The Three A's: AXTI, ADUR, & AMPX

Three Small Caps I'm Bullish On

Hi all,

As per my spreadsheet, there are 3 key small caps that I’ve been tracking lately. One of them (AXTI) I actually bought on Tuesday as paid subs know and we’re already up 30%. This one is a slightly higher risk play that I’ll be analyzing below.

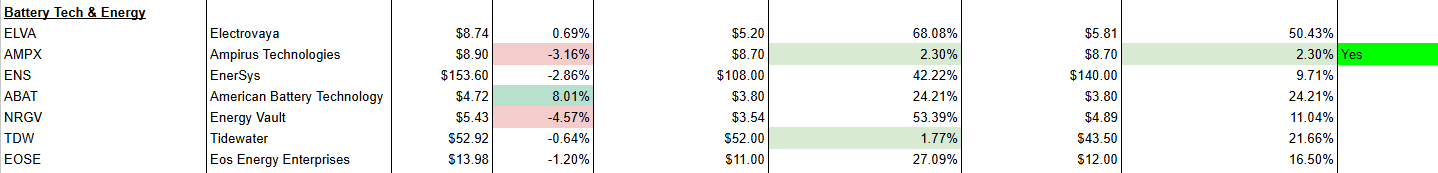

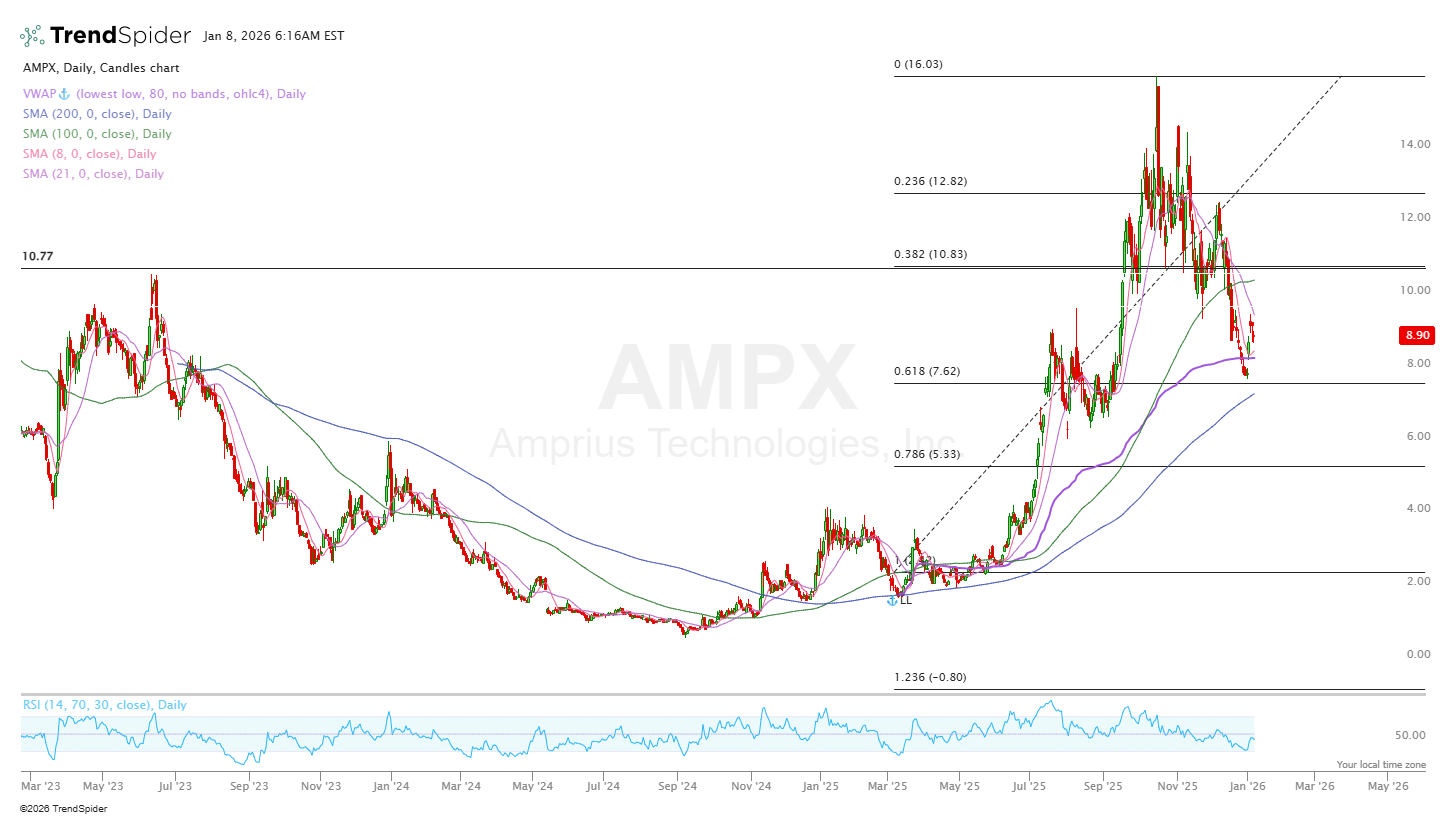

The other 2 small caps that I’ll talk about here (ADUR and AMPX) are in two industries that I’m very bullish on. AMPX shows up on my watchlist along within the “Battery Tech & Energy Storage” niche as the most attractive to me here (aside from those stocks already in my portfolio). ADUR is one I’ve been following on and off for about 6 months and thought it was finally time to really dive into more.

Before I get into these stocks, make sure you have a look at the offerings for my cheap paid service:

For just $16 a month you get access to my spreadsheet (tons of information), daily notes (5-20 messages per day), real time portfolio moves, and much more.

Prices will be going up on 1st February. If you become a subscriber now you’ll lock in the $16 a month price forever.

Give it a go 👇

AXT | AXTI

AXTI has moved nearly 1,000% over the last 6 months alone from a small $300M company to a $1.3B giant…and I think the story is just getting started. In my years of investing…I don’t think I’ve seen a stock move this consistently and aggressively. It’s moving against the wider optics market as well. On red days for CRDO, LITE, etc, AXTI has continued to surge +10-20% per day.

Introduction

Let’s take a step back first.

Historically data centers have relied on copper cabling. It used to be reliable, cost effective, and fairly efficient for short distances data connections. However, with the AI boom, the need for bandwidth has exploded and copper has become a bottleneck of the AI revolution.

This is why we’ve started to see an optics revolution. It’s why stocks like LITE, COHR, VIAV, AAOI, CIEN, and COMM have all performed extremely well.

So optics uses lasers to move data at the speed of light instead of copper. The catch is that you cannot build high-performance lasers out of standard Silicon. To generate the high-quality lasers needed for the AI boom you need a rare compound material called Indium Phosphide (InP).

Without InP the lasers don’t emit efficiently (or at all) at the critical wavelengths with high performance, reliability, and integrability needed for modern optical communications and photonics. And there comes in AXTI.

AXTI is one of the worlds leading manufacturers of Indium Phosphide substrate wafers - the foundational starting material for these photonic lasers. No AXTI means a big shortage on InP which ultimately means no high-performance data centers which hyperscalers are spending trillions of dollars on. It’s one of the biggest bottlenecks out there.

But there’s more to this story.

The technology argument for InP demand is clear. It’s the financial argument which makes even more sense to be bullish on AXTI. It’s currently sitting right in the middle of a perfect economic clash created by the bifurcation of Western and Chinese markets. Here’s how the economics is playing out:

The bottleneck has moved away from the lasers and towards the raw materials.

Initially, the AI bottleneck was with the finished components (the lasers). Reports suggests that NVDA strategically reserved massive capacity from laser manufacturers like COHR and LITE meaning other hyperscalers struggle to order the demand they need until 2027.

This forced players like AMZN and MSFT to go upstream to the raw material itself to build their own supply chains.

China vs West Price Gap

This rush for raw material has fractured the global market for Indium creating two distinct prices.

In China, 6N Indium is sitting around $415/kg

In the West, 6N Indium is sitting around $800/kg

AXTI advantage

Unlike Western competitors who must buy raw Indium at inflated Western prices, AXTI operates its primary manufacturing in Beijing.

This means they source raw materials from China (cheaply) and sell high to Western hyperscalers.

AXTI basically sit in a duopoly with Sumitono Electric Industries (SMTOY) based in Japan. SMTOY have high demand as well, but they don’t benefit from this pricing arbitrage that AXTI have giving AXTI quite a significant advantage.

Numbers

Expected FY26 revenue growth: 32%

Expected FY26 EBITDA growth: 223%

Net income margin: -18%

Risks

The upside for AXTI is clear. But the downside is also just as clear.

Because AXTI is a “hybrid”, a US headquartered company with almost 100% of its manufacturing in China, it sits directly in the crossfire of the US-China tech war. Here’s what could happen:

Export License Delays: If China tightens control, AXTI could face prolonged delays as they saw in Q2 2025 when revenue dipped. This would build backlogs but halt cash flow and slash quarterly revenue figures ~20-50% in some cases.

A breakdown in the US-China relationship could lead to US imposing tariffs on Chinese semiconductors or minerals, raising AXTI’s costs and making its product far less competitive in the West (slashing the advantage I just talked about). Alternatively, China could add more entities to its Unreliable Entity List and restrict AXTI’s access to global customers.

AXTI is a fairly big bet on calmer geopolitical tensions.

Valuation

NTM Sales Multiple: 11.6x

NTM EBITDA Multiple: 182x

I don’t think AXTI is a stock that in the short term is going to be driven by valuation too much. So far the numbers look ok. We’re getting some strong revenue growth (32%) for 11x sales which is solid. I think as long as geopolitics stay calm, I think we could see AXTI continue to move quite sharply but it’s inevitable we see quite an aggressive pullback or slowdown at some point soon. That could be a chance to add or buy AXTI if you’re interested in this higher risk play.

Aduro Clean Technologies | ADUR

I never love buying into stocks quite shortly after IPO. ADUR IPO’d in November 2024 and shot from $4 to $17 in less than a year before then pulling back to $12 which is where it looks to be stabilizing now in the short term.

I’ve known about ADUR for a while but always subconsciously ignored it a little because it was so soon after IPO and I think it’s so hard to gauge price movement of a stock within the first year or two of trading.

Introduction

ADUR is a Canadian clean technology company specializing in chemical recycling. The big picture problem we face today is the inability to recycle complex, dirty, or low-value waste. Traditional recycling methods only really works for clean plastics like water bottles. It cannot handle the vast majority of waste like Styrofoam, mixed packaging, or contaminated plastics meaning 90% of plastic waste actually ends up in landfills. That’s about 360 million tons of plastic per year due to our inability to recycle.

ADUR created a chemical process that breaks down these “unrecyclable” plastics into molecular building blocks, effectively creating a circular economy - a big theme to invest in (PCT, LOOP, EMN, DNMR, WM are other companies in this theme. I’ll have an article out on this in soon).

ADUR is currently in the commercialization phase having progressed from lab-scale proofs to pilot demonstrations. They’re still a long way away from revenue generation though. They currently have three main products:

Hydrochemolytic Plastic Upcycling (HPU): Dirty plastics —> high-purity feedstock that petrochemical companies buy to make new plastic.

Hydrochemolytic Bitumen Upgrading (HBU): Produces heavy, sludgy crude oil.

Hydrochemolytic Renewables Upgrading (HRU): Processes renewable oils

ADUR’s business model revolves around licensing these technologies to partners for royalties, whilst also planning to build and operate their own revenue-generating units. They currently hold over 20 patents and are expanding facilities in Ontario.

Numbers

There’s nothing really to talk about on the income statement yet because ADUR are pre-rev and making losses on SG&A and R&D expenses.

The balance sheet is healthy though, especially for an early development stage cleantech company.

Current Ratio: 28.3x

Cash: $15.09M

FY25 Cash Burn: $8.98M

Current Cash Runway: 20 months

Debt is very low with a debt-to-equity ratio of 0.05x

Risks

As with any small cap, there’s big commercialization and execution risk. I’d probably put ADUR in the higher tier of small caps in terms of risk for this as well since we’re still 2 years away from any revenue and essentially this is just a science project for the time being which makes the upside potential huge (just as big as the downside potential).

Here’s the main risks in bullet format:

Share dilution

Dependency risk on giants like Shell or Dow to adopt ADUR’s tech (over their own internal R&D).

Valuation

ADUR currently trades at $12.09 with a $400M market cap and an EV of ~$385M after deducting net cash. This is a pre-commercial development stage company with no revenue so classic metrics I look at per my spreadsheet are completely meaningless. This makes ADUR a stock that I don’t normally look into but big picture I think there’s potential and necessity in the cleantech space/circular economy space.

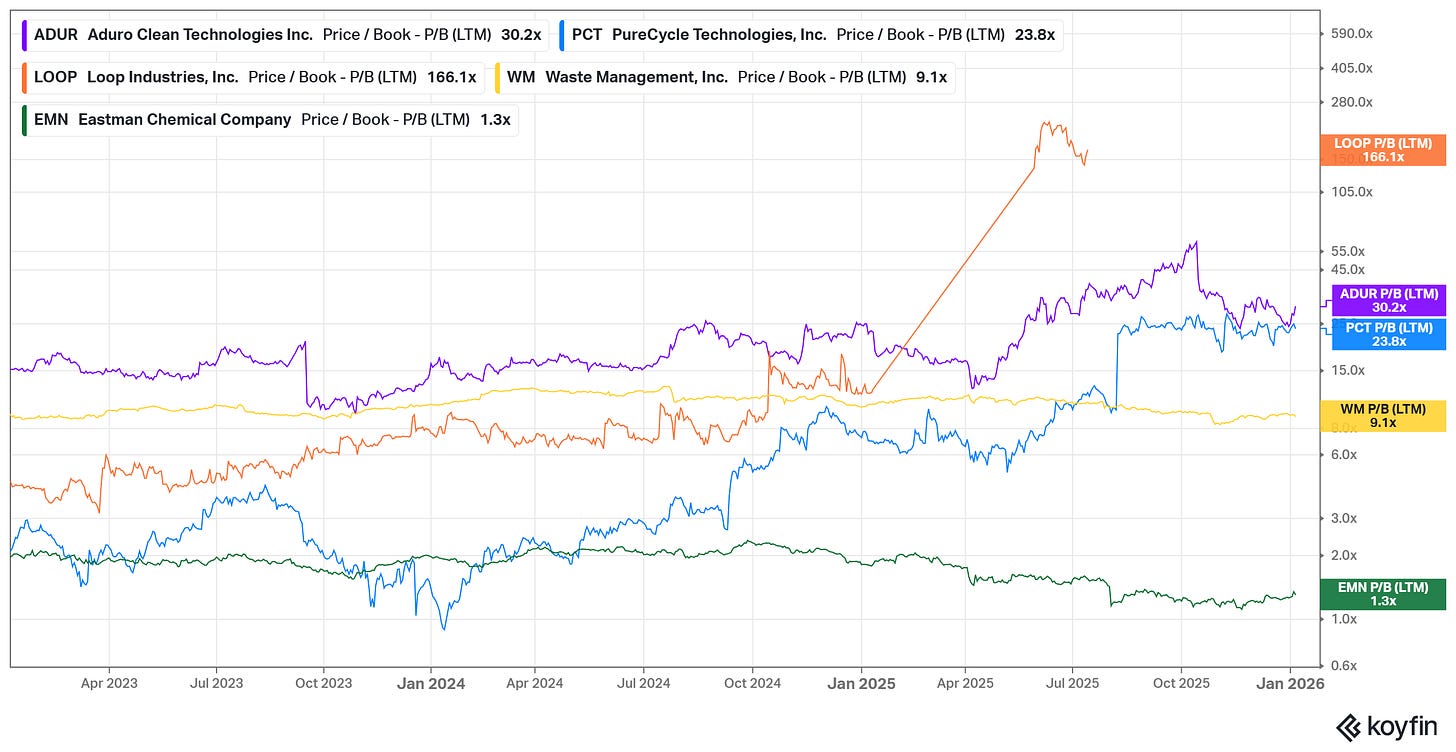

The best way to look at this valuation is via P/B which is at 30x suggesting the market is assigning a pretty high multiple to future growth and patents that ADUR has.

This is higher than peers (not direct peers) like PCT who are actually closer to revenue generation than ADUR.

It’s a very difficult company to value but at $300M market cap a P/B of 20x or 30x won’t ultimately make a big difference to returns long term if you think they can make a dent in the potentially $200-450B market they’re trying to win.

Ampirus Technologies | AMPX

AMPX recently flashed up as attractive on my spreadsheet based on technicals and valuations encouraging me to dive much more into the stock today.

Keep reading with a 7-day free trial

Subscribe to Make Money, Make Time to keep reading this post and get 7 days of free access to the full post archives.