SentinelOne -A Big Opportunity After A 20% Drop

I added more

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Company: SentinelOne

Ticker: S

Website: https://fr.sentinelone.com/

Current Stock Price: $17.75

52-Week High: $30.00

52- Week Low: $14.24

Market Cap: $5,375.14M

Headquarters: Mountain View, California

Number of Employees: 2,400

Introduction

In my opinion, everyone should hold some cybersecurity in their portfolio. Whether that’s in the form of an ETF or whether that’s an individual holding of one of the big cyber players such as Fortinet, CrowdStrike, SentinelOne, OKTA, Zscaler, Cloudfare, or Palo Alto Networks.

I’ve held Fortinet for the past 2.5 years or so and it’s done pretty well but it’s definitely lacking the higher risk/higher reward/higher growth nature that I like to expose myself to. That’s why I bought SentinelOne 6 months ago and added to my position last week after the earnings and subsequent 20% drop which wasn’t justified at all.

There’s been a wider pullback in software and cybersecurity of late, and therefore any earnings that aren’t a huge beat and a huge raise in guidance aren’t faring too well. Anyway, this provides investors like myself with a huge opportunity.

What does SentinelOne do?

SentinelOne is a cyber, data, and AI company competing in endpoint security and emerging technology market with their Singularity Platform (now it’s about a 60:40 split with endpoint and emerging tech). This platform fuses together its endpoint protection, endpoint detection, response, IoT security, and cloud workload protection all into one. They compete directly with CrowdStrike (CRWD) which has been an incredible stock and company to own over the last two years. Despite this, there are independent evaluations which suggest the SentinelOne’s Singularity and AI powered platform returns better results than CrowdStrike…though this of course does not suggest than S is necessarily a better or worse stock to own.

SentinelOne serves across a huge range of industries, just like most of their competitors. Although this of course isn’t a competitive advantage, it does show they have a wide TAM across banking, healthcare, public sector, digital, energy, manufacturing, retail, and education etc.

SentinelOne most recently introduced Purple AI, their AI Security Innovation. Purple is integrated into the Singularity Platform and makes the whole cyber detection and response a lot simpler and more seamless.

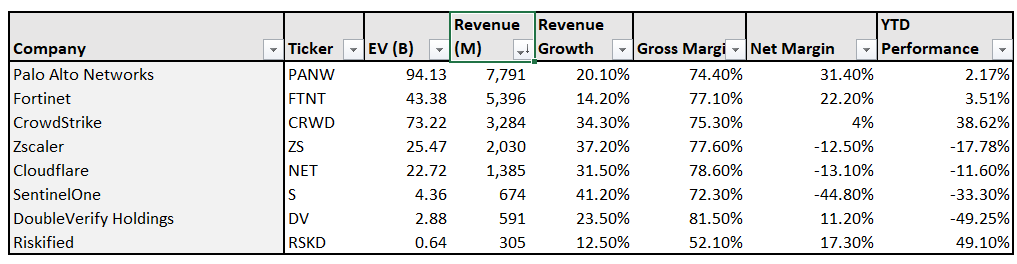

Table of comparison

The below is a quick table I put together just showing you where SentinelOne is compared to most of their competitors. As you can tell, the main difference is that their net margin is very weak compared to the other more mature companies like PANW, FTNT, and CRWD. This is expected though considering they are in completely different stages of growth. I’d say SentinelOne is about 2 years behind those companies in terms of profitability and go-to market roadmap.

I am bullish on SentinelOne (as I’m sure you’ll gauge from this article), but I think it’s important to note early here a worry that I do have. S does have the highest revenue growth here, however, Q1 results which I’ll talk about below did show that revenue growth isn’t that much higher than the likes of CRWD. Considering CRWD has 4x the revenue and is about 17x the size of S, I’d like to see revenue growth for SentinelOne much higher than what it is.

Recent Earnings

Growth

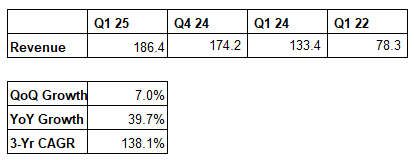

Revenue grew 39.7% YoY, which is impressive considering the macro environment and wider software market pullback of late. However, as I mentioned before I’d love to see this figure slightly higher.

This revenue growth beat estimates by 2.9% and beat guide by 3%.

Annualized Recurring Revenue for Q1 2025 was $762.2m, compared to $563.6m in Q1 2024. This is a 35.2% increase which missed ARR estimates by 0.4%.

There was a 30% increase in the number of customers paying +$100k. SentinelOne have always been strong in the mid-to-low market, but they’re clearly starting to see more success in the mid-to-large market now.

Net Retention Rate has slowed down and is now in the 110% range which is still extremely impressive. Considering SentinelOne are still in the expansion/growth phase of their journey and are therefore focused on growing customer numbers, a reduction in NRR isn’t too much of a worry.

Profitability

Beat $-25m EBIT estimate.

1.1% increase in gross profit margin, 8.9% increase in net profit margin, and FCF margin turned positive from -3.7% last quarter to 22.1% this quarter. This is one of the best FCF margin expansions I’ve seen in a long time.

Gross margin has grown YoY ~4% though is still behind peers. I expect to see SentinelOne reach the 77-78% GPM range in 2027/2028 as they continue to benefit from scale efficiencies.

$34 million of positive FCF.

Sales and marketing increased but decreased on a % of revenue basis.

Guidance

Lowered annual revenue guidance by 0.6% due to a wider macro uncertainty and tightening financial environment.

Kept EBIT guide in line with previous guidance.

Discussion on Q1’25 Earnings

I’d say the earnings were “meh” and perhaps didn’t justify a 20% drop. But they definitely weren’t quality earnings. We did see strong revenue growth, positive free cash flow, and strong margin expansion. The disappointment was the guidance.

“To reflect the impact of macro-dynamics in our go-to-market transition, we’ve modestly revised our full-year revenue outlook range. We’re expecting over 30% revenue growth this year".

Solid. But not amazing considering the growth stage that SentinelOne is in.

Compare this to CRWD who said:

“While the macro environment remains challenging, the unique capabilities and data gravity of the Falcon platform, coupled with our Falcon Flex program are driving larger platform deal sizes, consistently strong win rates, and record levels of pipeline for the year.”

CRWD raised annual revenue guide by 1%, whilst S lowered revenue guide by 0.6%.

It’s evident that CRWD are holding up better in the macro environment. I don’t believe it’s to do with a better product though which is the long term positive for me. It’s to do with better marketing, more engagement invites, and just an all-round better brand at the moment. Whether this lasts for the next 3-5 years is another question, and one, as an SentinelOne shareholder that I hope/believe does not happen.

Competitive Advantage

Tomer Weingarten said in one of his latest conferences that competitive advantage in the cybersecurity space isn’t actually much of a thing because the competition is so fierce. He believes success in the market all comes down to the best product that is marketed the best. I’m not sure I massively agree with this completely as competitive advantage is always a thing, and more important in more competitive markets. Perhaps, it’s just not as prevalent.

Anyway, in my opinion and from independent research S does boast arguably the best platform out of all competitors. The reason they aren’t winning more is due to them not being considered for as many engagements as the likes of Microsoft and CrowdStrike who are much bigger names. I think this is a slow burner that will definitely become less of an issue over time, especially now that SentinelOne has a positive free cash flow now and their win engagement rate (mid 70s) is up with the likes of CRWD and Microsoft.

The actual S software is quality and they’re expanding their TAM by now addressing far more than just the endpoint security market. Around 1/3rd of revenue is now coming from their Data Lake and cloud offering, helped by acquisitions of PingSafe and Stride Security. The PingSafe acquisition won’t be seen in the top line until Q3 of this year but this will definitely be a huge advantage. PingSafe is in the CNAAP market (Cloud Native Application Protection Platform) and is an agentless security software. Combining this with the current security will likely be the first cloud security platform powered by “unified AI and security data analytics.”

With the best in class technology and improving marketing S have begun winning bigger clients. They now are the security provider for one of the top 3 SaaS vendors in the US, and the biggest email provider in the world. With 12,000 accounts now being protected by S, management are fully focused on continuing to add more, and bigger, accounts to the portfolio. I sense this will start to become a snowball effect. If more and more big players start to go with SentinelOne over the competition, S will be invited to tender for many more engagements than they currently are. With this, their technology will win them more and more engagements over competition that they currently aren’t being given the opportunities to compete against on a regular basis.

Winning more of these bigger clients will lead to a much more predictable revenue stream. This is generally loved by investors and will make S a much more safe company to own.

A final competitive advantage I see that S’s rate of growth in the emerging technology markets with 40% contribution from NEW customers. This is extremely important due to relatively high switching costs that means once S wins a client they generally become a client for an extended period of time. SentinelOne’s growth outside of endpoint security is pretty staggering when compared to competitors. They’re becoming an all-in-one platform very quickly and also taking clients away from competitors that they will likely focus on cross-selling in the near future when management makes this more of a priority.

Management

SentinelOne has 2.98% inside ownership and is a founder led company. Here’s a brief rundown of the management team:

Tomer Weingarten:

Tomer is one of the co-founders and has been CEO of SentinelOne since 2013 (inception). Tomer has always been entrepreneurial, setting up various other companies such as Dpolls and Carambola Media.

David Bernhardt

David has been CFO since 2020 and previously held leadership rolls at Chegg where he was the Vice President of Finance and Chief Accounting Officer. Before that, David was Vice President of Finance at Palantir which he left in 2013.

Michael Cremen

Michael is new to SentinelOne after joining in November 2023. He has been in a few different Chief Revenue Officer jobs since 2019 such as at Veritas Technologies, Cohesity, and Elastic.

Ric Smith

Ric joined SentinelOne in 2021 as the CTO after various leadership positions at Medallia and Oracle.

Market

Software stocks have struggled of late in both fundamental performance and stock prices. However, this is just a huge opportunity for those brave enough to jump in to the highest quality stocks. AI is causing a major change to the industry with digital production booming. This means a lot more code and data which all needs to be secured. The opportunities for those who win in the cybermarket (CRWD, S, ZS, PANW, NET, OKTA etc) are therefore monstrous.

Growth and Trends

The global endpoint security market was valued at $14.86 billion in 2024 (LINK) and it’s projected to grow to $30.92 billion by 2032. This is a CAGR of 9.3%. The wider cybersecurity market is expected to reach $1.5-$2 trillion in the future (MCKINSEY LINK). Here’s the major growth trends:

Increasing Demand for Connected Devices: As technology like IoT expands further, so does demand for connected devices. With the market for IoT connected devices hitting $47.8 billion by 2027 (LINK - JONAH Article), so will the increasing need for security around these open-source connected devices.

Rising Implementation of Bring Your Own Devices: With flexibility and hybrid working on the rise, so is the use of remote location services and connected devices. This ups the risk for organizations who therefore need to secure endpoints.

Growing Cloud Spend: With a continued upsurge in cloud adoption, there’s an obvious boost in the demand for cloud security.

Risks

For me, there’s two main risks:

Revenue Growth

Though S is growing rapidly, they’re not growing that much quicker than CrowdStrike who are the biggest competitor. This is only a worry because CRWD’s revenue is about 4x SentinelOne’s already. At this stage of the cycle, I’d like to think SentinelOne was massively improving their top line at a much quicker rate than S.

To put it into perspective, when CRWD had revenue at similar levels to S, CRWD had revenue growth in the high 80s, low 90s range.

Unprofitability

I think this is the key driver as to why S currently trades at a discount relative to peers. In a much more risk on market, investors may be more focused on top line revenue growth figures, but the market sentiment isn’t like that currently. There’s many reasons for S’s unprofitability at the moment but the main reason is that it is much more expensive to win new clients, as opposed to cross-sell existing clients. S are currently in the life cycle where they are laser focused on adding more accounts to the 12,000 portfolio and this is an expensive venture.

However, Q1 2025 was the first quarter of positive FCF (-40% —> 18% FCF margin) so that’s definitely a start towards profitability and signs that management have the ability to really expand margins over the coming years.

I am aware that the market is probably more concerned with the unprofitable nature of S currently, but I am on board with management’s plan about really growing the accounts and revenue growth as quickly as possible. It is evident that management have the ability to cross-sell within their platform, and manage OpEx better than they are currently so I’m personally less focused on margin expansion for the next 3-4 quarters. I want growth. I want S to become a much bigger player in the cybersecurity space. I think we’ll learn just how good the software is then.

Valuation

S currently has an EV of $4.635 billion. They’re 2025 estimates are:

$813.8 million in revenue

$23.68 million in free cash flow

This puts SentinelOne at:

5.68x 2025 EV/Sales

195.73x 2025 EV/FCF

Comparing this to CRWD who are currently at:

17.90x 2025 EV/Sales

56.11x 2025 EV/FCF

Like I mentioned earlier, from an EV/Sales multiple, SentinelOne is far more fairly valued than CRWD considering revenues are growing at a fairly similar rate. I also included below a graph of Fwd EV/Sales for S which you can see is pretty much at it’s lowest multiple in history.

Of course there is the argument that CRWD may deserve to trade at a slightly higher multiple than S because they have 4.4x more revenue and still growing at similar rates. Their product pipeline is also about 2 years more advanced than S.

However, CRWD revenues growth rates are (and will continue) to slow down, and with that the EV/Sales multiple will inevitably compress from it’s lofty heights today. I don’t see that happening as much with S because the multiple is so compressed already and once profitability happens and further growth that multiple likely could increase.

Final Thought

SentinelOne is definitely on the riskier side of my portfolio which is why it’s not a huge part of my portfolio yet. If I continue to see management execute and sentiment around the stock improve I’ll obviously add if the time is right.

For me, the success of S all comes down to this:

In the short term, a solid product, a good brand, and profitability wins which is why CRWD has done +152% over the last 12 months.

However, S has a very high quality product and when spend ramps up again, I do believe S will start to see more success amongst some bigger clients. From there, it’s a snowball effect and there’s no reason S can’t see returns similar to CRWD over the next 5 years. The next 12 months are definitely big for S. I’ll keep you posted on my investment thesis.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I love the company's ticker. Single-letter tickers make the impression the company will grow into the stratosphere like it's the first of its kind.