3 Stocks That Will Beat The S&P 500 Over The Next Decade

PLTR NU TMDX

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Here’s 3 companies that I believe will outperform the S&P 500 over the next decade.

Palantir (PLTR)

Disclosure: I do not currently have a position in PLTR which admittedly I need to. I’ve had my eyes on PLTR for a long time but it’s always been my second or third favorite at the time I decided to add to existing stocks or start new positions so the time has never come around. With that being said, if the price is right, PLTR will 100% become a good part of my portfolio. I hope I haven’t missed it.

Introduction

PLTR is one of the most talked about stocks on FinX, yet I’ve not spoke about it too much. Since the other two stocks in this article (NU and TMDX) have been spoke about in this newsletter before, I’ll probably put 50% of the article towards PLTR and then 25% each to the other stocks.

Palantir operates a highly scalable, SaaS business. But what do they do?

The company generates revenue from selling subscriptions that allow access to its software. The software is designed for the intelligence community to assist in counterterrorism investigations globally.

PLTR does this through Gotham which is the software platform that allows users to identify these hidden patterns/inconsistencies within tons of data that is generated every second. This data stems from intelligence sources, reports from informants, and much more.

On top of this core business operation, PLTR has expanded into various other industries to help organizations create solutions to the biggest challenges they face. These issues may come from money laundering, supply chain complexities, and network stability.

Investment Thesis

Huge total addressable market (TAM)

Whether wars happen or not, PLTR has an incredible TAM that is estimated at ~$120 billion across both government and commercial sectors.

This huge government spend all began when PLTR won a lawsuit against the US Army in 2018 which means the federal government had to consider commercially available software options before considering building their own software. Essentially this means that software like Palantir Gotham can be funded through the huge government budgets and PLTR is able to achieve solid margins on these.

For the commercial sector, it was estimated by the International Data Corporation that global spending on these data products has topped $160 billion annually. Therefore, PLTR’s $2.3B revenue in 2023 is less than 2% of the total opportunity. With PLTR’s ability to rapidly expand their platform and introduce new products and use cases, there’s a huge opportunity for them to capture much more than 2% of the opportunity. The commercial segment opportunity is huge, and will remain huge as global spending on AI and data continues to surge each year.

Macro Trends

The big data trend has been present for a while now so this shouldn’t be anything new. The part worth touching on though is that this volume of data is continuing to grow at a pretty exponential rate mainly because data is now coming in many different formats. For example, text, numbers, images, videos etc etc. The difficult part is therefore turning this “messy” data into something that is worthwhile…and that’s exactly what PLTR does so well.

The other macro trend that is worth touching on is geopolitical tensions. It’s not nice mentioning that US China tensions or Ukraine Russia tensions are bullish for PLTR, but these events no doubt may bring into additional governmental demand in the short to mid-term.

Palantir AIP

AIP (Artificial Intelligence Platform) is the biggest expansion opportunity for PLTR and it’s more than likely that all of the company’s customers could be using AIP by default shortly. AIP essentially applies ontology and data integration to enable organizations to create AI solutions, even with messy and unorganized data. It’s a pretty incredible product that will be the front and center of all data-driven decision making across all industries. Just in Q1 ‘24 alone, PLTR added new AIP customers in the bottling industry, the energy industry, and the aerospace industry.

However, the exciting part is that PLTR is making AIP open source, which essentially allows developers to build on it creating a potential limitless adoption. Of course, with mass adoption becomes network effects which leads to even further mass adoption.

Before the networks effects take place though, we can be pretty confident that AIP is an extremely good product as there’s extremely good organic growth even today (up 26%).

Crunching the numbers quickly gives us this:

As seen above the global enterprise software market is expected to grow at 11% CAGR and reach $519b by 2030. If AIP is as revolutionary as I/many believe it is, then there’s no reason with mass adoption that PLTR can’t reach 5%-10% market share by the end of the decade. At 10% market share that’s $50 billion in revenue compared to analyst estimates of $8 billion a year in 2030.

An argument could be made here that I’m being far too optimistic but even at more conservative figures of 4% market share (seems awfully conservative to me with the potential of AIP), then we have $20.7 billion in revenue…vs $8 billion current estimates.

AIP has huge potential.

Q1 Highlights

I’m just going to bullet point some of the key takeaways from Q1 earnings here.

41 net new customers in US commercial and US commercial revenue increased 68% YoY. Commercial TCV (total contract value) grew 187% YoY.

Increased cross selling with a large Fortune 500 industrial company increasing annual revenue run rate by 5x.

$178 million contract from the US Army.

Adjusted gross margin (excluding SBC) was 83% and operating margin was 36% which is 6 consecutive quarters of margin expansion.

$149 million in FCF in Q1 alone which is equal to a 23% FCF margin.

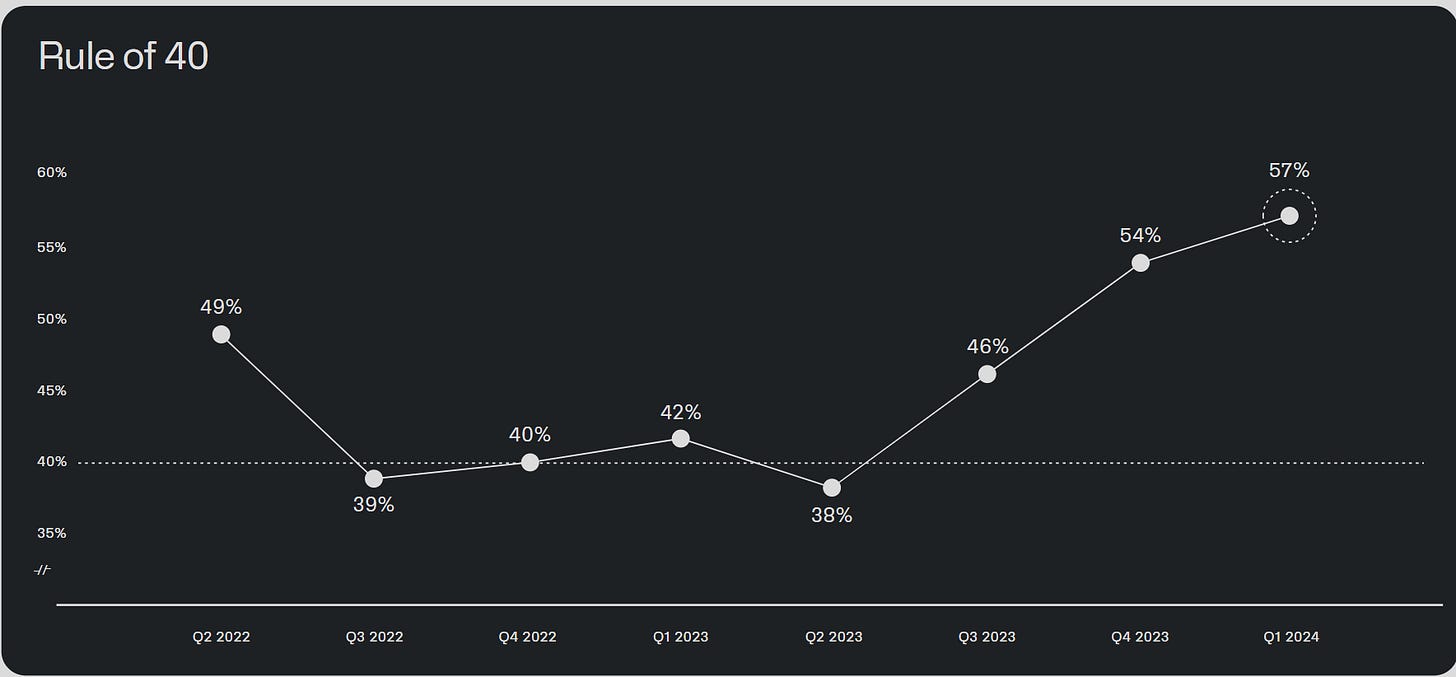

Rule of 40 score of 57.

Conclusion

I’ve got a lot more that I want to say about PLTR but I’ll save that for the upcoming deep dive as lots of details on PLTR isn’t the purpose of this article.

I’ll try get that deep dive out in the next month which will be at least 5,000 words and include my valuation model for PLTR. What I’ll finish with today though on PLTR is that the more I learn about the company, the more I believe this could be one of the best investments of the next decade by quite some margin.

NuBank (NU)

Disclosure: I don’t own NU, but it’s one of the highest stocks on my watchlist.

Introduction

NuBank is the leading digital banking platform in LatAm, which is notoriously a very stagnant banking market. Like other banks, Nubank has 2 main revenue streams:

Fees (Commission income) - Fees the company earns when customers make purchases using a NU debit or credit card.

Interest payments (Interest income) - Interest charged on personal loans, government bonds, credit card balances, and other interest-earning instruments. NU mainly invests its cash into liquid government bonds.

Currently, 81% of revenue comes from interest payments.

Investment Thesis

Macro Trends: One of the biggest bullish catalysts for NU is the digitalization trend in Brazil which should continue to onboard customers onto the NU platform. There’s a projected 88% smartphone adoption in Brazil by 2025. There’s no reason NU can’t onboard a big portion of these customers moving to digital banking. The big step for NU is to ensure that they are able to acquire the higher affluent customers who’s spending will be much more than the average consumer.

Macro Trends: The big opportunity for growth right now is outside of Brazil in areas like Colombia and Mexico which have a solid trend of digitalization and internet penetration as well as younger demographics. Currently, revenue in Mexico and Colombia is minimal compared to Brazil but the underlying demographics are very strong.

TAM: Approximately 700 million people now live in LatAm and most of them do not currently have the banking solution that they need. Around 67% of the United States population own a credit card, whilst in Brazil, Mexico, and Colombia these numbers are 27%, 9.5%, and 14% respectively.

TAM: The positive takeaway from the above point is that almost half of the population in Brazil, Mexico, and Colombia are below the age of 30. The younger population are far more open to opting into the digitalization trend and they’re the core of the country which are driving GDP growth in the LatAm region. LatAm is just like India in that both areas are currently boasting a huge demographic dividend that has historically led to huge boom cycles lasting multiple decades.

Mexico: Growth in Brazil over the last 3 years was incredible, but Mexico is currently reaching notable KPIs at a quicker rate than Brazil did over the last 2-3 years. One of the main reasons for this is the US/Mexico remittance market which is expected to reach $1.3 trillion by 2032. NU recently announced a partnership with Felix Pago to make the transfer of money from the US feasible.

Q1 Highlights

Revenues reached $2.7 billion which is a 64% YoY growth with gross profit reaching $1.7 billion (76% YoY growth).

In Brazil alone, 1.3 million people are becoming NU customers every month with most coming from referrals. This is key because of the lower acquisition costs.

In Mexico, there has been a 106% YoY growth in customer numbers.

Products per customer has grown slightly from 4 to 4.1 meaning NU are now strategically focusing on customer acquisition and customer monetization with their cross-selling strategies.

Conclusion

Similarly to PLTR, this is just a very brief touch on a company that I’ve not spoke about much in my newsletter. NU is on my list of deep dives over the next month. Stay tuned.

TransMedics Group (TMDX)

Introduction

I’ve mentioned TMDX a few times throughout my newsletter so far and I hope many of you managed to invest because the company is up nearly 100% YTD and 417% over the last 3 years.

Has the easy money been made on TMDX? Yes.

Is there a lot more upside for TMDX? Yes, I believe so.

Investment Thesis

Revolutionary product: TMDX is currently expanding their National OCS program, which is the backbone for increasing the adoption of the OCS technology. The OCS product is continuously going through big innovations making the product even more revolutionary. These improvements are being well noted my industry experts too who not only suggest that the OCS technology is more cost effective, but also much better outcomes such as reduced graft dysfunction post OCD heart transplants.

Aviation: TMDX currently have 14 aviation planes operating on a daily basis, with the aim to have 20 by year end. Owning the planes allows TMDX to have full control over the logistics operations and enhance efficiency, rather than relying on private jet brokers.

International expansion: TMDX is looking to expand internationally into Europe and Asia. They’ve previously attempted to operate in Europe but have struggled over the last few years, but they’re now in the process of conducting trials to change their strategy in these different geographies.

Q1 Numbers

Q1 revenue of $96.9 million which is an increase of 133% from Q1 2023 and a 19% increase from Q4 2023.

Revenue guidance is at $400 million for the FY24 which is a 66% growth YoY. I suspect TMDX beat this guidance.

Total operating expenses have grown 54% which is mainly due to a 94% growth in R&D related to investments into further product development. At this stage of the business cycle, this does not worry me at all.

Conclusion

There’s no denying that TMDX is not a cheap stock after it’s 100% increase in the last 6 months, however, when you consider the triple digit growth combined with margin expansion, it’s pretty difficult to argue against the company deserving a premium in the market.

I still do believe TMDX is in the stage where further beats and raises will occur over the next 2 years, and if that’s the case there’s no doubt that this stock has a considerable amount of upside left.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Thank for this, I was trying to learn more about Nubank given our position in MELI.

PLTR used to be a hype, in my opinion. But its technical patterns are becoming solid so there must be potential to make money on the stock.