Celsius (CELH) Quarterly Earnings Review + Deep Dive

A slight change in the story, but I still love it.

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Celsius Holdings - CELH

In this post we’re going to discuss the CELH earnings report from yesterday morning (07/05).

Company: Celsius

Ticker: CELH

Website: https://www.celsiusholdingsinc.com/

Current Stock Price: $76.76

52-Week High: $96.11

52- Week Low: $35.63

Market Cap: $18.26B

Headquarters: Boca Raton, Florida

Number of Employees: 765

I’ve been a CELH buyer since late last year and so far it’s done pretty well, though it’s been a volatile ride. I’ve been pretty lucky/smart in trimming and adding to my position at good times. I though the stock was overvalued when it was trading in the mid to high $90s back in mid March and I ended up taking a bit off in the low $90s.

I added back some more about 2 weeks ago when I saw the stock drop into the $60s. These were only fairly small changes to the holding as the majority of my investment is simply just buying and holding until I see fundamentals changing, but I like to trim and add when I think necessary too.

Here’s the current stock chart:

I still believe CELH could be a larger company than Monster (MNST) so unless anything drastically fundamental changes to the company, this is a stock I’m excited to own for the next decade.

Here’s my rundown of the quarter:

Celsius Q1’24 Earnings Review:

1. Demand

CELH reported $355.7 million for Q1 revenue, missing estimates by $34 million.

Revenue adversely affected due to inventory de-stocking by Pepsi which is beyond CELH control. More on this below.

CELH was responsible for 47% of the entire energy drink sector growth in Q1, now holding a 11.5% market share in the industry.

Just hit a 98.4% ACV.

International sales increased 42% QoQ to $16.2 million with Canada now achieving a 5.5% market share in just 2 quarters.

Discussion

The stock price dropped pre-market ~16% when CELH reported missed revenues and slowed growth as investors panicked that the high growth days of CELH were all over. As I write this, CELH is now only down 2% on the day as investors then realized the earnings report was actually very solid.

Let’s touch on the elephant in the room though in the missed revenue. Firstly, yes I was quite surprised to see this but it’s not all bad. The miss was down to Pepsi inventory de-stocking of ~$20 million. Management commentary on this was pretty light. They said “ongoing inventory fluctuations may be expected in subsequent quarters” but also said inventory was “stable” for now. At the end of the day, PEP has CELH best interests in heart and CELH has PEP’s best interests at heart. Inventory optimization is an ongoing challenge, especially with growth rates as high as they have been. I suspect this won’t be the last time we hear about this inventory de-stocking issue, but I’m predicting the effects won’t be as material as they were in this quarter moving forward.

For context, when Monster reached the $1.3 billion revenue range, they managed to grow revenue at 30% in the next year. CELH managed 37% even with a $20 million inventory de-stocking.

There’s some other quick notes I want to touch on regarding the CELH demand. We still don’t have a lot of data on the international growth numbers but management have said that data so far is a lot better than expected, especially in Canada where they’ve managed to gain 5.5% market share in just 6 months. Europe we have yet to get much commentary on but CELH is now getting more and more widely available in the UK where I’m currently based.

But just to give you a sense of the total addressable international market for the functional beverage industry (I like to look more towards the functional beverage market than the energy drink market as CELH is really disrupting both and Fieldly has openly said they’re going after the functional beverage market rather than the energy drink market), I ran some quick numbers.

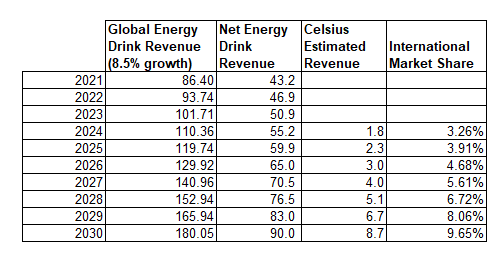

The international functional beverage market is currently valued at ~$214 billion and estimated to grow at 8-9% annually. If we take 50% of this revenue (around what actually goes to the brands) and compare this to the CELH revenue estimates, we’ll see the international market share figures:

Now a 2.56% international functional beverage market share seems more than attainable to me. The TAM is huge and CELH are out to get it.

P.s. I ran these numbers with slightly depressed CELH revenue estimates. I was originally estimating ~$2 billion in revenue for FY24 with 33% CAGR through to 2030…but after $356m quarter in Q1, ~$2 billion is looking quite unrealistic. I changed the assumptions to $1.8 billion in FY24 with 30% CAGR through to 2030.

I ran some further numbers looking specifically at the energy drink market rather than the functional beverage market. Estimates showed a $86.4 billion market in 2021 growing at 8.5% annually through to 2030. Running these same kind of numbers, we get this:

Looking at this chart above, if the energy drink market continues to grow at 8.5% (which I deem conservative with the new health trend and sugar free alternatives), CELH should manage just below a 10% global market share by 2030 vs ~3% today. Completely doable and fairly conservative assumptions made.

In terms of further demand, CELH have made some incredible partnerships in early 2024. The most notable are with the MLS and Inter Miami (home of Lionel Messi) and Ferrari F1 team. The Ferrari partnership has been the most exciting to me as it’s the first global partnership. They’re really setting the scene for the expansion outside of the US.

2. Margins/Profitability

This was the highlight of the CELH quarter for me.

Gross margin expansion to 51.2%, beating estimates at 47.0%.

Net income increased 106% to $65 million.

Adjusted EPS of $0.27, beating estimates by $0.07.

Discussion

For the past 4 years or so, CELH has been a pretty incredible revenue growth story. Although I stand by the fact that revenue growth still is huge, especially internationally, it’s never going to be a triple digit or high double digit rate again.

Now, management are slowly focusing on becoming an incredible earnings growth story…and well stock prices tend to follow earnings long term.

The 51.2% gross margin was huge (740 bps increase compared to Q1’23), leading to a 60% increase in gross profit which was $68,400,000 more than prior year. This has been driven due to controllable improvements such as increased efficiency, lower general and admin expenses compared to revenue (7% vs 8% last year), and natural economies of scale. But it’s also benefited from positively fluctuating freight and raw material cost savings which are generally less controllable aside from being diligent with forward contracts which CELH do with aluminum generally in Q4 of each year.

Nevertheless, management seemed stern on the fact that gross margins above 50% are likely not the new normal. With freight costs on the rise, a 3x increase in sales and marketing team, and the summer promotional cost increase, guidance remains in the high 40s for the next couple of quarters.

Although this 51.2% gross margin was incredible, I do agree that it seems a bit unattainable at the moment especially with summer coming up and the added costs so I’m going to keep a high 40% margin in my models for the time being. We need to also consider the expenses of international expansion which isn’t cheap at the beginning.

Added costs such as regulatory experts to take care of labelling, ingredients, fees, & taxes all mount up and pressure margins in the initial growth stages so I wouldn’t get used to a +50% GPM just yet.

3. Balance Sheet

CELH ended the quarter with $879.5 million cash on hand available for growth initiatives if and when necessary.

$0 in debt

Additional Notes

Market

Over the past 2 years the energy drink market has changed significantly, mainly thanks to CELH. What was once a two way race between Red Bull and Monster who were fighting for the male skateboard and extreme sport fanatics, has now turned into a three way race in which CELH has flipped the market completely in their favor.

For the first time, the energy drink market has hit an inflection point where now more than 50% of energy drink sales are from sugar-free healthier beverages like CELH. This shows how the market dynamics are changing. Traditional sugar loaded energy drinks like Monster are now not the preferred option and likely never will be again looking at this chart. In just the space of 6 years it’s gone from 30.5% sugar free sales to just over 50%. Where will it be in another 6 years…?

The most interesting part for me is the market share discrepancies. As per John Fieldy (CEO), data now suggests that CELH have 11% market share in the energy drink market. However, as per the MNST earnings call last week, CELH market share is just 8.5%. This to me is evident of the changing dynamics and who they’re respectively including in the energy drink market.

CELH are not only taking market share away from Monster and Red Bull’s consumers, but they’re also bringing new consumers into this newly defined energy drink market, which is what I don’t believe MNST are considering as part of their numbers. People are consuming CELH instead of their daily coffee and outside of normal energy drink usage occasions. For example, CELH have partnered with Jersey Mikes and Dunkin Donuts, allowing them to compete as that spontaneous side refreshment beverage with lunch for example.

Spring Resets

I believe a quite overlooked factor in the CELH growth story is in the spring resets and the push that this is going to give moving forward into Q2 and Q3. Most store stock resets are done between February to June so none of this was really built into the data we were given here (max ~ a third). Compared to last year when CELH had ~7% market share, many more stores now want CELH at their best locations and in their best coolers.

Not only this, but CELH also have a lot more negotiating leverage now they’re above the 10% share benchmark. Retailers want CELH. Gyms want CELH. Restaurants want CELH. And they’ll get them. This means even more CELH displays, SKUs, shelf space, and cooler space in much more convenient locations. As a consumer, you’ll be seeing CELH more throughout the year in better locations. The 98.4 ACV figure is tough to improve further, but the transitional moves into better locations within those stores is the key next step for CELH.

Valuation

Based on this discussion, here's my current investment model through to 2032 which shows a potential 140% upside from current prices, or 23.3% annually. I altered it slightly from my last model to reduce revenue growth and increase net margin.

It’s important to note that these assumptions are based on a good amount of things going right for CELH, particularly with the international expansion. Any bad data could obviously significantly impact the revenue, net income, and multiples I’ve included here.

Comparison to MNST

MNST are currently a $53.39 billion company. They’re doing:

$7.3 billion in revenue (LTM)

$2.1 billion in EBITDA

$1.5 billion in FCF

$1.6 non-GAAP EPS

This puts MNST at:

7.3x EV/Sales

25.4x EV/EBITDA

35.6x EV/FCF

CELH are as follows:

10.1x EV/Sales (using revenue estimates for FY24)

61.1x EV/EBITDA

183.3x EV/FCF

Based on these multiples, CELH doesn’t look cheap but you are getting +45% EPS growth compared to ~15% EPS growth with MNST which leads to PEG ratios of 2.1x for both CELH and MNST. Therefore, both rather expensive right now.

Personally, I wouldn’t be adding in the $70s, but I’d be looking to add in the mid $60s where a PEG ratio would be closer to 1.8 which seems a lot more reasonable.

Final Take

Celsius as a brand resembles hyper growth. It was the #1 dollar and unit grower in the U.S. multi-outlet + convenience (MULO+C) category (currently 11.5%). It’s also the best selling energy drink on Amazon with a 20.2% market share vs 20% for Monster and 12.2% for Red Bull. YoY gain on Amazon for CELH has been +30% which Monster and Red Bull are not even close to achieving.

CELH is now the 3rd largest MULO+C energy drink in the US. They’re beating Red Bull in a few key areas where they’ve managed to get above the 15% market share. They’ve got up to 98.4% ACV and are now focused on raising volume per location as well as convenience per location. For the club channel, revenue rose at 36%.

All in all, CELH is still growing rapidly. And now, they’re putting the pieces together to make it an extremely profitable growth story too. If international expansion is as successful as the US story 4-5 years ago, there’s no reason CELH won’t overtake MNST over the next decade.

I’m a long-term buyer.

I’ll have more CELH updates for you as and when I feel necessary. For the time being, you can follow me on X where I’ll be posting about CELH on a more regular basis than on here.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Celsius doesn't make me go 'omg'. It's seems okay, but some of the assumption are doable, yes, but still very bullish in my opinion.

Great write up overall.

Amazing write uP. Most of the overseas markets are still untapped for $CELH. We will see the real growth when it starts its international expansion. I believe it will be at least as big as Monster at some point.