An Update On My 3 Highest Conviction Plays + A New Buy

SOFI PYPL CELH UBER

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

I thought I’d do a slightly different article today and focus more on the recent news and events around some of my highest conviction stocks…SOFI, PYPL and CELH, all of which have been fairly volatile of late. I also have finally added my first position into UBER…a stock that has been on my radar for nearly 2 years. I’ve got a bit of an updated thesis/opinion on that one too.

Let’s start with SOFI…

▶SOFI

SOFI is an interesting one because currently the fundamentals aren’t aligning with the stock price at all and I’m not completely sure why. For example, comparing SOFI to a stock like HOOD (fairly similar revenue and fairly similar earnings). SOFI is much less cyclical, diversified, and resilient, yet has a market cap only about 30% of HOOD. The fundamentals are there for SOFI to be a $20+ stock, yet the sentiment and narrative around the stock isn’t there yet.

Whether this excites you or annoys you is completely how you perceive it but I’m confident that over time SOFI will be a great company to own and I’m in it for the long run unless any noticeable fundamental shifts start to occur.

Latest Earnings

BEAT revenue estimates by 3.8%

BEAT revenue guide by 4.6%

BEAT EBITDA estimate by 23.2%

BEAT EBITDA guide by 25.5%

RAISED annual EBITDA guide by 1.7%

The best part of the earnings for me personally was the rate of growth and rate of margin expansion of the financial services division. Over the last 12 months we’ve seen financial services revenue increase by ~$69m with contribution profit increasing $61m meaning costs have only increased ~$8m. This means that the financial services segment is a relatively fixed cost business meaning profits will begin to absolutely soar as revenue increases.

Considering guidance is telling us revenue growth is likely in the 50% CAGR range, I’m pretty excited about this segment.

Stock-Based Compensation

For as long as I’ve known about SoFi the bear case that kept coming up was stock-based compensation and share dilution. This bear case is becoming weaker and weaker by the quarter now as SBC is currently at it’s lowest in absolute terms ($55 million in Q1) and relative terms (now below 10% of revenue).

I do see this trend downwards continue as management have continued to state there is an active move in the stock plan towards performance stock units and not restricted stock units. Performance stock units are only awarded if certain performance targets are met meaning the plan is fully contingent on growth at SOFI. This will no doubt lead to further alignment between management as shareholders as well as less dilution. All very positive.

CEO & Institutional Buying

As the old saying goes, “insiders sell for many reasons, but only buy for one”. Anthony Noto, CEO, has bought over $1m worth of shares over the past year, with $600,000 over those being in the past month. Despite the weakness in the stock price, it’s clear management has incredible amounts of faith in the company and Noto is putting money where his mouth is.

Not only this, we’re also starting to see institutional buying increase over the last couple months. I don’t look too much into this normally as I’m more focused on fundamentals and valuations, but it’s an added confluence to show the big players are starting to see the value SOFI has to offer.

▶PayPal

I saw this horrible chart on X the other day showing how EBAY, a forgotten online retail brand near 10 year lows, has outperformed PYPL. That’s pretty brutal.

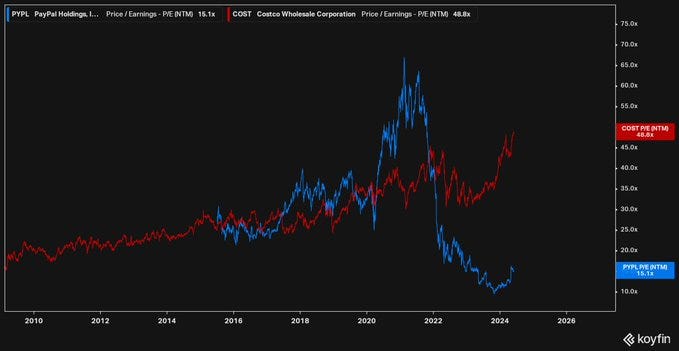

I also saw this insane chart on X (posted by Natan) showing the forward PE of Costco (49) vs the forward PE of PayPal (15):

I don’t know how to explain this gap…especially when PYPL is growing revenues at faster rates than COST. Market sentiment and Mr. Market are crazy forces sometimes that lead to crazy opportunities.

Latest Earnings

“What we said at the start of the year still holds: this is a transition year where we are focused on execution and making critical choices that will set the business up for long term success.” - Alex Chriss (CEO)

Beat revenue estimates and beat revenue guidance.

Net revenues increased 9% to $7.7 billion beating estimates by $180 million.

Total payment volume increased 14% to $403.9 billion. This beat estimates by 2.8%.

International total payment volume increased 17% on a currency-neutral basis.

Payment transactions increased 11% to $6.5 billion.

Met active account estimates, though this was a decrease of 1% to 427 million.

Transactions per active account (a trailing 12-month number) was 60 in Q1. This is up 13%.

Advertising Business

PYPL recently announced the hiring of Mark Grether, who formerly led UBER’s advertising business which reached a $900 million run rate in Q4 2023. Grether was hired to lead PYPL’s newly formed Ads division.

PYPL processed 6.5 million transactions (or about “a quarter of the worlds $6 trillion in digital commerce”) from 427 million consumers in Q1 2024 alone and therefore generates a humongous amount of data on their consumers from recent purchase trends to overall spending behaviors. The ad sales will therefore help merchants sell more products effectively, thus increasing transaction revenue for PYPL as a payment processor. On top of this, ad sales are one of the most high margin sectors to be involved in and with the data that PYPL boasts, I’m sure their prices will reflect a high value. We don’t know much else on the specifics of the PYPL ad business yet, but it seems from the outskirts a pretty straightforward play that would more or less mimic the UBER approach

I’m not surprised by this move and neither should you be. Many other firms have forayed into this business such as Chase, Visa, and Mastercard.

This is yet another innovation that we are seeing at PYPL. As with other new products and changes, I don’t think we will see too many material differences in the numbers over the next 2-3 quarters but I think we’ll start to see signs approaching that these innovations are impactful. Of course we can’t expect every innovation to be a raging success, but even if a few of them are positive, then PYPL will begin to materialize into the recovery story I, and many, believe it deserves.

Analyst Upgrades

Earlier this week we had one of the first notable analyst profit target increases in a while from Dan Dolev at Mizuho. He raised the profit target to $90 which is a 45% increase from today’s prices.

His why is perhaps the most interesting point here.

At the innovation day back in January when Alex Chriss famously said PYPL were going to “shock the world”, Dolev, along with many others, was pretty unimpressed with the innovations Chriss presented.

However, a lot more data has come out since this first presentation with beta testing showing an 80% conversion rate (for Fastlane) compared to average guest checkout conversion rates in the 40% range.

Dolev had this to say:

“Our proprietary analysis of PYPL’s newly-introduced Fastlane product shows potential for $1.0-$1.5 billion in transaction margin dollar lift (5-10% upside) over the medium term, given the $1.43 trillion of annual e-commerce spend that we believe is addressable by Fastlane.”

We have to give credit to Dan Dolev here who, like many of us, realized he underestimated the sheer potential of PYPL’s product innovations.

This profit target was purely focused on Fastlane too. Other considerations such as the advertising business, cost cutting efficiencies, Venmo, Xoom, and Braintree have yet to really be discussed as much as Fastlane but I’m sure some of these will slowly start to stir up a sentiment shift that PYPL deserves.

Senior Unconverted Loan Note

PYPL announced a few days ago an offering of senior unconverted notes of $1.25 billion which is debt that Fitch assigned an A- grade on. Similar to the advertising business, the details on this are fairly sparse so we can only speculate.

What I will say is that it’s most definitely not because PYPL are running out of money. They’re generating at least $5 billion in free cash flow this year, most likely a lot more. My estimates are in the mid-to-low $6 billion range. It’s also likely not for any form of an acquisition as Chriss has openly said they are fully focused on driving efficiencies currently and will likely not add much complexity (aside from the advertising business) that comes with an acquisition.

My guess is that the loan will be used to refinance some maturing debt (2.40% 2024 maturities) so that they can use FCF and existing cash to fuel buybacks. This is the only thing that makes sense to me currently. Again I’m speculating, but the bullish take on this for me is perhaps that they have more than enough cash to cover the 2024 loan maturity and do $5 billion in buybacks. Therefore, this suggests potential for far great than $5 billion in buybacks.

▶Celsius

Earnings

CELH reported $355.7 million for Q1 revenue, missing estimates by $34 million.

Revenue adversely affected due to inventory de-stocking by Pepsi which is beyond CELH control. More on this below.

CELH was responsible for 47% of the entire energy drink sector growth in Q1, now holding a 11.5% market share in the industry.

Just hit a 98.4% ACV.

International sales increased 42% QoQ to $16.2 million with Canada now achieving a 5.5% market share in just 2 quarters.

Gross margin expansion to 51.2%, beating estimates at 47.0%.

Net income increased 106% to $65 million.

Adjusted EPS of $0.27, beating estimates by $0.07.

Nielsen Data

Every CELH bear has been bragging from the rooftops this week after CELH finished the week down 16% (still up 9% on the month) mainly because the most up to date Nielsen data on the beverage market came out which definitely wasn’t deserving of a 16% drop drop.

The data showed a slight decrease in the sizzling rate of growth that we have gotten used to with CELH, though this isn’t something to be surprised about. In my last CELH article I spoke about how CELH is now a $20 billion company with moderate growth rates (still far higher than Red Bull and Monster) and rapidly expanding margins. We shouldn’t be surprised to see 48% YoY growth rates now compared to triple digits last year. Let’s still remember that Red Bull only had 3.1% growth and Monster actually declined 0.2%.

The data also showed a very slight reduction in market share down to about 10.5% for CELH compared to prior month figures at around 10.8%. Firstly, we have to take this numbers with a pinch of salt as it’s pretty impossible to quantify all sales exactly. Secondly, if you think a market share drop of this amount over a 4 week period is a reason to be worried then you shouldn’t be invested in the company long term.

Analysts

One of the more high profile analysts on CELH, Dara Mohsenian of Morgan Stanley reduced his profit target on CELH on the market share data and also on the latest CELH pricing which is down 7.2% YoY. The pricing was the only part of the Nielsen data I really care about as that’s fully in management’s control, but then again 7.2% over a 4 week period is nothing concerning.

What would be concerning is if we continued to see these trends over the next year or so. Of course then I’d have to re-evaluate my conviction around CELH but for now the reality and longer-term trend remains as follows:

CELH accounted for 50% of all energy drink market growth over the last 12 months.

CELH has further channels to market with PEP partnership such as more sporting venues, universities, hospitality etc

CELH is now just beginning it’s international expansion. With international markets over 40% of MNST revenue and less than 4% of CELH revenue, there’s a huge opportunity here.

More than 80% of convenience store owners noted CELH will benefit from a shelf reset.

Gross margins expanded from 40% in 2020 to 51% in 2024. MNST managed to average 56% gross margins so there is still room to grow but I don’t think we will see this for a number of years still. International expansion is an expensive venture and raw material (aluminum mainly) are on the slight rise again.

CELH has been a great stock for me so far and I’m confident it will continue to do so. The fact that 1 week of research showing an immaterial decrease in market share that led to a 16% drop in the stock price just shows the state of the market.

I added to my position this week. The more CELH I can scoop up in the $70s the better.

▶Uber

I recently did a deep-ish dive on UBER about 2 weeks ago where I expressed my bullishness and why I wanted to start a position in the company. Well, this week I finally started my first position after the company was on my watchlist for the past 14 months or so. My purchase cost was ~$64 which I’m fine with. Obviously I would have liked to get in at the ~$40s where I was watching it closely but the time never came.

I’m glad I waited until my conviction was as strong as it is now.

I’m not going to add much to this UBER discussion, however, I am going to add to my opinion on the robotaxi/automotive vehicle conversation that I briefly touched on in my deep dive before.

Autonomous Vehicle / Robotaxi - A Killer Of Uber Or Another Catalyst?

Last time I spoke about how UBER and TSLA may partner up.

Here’s some more information on this topic and looking at it from a slightly different angle:

UBER has a 10-year partnership with Aptiv (APTV) and Hyundai (Motional) to deploy robotaxis across North America. They plan to introduce the electric Hyundai Ioniq-5 based autonomous vehicle into the Uber app which positions the company very nicely if this strategy is executed well. On top of this partnership, UBER also has ties with Nuro (for self-delivery / UBER eats) and ties with Waymo to integrate the autonomous technology into the UBER platform. Add on partnerships with NVDA and Toyota into this portfolio and you’ve got a company that is positioned well to execute a solid plan and compete with TSLA if no partnership is reached.

However, this isn’t the main reason to be as confident as I am on the robotaxi topic.

Aurora

A years years ago UBER had an autonomous vehicle unit called Advanced Technologies Group which it sold to Aurora in 2020. UBER maintained a significant stake in the company and now has a very close partnership with Aurora. For me, this is UBER’s hidden weapon that not many people are talking about since UBER can benefit from the advancements Aurora make without necessarily bearing the full risk of all the operational costs that come with this industry.

Once the Aurora technology is ready, UBER will deploy the technology onto the UBER platform, just like it’s doing with the likes of Hyundai, Motional, Waymo, and Toyota. However, they’ll benefit much more from this success as they have a large stake in the company. We can speculate as much as we like on what will happen over the next decade but I think these are three important facts:

TSLA would benefit massively from the UBER platform.

UBER has formed many strategic partnerships with top brands already which will allow them to compete alongside (or against) TSLA if no partnerships are made.

Aurora is UBER’s low risk (not bearing many operational costs), high reward play.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Great thoughts here, Oliver. Two comments:

1). That SoFi CEO loaded up on his company's stock is a good sign, indeed. Dara Khosrowshahi also bought 200k shares of Uber about a year ago, look how it's done since then.

2). Speaking of Uber, I'm pleased you mentioned Aurora. Autonomous driving should be Uber's greatest strength.