12/15/2025 - Ideas For The Upcoming Week

Hi all,

Above is the SPY on the daily time frame and below is the SPY on the weekly time frame.

One thing is for sure - momentum is slowing and I think a pullback of some magnitude is coming. That could be a nice 5% pullback or it could be a +20% pullback which macro bears have been talking about since 2023…

Purely looking at the SPY technicals I think we will remain in an uptrend until we see a break of the 675 level. If we lose that then I think there’s a legitimate argument to say a much larger downtrend is coming.

Friday was obviously a pretty bearish day. I told paid subs I didn’t make any buys or sells on that day purely because I never like to do much on big days like that. I like to see where the market wants to go over a 2-3 day period rather than 1 afternoon. I think the first couple of days of this week will be quite telling for where we head for the next month or so.

As ever, here’s a few setups I’m watching. Some are in my portfolio already and some aren’t.

If you want real time updates from me throughout the week consider becoming a paid subscriber for just $16 a month. Definitely worth a try for a month and if you don’t like it you can cancel. I suspect you’ll find far more value in it than $16 a month though.

With it you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet which includes watchlists, investing universe, valuation models etc

Access to the paid chat that I spend about an hour in per day

Real time buy, add, trim, and sell alerts.

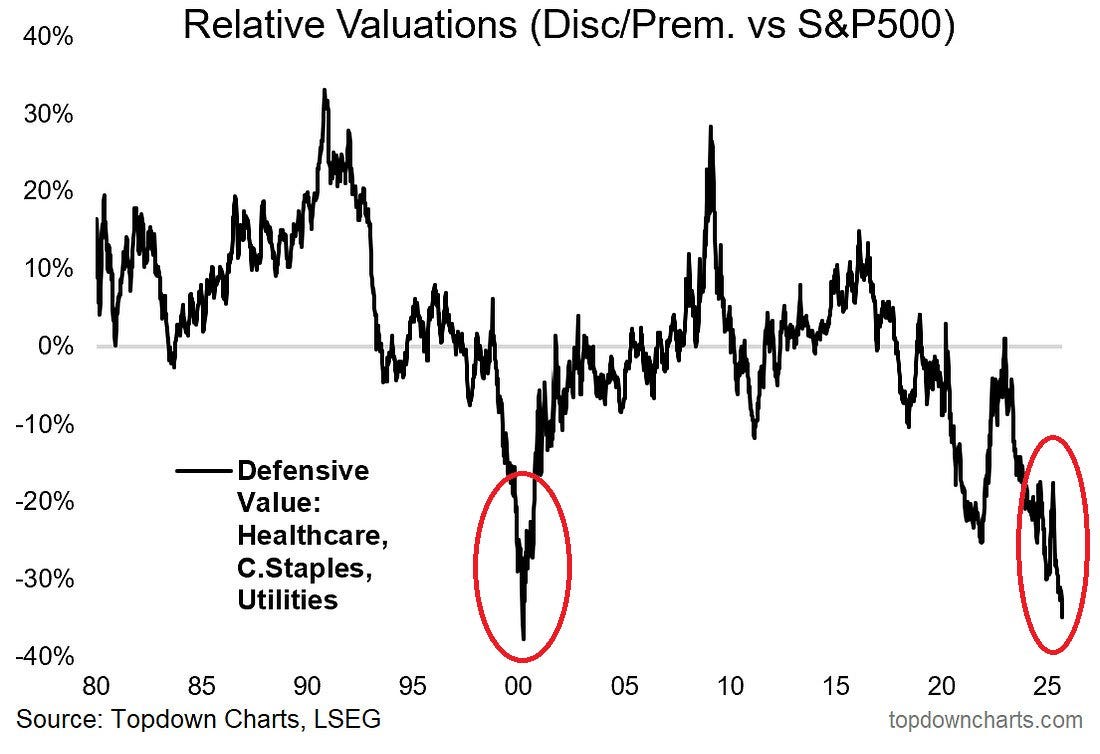

Defensive

Defensive value plays (healthcare, consumer staples etc) are trading at very discounted levels now. I’m generally quite an aggressive investor so my exposure here is definitely on the lower end but I’m also far more willing than many people to ride drawdowns especially in stocks I am very bullish on over a 3-5 year period (LMND, NU, PATH, TMDX just to name a few).

Anyway, here’s a play that I have been following a bit over the last 6 months that is finally starting to turn around after a recent break of the 200 daily… UPS.

UPS (United Parcel Service) has been below the 200 daily since July 2023. This is a great technical sign of a reversal here and something we should be looking into.

UPS currently trades at one of the lowest valuations in the sector at 15.6x NTM PE (DHL trades at 18x, GXO trades at 19x and FDX trades at a very similar PE). Fundamentally, I think there’s a few things not to like about UPS. Revenue growth is pretty poor compared to peers for example, but they are shifting strategy away from a reliance on AMZN. Margins also aren’t great with gross margins ~800 bps away from FDX.

However, net income margins at UPS are ~200 bps higher (than FDX and DHL) which directly translates into a higher ROE vs peers.

Ultimately, big picture I wouldn’t invest in UPS for a 100% upside opportunity. I would however consider it as an investment to lower the beta of my portfolio whilst also trying to get a +30-50% upside. No doubt an opportunity I think at this level (if you’re feeling a little bearish on the macro).

Neutral Risk

PATH

Paid subs will know that I discuss a lot of stocks. I’m always looking for new opportunities and we find some quite often. However, I also balance my portfolio right in line with my conviction and I still think PATH at $17 is far too cheap given the potential of Maestro.

If you want an up to date deep dive into PATH check out this article I wrote last week.

It’s got:

Business overview

Financials

Opportunities

Risks

Valuation

All packed into ~10 minute read and most importantly it’s free.

HROW

My other pick this week is HROW…linking my deep dive here for you.

The reason I love HROW is because I’m overall quite bullish on the biotech industry…but HROW does this in a very low risk way. Take a look at the numbers here:

Revenue has increased 413% over the last 5 years (39% CAGR).

EBITDA has increased 1,134% over the last 5 years (65.3% CAGR).

EBITDA is expected to grow at 85% next year (faster than the last 5 year CAGR) and yet HROW trades at just 18.2x.

I’ve said this many times, but I don’t think there’s many quality companies out there with a EV/EBITDA/Growth ratio higher than 4x…and HROW is one of them.

HROW is already a fairly sized position in my portfolio, but I’d like it to be bigger. My next big adding position will be at the circle labelled out on the chart (right at a key support level and ~200 daily).

Aggressive

FOUR

FOUR could easily be in the “neutral” category as well but given they’re a key payments player in less recession proof niches like hospitality and restaurants, I think the turnaround story is arguably slightly higher risk. Add on FISV outlook cut and I think there’s some quite negative sentiment around this sector at the moment.

But there’s a few key reasons why I think FOUR is extremely good value here:

The margin of safety is huge. We’ve seen this in the last few days as well. When other high growth stocks have dropped +4% in single days, FOUR has generally consolidated or held up. At 8x NTM EBITDA for an estimated 43% growth, I think there’s very little margin compression that can happen from here. This one has already been fully compressed.

They’re guiding for a $1B FCF run rate in the next 2 fiscal years. They currently trade at 7.7x FCF but that is vastly undervalued given FCF is growing +25% for the next 2-3 years. I think FOUR can hit a +12x FCF multiple quite conservatively which offers a $12B market cap (2x opportunity).

Finally, I ultimately love company’s where the TAM is almost infinite. There’s no doubt FOUR operate in one of those places and with their M&A expertise I think they have a huge opportunity to continue growing +30% YoY.

SMR

I’ve been talking about SMR almost daily to my paid subs lately. Join us for $16 a month and you’ll get my exact playbook for this company which I ultimately think has a 3-4x potential down the road.

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.