2026 Portfolio, Ideas, Themes, & Thoughts

I hope everyone had a nice break over the holiday. I spend the year following the markets on a daily basis so it’s nice occasionally to sit back, refresh, and reset for the year ahead. I will be back to my normal daily schedule from now on.

I thought now was a perfect time to start the year off with a lengthy post about my current positioning, my thoughts going into 2026, and the themes I’m focused on for this year.

2025 was a solid year for me in the markets and here on Substack. I ended the year up 47% (vs the SPY which was 16% and QQQ which was up 20%). I also ended the year with over 500 paying subscribers (up from less than 75) at the start of the year so there’s been great growth here as well and that’s ultimately thanks to all of you who follow here. I will continue to strive to build the best, and cheapest service to the masses here and hope soon to take this fulltime.

So before we go on, I want to just say a huge thank you to all of you on here. I strive to educate, to provide ideas, to challenge, and to converse with as many of you as I can. Without your reading, commenting, and sharing, none of this would have been possible so far.

Overall, I’m happy with 2025. There are some themes I missed or didn’t buy into as aggressively as I should have but when your cash pile is finite you unfortunately have to pick and choose, and I chose big investments into LMND which paid off nicely.

Paid subscribers will note (when my spreadsheet is released tomorrow) that I added a nice bit of cash to my portfolio to start the year. This will allow me to take advantage of some more opportunities. I may add some more cash in Q2 or Q3 as well because my ultimate aim is to get my portfolio to a size where selling options make sense which will give me some more options to hedge or build some new strategies. I will of course share this with paid subs when I get there but I don’t think my current portfolio size of ~$250k makes sense to start selling options.

In this article:

The 2026 Portfolio

My 6 Biggest Positions

Stocks I am Interested to Add in Q1

Stocks I am Interested to Buy in Q1

Big Themes I am Interested in for 2026

My Thoughts on the Macro

Takeaways

The 2026 Portfolio

As paid subs already know, I’m a big believer in concentration which is why my top 6 positions make up ~50% of my core portfolio which now has 30 stocks in it. I’ll be going over those 6 positions in this article, as well as those stocks I want to focus on increasing my position size in considerably.

Big position sizing makes complete sense to me. I know some people may argue that I am over diversifying with 30 names in the portfolio but when you look at the position size it makes sense. If I was equally weighted across all 30 stocks then I’d more or less be indexing and be wasting my time with all of this research, but I’m not. Many of the smaller positions in my portfolio are either:

Stocks I only recently bought into and want to aggressively buy in 2026 or

Stocks that I think are much higher risk higher reward and hence don’t want to bet a huge portion of my portfolio on.

I also have around $11k in my swing trade portfolio. These are also slightly higher risk higher reward plays where my aim isn’t to ultimately hold long term, but it’s instead to get a fairly quick 50-100% gain from them. I’ve done fairly well on companies like ONDS (+157%) and SES (+56%) for example. My holding period aim on these is probably less than a year whereas stocks in the core portfolio I aim to hold for 3-5 years or so.

In 2026 I want to put an increased focus on this swing trade portfolio and slightly increase the position sizing here, and potentially even introduce some options strategies. Perhaps take more risks. I’m still fairly young and don’t have a multi-million-dollar portfolio yet so my main aims are capital gains rather than capital preservation. With that being said, I’m well aware of the risks and will only take bigger risks when it makes sense to me.

My 6 biggest positions

Lemonade | LMND

This is my largest position so far with a cost basis of $37 making Friday’s close price of $76 a 100% gain so far. I have absolutely zero intention of trimming or selling anytime soon and long term I suspect todays price of $76 would be a very good cost basis. I’m a big believer that the next stage of big winners will be those AI application companies who use AI the best. I have no doubt at all that LMND will be one of those companies.

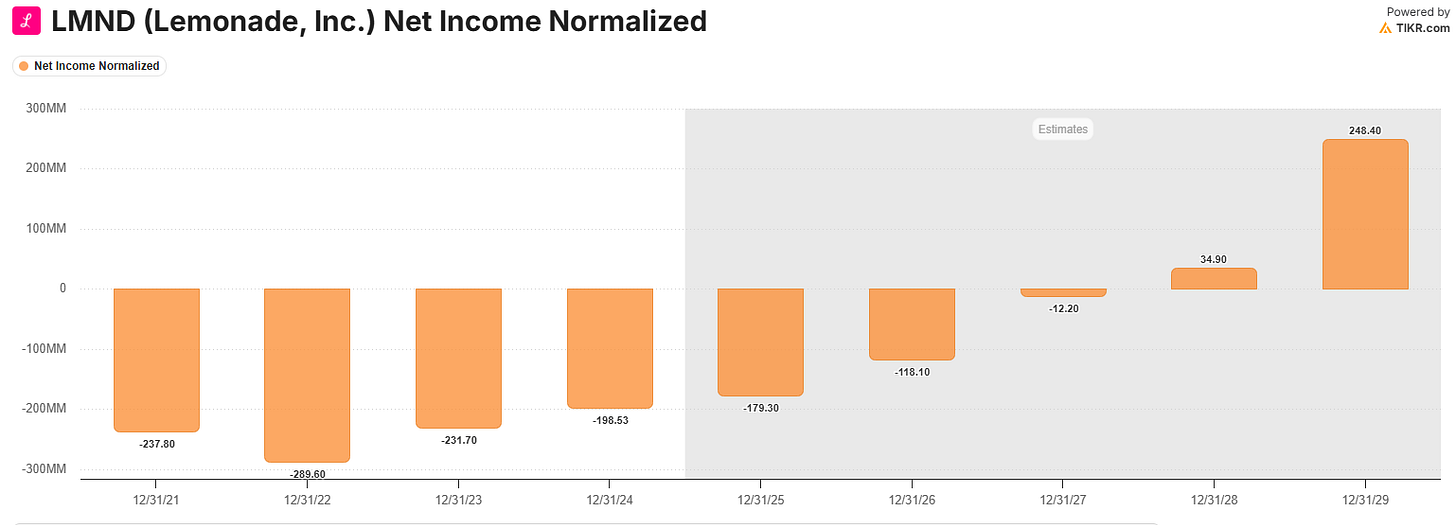

I see bear arguments all the time about LMND’s profitability. Look at the trends. It’s clear the business model is working so far. If you still think LMND is just an unprofitable insurer then you need to understand that LMND is in the process of significantly ramping up growth spend to acquire more customers. Of course in the short term that hinders profitability but the value creation over a +5 year period will be substantial. The underlying business is growing great and I’m in it for the long run.

NuBank | NU

This is my 2nd largest position and has been up there in my portfolio for quite a long time. NU has some of the best unit economics globally out of all fintechs. In fact I can’t really think of another fintech anywhere near to them. So based on that alone I think the opportunity for them to be a steady compounder for years is clear. NU also offers a very nice bit of diversity to Latin America which I am very bullish on. My portfolio is very geared towards the US market and I think the emerging markets are due a nice run.

UiPath | PATH

PATH very rapidly became my 3rd biggest position over the last 2-3 months. See why here 👇

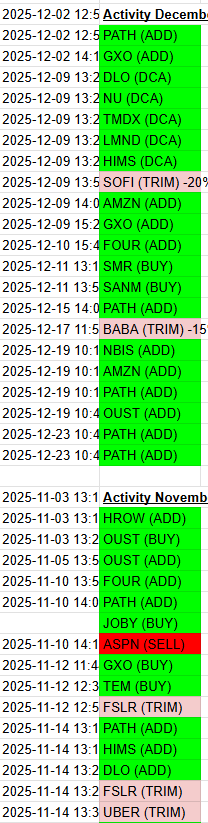

Here’s my timestamped activity from my spreadsheet (paid subs get access). You’ll see PATH was probably by far the most regular buy. This also is only November and December. I first bought PATH in early September.

UiPath (PATH) Deep Dive & Earnings Review

Here’s my PATH Deep Dive & Earnings Review 👇Make Money, Make Time is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

TransMedics | TMDX

The end of December was very strong in terms of flight numbers so I suspect we will see just above $600M for FY25 which will equate to between 36-38% growth. This will depend on 3rd party flight data mix, DCD/DBD mix, and a couple other data points. I suspect from here we see ~22-24% growth in FY26 which could put us upwards of $744M in revenue on 25% EBITDA margins meaning we could see $186M in EBITDA.

That would be 24% increase in EBITDA making the 28x EBITDA multiple today fairly high, but not too bad. MedTech peers like ISRG trade at 42x EBITDA for ~half of the growth. I’m probably not going to add much to TMDX at current prices. I just see more potential in PATH, LMND, AMZN, ZETA for example and other smaller positions but I still see some very strong growth (and recession proof growth) for TMDX ahead.

Zeta Global Holdings | ZETA

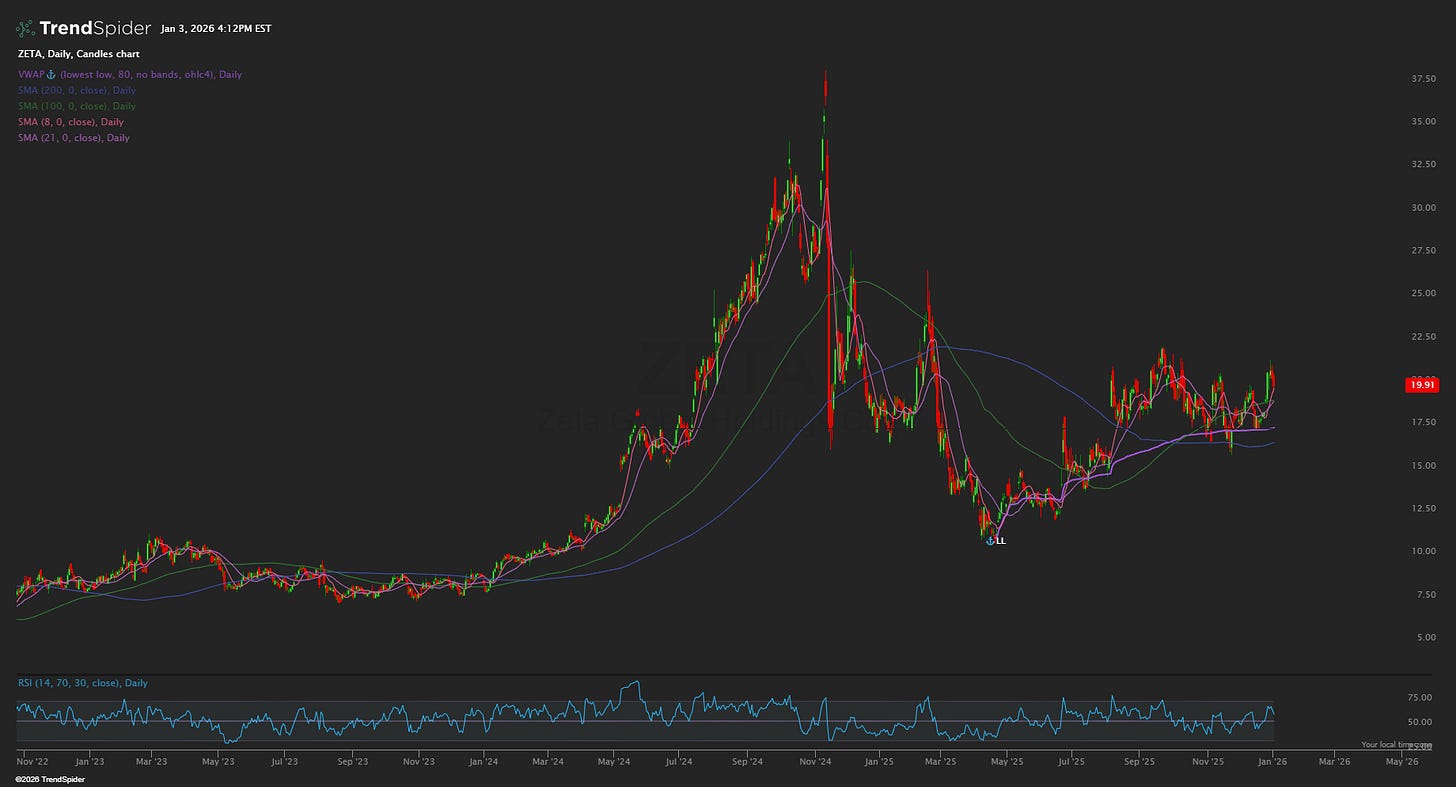

Current analyst estimates suggest ZETA could do 34% growth in FY26. With this growth we have a stock trading at LESS than 3x NTM sales. There’s also a good chance we see more than 34% growth as long as the macro remains strong. Note that management often sandbag guidance.

We also have GAAP profitability likely to happen too. That is likely priced in for now but inflection points like this almost always start to appear within institutional algorithms and when that happens with ZETA we will no doubt see some more strength.

Amazon | AMZN

This is a name that I won’t be a 2-3x multi-bagger but it will be a name that allows me to sleep well at night if the macro turns bad. It’s not moved over the last year, yet AWS is growing incredibly fast, and robotics is set to increase operating margins substantially.

Here’s a very brief rundown of how I view AMZN. I’ll dive deeper into this over the next month:

Digital Ads: FY25 revenue is $70B with operating margins ~50%. With forecast revenue on digital ad spend set to hit $1.5T by 2030, and AMZN’s 12-15% share in the market, this is easily a $1T opportunity over time with 25x EBIT margins.

E-commerce: McKinsey estimated by 2040 that the international e-commerce market will be worth between $14T-$21T. If we take a midpoint ~$17T and use their international market share ~15%, GMV could quite comfortably hit $2.55T by 2040 (only a CAGR of 8%). Assuming a take rate of 25%, we have revenue potential of $625B. With margin expansion through robotics and delivery network optimization, FCF margins could hit ~8-10% which puts FCF at $60B. Based on a 40x FCF multiple (lower than COST and WMT), I think AMZN e-comm can hit $2.4T valuation.

AWS: US Cloud is expected to grow to $2.3T by 2032. The current revenue run rate is $132B with 20% YoY growth. Peers trade in the 10-15x sales range which is fair for AWS growing at 20% with elite margins. 10x multiple puts them at $1.3T and 15x puts them just under $2T.

This isn’t including Project Kuiper, Zoox, Twitch, etc.

I’m not going to name the other stocks in my portfolio now. That’s for paid subs but you’ll see some more names below here in the next section.

Stocks I Am Interested to Add in Q1

There are some stocks in my portfolio with a weighting ~2-3% (and even lower) that I am very keen to buy into heavier in Q1 2025. I’ll list 3 of them here:

Ouster | OUST

One of the themes I’m most bullish on in 2026 onwards (as are a lot of people) is physical AI. The opportunities here are set to be huge. Jensen has said he’s looking at a multi-trillion dollar opportunity. Elon has said Optimus alone could be the highest value product of all time.

I released the below article for free last week. It’s a full breakdown of the entire robotics ecosystem from the frontier plays (like OUST) to the backbone providers (RRX, CGNX etc).

One of the most inevitable themes for me is LiDAR and the strongest company by far in that theme is OUST. I currently own a very small position in OUST (0.9% of portfolio) but this is one I want to aggressively build in the near term. We’ve bounced off the 200 daily MA 3 times since November so that’s giving some nice confidence that this is a near term bottom.

NuScale Power | SMR

SMR has been one of the most mentioned names to my paid subs in the backend of 2025. I was following price action almost on a daily basis until it broke my buying zone and started to fall sub $15 until the very bullish (+15%) day on Friday 02/01/2026.

That jump on Friday isn’t enough to give me confidence to add to my position, but it sure is a nice start. SMR remains a very high risk play since it’s still pre-revenue, hence why valuing it isn’t easy, and hence why I’m very picky about some nice technical entries.

Nevertheless, I do believe that if SMR are able to realize some revenues from massive Tennessee Valley Authority (TVA) deal then SMR is a 3-5x opportunity. This is currently the single most critical narrative for SMR’s stock because it represents 6GW of power. With mandates to decarbonize, and the region needing massive power for data centers, SMR is currently the only certified small modular reactor which makes this a solid bet. However, TVA are cautious, and slow. This decision could quite easily be extended through to 2027 which could pressure a catalyst driven stock like SMR.

Nebius | NBIS

I missed the first wave for NBIS, but I managed to get in at a nice level with an average cost of $85 after the NBIS pullback from $140. Neoclouds are inherently a bit riskier but the numbers for NBIS offset that risk quite nicely. Currently trading at ~1.8x Fwd ARR with ARR expected to grow 8x over the next 12 months.

That’s insanely cheap.

Stocks I Am Interested to Buy in Q1

Again, I won’t list all the names I’m interested in here but here’s a list of some plays I’m watching quite closely:

ABAT above $3.75

AMPX ~$8

VIAV ~$14

ASTS

Big Themes I am Interested In 2026

In January and February of 2026, I’ll begin building a very comprehensive list of themes like I did with Robotics and Optics in December 2025.

This is just the start. I’ll be building this comprehensive list over the coming weeks and adding all stocks mentioned to my Investing Universe that paid subs have access to.

From there we essentially can track every stock in every theme we are bullish on and it’s all ranked and rated by valuation vs growth which is a nice metric I use to screen out some of the best plays.

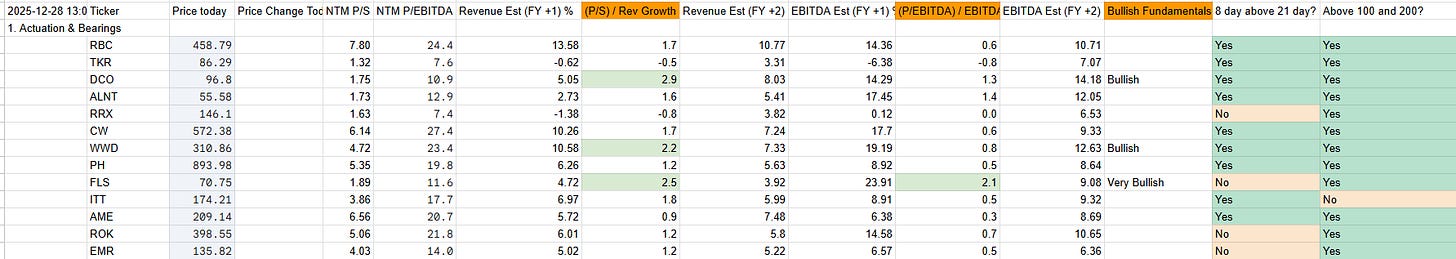

Here’s a snapshot of the Investing Universe for Actuation & Bearings on the Robotics tab of my spreadsheet.

Think something like this would be useful? Get it easily for $16 a month. Prices will be going up in February.

Here’s some more themes you can expect from me over the next month or so. There’s many more to add though so stay tuned.

Indium Phosphide Bottleneck

Copper cables can no longer transmit data fast enough or far enough without melting or losing signal. The main solution is optical interconnects (fibre optics). To send data over fibre you need a laser which is where Indium Phosphate comes in. It’s the only commercially viable material that can generate laser at the speed and thermal efficiency required by hyperscalers.

Here you’ve got the big players that we spoke about in our optics piece:

Optics: The Next Big Theme & The Best Stocks Today

Hi all👋Make Money, Make Time is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

And we’ve also got a very niche upstream player called AXT (AXTI) which gives you exposure to the raw material itself. They have significant operations in China making this highly sensitive to US-China export controls but the upside potential is huge.

AI Applications

You’ll note that a good portion of my top positions fall into this category. The numbers are too clear to ignore.

For the last 3 years of the bull cycle, the market has rewarded the CapEx cycle. The NVDA’s etc. I expect the next cycle in 2026 onwards to reward the companies applying models to specific verticals (Insurance, Marketing, Logistics etc). Those companies who have the highest revenue per employee will start to pull away from the pack. It’s the fundamental reason I am so bullish on LMND and why ZETA is a huge position as well.

Space

The space trade isn’t anything new but most often the best trades are sometimes the most obvious trades. The space economy has now shifted from a government funded project to a scalable industrial sector with many layers to the ecosystem. I currently own one space stock in my swing trade portfolio (SPIR) which I’m currently down 27% on. There are many other stocks I’m interested in though. ASTS is likely the main one.

Insurance Marketing

Insurance Marketing is effectively the “Fintech for Customer Acquisition” - these companies operate the digital marketplaces and data exchanges that connect high-intent consumers with carriers. A prime example is how PGR utilizes these platforms. Whilst PGR spends billions on ads to build brand awareness, they also rely heavily on marketing partners to capture the actual transaction. When a user searches “cheap insurance” they often land on comparison sites. These are the sites that auction the high-intent lead in real time. PGR then bids on that specific user data because their internal algorithms predict a higher LTV.

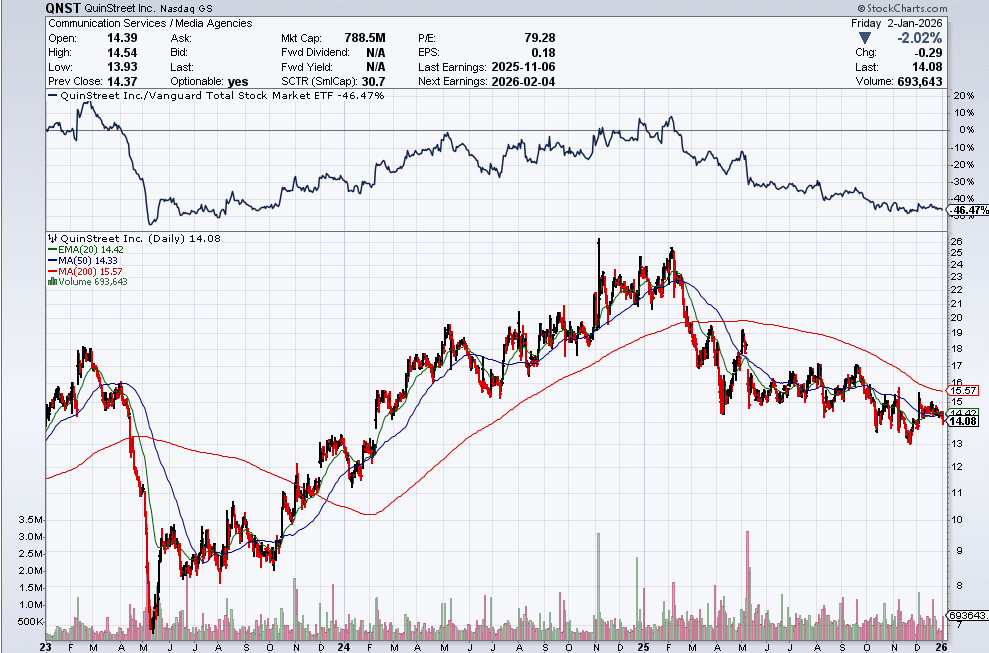

There’s been some very bullish forecasts for this market with growth upwards of 35% CAGR through to 2029 as the shift from profit preservation to market share grabbing begins a new cycle. We’ll be looking into plays like QNST, TREE, EVER, and MAX.

My Thoughts on the Macro

As I’ve said throughout the entirety of Q3 and Q4 2025, I remain bullish on the macro. I think rates will slowly come down and AI will continue to improve earnings and hyperscalers CapEx remains high. The other obvious side to this is that it’s extremely rare to see 3 years of pretty extraordinary SPY returns (2023: 26%, 2024: 25%, 2025: 16%). Aside from back in 2019-2021, this growth hasn’t really happened since the late 1990s so we just need to be aware of that.

Technically, we’re no doubt still in a bull market, but there’s no doubt momentum has been slowing a bit. We’re struggling to make new highs, but we’re also making higher lows over the last month. As long as we stay about the 100 daily ~667 I think it’s very hard to switch to a bearish bias. Even then, I’d be more bullish but obviously slightly more cautious.

In terms of my exact estimates for 2026 - it’s very hard to say. Many investment banks are throwing out SPY targets ~7,600+. I think that’s completely feasible but we do need steady inflation and some more positive unemployment data than we’ve been seeing. I suspect earnings growth will continue and that’s the backbone of what keeps me bullish on the wider market.

Anyhow, I am no macro expert. My ultimate goal is to build a portfolio that performs very strongly in a continued bull market and holds up better than many in a bear market. That’s why AMZN is becoming a very big position. That’s why I bought into SVM and ALB. That’s why my cash pile is now +10% of my portfolio. That’s why I am very picky with entries and why I only add to positions when I think multiples are already very compressed. I will continue to do just that and try to ignore the macro noise as much as possible.

Takeaways

Portfolio management is completely personal. My strategy should not necessarily be the same as your strategy. It’s all dependent on your financial position in life and what you want out of your portfolio.

For me personally, I am in a stage of slightly higher risk, higher beta investing to aim to get my portfolio to a place where I can make meaningful income from options selling whilst also aggressively still betting on companies I have high conviction in. Once I reach a stage where my portfolio is upwards of $5M then my strategy would be completely different to what it is now. For now, I’m still young, aggressive, and have big goals.

With that being said, I try to cater to many different investment styles. I say it a lot to my paid subscribers, but there’s many times per day where I mention a stock but have no interest in adding it to my portfolio. I mention it because I think it could help some people in a slightly different situation to me with different investment goals.

One example of this is UBER. I actually used to own UBER until Q3/Q4 2025. I gained ~30% on it with a $2-3k position. I know that position size is less than many here, but that’s exactly why for me, I sold out. Did I think UBER would 2-3x from here? No. So, for my personal goals of capital accumulation a 30-50% gain on a $3k position would do nothing for me.

But would a solid, high FCF growth company with potential to increase 40% be a very good investment for someone with a $1M portfolio? Much more likely. Hence why I like to talk about these stocks as well.

For me personally, I’m betting big on LMND, PATH, ZETA, NU etc and some more that I have mentioned here and will only mention to paid subscribers. Just to remind you, I offer a $16 per month service where I:

Give you my detailed (+15 tabs) spreadsheet with +200 stocks on, my portfolio, my watchlist.

Give you my valuation models for my top positions

Write daily notes (~5-20 messages per day on average)

My prices will be going up in February. Give it a go now for just $16 a month. I suspect you’ll find great value in it.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Solid breakdown on the AMZN position. The robotics piece for ecommerce margin expansion is probablythe most underappreciated angle right now. I've been tracking some of the automation rollout in their fulfillment centers and the operational leverage they're building is pretty wild. Once that compounds over theri massive scale, the incremental FCF from just shaving a few percent off logistics costs could be substantial. The way this ties into your physical AI theme with companies like OUST makes alot of sense too, since the infrastructure layer benefits first before margins trickle down to pure-play automation providers.

Great overview, thanks. A name I've stumbled on that you should check is Aeluma. New technology that is en route to be game changing. The most significant technical advantage of Aeluma is their ability to grow high-performance compound semiconductors (specifically InGaAs—Indium Gallium Arsenide) directly on large-diameter silicon wafers (12-inch/300mm).

The Problem: Normally, SWIR sensors are made on small, 3-inch or 4-inch Indium Phosphide wafers. This makes them expensive, hard to scale, and difficult to integrate with standard computer chips.

The Solution: Aeluma uses a proprietary process to put that high-performance material on massive silicon wafers used by giant factories (like TSMC or Intel). This leads to a 10x reduction in manufacturing cost and allows for mass-market production that was previously impossible.

And they have more breakthroughs!