My Ranking of 15 Quality Stocks

One Pagers Galore!

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

It’s #WednesdayWisdom!

Firstly apologies that this article isn’t on a Wednesday. I have had numerous issues with publishing and for one reason or another I couldn’t get this article to publish until today.

Today I’m mixing it up slightly from my usual Wednesday format.

I thought it would be a good idea to rank 25 quality stocks which I actually found very difficult because they’re all companies I would happily own.

We’ll start at 25 and work our way downwards to number 1. For the top 3, I decided to add a bit of an investment these surrounding them on top of the One-Pager.

15. Arrow GreenTech

14. Sociedad Quimica y Minera de Chile

13. S&P Global

12. Crocs

11. VeriSign

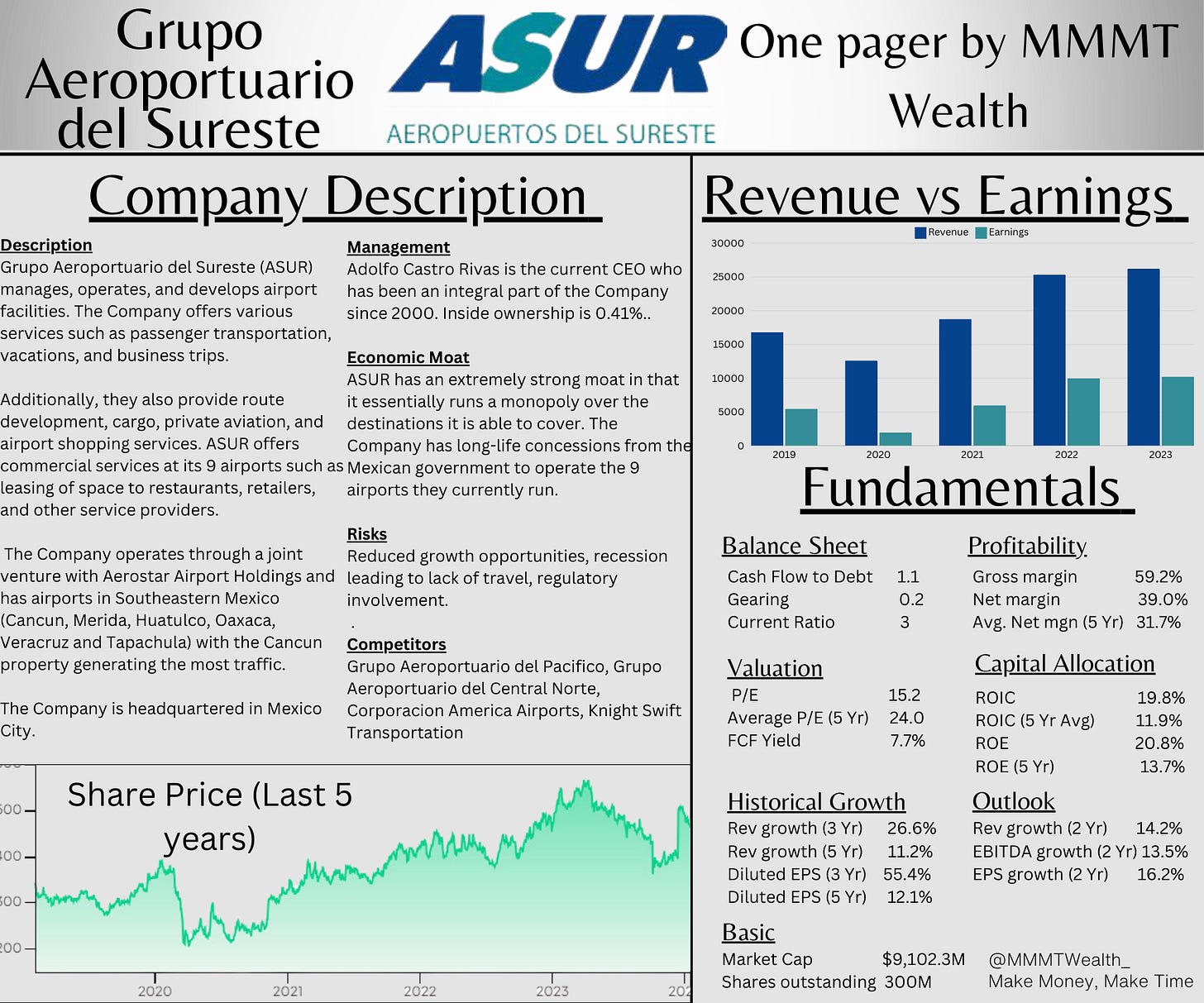

10. Grupo Aeroportuario del Sureste

9. Gofore

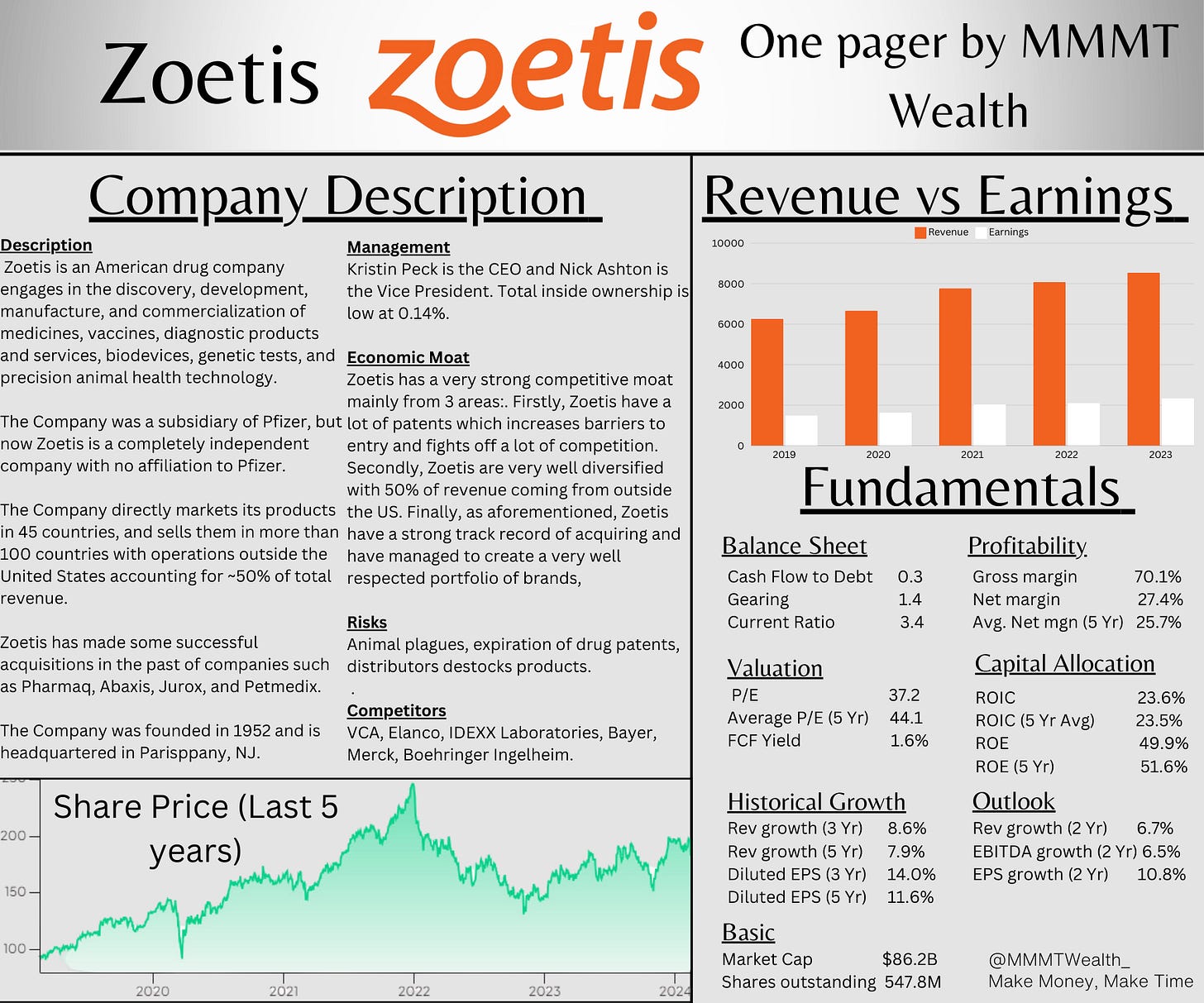

8. Zoetis

7. Copart

6. Alibaba Group Holdings

5. Veeva Systems

4. PayPal Holdings

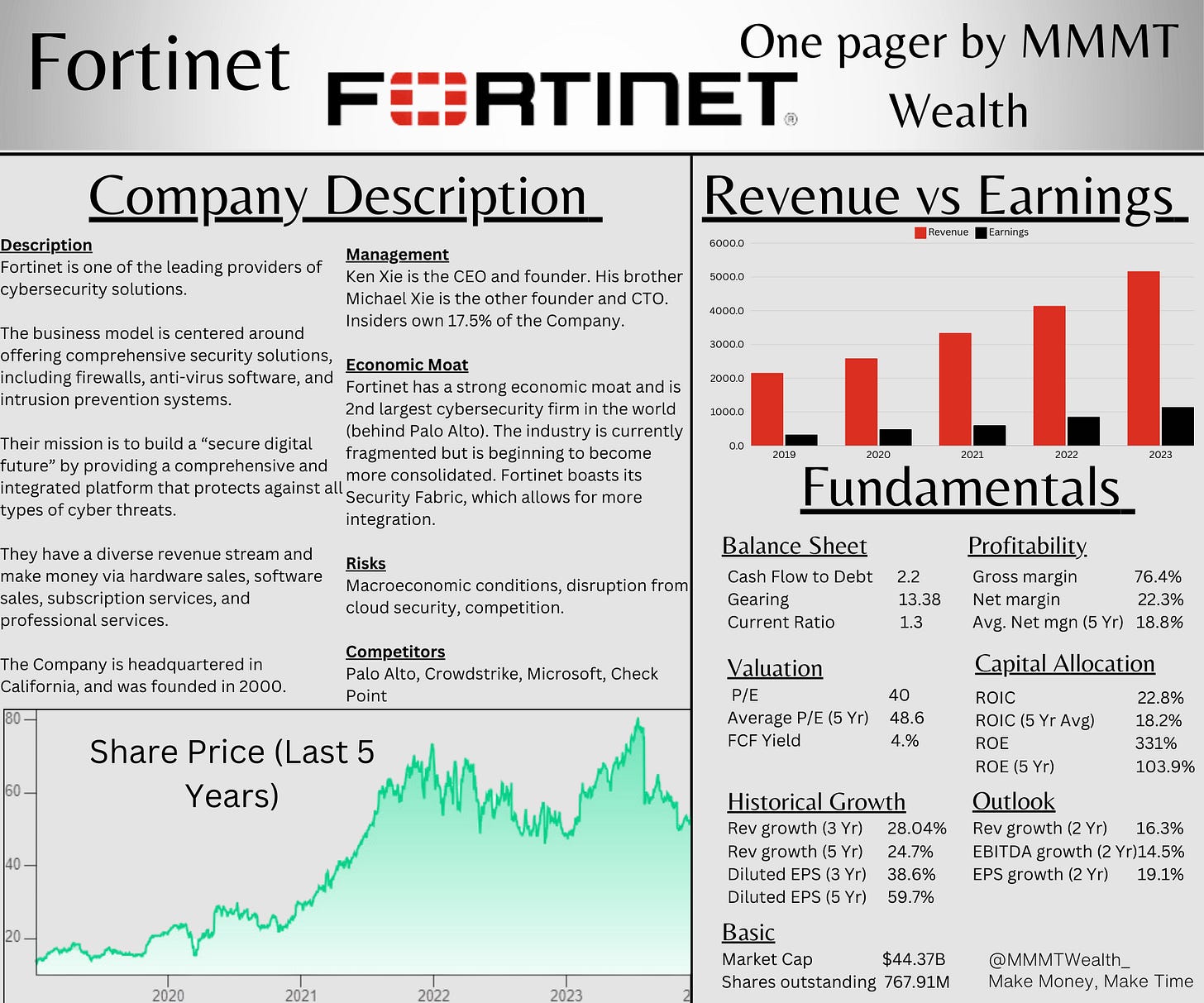

🥉3. Fortinet

Fortinet FTNT 0.00%↑ is 3rd on my list. Here’s the One-Pager and a concise investment case:

Investment Case:

Fortinet boast a huge installation base with everything being built on the same operating system meaning clients can simply turn on the SASE function. This gives me a lot of confidence that Fortinet can continue to bring in clients, and easily cross-sell them to the SASE function.

76% of Fortune 100 companies are clients of Fortinet, as well as 69% of Global 2000. This highlights the quality of the product, as well as Fortinet’s competitive advantage in the industry.

Fortinet has the most diversified business out of most cybersecurity companies.

🥈2. Celsius

And second place is Celsius…the energy drink company rapidly taking market share from the big players. Here’s the One-Pager and investment case:

Investment Case:

A very strong and positive start to the Celius and Pepsi partnership. Pepsi have assisted Celsius with getting the products in the foodservice channel (which now accounts for 12.5% of revenues).

Celsius is selling at considerably faster rates than Monster and Red Bull meaning they’re getting more and more shelf/cooler space each year.

Celsius have just begun their international expansion into Canada, UK, and Ireland. We don’t have any specific numbers yet (and international sales are currently only 4%) but this presents a massive opportunity if successful.

🥇1. SoFi Technologies

And the winner is…SoFi. Here’s the One-Pager and below is a brief investment case on why I’m so bullish.

I wrote a deep dive into SoFi here:

If you don’t have the time to read that article above, here’s a very condensed version:

All figures are signaling an ongoing trend towards SoFi becomes the “all in one financial app” that the CEO believes it will be. Members are constantly increasing, as are products, and deposits. SoFi’s moat is becoming larger every quarter.

The technology platform and financial services division are growing at extremely fast rates showing the continued diversification of SoFi.

Taking 20% growth beyond 2026, this would give a PEG ratio of 0.47 currently. That’s extremely cheap.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

You can never go wrong with $SOFI.

It's also my #1 conviction stock!

Interesting list! Got several of these on my watchlist.