5 Stocks Passing A Very Strict Screen

NVDA CRWD APP COIN HIMS

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

1. Nvidia (NVDA)

Introduction

I’ve never owned NVDA and it pains me to say that. What I do believe though is that NVDA is not in a bubble like many people believe it is. Those people just see a stock chart that has gone up and up and therefore instantly think “bubble”.

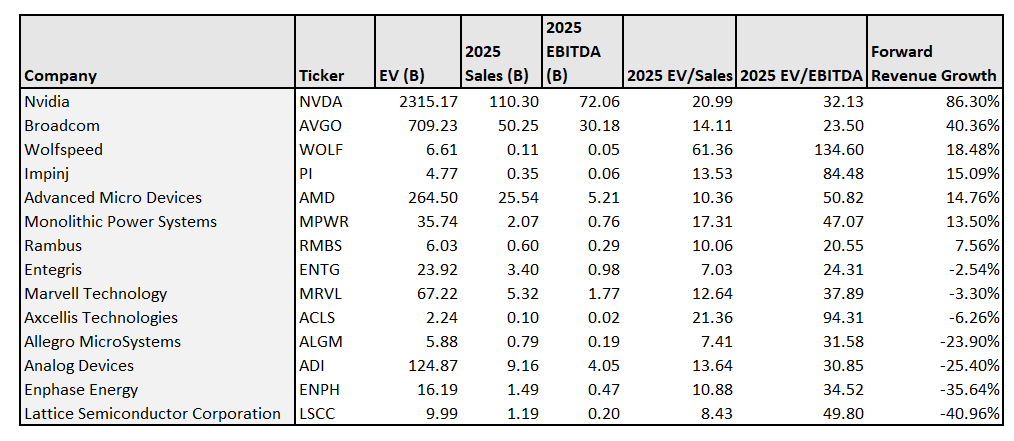

Hopefully this above comp table for semiconductor companies gives you some insight as to how NVDA isn’t overvalued at all. Compare the growth rate of 86% at a 21x 2025 EV/EBITDA to Axcellis Technologies which has -6% growth rate and the same multiple attached.

Investment Thesis

When compared to competitors in the semiconductor industry, NVDA is basically operating in a monopoly. With innovation being absolutely crucial in the industry, NVDA are the only company with the potential to heavily reinvest into R&D. Intel are in a large net debt position and AMD (probably the second best company) has a cash position five times smaller than NVDA.

NVDA’s innovative capabilities are far beyond competitors too. At the recent GTC conference, CEO Jensen Huang presented the new Blackwell chip family which is predicted to perform tasks at 2x the speed of the current chips (which are also incredible). With top products come higher prices and NVDA certainly has the pricing power to win here.

All companies are ramping up their investments into AI with Amazon, Microsoft, Google, X, Tesla, and Meta all investing hundreds of billions into data centers across the world. And Jensen knows this too. Here’s what he said recently:

“The days of millions of GPU data centers are coming. And the reason for that is very simple. Of course, we want to train much larger models. But very importantly, in the future, almost every interaction you have with the Internet or with a computer will likely have a generative AI running in the cloud somewhere…The amount of generation we’re going to do in the future is going to be extraordinary.”

Visual

Valuation

Everyone says NVDA is in a bubble, but it couldn’t be further from the truth. See the table I made above.

NVDA currently has an EV of $2,951.2 billion. 2025 estimates are:

$120 billion revenue

$77 billion EBITDA

$59.3 billion free cash flow

This puts NVDA at:

24.6x 2025 EV/Sales

38.3x 2025 EV/EBITDA

49.7x 2025 EV/FCF

I’m aware these multiples are slightly different to the table above. I made the table about 2 weeks ago and NVDA has since had a (further) big run up so the multiples are now slightly different.

Anyway, the point remains that other semiconductor companies have substantially higher multiples with much less revenue growth. NVDA still is a very good play at today’s prices.

2. CrowdStrike (CRWD)

Introduction

I spoke about CRWD a bit during my recent article about SentinelOne as they are competitors. I’ve never had a position in CRWD as for one reason or another I’ve always been more excited by the potential that S offers. However, there’s no denying that CRWD is the number 1 company in the endpoint security market today. The stock has risen 150% over the last year and has a lot more room to run as it’s just entered the S&P 500.

Investment Thesis

I’m extremely bullish on the cyber industry as a whole. With ever-increasing digitalization, growing geopolitical tensions, and rising complexity of AI cyberattacks, many leading cyber companies are likely in a position to ride the tailwind over the next few years.

Just as I spoke about with SentinelOne, CRWD is also expanding their TAM by entering new markets such as SIEM, Cloud, Data, Automation, & Identity Protection. All these markets have huge growth rates which has lead the company to believe there is an instant $100 billion TAM to be added which will grow to $225 billion by 2028.

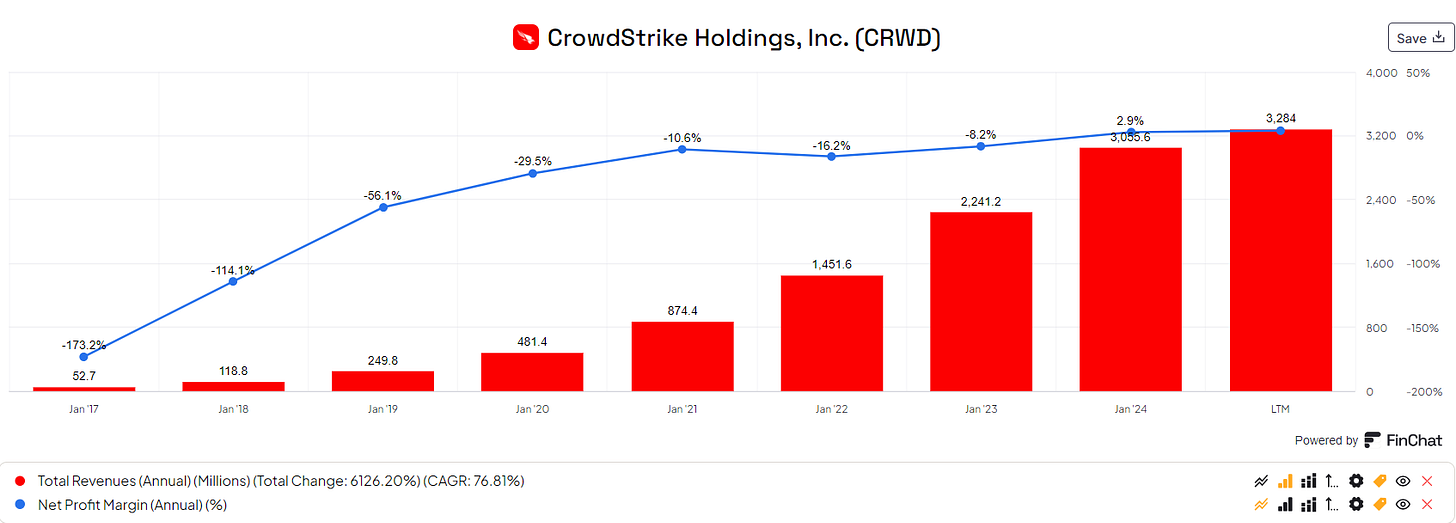

CRWD are still in a huge growth phase with +30% revenue growth whilst also expanding margins (FCF margin at 35% vs 33% 12 months ago). This is a rare pace of revenue growth with margin expansion too.

Visual

Valuation

CRWD currently has an EV of $90.92 billion. 2025 estimates are:

$4 billion revenue

$1.06 billion EBITDA

$1.29 billion free cash flow

This puts CRWD at:

22.7x 2025 EV/Sales

85.8x 2025 EV/EBITDA

70.4x 2025 EV/FCF

This is the only reason I don’t have a position in CRWD just because these multiples seem insane to me. It’s the same story with SHOP which is a quality company but I just can’t fathom the multiples currently.

For this reason, I’m most bullish on SentinelOne (S) which granted currently does not have the quality of CRWD, but it definitely trades at a much fairer multiple.

3. AppLovin (APP)

Introduction

APP is a SaaS company operating in the mobile ad tech industry. The last 18 months or so we’ve seen an incredible recovery in the advertising market with perhaps the most popular recovery story being that of META. On top of this, APP also own a portfolio of mobile apps/games. Both of these are in the midst of a significant change due to AI’s personalization capabilities making APP a nice company to own in an exciting industry.

We’ll delve more into this in the investment thesis below:

Investment Thesis

As the shift from TV to online streaming continues to accelerate, the demand for a more personalized ad space is becoming more important. Simply put, AXON 2.0’s AI capabilities are making ad buying much more effective for the same amount of money meaning better returns on ad spend and therefore more budget space.

With AI capabilities comes more real-time bidding. This is essentially the buying and selling of ad impressions in real-time auctions (occurring very very quickly). This leads to increased bid density and therefore leads to more revenue for APP.

APP are now focused on acquiring customers outside of their core gaming category. They’re focused on e-commerce (app installs up 43% YoY) and fintech (app installs up 42% YoY) and focused on growth outside of the US.

APP has a huge amount of free cash flow for the size of the company. For example, APP and Boston Scientific Group have similar FCF and BSX is 4.5x the size. Further, compare it to Fortinet, a quality company that I own. FTNT is 1.8x the size and again has very similar levels of FCF.

Visual

Valuation

APP currently has an EV of $28.59 billion. 2025 estimates are:

$4.88 billion revenue

$2.264 billion EBITDA

$1.92 billion free cash flow

This puts APP at:

5.85x 2025 EV/Sales

12.6x 2025 EV/EBITDA

14.9x 2025 EV/FCF

With growth rates at 24% and net margin expansion of 51.4% over the last year, these multiples are more than reasonable I’d say.

Compare this to APP’s closest competitor, Unity (U) who has the following multiples:

3.7x EV/Sales

13.9x 2024 EV/EBITDA

19.1x EV/FCF

For a cheaper multiple, you get what I believe to be a far more advanced company in APP. Good valuation.

4. Coinbase (COIN)

Introduction

I’ve not spoken about COIN much at all on X or on here, but COIN was actually one of the first individual stocks I owned. I first bought at around $190 and I also added in late 2023 in the $80s when I was buying Bitcoin too. COIN isn’t a huge position for me, especially compared to the likes of BABA, CELH, PYPL, HIMS, & S, but I do like it in my portfolio as a bit of a crypto play.

Investment Thesis

COIN has a 76% market share in the United States amongst all crypto exchanges. Having this share of the market in the crypto revolution is a pretty huge opportunity. Because I’ve not spoken too much about crypto before, let me just touch on it quickly. I do own Bitcoin and I do own Ethereum and I have done for quite a long time. I don’t spend my time researching crypto assets too much, but I do fully understand the risk to reward potential of owning crypto.

Visual

Valuation

COIN currently has an EV of $57.84 billion. 2025 estimates are:

$5.66 billion revenue

$2.74 billion EBITDA

$0.63 billion free cash flow

This puts COIN at:

10.2x 2025 EV/Sales

21.1x 2025 EV/EBITDA

91.8x 2025 EV/FCF

These are quite clearly not that cheap multiples considering the revenue growth is not stable, and likely won’t be that predictable for a while due to BTC volatility. You could make a very valid argument that COIN at these prices is a bit overvalued.

5. Hims & Hers (HIMS)

Introduction

Healthcare in the US is shocking, unless you’re very wealthy. I’ve never used HIMS myself but I love what the company are trying to achieve:

To enable every household in the US to find personalized medical care that has historically only been available to the wealthiest.

We live in a digital age where consumers are used to downloading apps and scheduling meetings online. HIMS are therefore attempting to fix one of the biggest issues throughout the United States by focusing on this digital world we live in now.

HIMS is an online healthcare platform for diagnosing, and treating a range of conditions. Currently they’re focused on just a few, namely hair loss, mental health, weight loss, and sexual health though they will obviously expand their TAM a lot soon.

Investment Thesis

The future of healthcare is going digital and HIMS is one of the first disruptors of the traditional system. There’s no reason that nearly all health-related questions will not start on a platform like HIMS where a patient can be connected with a qualified physician to give initial and timely advice. Here’s what CEO Andrew Dudum said on this topic:

“80% of the $4 trillion healthcare market will move toward a delivery service that looks like Hims & Hers in the next five to ten years.”

When you think about it, the healthcare industry is one of the few huge industries (estimated at $6.4 trillion by 2027) to not be disrupted by technology. Based on 2024 revenue estimates, HIMS has therefore only captured 0.03% of the market. The opportunity is huge and HIMS is starting to become more widely known by the day.

The TAM for HIMS is estimated to grow by about $500 billion over the next few years as the company start to introduce sleep, fertility, diabetes, and cholesterol treatments. In the long term, HIMS plans to offer everything from medication to cognitive behavior therapy to insomnia treatment to coaching services. The TAM is ginormous and HIMS have a huge first mover advantage.

Visual

Valuation

HIMS currently has an EV of $4,904.4 million. 2025 estimates are:

$1,529.6 million revenue

$187.7 million EBITDA

$141.5 million free cash flow

This puts HIMS at:

3.2x 2025 EV/Sales

26.1x 2025 EV/EBITDA

34.7x 2025 EV/FCF

On an EBITDA and FCF basis, these do look fairly high multiples but HIMS is an early stage company with an enormous TAM. Any fair drops over the course of the next year I’ll be happily adding to my HIMS position. Honestly, right now I’m more concerned about getting money invested into the company rather than trying to wait for a specific price target.

I made this mistake with NVDA where I just waited and waited and waited, and ended up missing life changing money. I don’t want to make a similar mistake for HIMS which I have enormous conviction in.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I don't own any of those stocks but some are interesting. Nice analysis, Oliver.