.9%

EV/Sales: 2.9x

Net Margin: 2.96%

Chart

Quite a lot going on in this chart but the bar charts are revenue for lending, financial services, and the tech platform. You can see quite clearly how nicely they’re all growing, particularly the financial services platform.

Combine this with a solid margin expansion and you’ve basically got a very well diversified, high growth company, with solid margin expansion.

Yet, the valuation (Fwd P/S) has more or less stayed flat since 2022 when net margin was -21.1% and revenue was 40%+ lower.

3. Kinsale Capital (KNSL)

Introduction

KNSL is not a company but I own but it’s an extremely well-run company with a very strong position in a niche market. Kinsale are a specialty insurance company that offer solutions for complex property, casualty, and professional accounts that cannot be found on the standard insurance market.

Numbers

Revenue Growth: 30.0%

EV/Sales: 7.8x

Net Margin: 24.1%

Chart

Hopefully this graph shows just how strong of a compounder Kinsale Capital is. All metrics have been steadily trending upwards aside from net debt which has remained fairly flat since early 2023.

Look mainly at the FCF amount vs the net debt figure. $275.12 million in FCF vs $12.96 million in net debt. This company is one of the most financially sound companies out there and they’re still growing at 30% per year.

4. Amazon (AMZN)

Introduction

I’ve been talking about AMZN a lot on my X account. I’m not currently an owner but AMZN is very high up on my watchlist. The next significant drop I see at AMZN will lead me to investing very heavily.

Numbers

Revenue Growth: 10.1%

EV/Sales: 3.4x

Net Margin: 9.1%

Chart

Obviously the core of AMZN is their online store revenue, but AMZN’s AWS segment is being extremely underestimated.

AWS offers $105 billion in annual run rate, quarterly operating income of $9.3 billion, and an operating margin of 35%. A company operating with these kind of metrics should NOT be trading at at a 3.5x EV/Sales or 17x EV/EBITDA.

The AWS segment alone could justify the $1.8 trillion market cap of AMZN. Look at the metrics of PLTR and see this for yourself.

5. DLocal (DLO)

Introduction

I happily own DLocal, and I think the fundamentals are strong but unfortunately the stock price hasn’t really agreed with my thesis so far. Short term I’m absolutely fine with that.

Numbers

Revenue Growth: 6.3%

EV/Sales: 2.7x

Net Margin: 27.0%

Chart

Lots of lines going on in this graph…sorry. All it is though is a comparison between Visa (V) and DLocal (DLO) in terms of revenue growth, gross margin, and EV/Sales.

Here are the numbers to make it a bit clearer for you:

Visa:

Revenue growth: 9.7%

Gross margin: 97.8%

EV/Sales: 15.9x

DLocal:

Revenue growth: 33.8%

Gross margin: 39.2%

EV/Sales: 2.38x

Visa is a quality company yes and highly deserving of a good multiple like 15.9x. But DLO has much stronger revenue growth and much more room for TAM expansion, yet they’re trading for 2.4x. The difference between these two payment processors is far too large considering the DLO outlook.

6. PayPal (PYPL)

Introduction

PYPL is perhaps one of my favorite companies to own this year simply because I’ve proved so many people wrong with it.

I don't see why PYPL can't reach double digit revenue growth again over the next 2-3 years.

At 10% growth, we have ~$50 billion in revenue in 5 years. At 6x Price/Sales (below the 5 year average), we then have a $300 billion company.

3.6x from today.

Numbers

Revenue Growth: 8.2%

EV/Sales: 2.6x

Net Margin: 14.3%

Chart

The most common response I got to my PYPL posts on X was “PayPal is a dead company, why would you invest in that cr*p?”

Is this chart a sign of a “dead” company?

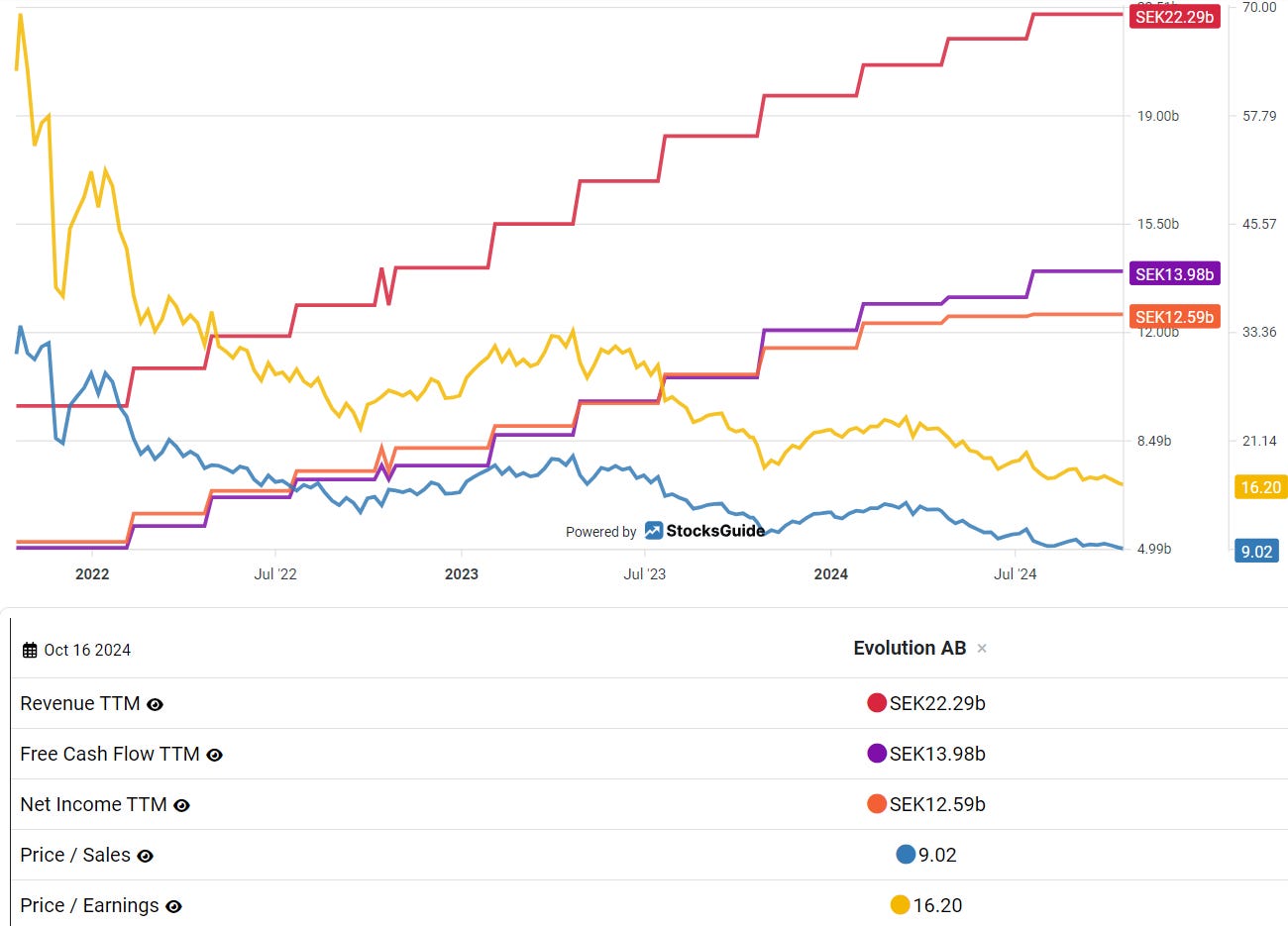

7. Evolution AB (EVO)

Introduction

EVO isn’t a company I own, but it’s a company I’ve followed for quite some where I’ve just been waiting for the right time to enter a position. I think that time is slowly coming from a technical standpoint, but I still think it’s not that cheap which is why I haven’t invested just yet.

Numbers

Revenue Growth: 15.7%

EV/Sales: 8.7x

Net Margin: 52.9%

Chart

Revenue up. Free cash flow up. Net income up.

P/E down. P/S down. And PEG ratio is now 0.77x.

Much more information needed to make an investment, but this provides a solid suggestion that there’s potential EVO is undervalued.

8. Celsius Holdings (CELH)

Introduction

CELH (along with DLO) has been my worst performing stock that I’ve owned and I don’t really know completely why.

I have planned a bigger post coming out on CELH soon about a little update looking more specifically at the Nielsen data, and PEP inventory levels. As a little spoiler though I think things are starting to look much more positive again over the last 3-4 weeks.

Numbers

Revenue Growth: 23.4%

EV/Sales: 5.0x

Net Margin: 19.9%

Chart

Revenue growth has slowed at CELH as we all should have expected. But Wall Street has completely punished CELH for a lack of growth.

I think the market is completely overlooking how much of the TAM Celsius still has to win internationally. The international expansion opportunity has only just begun. This is a good long term play.

9. SentinelOne (S)

Introduction

I think everyone should have at least some exposure to the cybersecurity industry. I also think SentinelOne is the best cybersecurity company to own today. Want to see why?

Numbers

Revenue Growth: 39.7%

EV/Sales: 10.5x

Net Margin: -37.6%

Chart

CRWD is one of the most loved cybersecurity companies to own amongst retail investors.

But you can get higher growth rates for a multiple over 1/3rd less with SentinelOne.

10. ASML (ASML)

Introduction

Many people don’t understand that ASML has a complete monopoly in the EUV lithography market (a technology used for manufacturing integrated circuits).

Any company that has a 100% market share in the semiconductor industry should be taken very seriously.

Numbers

Revenue Growth: -9.6%

EV/Sales: 9.7x

Net Margin: 25.3%

Chart

Hopefully this chart shows you there’s currently a big disconnect between the underlying fundamentals and the valuation on an EV/Sales basis. ASML is one of the most important companies in the world and it’s going nowhere anytime soon.

This is a buy.

I deliberately left this one till the end to reward all of you who read all the way through.

That’s it for the day

I hope you loved this article. As I continue to develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I’m 7 for 10! Couldn’t agree with you more. Thanks for the charts

How do we get the newsletter?