👀10 Quality Stocks On My Watchlist

I'd be happily invested in them all.

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Make sure you subscribe so you don’t miss the next one (it’s free).

Being a quality investor is more about waiting patiently than taking action. That’s exactly why watchlists are so important.

I have portfolio made up of 16 stocks, but a watchlist of 35+ stocks. Today, I’m going to give a very brief breakdown of 10 stocks on my watchlist.

I’d be more than happy to own each and every one of them, but for one reason or another that time has not come yet.

1. Albermarle Corporation (ALB)

Introduction

Albermarle Corporation is a global specialty chemicals company that produces and sells ingredients for a range of industries.

ALB operated in 3 segments:

Energy Storage (Lithium)

Specialities (Lithium, Bromine)

Catalysts (Ketjen)

The main application for Lithium is of course electric vehicles which have been lacking demand a lot recently, one of the reasons as to why Lithium prices have been trending downwards, and with that, the ALB stock price.

Numbers

3-Yr Revenue Growth: 45.4%

FCF Margin: -8.57%

ROIC: 2.9%

FCF Yield: -4.8%

Gross Margin: 12.4%

Net Margin: 16.4%

Brief Investment Case

Last year China shut down a production hub responsible for 10% of the world’s supply after environmental mining violations. This will naturally trickle down and increase demand for ALB.

ALB stock is very correlated to Lithium prices where projections are suggesting that prices are finally starting to stabilize. Demand through to 2030 is still extremely promising, despite the lower EV demand.

EPS guidance of $30 in 2028. With a 12x P/E (this is conservative) ALB is then a $360 stock. That’s a 190% increase from current prices.

Graphic

2. AirBnB (ABNB)

Introduction

I’m sure you all know what AirBnB does so no need for an introduction here.

Numbers

3-Yr Revenue Growth: 43.2%

FCF Margin: 39.2%

ROIC: 33.9%

FCF Yield: 3.8%

Gross Margin: 82.8%

Net Margin: 48.3%

Brief Investment Case

As well as international expansion with Korea, Germany, and Brazil all standing out, sponsored listings are also on the horizon which could likely lead to double-digit EBITDA growth for ABNB. Expedia (EXPE) and Booking (BKNG) both have this feature.

Since margins and balance sheet is so solid, there’s also potential for ABNB to expand into other travel services such as food reservations or car rentals as adds on and cross-selling opportunities.

Graphic

3. Dino Polska (DNP)

Introduction

Dino Polska is a Polish grocery store chain focused on rural areas currently in Western and Central Poland. They are growing at extraordinary rates and have an incredibly strong moat.

I wrote an article on Dino Polska about 3 weeks ago. You can see it here (along with another quality compounder).

Numbers

3-Yr Revenue Growth: 36.4%

FCF Margin: 2.3%

ROIC: 20.2%

FCF Yield: 1.6%

Gross Margin: 23.1%

Net Margin: 5.5%

Brief Investment Case

Dino has created one of the strongest moats in the entire market making it almost impossible for any new entrant to replicate the business strategy.

Not only do they have an extremely strong moat, but they’ve also got tons of untapped potential (within Poland and internationally).

Graphic

Like the look of this graph? I do.

4. Cadence (CDNS)

Cadence Design Systems (CDNS) is a leader in the EDA software space. EDA (electronic design automation) is the design of electronic systems such as integrated circuits (ICs), chips, and printed circuit boards (PCBs).

Numbers

3-Yr Revenue Growth: 13.3%

FCF Margin: 29.7%

ROIC: 22.8%

FCF Yield: 1.7%

Gross Margin: 89.4%

Net Margin: 25.7%

Brief Investment Case

The EDA market is very complex and solutions tend to be developed over the course of decades. This means that there’s high barriers to entry, so investing in leaders (CDNS and Synopsys) in the space already is a solid idea if the valuation is correct. CDNS currently have just over 30% market share.

The wider market has a very strong tailwind. Chips, ICs and PCBs, are being used ever more frequently and for more complex purposes. Again, investing in a leader in an industry with this much potential will likely provide a solid upside.

85% of CDNS revenue is recurring and high margin.

CDNS boasts very high FCF.

Graphic

5. Costco (COST)

Introduction

COST engages in the operation of membership warehouses internationally offering branded and private-labelled products across a wide range of products. From groceries to health and beauty, from electronics to garden products, from office supplies to bakery products, Costco does it all.

COST also operates an e-commerce website, gasoline, pharmacies, food courts, and tire installation services.

Numbers

3-Yr Revenue Growth: 11.7%

FCF Margin: 2.5%

ROIC: 15.4%

FCF Yield: 1.9%

Gross Margin: 12.6%

Net Margin: 2.7%

Brief Investment Case

Though not currently attractive valued, I could make the argument that COST is the greatest compounder of all compounders. This is because of COST’s ability to continuously cut costs (through scale) and subsequently benefit the end-consumer. The membership retention rate has gone from 90.5% to 92.9%.

COST is also one of the few recurring revenue, subscription based business models outside the tech/software world. This is one of the reasons why COST can (and should) trade at a more premium valuation.

Costco also continues to buyback shares and pay out dividends. Q2 2024 saw a $159m buyback and a $15 per share dividend.

Graphic

6. SentinelOne (S)

Introduction

I started a fairly small position in SentinelOne about a month ago now, but I want to make it a much more substantial part of my portfolio which is why I’ve included it in this article.

SentinelOne competes in endpoint security (defending endpoints such as desktops, laptops, and mobiles). This means they compete directly with CrowdStrike (CRWD) and Palo Alto (PANW).

Numbers

3-Yr Revenue Growth: 88.3%

FCF Margin: -11.2%

ROIC: -24.6%

FCF Yield: -1%

Gross Margin: 71.1%

Net Margin: -54.5%

Brief Investment Case

A recent “weaker” earnings report created an opportunity for those wanting to invest. Management gave a fairly conservative revenue guidance based on the assumption that “macro uncertainties persist all year”. This seems to be a trend for SentinelOne and I’m confident revenue guidance will be raised throughout the year. EBIT also missed but that was because of two large acquisitions.

Growth of margin expansion is extremely rapid compared to peers in a similar stage of the cycle.

Extremely attractive market (Endpoint Detection and Response) estimated to grow at +20% annually as per Grand View Research, Mordor Intelligence, and others. SentinelOne is just behind CRWD in this industry so therefore very well positioned (and at a cheaper valuation) to grow with the market.

Graphic

7. Lululemon (LULU)

Introduction

LULU designs, distributes, and retails athletic apparel and footwear. The Company sells products through company-operated stores, outlets, fitness studios, partners, and online. My apartment has a LULU package about once a month (my girlfriend is addicted).

Numbers

3-Yr Revenue Growth: 29.8%

FCF Margin: 17.1%

ROIC: 32.9%

FCF Yield: 3.6%

Gross Margin: 58.3%

Net Margin: 16.1%

Brief Investment Case

LULU have a very impressive pipeline of international expansion giving an impressive TAM. China saw the biggest growth with a 78% increase in revenue compared to last year. With competition increasing rapidly in the US (by the likes of ONON, DECK, NKE and other non-publicly traded companies), rapid innovation combined with aggressive expansion is needed.

LULU is currently valued at 15.4x forward adj EBITDA (well below 10 year average of 21.2x).

LULU are a very innovation driven company. They’ve got products in the pipeline such as a hydrogen yarn legging, a Support Code Bra, and lots of new footwear to compete with the likes of ONON, NKE, and DECK. It’s tough to tell exactly how they’ll compete against peers, but I am certain that LULU is currently trading at a discount without a massive change in the fundamentals to when the stock price was in the high $400s.

Graphic

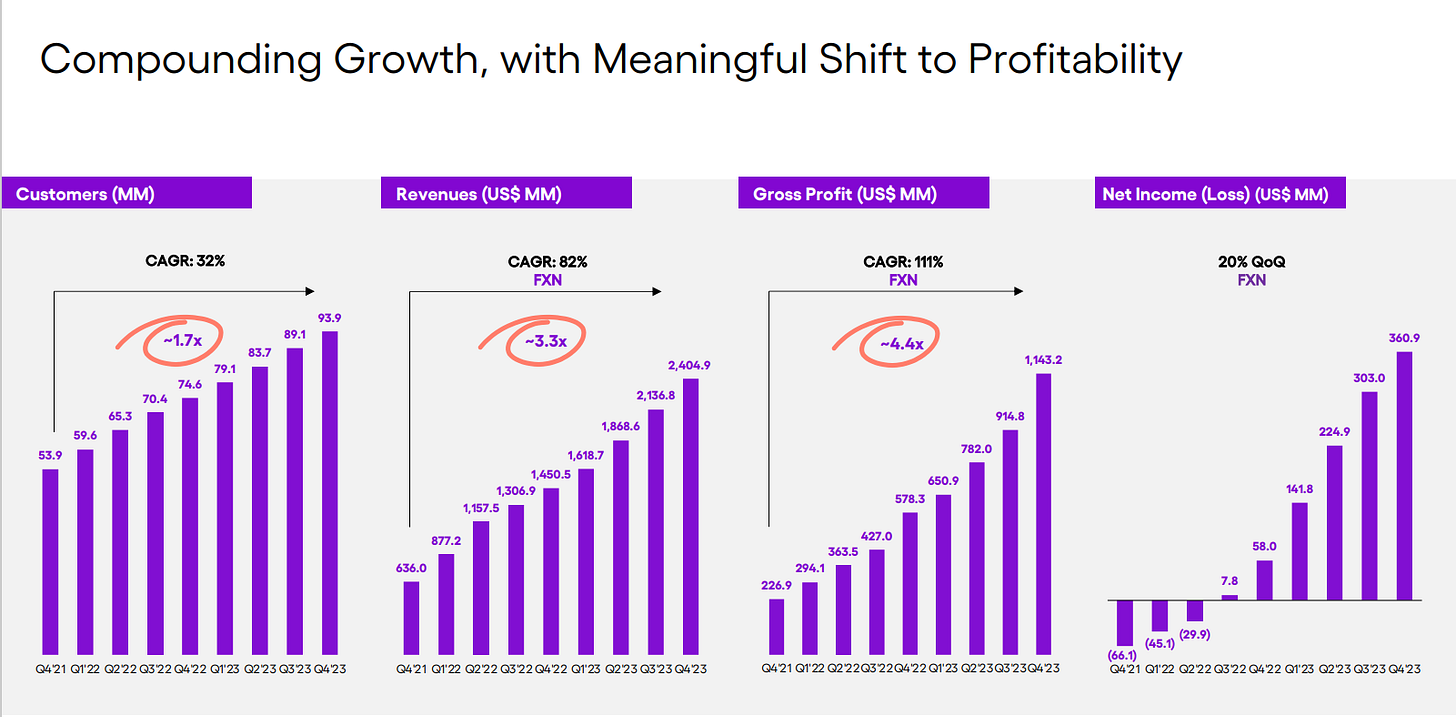

8. Nu Holdings (NU)

Introduction

NU is a founder-led digital banking platform based in Brazil, Mexico, and Colombia . The mission is simple: “fostering access to financial services across Latin America.”

Of course there are risks in Latin America, but I’m a big believer in diversifying your portfolio away from purely America (especially today with fears of a prolonged US recession).

Numbers

3-Yr Revenue Growth: 105.8%

FCF Margin: 33.6%

ROIC: 4.8%

FCF Yield: 3.2%

Gross Margin: 100%

Net Margin: 27.8%

Brief Investment Case

NU offers a nice diversification into the Latin America market which is one of the fastest growing markets worldwide and in the very early stages of their economic potential.

Brazil’s population (NU’s main focus so far) has a very young population who are the drivers behind economic growth. This group will continue to spend more and more over the coming years and credit will be taken to support this spending. Combine this with the fact that Brazil is one of the top countries worldwide when ranked for mobile adoption rates, and you’ve got a perfect demographic for a fintech like NU.

NU are doing an incredible job at customer acquisition with customers growing 26% YoY. The shift is now to customer monetization and results are already showing this with net income jumping 500% in just 12 months. Analysts expect 50% CAGR over the next 3-4 years.

Graphic

9. Uber (UBER)

Introduction

I’m pretty sure the vast majority of you know what Uber do so going to skip this section.

Numbers

3-Yr Revenue Growth: 49.6%

FCF Margin: 9.0%

ROIC: 3.6%

FCF Yield: 2.8%

Gross Margin: 32.6%

Net Margin: 5.1%

Brief Investment Case

UBER has finally reached an inflection point and now generates about $3.3 billion in free cash flow annually with estimates of 90% conversion of adjusted EBITDA in 2024-2026.

UBER are now at a stage where heavy marketing is not necessary as the platform essentially does the work for them. Looking at the FY23 year, 31% of first delivery orders came from the mobility app, whilst 22% of rides came from the delivery app.

UBER also has recently set up a successful membership program called Uber One which is just another competitive advantage.

Advertising has also taken off recently generating $1 billion in revenue with 550,000 advertising merchants (up 75% YoY).

The amount of opportunities going forward for UBER are more than any other company I know. There’s Uber Direct, Travel (plane tickets, coaches, car hire), etc. They can essentially become the default choice for the movement of anything (people and things).

Graphic

10. Telefonica Brasil (VIV)

Introduction

Telefonica Brasil is a mobile telecommunications company in…you guessed it…Brazil.

It’s offers local, domestic, and international long-distance communications and internet access through 3G, 4G,4.5G, and 5G as well as roaming services. On top of this, they offer TV services, data services, and broadband as well as other smaller sectors outside this core offering.

Numbers

3-Yr Revenue Growth: 6.5%

FCF Margin: 19.2%

ROIC: 6.7%

FCF Yield: 12.6%

Gross Margin: 47.5%

Net Margin: 9.7%

Brief Investment Case

Telefonica Brasil is one of the most defensive, income-focused investments on this list whilst still providing a solid diversification into Brazil which I deem a good idea.

Telefonica Brasil has become a cash flow giant with EBITDA expansion and CapEx intensity reduction leading to free cash flow increasing +10%.

Mobile communications makes up ~70% of total revenue, however Telefonica are focused on diversifying their revenue. They’ve introduced a financial services sectors (growing at 36% YoY), smartphone insurance (growing at 20% YoY), as well as a consumer electronics division.

Graphic

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I have quite a few shares of Uber in my portfolio. I'll add these four points to your investment case:

1). Uber announced a $7b buyback program in Feb. (kinda suspicious as it's still a growth stock but what the hell, if they want to hike the stock price, I'm in)

2). There's large institutional interest. It was obvious even last year (I saw persistent accumulation over several months), then Uber became part of the S&P 500. Which means more funds must buy and hold it. Nasdaq.com shows that BlackRock and Vanguard increased their hldings of Uber by 30%+ last quarter.

3). There are Uber Eats ads here in Germany. I was in Romania last week and saw tons of taxis sporting 'Uber', the same in Brazil, Czech Republic, and a few other countries. I've used Uber myself and liked it.

4). The CEO isn't a rookie. He's got a solid background in business. Must be the reason Uber did far better than Lyft during the pandemic by expanding its business to delivery.

Some very interesting stocks in there. I was not familiar with Cadence and VIV, yet.