Here's Why I Bought Hims & Hers (HIMS)

Everything you need to know!

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Company: Hims & Hers

Ticker: HIMS

Website: https://www.hims.com/

Current Stock Price: $22.36

52-Week High: $24.79

52- Week Low: $5.89

Market Cap: $4.75 billion

Headquarters: San Francisco, California

Number of Employees: 1,046

Introduction

HIMS was only a more recent buy for me to be honest. I’d had them on my radar a little but I never truly dug into the company until I started seeing the YTD performance jump up and up. That made me start to dive in and see what all the hype was about.

And it’s safe to say pretty quickly after my research I clicked buy for the first time on HIMS. In this article I’ll tell you everything you need to know about HIMS.

Business

HIMS is an integrated healthcare platform aiming to disrupt the multi-trillion industry by essentially simplifying processes and getting rid of all the complexities surrounding insurance and getting appointments with physicians. There’s many healthcare conditions that can be treated perfectly well through online consultations and expediated delivery of medications. This is exactly what HIMS is doing.

We live in a digital world now and technology is one of the few trillion dollar industries that has had little disruption to date. Of course not all medical conditions can be treated online, however, there is a good chunk that can be. HIMS have started their growth trajectory by focusing on just a few areas such as hair loss, erectile dysfunction, contraceptives, STDs, mental health and weight loss.

You’ll probably realize that these health issues are:

Very common in the United States.

Very stigmatized and fairly difficult for people to talk about.

Some patients don’t like the idea of having to go to see a doctor in person to discuss these stigmatized issues and therefore the idea of discussing online with a physician from the comfort of your own home seems a lot better.

Business Model

HIMS has two revenue streams:

Online Revenue - The sale of products and services on the platform, whether that be subscription recurring revenue or one-off sales.

Wholesale Revenue - Non-prescription product sales through wholesale purchasing agreements. These will be all non-prescription products and this revenue stream has been growing rapidly at 58% YoY, though it still does represent less than 5% of the total revenue of the business (partly because online has been growing so well).

HIMS is generating more and more brand awareness and therefore more wholesale partners are wanting to sell HIMS products. Hence, we are seeing wholesale revenue grow at a quicker rate than online revenue, though the numbers are of course much smaller.

If this trend continues, which it likely will, we’ll see some margin compression since wholesale revenue has much tighter margins than online. However, of course wholesale allows HIMS to generate further reach and get their products seen by more and more people.

Acquiring Customers

One of the negatives of HIMS is how much money they spend on marketing, hence one of the reasons why operating and net margins have only very recently inflected positive.

People don’t like to talk about stigmatized health issues like acne, for example, and instead prefer to bottle it up inside. Therefore, it’s quite difficult for HIMS to grow organically through “word of mouth” meaning they must spend aggressively to get the word out to the masses about exactly how they can help individuals suffering with these issues.

There’s 2 main positives to take away here though:

Marketing spend as a % of revenue is coming down basically every quarter.

HIMS has a very loyal customer base with +80% long term retention, meaning it is well worth the higher customer acquisition costs. Further, spend per member is increasing YoY so this marketing as a % of revenue should continue to go down. For reference, marketing as a % of revenue used to be in high 90s and now we are seeing it below 50%.

Competitive Advantage

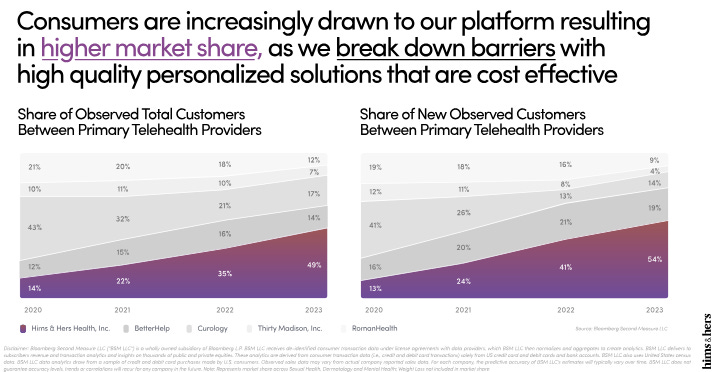

On the front of it, the competitive advantage for HIMS probably isn’t as obvious as other companies we have covered in this newsletter, but there’s no doubt there is a growing competitive advantage. HIMS operates in a very competitive market and having no competitive advantage would make it impossible for them to have won a 49% market share in just 7 years.

A few of the competitors include (Teladoc) who mainly offer telehealth services, GoodRx (who mainly offer prescription products online), and Keeps (who currently only operates in the hair loss segment). But there’s not many companies that currently offer all services (telehealth, prescriptions, and products) through an easy to use app at very affordable prices. It reminds me of the SoFi moat that people also say is non-existent. They’re building the one-stop stop for all things finance and investors haven’t fully appreciated this yet.

There is one company called Ro who does compete with Hims & Hers and offers treatments, however, Hims & Hers currently has far superior loyalty and branding that has all been marketed to perfection. You can see HIMS has pricing power in the market as their prices are generally slightly higher.

You can see more information on the difference between HIMS and RO (mainly in the ED treatments here: https://www.healthline.com/health/hims-vs-roman#hims-vs-roman)

I don’t have the gross margins for Ro, but I’m pretty confident in saying this gross margin chart is evident of a good competitive advantage.

The unique experience HIMS has managed to create through their marketing, technology, products, and quality all contribute to this success. It’s also worth noting a couple more factors:

Network effects will become more and more important over time. As the HIMS brand develops and more physicians/providers are onboarded to the system, access to treatment, products, and drugs will become much faster and easier. Therefore more customer will use HIMS.

HIMS are currently going after quite a specific market in the millennials, hence the big marketing spend on social media such as TikTok and Instagram. If HIMS can develop brand loyalty amongst this demographic, they’ll likely be customers for years to come and take away the the potential for competitors like Ro to acquire these customers.

“We believe this demographic will make up the majority of healthcare spend in the coming decades, and as such, we have intentionally built our brand and technologies to align with the expectations of this consumer group.” - Andrew Dudum, CEO

A lot of the problems HIMS treats for are those stigmatized issues that are generally more prevalent amongst the younger, more tech savvy generation (sex, skin, weight loss, mental health). Unfortunately, within the social media influencing world and people continuing to compare themselves to profiles online, issues such as skin, sex, and weight become more and more stigmatized. Therefore, HIMS ability to market themselves directly on these platforms where the issues are created is highly successful.

The numbers talk for themselves with an incredible 41% CAGR growth in the number of subscribers.

Most Recent Earnings

Demand

HIMS is now a GAAP profitable company with revenue growth at 46% YoY. That in itself is quite a rare rate of growth for a company expanding margins at the pace HIMS are which is reflective of how quality the company is. I’ll mention it a few times in this article but this is also only just the start for HIMS with an expanding portfolio of personalized treatments.

HIMS currently has 1.7 million subscribers on the platform, up 172,000 QoQ (41% YoY). Subscribers to personalized solutions has increased 6x in the space of 2 years. The longer term aim is hundreds of millions of subscribers which is completely possible with the current rate of growth and TAM.

The ability for HIMS to get more eyes on the products (through marketing and wholesale) and then generate subscriptions which ultimately turn into personalized subscriptions is what will really drive the long term success of HIMS.

Guidance for the entire financial year is just below $1.2 billion which appears to not include the new GLP-1 offering

Profitability

As you can see from the chart above, gross and net margins have seen substantial expansion over the last 12 months with gross expanding 200 bps and net inflecting from -4.70% to +4.0%. This is all due to scale and efficiencies from cutting costs in logistics, raw ingredients and customer support through affiliated pharmacies and tech improvements.

I don’t believe gross and net margins will expand huge amounts in the future as the aim is to continue to drive cost cuts and eventually pass these onto the end consumer so they get more value. This is especially key with bigger players such as AMZN coming in at $9 a month. HIMS will never offer these kind of prices as their value proposition is quite different to AMZN, but more cost cuts will mean people will be more willing to try the higher value add of HIMS compared to the cheap lower value add of AMZN.

In the shorter term I also expect margins to stabilize as wholesale revenue becomes a bigger and bigger portion of revenue. For me this is completely fine. HIMS have goals to reach hundreds of million subscribers and therefore they can’t expect to expand margins and achieve this kind of required subscriber growth at the same time. Margin expansion will come slowly in the future but for now the focus needs to continue to be on getting the HIMS products in front of more and more customers.

Longer term, reaching 30% EBITDA margins will be a huge challenge, but managing expenses with stable gross margins above 80% will make it possible.

Longer Term Trends

Marketing as a % of revenue is down to 47% which is coming down on an annual basis as retention rate improves (highlighting high value add) and cheaper acquisition costs (through wholesale channels for example). I don’t expect this number to drop too quickly down to the target of 30% and I don’t see why it should if subscriber goals are in the hundreds of millions.

HIMS have a brilliant marketing strategy and they need to continue investing into this, especially now with competition intensifying.

Opportunities

The total addressable market for HIMS is enormous when you really dig into it and this is one of the main reasons I decided to invest in the company. The healthcare market as a whole is a +$6 trillion market by 2027, yet it’s extremely complex, inefficient, and not yet been disrupted at all.

It’s a market focused on maximizing profits for providers and insurers, and has little to no consideration for the actual consumer (even if they do have insurance). With extremely high deductibles most patients aren’t even reaping the benefits of their $3,000+ insurance annual charge until they’ve paid a large chunk themselves. It’s a broken system.

And further, with no insurance, the US healthcare system is absolutely abysmal and pretty inaccessible to a wide portion of the population.

HIMS currently addresses 5 key markets:

Weight loss

Hair

Sexual health

Mental health

Skin care

Let’s discuss the huge opportunities ahead for HIMS and explain why the total addressable market is so big.

Product Expansion

HIMS has chosen to specialize their treatments to the above 5 areas to begin their expansion journey, however, this is not where they will be in the next 5-10 years.

I see no reason why HIMS can’t become the go-to health service for almost all health issues before going to see a physician in person. The current pipeline is to dive into the sleep, fertility, diabetes, and cholesterol markets which all have the ability to consistently be treated well via online communication and good medication.

On top of this, more categories are in the works such as pharmaceutical medication, cognitive behavior therapy, and coaching services. HIMS has the ability to gradually increase their TAM year on year as they begin to expand their product line. With their loyal customer base that they’ve managed to build since inception, cross selling likely becomes better and better within an expanding TAM. Huge opportunities.

Wholesale

As briefly touched on already, HIMS are growing their wholesale business at rapid rates, though of course lower margins. At this stage of their growth trajectory, HIMS will be continue to focus on growing this revenue stream.

Partnering with the biggest stores in the world such as Walgreens, Walmart, and CVS allows HIMS to get more and more eyes on their products, and hopefully on to their platform, and finally on to the personalized subscription plans.

International

The US market has always been the primary market for HIMS since the company is essentially built on the downfalls of the US healthcare industry. However, HIMS has acquired companies in the UK prepping them for an international launch if that time ever does come.

I don’t think international expansion is on the radar for the next 10 years or so as the opportunities in the US are so extensive. However, there’s no doubt that this business model does have international potential.

Of course HIMS will have to be very strategic as to where they plan their international expansion. In the UK, there is the NHS (National Health Service) which is completely free for all UK citizens, however, wait times and treatment quality are not great and therefore some of the UK population with slightly more disposable income could be willing to get on board with HIMS. I’m less familiar with other healthcare markets outside the UK and US, and now is not the time for that discussion, but I’m sure most countries have inefficiencies that HIMS can exploit.

Insurance

Although not a big factor right now, but HIMS have the option for additional growth into insurance-covered services after their acquisition of Apostrophe back in 2021. Apostrophe is a mail-order pharmacy located in Arizona that essentially provides prescription fulfilment services to consumers of HIMS.

As per management, this increases drug coverage by 400% with access to $408 billion in untapped spend on top of the $100+ billion in more generic, non-insurance covered drugs. This not only increases the TAM for HIMS substantially as they’ll be able to treat a broader range of conditions, but it also offers much more treatment flexibility, and therefore treatment personalization.

GLP-1

Around 42% of the US population are now considered obese compared to just 30% back in 2000. This means more individuals are seeking products to help them safely lose weight and the solution is now becoming more mainstream thanks to GLP-1 injections.

Goldman Sachs has projected Eli Lilly’s global sales of GLP-1 will be ~$130 billion through to 2030. HIMS GLP-1 injections are becoming much more commonplace due to shortages in the branded medications such as Wegovy and Ozempic and also due to the $199 price that HIMS is able to offer compared to companies like Eli Lilly.

When looking at these numbers, if 40% of Americans take GLP-1 (unlikely but at rates of obesity growth, not completely unrealistic) at current (Eli Lilly) prices of $15,000 annually that’s a $1 trillion bill per year. Plus, interest online in these GLP-1 drugs has been skyrocketing and online marketing is where HIMS specializes. If HIMS can capitalize well on this weight loss trend, earnings growth could be enormous.

B2B

Currently HIMS operates purely a D2C (direct to consumer) business model but management have said there is of course future potential for B2B. Most of HIMS patients today do in fact have insurance, but they still come to Hims & Hers because existing offerings are just too complex. What is covered by the insurance? What isn’t covered? Most patients don’t even reap the benefits of insurance packages because deductibles are +$2,000 meaning most patients have to spend over £200 a month just to reach the point where the insurance becomes accessible.

Alex Dudum, CEO, has made it very clear that Hims & Hers would like to transition into B2B at some point in the future, but this is not a goal that is being worked on today. They do not want to build their model on an offering that is suited directly to businesses (as opposed to consumers) because that is essentially the problem today with US healthcare.

The aim is to get subscriber count up into the hundreds of millions to essentially prove that all customers are using this product and then from there they can bundle it into a bigger B2B offer.

All in all, HIMS has numerous avenues for future growth from those that are in the short term timeline to those that have yet to be developed. I love the idea of investing in a company that has so many opportunities for reinvestment and growth and HIMS matches that criteria to a T.

Technology

Customers want personalized treatments, hence why over 35% of HIMS subscribers are now opting for personalized subscriptions. This is another competitive advantage that is separating HIMS from competitors as other telehealth companies generally struggle to create personalization compared to traditional in-patient visits.

The ability to offer personalized care increases a customers loyalty to the platform as well as acquiring more customers to the platform. Personalization is a result of leveraging AI to effectively work with the tons of data points they collect annually to understand key individual patient concerns. These patient concerns mainly surround side effects and individualizing doses for now but more personalization is what will separate HIMS from competitors.

Growing personalized subscriptions by 176% YoY is perhaps the most overlooked aspect of the bullish case for HIMS and one that is created a recurring revenue moat.

Risks

With any investment comes risk and perhaps HIMS is on the higher end of the risk spectrum due to the business cycle stage they’re currently in.

There’s 3 main risks I consider/hear about:

HIMS has no economic moat.

Amazon will destroy HIMS.

High stock-based competition.

HIMS has no economic moat

Please refer to Competitive Advantage section for my discussion on the HIMS economic moat.

Amazon competition

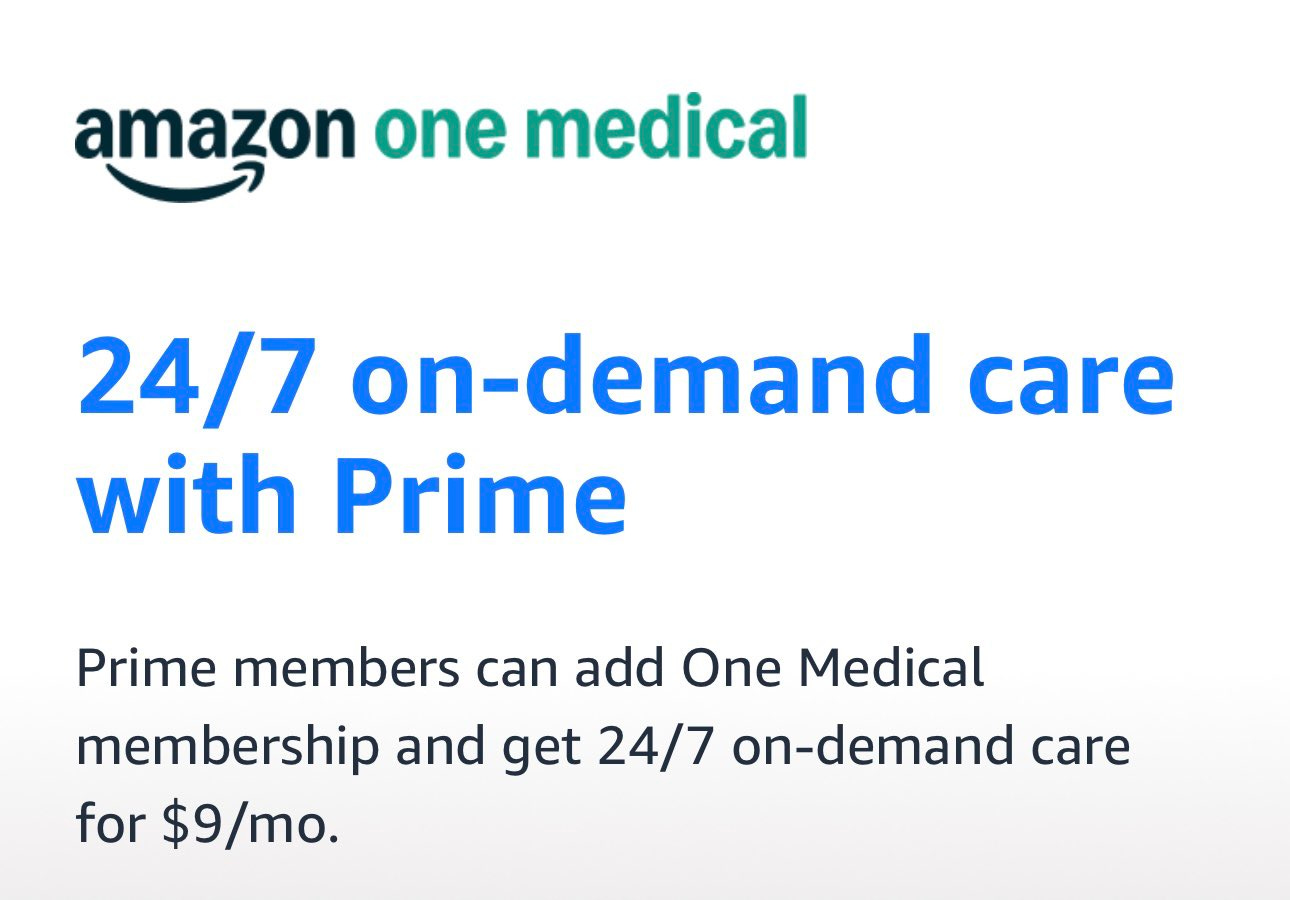

Amazon recently announced they are offering 24/7 unlimited on demand care via text and video call for $9 a month. Here’s what I think about it:

Will Amazon compete in the telehealth industry? Yes, no doubt. The backing and reach they have is the biggest in the world and they can force themselves into pretty much every industry they want.

Will Amazon be a big threat to the future of HIMS? No, I don’t believe so.

I see both HIMS, TDOC, AMZN, & RO all co-existing in the market place. HIMS has a different value proposition to AMZN in that currently they’re focused on these very stigmatized health issues and personalized solutions, whilst AMZN appears to just be going in as a more general telehealth player. HIMS have managed to carve out their share in the market and I don’t see that changing much.

The worry I do have is that AMZN will be reducing the total TAM that HIMS can take but the counter to that is AMZN will likely increase the speed in which telehealth becomes a lot more mainstream as well as simply expanding the market. If HIMS can maintain their value proposition then it shouldn’t be too much of a problem, but Amazon are of course coming in at very low prices looking to take share immediately.

High Stock-Based Compensation

Share dilution has been a slight issue for HIMS, as it is for many companies in HIMS current life cycle. However, management are fully aware of this, hence their current $50 million buyback scheme over the next 18 months or so. At the rate of dilution currently, I don’t think this will make a huge difference to the shares outstanding figure, but it’s a promising sign that HIMS has such robust financials that they’re able to buyback shares already.

Valuation

HIMS currently has an EV of $4,565.74 million, up 132% this year alone.

Using the following analyst estimates:

$1,546.52 million in revenue (2025)

$187.74 million in EBITDA (2025)

$141.45 million in FCF (2025)

We have the following multiples:

2.9x 2025 EV/Revenue

25.1x 2025 EV/EBITDA

32.3x 2025 EV/FCF

Looking at this alone (without all the other information about the opportunities for HIMS in the future), I’d say 2.9x EV/Revenue for revenue growth in the mid 40s and gross margin near 80% is incredibly good.

The reason the company is likely valued where it is is because net margins are not yet where they need to be, but as I’ve said in this article a few times I am completely fine with a few more years of high investment into the company before really focusing on net margin expansion.

If estimates for EBITDA weren’t increasing at 40% annually, then you could argue a 25.1x EV/EBITDA multiple is on the higher end, but 40% CAGR in EBITDA is impressive and I’m more than willing to pay a 25x multiple for that.

See investment model below:

Now this model isn’t easy but HIMS is such an early growth company with tons of opportunities and therefore estimating revenue growth and net margin expansion is really difficult. If I’m completely honest I’d much prefer to see net margins not reach 10% by 2028 and instead see revenue growth be maintained in the 20s/30s, but I know this is extremely difficult to achieve.

Revenue growth in the 20s I do see as possible up to 2030 simply because HIMS are competing in a huge market with a huge TAM and the opportunities are completely endless. Of course, this doesn’t mean it is guaranteed as management still need to continue to execute very well.

And of course this model won’t be spot on, but it does show the potential revenue growth / net margin expansion possibilities and the resulting fair values more or less.

Conclusion

I hope I’ve covered as much as possible and everything that needs to be said about HIMS. If I could close by hammering one point home it’s that the TAM for HIMS is potentially the largest I’ve ever seen for a company. I’ve not come across many companies with such a large amount of opportunities ahead of them. That’s extremely exciting.

I like to think that profitability and margins will take care of themselves more naturally with scale. But for now, as management keep saying subscriber count is growing rapidly but it’s nowhere near the end goal. Their marketing expertise needs to continue to be funded very well.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

If I'm not mistaken, the users of this service primarily want to obtain specific prescription medications at a low cost. Then price competition is likely to become an issue quickly. Additionally, the TAM is unlikely to expand. Fields like hair loss, dieting, and sexual health succeed because the treatments have a low dependency on physicians.

Interesting company. Never heard of it. It just became profitable, it's a good sign. Technically, it's almost completed its IPO bottom. Also a good sign, although now that the price is near the all-time high, it'll probably need a bombastic earnings report to go over the high of 2021. The stock-based compensation has led from 192M shares to 214M shares over the last two years. I wouldn't be happy if I held the stock but young IPOs are like that. You have to factor in this risk. Overall, a nice pick, Oliver.