A Deep Dive Into UBER in 2025

Hi fellow investors 👋

Want to see the previous articles I have wrote?

This deep dive is on UBER. I’ve given the majority of this article to my free subscribers but the valuation section I have made paid. My paid subscription is just $18 a month so I kindly do ask that if you can spare this cost it would help me massively in turning this into a full time profession which:

I work every day to do.

Would allow me to increase the quality and quantity of my work exponentially.

In addition to my newsletter, I’m also very active on X heading towards 40,000 followers hopefully in the next couple of weeks. You can find me on X here.

UBER is a 5.5% position in my portfolio📊

Company: Uber Technologies

Ticker: UBER

Stock Price Today: $67.3

Stock Price High: $86.3

% drawdown from high: 23%

Market Cap: $142.6B

Outline

Introduction

Competitive Advantage

Financials

Opportunities

Risks

Valuation

Conclusion

Introduction

UBER has become the dominant force in all things transportation over the last few years. Their closest competitor is LYFT, but UBER currently complete 12x more trips (including delivery) so there’s quite a limited amount of competition in the industry. I think most people massively underestimate UBER. The company is considered a ridesharing and delivery platform, which is exactly what it is. But it also operates an incredibly successful, and highly complex technology platform.

I first bought UBER back in May 2024 at $66, and recently added a bit more when the stock hit around the same level a few days ago. That’s why I thought this deep dive and update of UBER’s business in 2025 was the perfect time.

UBER has quietly become the best free cash flow growth story in all of tech. They’ve managed to grow FCF from negative $5B in 2019 to $6B in the last 12 months meaning they’ve got a 3Y CAGR of 202% in FCF growth. There’s only 11 other companies in the entire US market (above a $5B market cap) with this growth.

When you take away airlines, healthcare, and oil & gas, there’s only 5 other companies in the market:

Sempra | SRE

Coherent Group | COHR

U-Haul Holding | UHAL

Shift4 Payments | FOUR

The AZEK Company | AZEK

UBER has dropped 23% since the $86 peak in October due mainly due to a retail wide narrative that Tesla’s robotaxi is going to ruin the entire UBER business. There’s multiple reasons as to why I don’t think this will happen which I’ll get into later in this article. The other reason for the drop was a slow down in the gross bookings, another point we will touch on here.

I do think UBER is one of the most undervalued tech companies in the market today, hence why it’s become a significant part of my portfolio. Let’s dive into why👇

Competitive Advantage

UBER’s moat is far wider than most people see so I wanted to explain it here. I’ll bullet point it to make a little more concise:

Wide range of products making customer acquisition costs much cheaper: Everyone thinks of SOFI has the “one-stop shop” for all financial needs. UBER is exactly the same for transportation. UBER have invested massively into their product offering to now include Mobility (could be from UberX to Uber Comfort, or Uber Pool, or Uber Reserve, or Uber Shuttle), Delivery (could be from Uber Eats to Uber Grocery to Pet Supplies Delivery to Uber Direct etc) and much more. The point is that it doesn’t matter what product someone first users with UBER. Once they do, they are on the platform and can see quickly the wide suite of offerings which keeps customers on the platform (increasing LTV) for a much lower acquisition cost. This is also all now tied together by Uber One, UBER’s membership program that offers product discounts across all products.

There’s no competitor on the market with a product range like UBER: UBER’s closest competitor in the US is Lyft who only compete in Mobility and have a smaller offering in that segment. In the UK, there’s Deliveroo which are in the Delivery sector. The only company that I think has the potential to be as wide moated as UBER is Grab, but that will only be in Southeast Asia region. This isn’t suggesting companies like DoorDash, Deliveroo, Lyft, and others won’t invest into a wider ranging product offering. I don’t think it will be very successful today though because UBER made these investments year ago and are now reaping the rewards. Making these investments today will need a huge amount of capital, and be a very high risk approach because there’s already leaders in each segment. Coming in now and completely disrupting this market is no easy task.

Other companies are getting priced out: This is a market where only a few players can win. Consumers don’t and won’t ever download and check 3-4 different mobility apps to save a few dollars here and there. They may have 2 different apps on their phone and compare those and that’s likely only if the first app they check has longer wait times or extortionate prices. That first app is generally UBER so for a competitor to come and disrupt that they would need extremely low prices and very high supply. That’s not going to happen because that isn’t profitable.

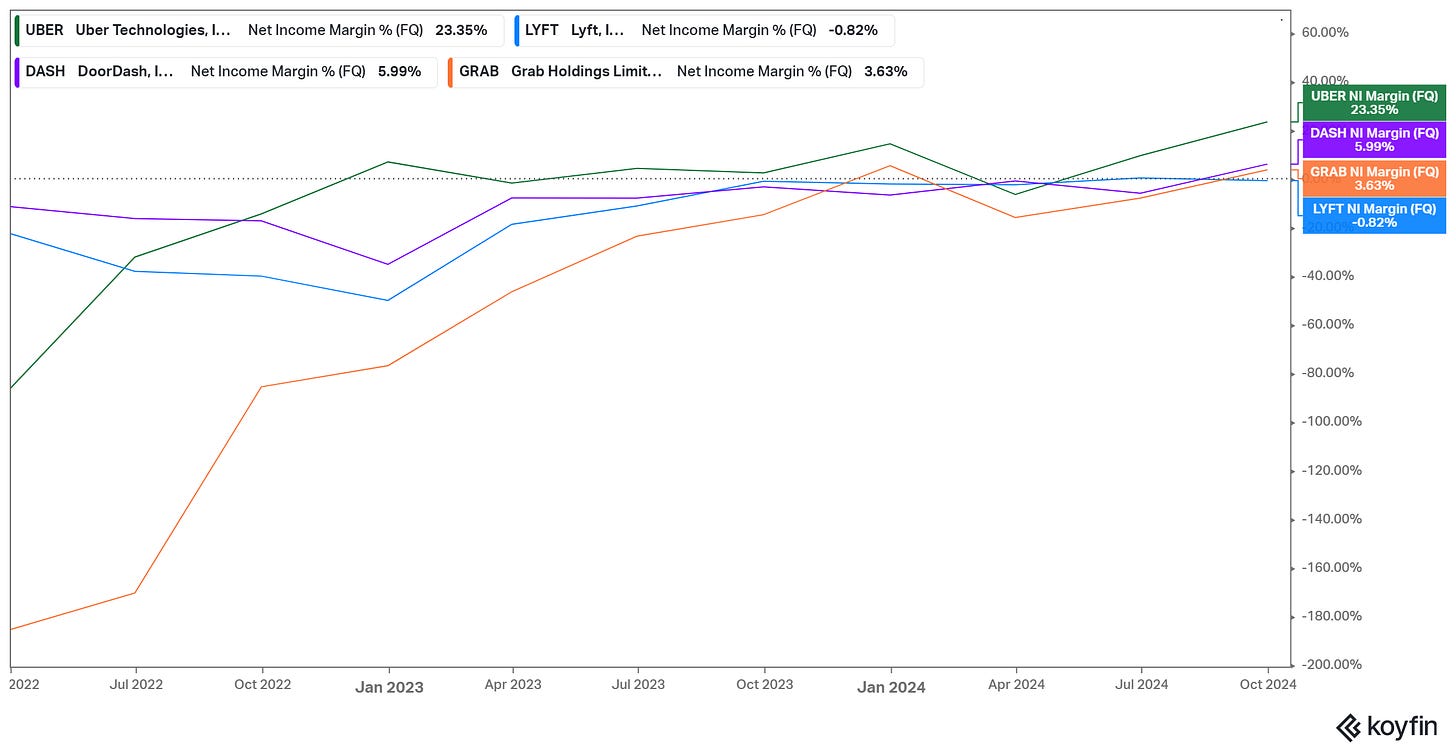

Other competitors aren’t profitable: The path forward for competitors like LYFT, and DASH is far more complex because they aren’t as profitable. They don’t have the luxury of increasing prices because that will further increase UBER’s share in the market. They don’t have the luxury of cutting R&D costs much because they need to innovate to win over UBER. Oppositely, UBER are in a position where they can price competitors out the market if they need to. They’re in a position of control because they are now highly profitable and generating a huge amount of EBITDA and FCF.

UBER has far more data than other competitors: Data is money nowadays, and compared to competitors, UBER has far more data due to their scale and wider product offering. UBER have data on time of travel, distance of travel, main locations of travel, regularity of travel, size of groups people travel in, food preferences, times of meals, days and times people order food in etc etc. This means UBER can fine tune their products much more than competitors, release new products much easier with more data and prior information, and advertise much more successfully.

UBER has the best brand out there: I don’t like to use this one too regularly because it’s quite a cheap one but for UBER I think it’s extremely valid because the name has become a verb. As I mentioned before, the ride-hailing market is more or less a winner takes all market. UBER is no doubt at the forefront of people’s minds and in most instances, people check UBER before checking Lyft. This means winning for UBER is much more in their own control rather than for a company like Lyft who have to reduce prices and reduce wait times just to get a look in vs UBER.

Financials

I’ve based this information on latest earnings from October 31st 2024. Q4 earnings are being released on February 5th 2025.

Recent earnings were ok, but the stock did drop ~9% post earnings due to gross bookings falling short of expectations.

Here’s a summary of the earnings👇

Gross bookings rose 16% YoY (mobility saw 17% YoY growth and delivery saw 16% YoY growth).

Revenue beat expectations and rose 22% YoY. This is very strong since revenue growth is growing quicker than gross bookings.

Adjusted EBITDA came in at $1.7 billion which is up 55% YoY which was 4.1% of gross bookings. For context, UBER had negative EBITDA figures 18 months ago. This shows how well UBER are doing at converting their top line revenue into earnings.

Margins came in at 33% (gross) and 23% (net) which is far higher than any competitors and far higher than Q1 2024 where net income margin was -6%.

One of the main reasons I love UBER is because of the capital light business model which means FCF generation is generally quite substantial. Q3 2024 was no different with $2.1B in FCF in the quarter alone. This is about 2.2x Q3 2023.

The balance sheet showed $9.1 billion in cash & equivalents meaning they can easily continue to buy back shares. Q3 saw $375 million in share buybacks alone. This should mean that the 1% stock dilution we are seeing per annum should slow down, and even completely turn around as management expect 2025 will be a year of share count reduction.

One of the main reasons we saw gross bookings decline was there was a large increase in the commercial insurance costs which UBER had to pass on to customers in big states like California. This dragged down the gross bookings number, which actually looked worse than that they were because last year had such strong growth so the comparison to last year was a tricky one to make.

Opportunities

UBER’s network spans 161 million monthly active users making it one of the largest online platforms in the world. Although they have achieved a lot so far, the total addressable market and avenues for growth ahead are substantial when you have this many people using your platform on a regular basis.

Although UBER is a $141B company, they only account for ~0.7% of total miles driven globally. Each basis point increase in this figure is worth millions and millions of dollars and I have no doubt that UBER will become an even more dominant company in the tech world over the coming years with these opportunities 👇

AV Market

This is one of the most commonly discussed bear arguments for UBER at the moment. Too many people are fixated on the TSLA vision, rather than UBER’s incredible technology, AV partnerships, and huge demand aggregation potential.

Before we discuss the arguments for and against UBER’s position in the AV market, let’s look at the current partnerships they have:

Waymo (Alphabet)

Aurora

Volvo

Toyota

Daimler

Nuro

Baidu

Ford

Aptiv

Zoox

My take on the AV market

The bear argument for UBER is that they aren’t well positioned to stay competitive when the AV market reaches the forecasted size. Before I say anything else, let’s just be clear that this is all opinion based on a market that doesn’t really exist yet so I’d be very interested to hear your opinions too👇

Bears think companies like Waymo and TSLA will dominate the entire market and UBER will be left behind. There’s a few reasons why I think this won’t happen:

People massively underestimate the UBER technology: UBER was founded in 2008 meaning it took ~15 years and multiple billions of dollars for the platform to become profitable and optimized. UBER have generated a huge amount of data which allows them to precisely connect consumer to driver within seconds for exactly the right price. That’s no easy feat and a company like Waymo or Tesla couldn’t just churn out a platform like UBER within a couple of years.

People massively underestimate the UBER daily operations: UBER’s daily operations include payment processing, refunds, lost items, regulations, fraud, health and safety etc etc. Though fairly easy, this is not cheap to operate. UBER have done an extremely good job at streamlining these operations. This will obviously bring down costs quite significantly due to competition for demand on the app, but it will also mean AV companies will have significantly higher utilization rates (and profitability due to the efficiency of UBER platform) compared to if they go solo.

People massively underestimate UBER’s demand: UBER creates demand. AV players fighting alone for market share will likely lose if there are other AV’s on the UBER app already which will be extremely easy for consumers to order since they’re so used to the UBER app. I see UBER being a demand aggregator just like Expedia (Dara’s last company).

People massively underestimate the size of the AV market compared to current supply: I see the AV market being highly fragmented, just like the auto market today. Here’s some rough calculations for you: McKinsey estimate the AV market will be worth ~$400 billion by 2030. At an average of $16 per ride (current UBER average is $20 but AV’s will be significantly cheaper so let’s assume $16). This would mean they’ll be ~68 million AV rides per day which would mean we’d need about 3.4 million robotaxis on the road per day assuming 1 car does 20 trips per day. Morgan Stanley currently estimates that TSLA will have ~100k AV vehicles in their fleet by 2030, and 3.2 million by 2038. This will mean UBER’s partners listed above will likely win a significant portion of the market, and therefore so will UBER.

If it does happen, UBER are already partnered with Waymo: We don’t know internal discussions between the companies but UBER is likely to benefit from Waymo’s AV technology for the next few years at least. Whether Waymo go solo in the future is unknown but I’d assume if UBER take rate is fairly low, it makes complete sense to use UBER.

So my take here is that I don’t fully see the bear AV case for UBER. Of course they aren’t manufacturing any AV cars because that’s not the business they do, but that does not mean by any way that they will lose out in the AV race. They’ll just compete differently. I also don’t think it’s impossible that TSLA’s won’t be on the UBER platform.

The economics of AV partnerships are the most interesting part of this entire debate in my opinion and to be honest I have no idea what they look like. Here’s an estimate though (that I’ll include in my investment model below).

Let’s say I book a Waymo AV for $40 via the UBER app. There’s many things to consider first:

Are UBER buying the fleet?

Are UBER serving the fleet?

Are UBER purely there for demand?

I think number 3 is most likely. Considering that today UBER’s take rate is only 18-25% ish as most of the revenue goes to the drivers, I would assume that UBER would be able to generate a take rate upwards of 35-45% since now there is no driver. I personally struggle to see the majority of the revenue getting to UBER but a 40% ish take rate could be highly highly profitable here if you consider the market forecasts and rides per annum.

Delivery

One area where I foresee huge growth for UBER is in Delivery which currently makes up ~31% of revenue compared to Mobility which makes up 57%. On a revenue growth basis, Delivery is the only segment within UBER where the growth rate is actually increasing. Revenue growth for Delivery in Q3 2023 was 6% but today this is 18.2%. When you compare this to Mobility which is still growing at 26% today, but the growth rate last year was 33%.

The original idea for UBER was food delivery, but that has quickly expanded into grocery and all other kinds of retail where the opportunity is quite frankly enormous.

Here’s where the UBER Delivery growth is coming from:

Increasing appeal of the marketplace by using more photos, better UX, and video promotions.

Increasing appeal of marketplace by bringing more merchants on to the platform which is easily done because of the previous point.

Increasing the amount of categories. Originally just food, but now grocery and retail.

In the e-commerce economy, UBER Delivery will absolutely thrive.

Uber Direct

Combining this growth with UBER Direct which is Uber’s delivery platform for businesses shows that UBER have this segment that is becoming a huge global logistics company which could generate billions of dollars in value alone. UBER Direct is the “big bet” that I like most out of the other big bets like UBER Health.

Here’s a little investment thesis into UBER Direct alone:

UBER Direct will likely compete against big logistics companies (FedEx, UPS, DHL), last-mile delivery companies (DoorDash Drive, InstaCart), and logistics services (Amazon, Postmates etc).

The TAM is pretty large but clearly there’s a lot of competition already here for a new company to come in and disrupt them. The TAM for last-mile delivery is expected to be ~$200 billion by 2030, so even a 3% market share here could be worth $6B in revenue which would equate to 14% of UBER’s total revenue today.

There’s a few advantages that UBER will have over other traditional logistics services. Firstly, I see UBER really pushing their partnerships with grocery and retail stores to include UBER Direct as part of their deal.

Secondly, there’s no company on the planet with as advanced routing optimization and pricing expertise as UBER. Leveraging the current technology here gives UBER a huge head start already over any other company.

Thirdly, as the e-commerce boom continues over the next decade, customer expectations will increase rapidly from 2-3 standard delivery to same-day (or even shorter) delivery. Those companies with the most advanced technology, and routing optimization will be the only companies that can survive. I have no doubt that UBER will be one of those companies that has the ability to offer same day delivery by leveraging their tech, driver supply, and potential AV partnerships in the future.

This segment will be another area where we will likely see increased AV demand so those companies who put their AV’s on the UBER app directly will be those with the highest utilization rates by quite some distances.

Advertising

I’ll include a brief bit about advertising straight after Delivery because delivery is one of the key reasons why the Advertising platform (growing at 80% YoY) is so successful. I see the growth in the Delivery business becoming quite correlated to the Advertising business over time. Of course, Mobility has some strong advertising avenues for growth too, but the Delivery segment will make advertising there a lot easier.

Uber One

Uber One is UBER’s membership program which is also a huge competitive advantage as it is the main reason why we are seeing an increased spend per user. The value for the consumer is very good, hence why we are now seeing 25 million members on the platform which is a 75% YoY growth.

From increased customer loyalty, to higher LTV, to more cross-selling, to increased demand forecasting, to merchant retention, to margin expansion, UBER One is a huge deal for the company. At 75% YoY, there’s not many companies out there with subscription based growth rates like this. For example, one of the more successful subscription platforms out there is Robinhood Gold which is now at ~2 million subscribers and 61% YoY growth. UBER One completely blows this out of the water.

Longer Rides

UBER are currently introducing new products to their Mobility sector like Uber for Teens, Uber for Business etc. These will all increase the TAM a small amount of course, particularly Uber for Teens because if you can get the younger generation to become loyal members of UBER from an early age, you have a strong business for the next decade or so.

However, the area where I see the most room for growth is by increasing the ride length. Currently the average ride is between $20-30 which is fairly small and likely always quick rides into and out of city centers. The positive of this is that there’s a huge number of these people so the demand is always high, but the negative is that most of these rides are quick and for much less fees.

There are positives of both, but here’s some positives of longer rides for UBER:

Less “dead time” between drop off and pick ups decreasing the amount of time the car isn’t earning.

Less likely to be traffic in city centers where the business model for UBER does not cater for time in car, but for a set price prior to travel.

Less operational and logistical strain of payment processing, lost items, customer support etc.

UBER have crushed it in highly dense urban areas where short Uber rides are the norm. They’ve yet to crush it in the more rural areas where longer rides are the norm because of two main reasons:

Driver supply is much less meaning more wait time and less likelihood of using UBER.

More people have vehicles in rural areas, hence reducing the need for UBER.

If UBER can carve out some more customers in rural areas, then there’s a significant opportunity to increase gross bookings, revenue, and margins.

“In the US, especially if you look at noncore cities, it’s 60%-70% of the market, so the majority of the market is there. Generally, it’s growing faster than city centers as well.” - Dara Khosrowshahi

International

UBER are currently growing faster internationally than they are domestically in the US so there’s obviously further growth potential particularly in European cities where UBER has struggled due to regulations.

I do see more potential in rural US though over the next 3-5 years.

Margin Expansion / Technology

UBER has tons of data which has gone towards an extremely successful ads platform, but also into training thousands of LLMs per month to allow the platform to make millions of predictions constantly to enhance routing, pricing, incentives, verification, matching etc.

UBER use open source models like Meta Llama 2 and closed source models like OpenAi, Google, and others. These models for Uber Eats for example are currently finetuned enough to reproduce similar performance to GPT-4 but just on a huge UBER like scale meaning item tagging, restaurants, food items, search queries, and user preference is all handled here. These models are only going to improve over time.

Over the next decade, I suspect these LLMs should continue to drive margin expansion even further to the point where customer support is almost non-existent.

More margin expansion will come from:

Higher spend per user

Less promotions and less CAC

Less operational work as AI integration takes over

Smaller workforce

Risks

UBER has some pretty significant risks that we need to consider namely regulatory, and environmentally.

Driver Supply

UBER’s main issue in rural USA is driver supply. Though I personally don’t see this happening, there’s of course a risk that UBER drivers stop driving for UBER either migrating to LYFT (where earnings could be higher), or starting a whole new gig entirely.

UBER demand is very closely correlated to UBER supply so management have to be careful that their take rate is moderate enough to ensure revenue growth, but low enough to ensure driver supply is high.

Gig Economy Laws

UBER would be materially affected if gig economy laws forced UBER to classify drivers as employees. In the US, the position varies state by state with the most high profile ballot being Proposition 22 which was passed in California in November 2020. Proposition 22 currently allows gig companies to classify workers as independent contractors which is obviously beneficial for UBER who spent multiple millions of dollars campaigning for Proposition 22.

However, as of August 2021, the California Superior Court ruled Prop 22 unconstitutional meaning the case is again under appeal. UBER has already paid ~$400 million for individual settlements, and this could just be the beginning. If the company must reclassify drivers as employees of the company, there will likely be huge alterations to the financial statements.

Data Privacy

As data continues to become more and more prevalent, so will rules and regulations surrounding data. UBER has one of the best data sets in their niche, but with stricter rules around data usage, there could be limitations on how much UBER can actually leverage AI and personalization.

ESG Challenges / AV Acceleration

I’m not exactly sure what will happen under Trump’s presidency, but will Elon in Trump’s corner I do sense there will be further pushes towards electrification and autonomy. There’s potential that this pressure may come earlier than UBER management expect in which case we may see some difficulties.

Debt

As of Q3, UBER has $11 billion worth of long term debt on the balance sheet which is more than the cash & cash equivalents figure. Moving forward, UBER needs to continue to invest into R&D, partnerships, and the AV revolution but this level of debt has to be a bit of a concern.

I feel it’s ok since UBER are generating huge ($6B) amounts of FCF annually, but of course a good portion of this cash flow will have to be paid towards interest and principal on the debt amounts.

Valuation

The fun part 👇