The Entire Space Ecosystem

The industrialization of space has always been a huge goal. Whether that be because of defense, rare earths, mining, communication, or connectivity etc, the space economy was always going to be a massive opportunity. For the most part of my investing career so far, it just seemed such a distant goal. But not anymore.

“The first trillionaire there will ever be is the person who exploits the natural resources on asteroids.”

It’s been an incredible theme to invest in over the last year, but I see this theme being a 10-20 year story rather than just the past year we’ve had.

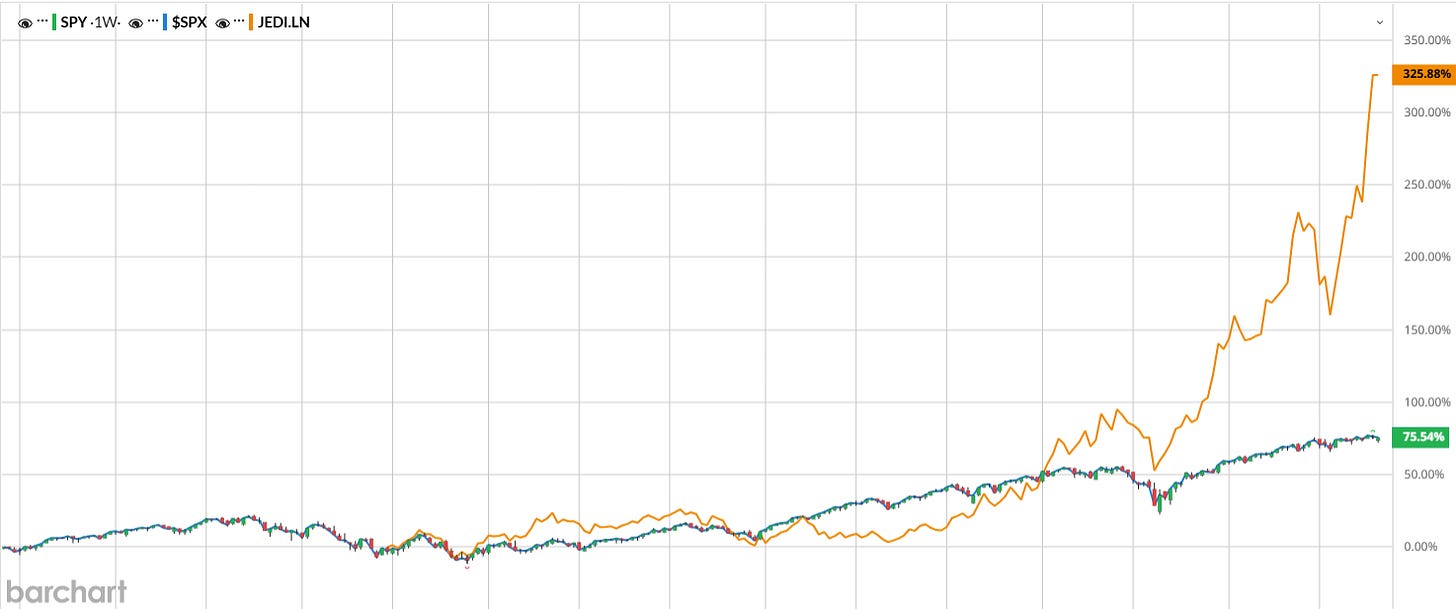

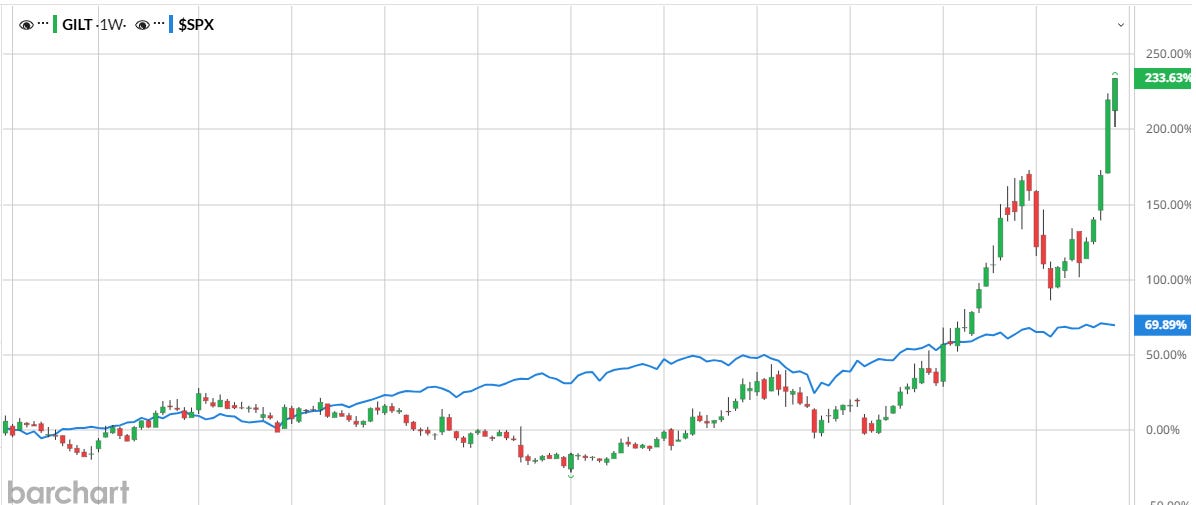

Vaneck Space Innovators Ucits ETF: +132% over the last year

SPY: +13% over the last year

With the collapse of launch costs, expanding satellite constellation, and huge private sector innovation, approximately $55B poured into the industry in 2025. With the end applications becoming ever clearer (climate monitoring, global connectivity, national security etc), governments and enterprises are racing the capitalize on the opportunities.

Big picture, the space economy is projected to hit ~1.9T-$2.0T by 2035 and $10T by 2050 (compared to $613B today) making this one of the fastest growing niches to be involved in. In this article, I’ve broken down the key players within the entire ecosystem just like I did with my robotics and optics pieces.

From here, I add all these stocks to my spreadsheet which paid subs have access to. This spreadsheet uses a few criteria to spit out whether I should be bullish or bearish on the stock, and from there I decide whether it’s worth diving deeper into the company.

The narrative here for the stocks is not a deep dive. It’s very brief introductions and a quick look at valuations. Please also note that there’s currently a lot of crossover in the space economy so breaking it down by segment of the ecosystem is not that easy. You’ll see the same stocks listed a few times.

I’ve broken this article down into the Infrastructure Stack and the Applications stack. Here’s the plan:

The Infrastructure Stack

Launch Services

Stocks To Invest In

In-Space Mobility & Logistics

Orbital Tugs

Refueling & Life Extension

Stocks To Invest In

Propulsion Systems

Stocks To Invest In

Communications

Stocks To Invest In

Power Generation Systems

Stocks To Invest In

The Applications Vertical

Earth Observation / Data Services / Analytics

Stocks To Invest In

Cislunar & Deep Space Economy

Stocks To Invest In

Defense / Golden Dome

Stocks To Invest In

If you want real time updates from me throughout the week then consider becoming a paid subscriber. Definitely worth a try for a month and if you don’t like it you can cancel. I suspect you’ll find far more value in it than $16 a month though.

With it you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet. One of the most in-depth and helpful resources out there.

Access to the paid chat where I send ~5-20 messages per day.

Real time buy, add, trim, and sell alerts.

The Infrastructure Stack

As with any new innovation, the infrastructure buildout phase is always Phase 1. We’ve seen this in the space economy too with huge capital flooding into this layer and rapid expansion that often will span about a decade before applications can fully mature within the infrastructure.

Today, this stack is the foundation that acts almost as a multiplier for downstream industries which we’ll see far more off over the next decade. I think for the next 5 years though the infrastructure layer will be the most important theme to follow within space.

Launch Services

This is pretty much the very foundation of the entire space economy. Without it, nothing gets past the Earth’s atmosphere. As with anything though, this layer has undergone a huge shift with reusable technologies now slashing launch costs from over $10,000 per kilogram to under $1,000 today. This has led to more access for more players, and therefore a huge increase in the number of orbital attempts YoY.

This isn’t the fastest growth layer within the ecosystem, but the estimated CAGR still sits just above 20% for the next 5 years.

Launch Services Stocks to Invest In

Rocket Lab | RKLB

Virgin Galactic | SPCE

L3Harris Technologies | LHX

Firefly Aerospace | FLY

Boeing | BA

Northrop Grumman | NOC

Lockheed Martin | LMT

Here’s 3 in more depth:

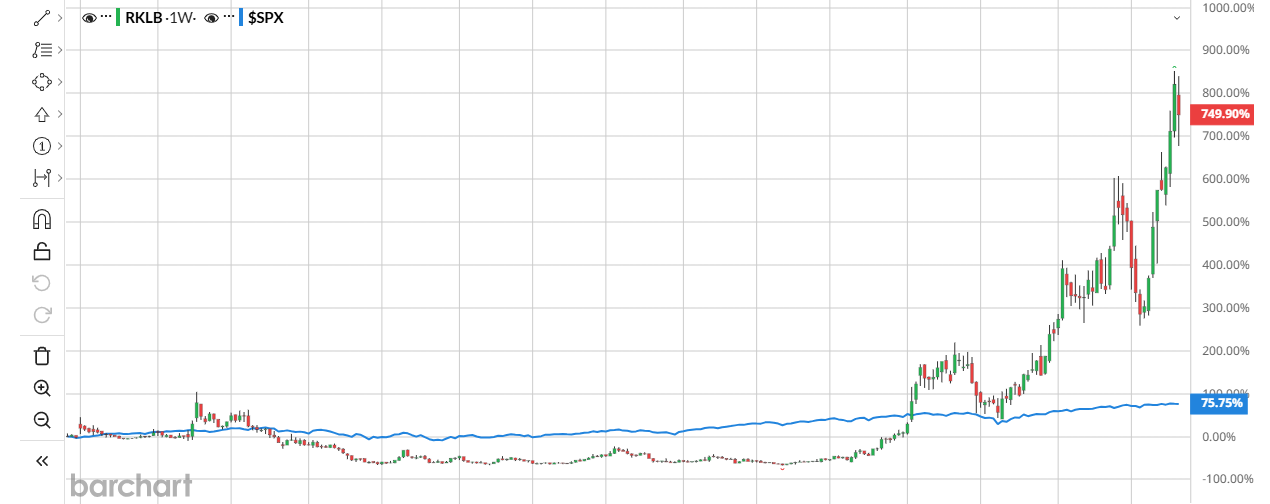

Rocket Lab | RKLB

It’d be impossible not to include RKLB as a favorite in this niche seeing as they’re almost a critical company in national security today. It’s worth noting here that RKLB isn’t just a launch service now although this is the longstanding, reliable part of the business. The Space Systems segment of the business is the high growth engine today.

The downside to RKLB is the valuation is very high at 60x NTM sales. To justify this kind of multiple, I’d like revenue growth rates in the 50-75% range which RKLB is currently just below as per analyst estimates. Therefore, on traditional metrics, I don’t think RKLB comes up that good anymore at today’s valuations but there’s been many instances over the last 2-3 years where valuations have remained stretched for far longer than many think and RKLB may be no different.

Valuation:

NTM EV/Sales: 60.3x

2026 Expected revenue growth: 51%

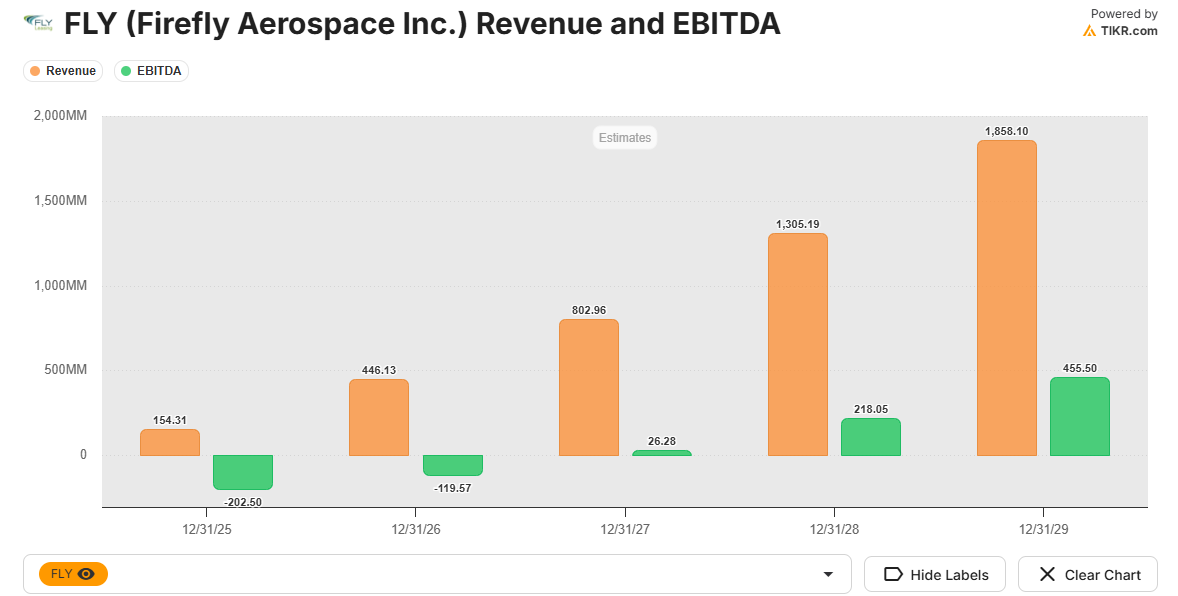

Firefly Aerospace | FLY

I think FLY is probably my favorite within this basket though it remains way down from IPO price. I see this happen all the time and that’s one reason I’m very hesitant to dive deeper into FLY today. I like to wait at least 1-1.5 years post IPO before even considering an investment and FLY only IPO’d in Aug 25.

If you’re more comfortable investing shortly post IPO’s, then a 11x NTM sales multiple for 190% expected growth in FY26, the hiring of an ex-BA as COO, and FLY’s partnership with NOC are all signs that this is worth a look into.

Valuation:

NTM EV/Sales: 11.9x

2026 Expected revenue growth: 189%

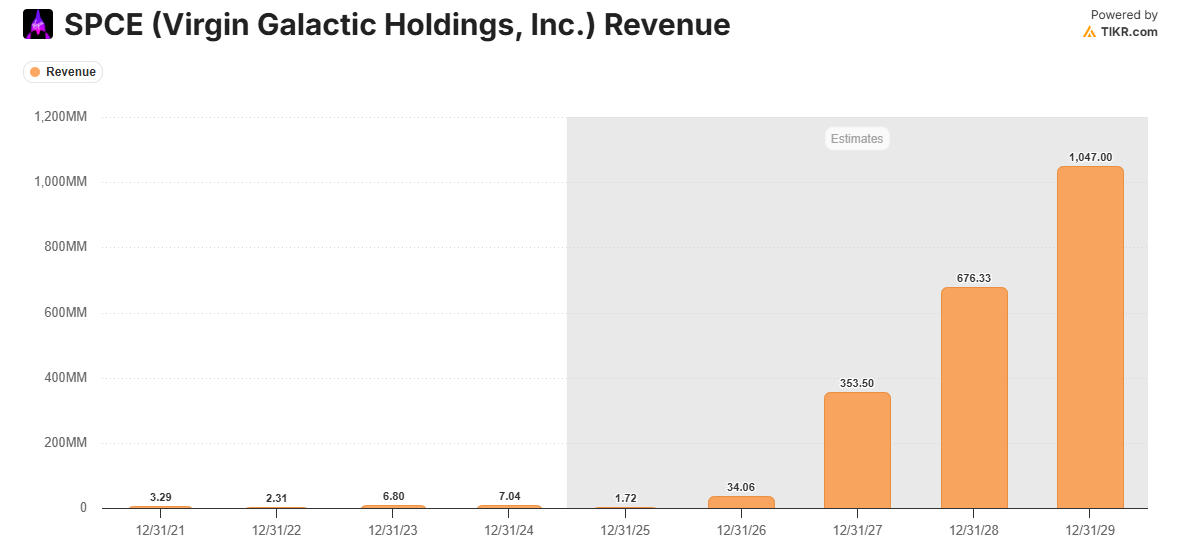

Virgin Galactic | SPCE

SPCE is by far the riskiest of the list here. They’re also in the niche of suborbital launches for tourism and research rather than what RKLB does for example.

I’d put it in the basket off potentially huge upside from $200M market cap today, but if much goes wrong then it could be a huge loser. Cash burn is still high. They’ve still yet to prove much. Share dilution will be massive.

Aside from that, SPCE have now completed their facility in Arizona and assembled their first Delta Class. Management have guided that 2 Delta spaceships could generate $450M in revenue and $100M in adj. EBITDA which analysts currently aren’t expecting until FY28, slightly later than management are suggesting. This alone could cause quite a big re-rating.

Being very optimistic, SPCE will hit $1B in revenue by FY28/29 (after Delta #3 and #4 are launched). With a 20% FCF multiple which is estimated by FY29, and a fairly conservative 8x FCF multiple, we could hit a $1.6B market cap by FY29 which would be a huge return from $200M today. The big risk is that cash runway, and share dilution makes this return pretty small though.

Valuation:

NTM EV/Sales: 36.1x

2026 Expected revenue growth: 1,879%

In-Space Mobility & Logistics

This layer essentially represents the movement, servicing, and sustainment of assets in orbit and beyond. As more and more satellites go up, and more satellites become serviceable (rather than disposable), the necessity for the following increases:

Orbital Tugs:

Refuelling:

The space logistics market currently only sits at ~$7.5B but it’s projected to hit ~$18B by 2030 which is a 29% CAGR. The big driver here is that in-space logistics goes far beyond LOE, and into cislunar and other planetary logistics operations where tugs and transfer vehicles ferry loads to lunar outposts, or elsewhere.

Mobility & Logistics Stocks to Invest In:

Momentus | MNTS

Rocket Lab | RKLB

Northrop Grumman | NOC

Lockheed Martin | LMT

Intuitive Machines | LUNR

Redwire Corporation | RDW

Here’s 3 in more depth:

Redwire Corporation | RDW

RDW provides AI driven robotics, docking mechanisms, and general sustainable logistics for commercial and defense applications. They’re carving out a very good share in the cislunar niche too.

Paid subs will know that I recently added RDW to my swing trade portfolio here as a small position that I am looking to build on. I’ve put a lot more narrative in the paid chat on this one.

Valuation:

NTM EV/Sales: 5.5x

2026 Expected revenue growth: 43%

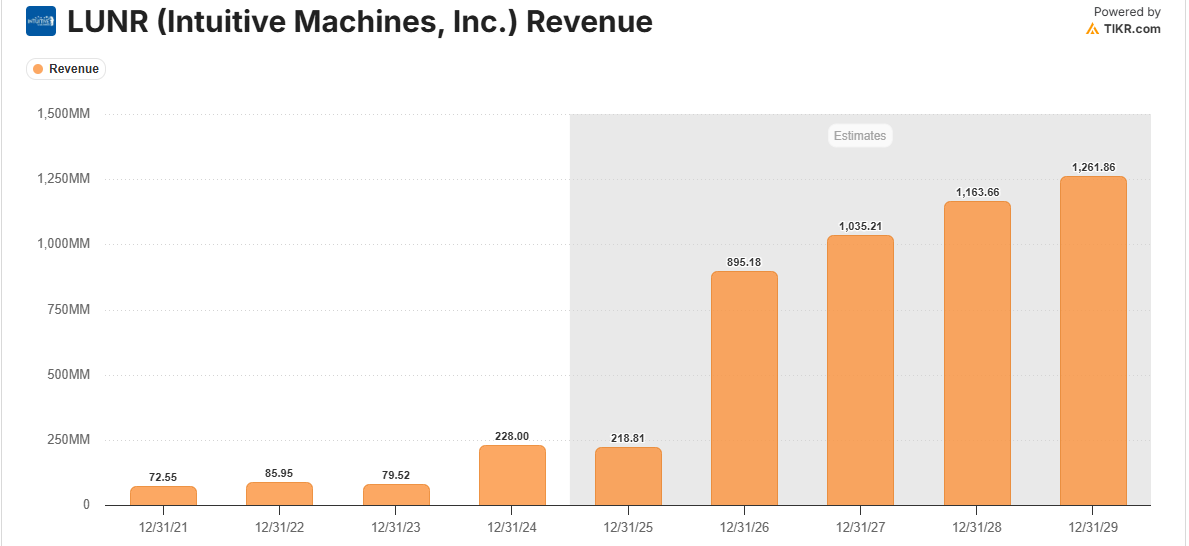

Intuitive Machines | LUNR

LUNR operate mainly in cislunar and lunar mobility, leveraging its lunar lander (Nova-C) to deliver satellites, scientific instruments, and other cargo to the Moon’s surface. LUNR also offers infrastructure-as-a-service for lunar navigation, maintenance, data collection, and system monitoring.

LUNR recently acquired Lanteris Space Systems, hence the huge jump up in revenue expected in FY26. Most importantly, LUNR acquired Lanteris at 1.3 P/S which in this niche is extremely cheap and essentially almost added value instantly to the LUNR stock which trades at 3.9x NTM sales.

If LUNR hits $1.3B in revenue by FY29, that would be a 13% CAGR (post-acquisition) which is deserving of a multiple in the 4-6x range I think depending on a number of other factors of course. $1.3B in valuation * 5x (midpoint) then makes LUNR a $6.5B company vs $4B today so there’s nice upside here dependent a lot on share dilution though.

Valuation:

NTM EV/Sales: 3.9x

2026 Expected revenue growth: 309%

Momentus | MNTS

MNTS is a tiny $13M company that I wouldn’t normally talk about but it’s one of the few purer plays here aside from LUNR and RDW (and then the big defense primes I listed above). This is of course a hugely risky play but with such low float, there’s potential for some positive catalysts to take this one up a lot.

MNTS provide orbital transportation through its Vigoride orbital transfer vehicles which function as space tugs for last-mile satellite delivery, repositioning, and deployment in LOE. As of late, they’ve secured key contracts with NASA for advanced materials production missions so they’re a serious player in this niche…yet only trade for a $13M market cap.

Valuation:

NTM P/S: 6.1x

2026 Expected revenue growth: 151%

Propulsion Systems

Propulsion systems serve as the powerhouse of the stack delivering the thrust and energy required to propel vehicles from Earth into orbit and move them around space. This layer has evolved a lot recently from chemical rockets to advanced electric, nuclear, and hybrid variants which has slashed fuel needs considerably reducing the need for refueling.

Propulsion Systems Stocks to Invest In:

L3Harris Technologies | LHX

Curtiss-Wright | CW

Howmet Aerospace | HWM

Northrop Grumman | NOC

Lockheed Martin | LMT

RTX Corporation | RTX

Boeing | BA

There’s really no pure play stock within propulsion, but of this list here’s where I think the best opportunity lies from a general space ecosystem overview:

Lockheed Martin | LMT

Based on NASA contracts and DoD programs, LTM currently stands out slightly from the crowd above when talking about how entrenched they are in the space ecosystem. This is one of the most stable bets on space you can make, though of course it won’t be a rapid gainer at a $137B market cap today.

I do think the stock has ran quite a lot though relative to other defense and aerospace players and I think the next leg up will be quite reliant on a big defense or aerospace win, potentially within the Golden Dome project for example. I’d position LMT as one of the leading players to win a contract like this, but the valuation today is quite reliant on that win.

With that being said, let me caveat it with the fact that it appears the DoD and Pentagon award contracts pretty evenly amongst the big defense primes (LMT, NOC, and BA) so this LMT edge that I see today could be quite easily evened out.

Valuation:

NTM P/E: 21.6x

NTM P/FCF: 21.6x

Communications

This simply forms the network that connects orbital assets to Earth and each other, essential for broadband internet, real-time navigation, defense operations, and much more. This is probably the infrastructure layer that has the most potential in my opinion and the forecasts back this up with a market estimated to be valued at $225B by 2033 (offering 13% CAGR from today).

The innovations within this layer are endless. I’m going to structure this section slightly differently as I want to touch on a few more stocks that are driving the most innovation here.

We are moving away from proprietary satellite phones to standard smartphones connecting directly to satellites. This gives you ~5B mobiles who currently lose signal in “dead” zones. This is where ASTS comes in.

GEO (Geostationary Earth Orbit) and LEO (Low Earth Orbit) are both now very necessary. Defense and enterprise customers demand networks that can switch between both GEO and LEO seamlessly. This is where VSAT and SATS comes in.

The bottleneck ultimately sits at the ground layer. Old mechanical dishes on the ground cannot move fast enough to track thousands of LEO satellites which is where Flat Panel Antennas have come in that use microchips to steer the beam electronically in milliseconds. The players here at GILT and SATX.

Communications Stocks to Invest In:

Iridium Communications | IRDM (discussed in robotics piece)

AST SpaceMobile | ASTS

Viasat | VSAT

EchoStar Corporation | SATS

Globalstar | GSAT

Gilat Satellite Networks | GILT

SatixFy Cimmunications | SATX

Comtech Telecommunications | CMTL

Telesat Corporation | TSAT

Here’s 2 in more depth:

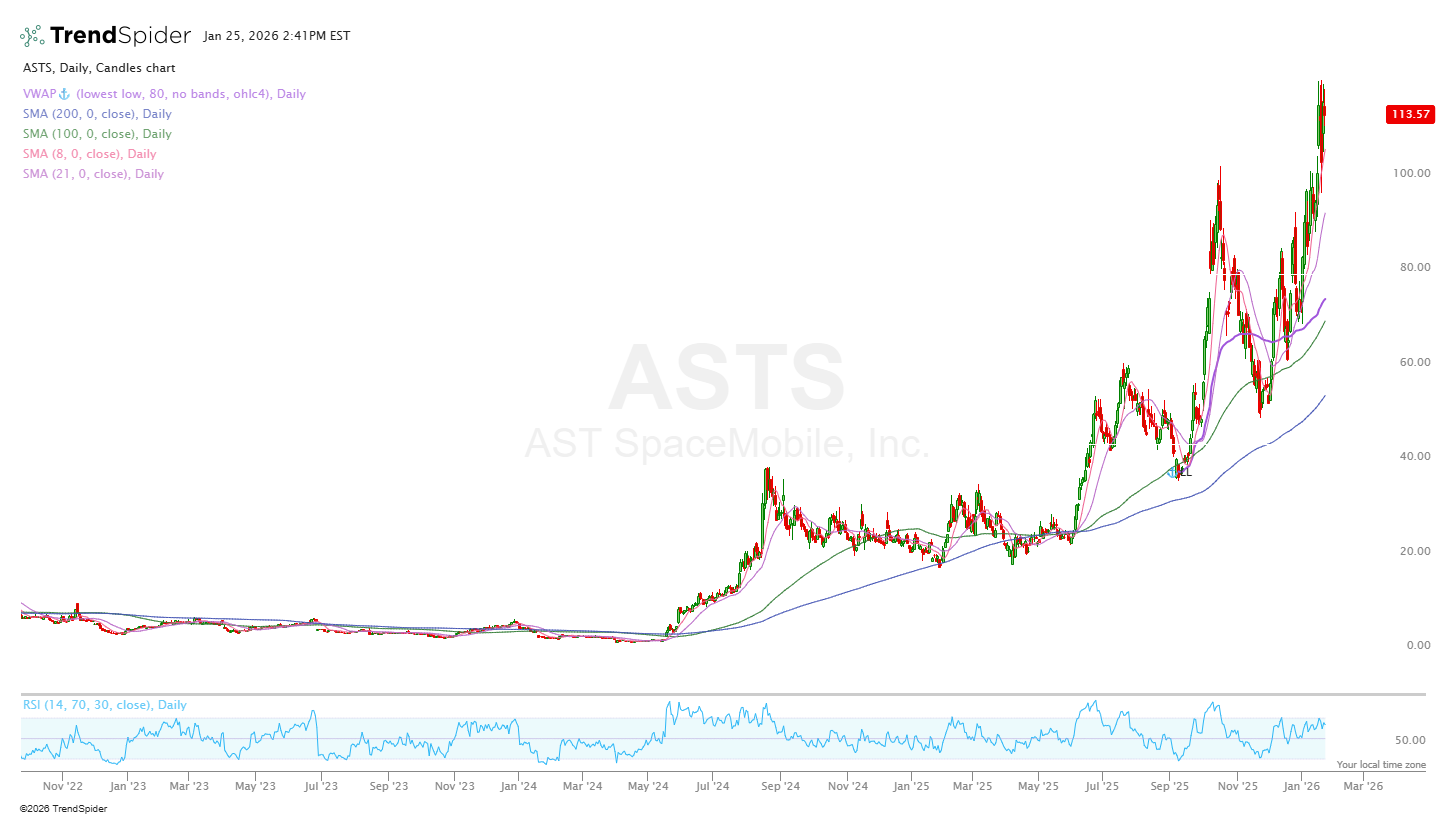

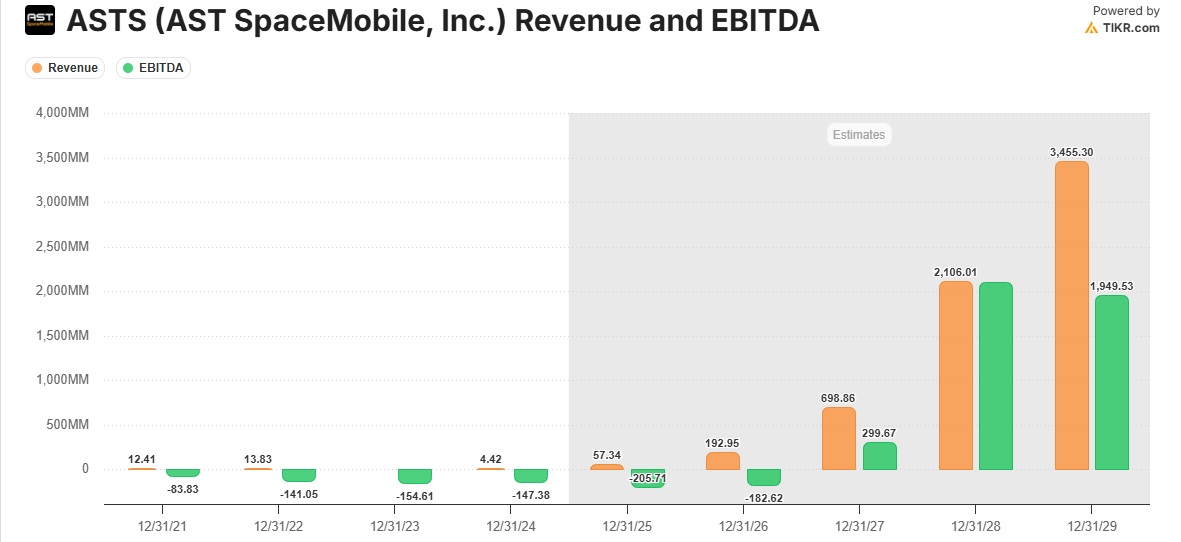

AST SpaceMobile | ASTS

ASTS is developing a huge space-based cellular broadband network that can connect directly to smartphones and eliminates “dead zones”. They’ve now launched Bluebird 6 satellite which is so far the largest commercial communications array in LOE. They’re also an extremely safe play because of their partnerships with MNO’s (VZ and STC Group for example) so when you compare the future potential of ASTS at $38B to VZ at $167B I think the multi-decade opportunity is quite large.

The main issue with ASTS is going to be Starlink which is currently the leader. There are a few ways to think about this Starlink competition:

If SpaceX IPO’s above $1T (of which a huge portion of that is Starlink as the current cash flow engine), then ASTS at $38B is vastly undervalued even if Starlink is ahead.

It’s very unlikely there will be a winner takes all market here.

Starlink operates direct-to-consumer that requires a dedicated dish terminal. As mentioned above, ASTS operates in partnership with MNO’s. So Starlink competes against MNO’s and ASTS competes with MNO’s. It ultimately depends what you view as the most likely outcome here.

Valuation:

EV/Sales: 184x

2026 expected revenue growth: 237%

Gilat Satellite Networks | GILT

GILT is a provider of satellite ground infrastructure (the antennas, modems, and networks connecting satellites to Earth). From a growth perspective it’s been extremely good (47% in FY25) but estimates are tapering off into the 13% range in FY26 which doesn’t make this a high growth story anymore.

Nevertheless, multiples are quite slip at 2.5x NTM sales which is nice for the growth. However, from an EBITDA point of view, GILT trade at 20x NTM EBITDA which is far less attractive for the expected 22% growth they’re set to post in FY26. GILT is an extremely important part of the supply chain, but I’m not fully convinced by the valuation today. I’d probably look for a pullback to at least $14.

Power Generation Systems

There are some very advanced energy systems that are needed to power spacecraft, satellites, and other deep space missions. Most of the time solar is unable to produce enough power (due to shadowed areas or distance from the Sun). This limits power generation sources quite drastically to nuclear which is currently far superior to alternative energy sources for long-duration missions.

Most of the stocks below are within the nuclear niche, though RDW operates purely in the solar niche which works well for near-Earth and cislunar missions.

Power Generation Systems Stocks to Invest In:

BWX Technologies | BWX

NANO Nuclear Energy | NNE

Lockheed Martin | LMT

Oklo | OKLO

Redwire | RDW

Rocket Lab | RKLB

The Boeing Company | BA

NuScale Power | SMR

Amentum Holdings | AMTM

Enersys | ENS

Honeywell | HON

Here’s 2 in more depth:

BWX Technologies | BWXT

BWXT is a leading service provider in the nuclear industry that is carving out a nice share in space. I’ve followed recent quarters for BWXT and the numbers have been extremely impressive with Q3 25 posting a 29% YoY increase with 20% EPS growth.

BWXT’s backlog currently sits at $7.4B (119% increase YoY) of which most has come from their Uranium processing plant in Tennessee and a contract from the government which provides a lot of stability.

Purely from a forward growth perspective, BWXT is not a stock I’d buy though as estimates don’t look that strong relative to multiples, granted not all plays can be analyzed via growth multiple metrics. Nevertheless, BWXT no doubt trades at a premium to peers and I don’t see a huge margin of safety of buying this stock here but this could be a nice stable company to own if we get a significant pullback.

Valuation

EV/Sales: 5.8x

EV/EBITDA: 33.0x

P.E: 51.6x

NANO Nuclear Energy | NNE

This is one of the emerging pure players in this segment so I felt it was more worthwhile to touch on this rather than adding more crossover.

The bigger players like BWXT focus on government contracts whilst NNE is positioning itself as a vertically integrated developer of portable, modular reactors that can be easily transported with the ultimate goal being for them to be transported with rockets for space. They’ve designed the ZEUS Reactor which is a solid-core battery reactor with no moving parts making it theoretically ideal for the harsh vacuum of space.

NNE is still years away from commercialization and they aren’t expected to make any substantial revenue until 2028 onwards so think is a very risky play. I would personally not buy into this story yet as I don’t want to overexpose myself to these pre-revenue stocks. I already own SMR and I’m more than happy taking a risk on that one.

The Applications Vertical

This is the downstream segment of the space economy - representing the transformative layer where the space infrastructure layer starts to deliver economical and societal value. A lot of the applications vertical are in very early stages, hence this section won’t be anywhere near as long but I’d like to still talk about a few more stocks.

One of the key applications is of course satellite communications (SATS, IRDM, ASTS etc) as we discussed above. I think that could’ve been included in infrastructure or in applications, but I’m not going to repeat myself here.

The other key application layers are:

Earth Observation / Data Services / Analytics

Cislunar Economy

Defense Applications

Earth Observation / Data Services / Analytics

This segment is a huge part of the downstream value creation enabling precision applications in agriculture (crop yield forecasting), environmental monitoring (climate change, deforestation), disaster response and insurance risk assessment, resource exploration (oil, gas, mining), urban planning, supply chains, and defense/intelligence. The global earth observation market is projected to hit $10B annually but this is only just getting started, as is with most of the space application vertical.

A lot of the stocks in this niche have the potential to be high-margin, recurring revenue generators that deliver predictive modelling and detection.

Earth Observation / Data Services Stocks to Invest In:

Planet Labs | PL

BlackSky Technology | BKSY

Spire Global | SPIR

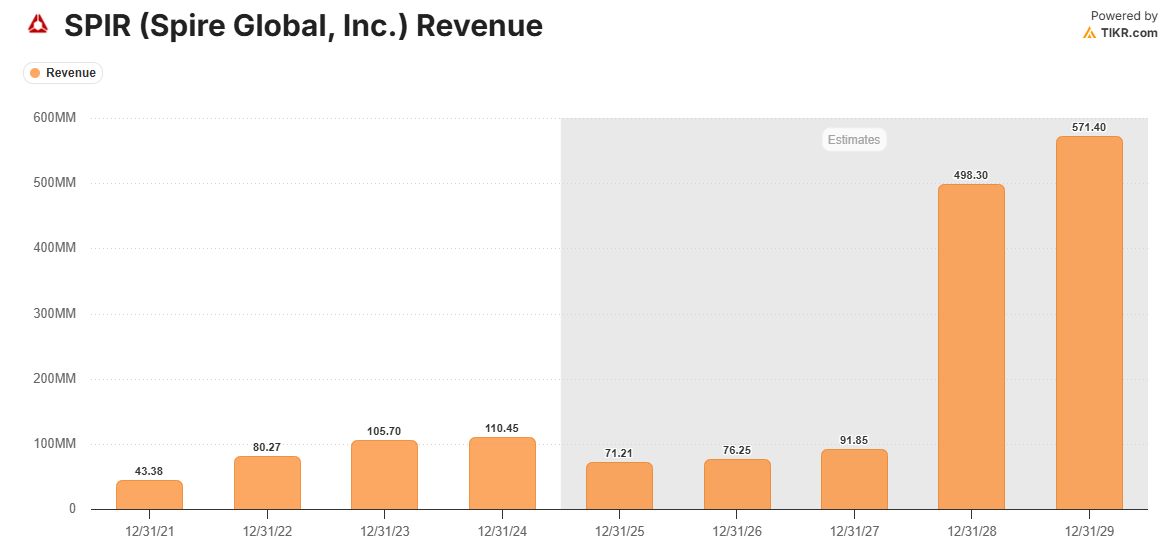

Spire Global | SPIR

I first bought into SPIR at $10.80 so I’m currently up ~15% on my position which has been a bit of a disappointment so far. I think long term SPIR has very good potential, but perhaps my timing has been wrong since the stock has chopped around in this $10-$12 range for a long time.

SPIR basically operate a large fleet of small satellites in LEO to collect unique data from space. This includes:

Weather patterns

Ship and aircraft movements

Climate data

Etc

They then process this data with AI and software to create useful analytics, predictions, and reports for their customers which range from businesses to governments who pay subscription fees to access the data.

SPIR currently trade at 4.9x sales for 7% expected growth in FY26, but revenue growth rates are expected to rise considerably in FY27 and FY28 as part of their $200M backlog. If this revenue starts to get recognised in the next 12-24 months then I think SPIR could get a nice re-rating. Ultimately, SPIR is currently posting revenues of less than $100M in a $10B TAM so there’s a huge amount of greenspace for them to win. If there’s a structural shift in how governments get hold of data (via space), SPIR will be one of the key beneficiaries.

Cislunar Economy

This section won’t include any writeup on specific stocks for the sake of crossover, but the cislunar economy is a very exciting emergence that I could quite easily spend a whole article on.

The cislunar economy refers to the emerging set of commercial and governmental activities that are taking place across the Earth to Moon system. The ultimate goal is to build shared, interoperable infrastructure for communication, transportation, and power. As with the entire space economy, most of the economy is all infrastructure today but down the road exploration and sustained lunar presence put the total forecasted cislunar market upwards of $150B. This forecast obviously hinges on data, mobility, and most of all resources on the lunar surface but I suspect that is 2040 onwards.

Cislunar Economy Stocks to Invest In:

As mentioned, none of these are specific to the cislunar economy but there’s a lot of crossovers from other segments.

Intuitive Machines | LUNR

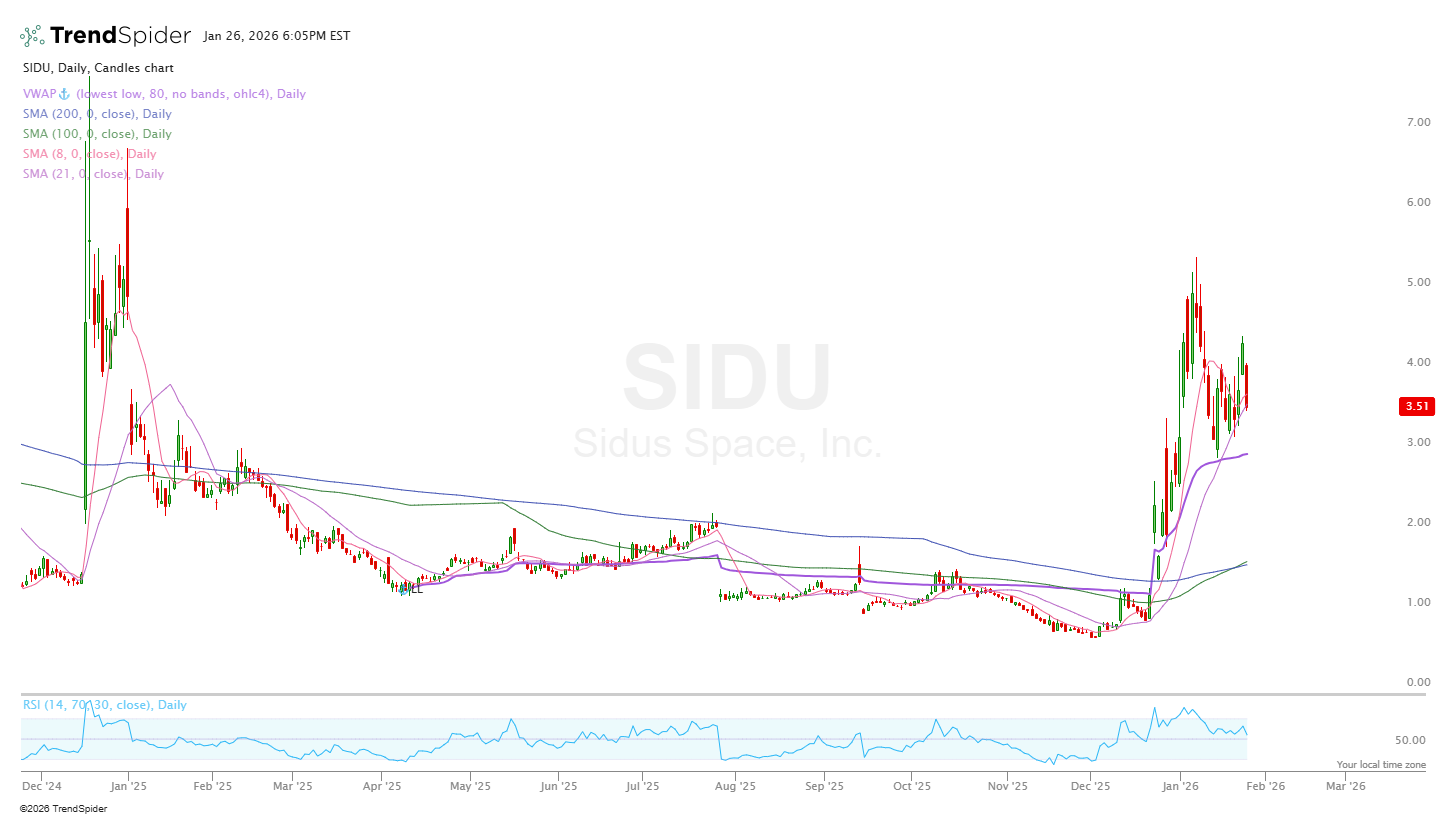

Sidus Space | SIDU

Firefly Aerospace | FLY

Defense Applications / Golden Dome

This section also won’t include writeups on specific stocks because of the crossover but there will be a comprehensive list of stocks that will of course be on the spreadsheet. I also don’t know which stocks will be most involved in this niche yet.

One of the big goals of space is defense. Trump mentioned in early 2025 the Golden Dome initiative which is a long-term pivot towards building a protective layer over the US through advanced space technologies. The companies who win big contracts here will no doubt he huge long-term winners.

The idea essentially comes from Israel’s Iron Dome, but this is on a far different scale. It aims to create a shield against ballistic, cruise, and hypersonic threats by using LEO satellite constellations for real-time detection, tracking, and interception.

From a structural point of view, the Golden Dome will look like this:

A layer of hundreds of LEO satellites for sensing and scanning threats.

An AI-driven command and decision layer for data fusion and autonomous targeting.

A layer of weapons satellites that can destroy incoming missiles right after launch or midcourse.

A terrestrial backstop in the air and on the ground that includes land-based missile interceptors.

From this alone you should be able to gauge the huge investment required to buildout this vision. Here’s the stocks set to benefit:

Defense Stocks to Invest In:

Lockheed Martin | LMT

L3Harris Technologies | LHX

Northrop Grumman | NOC

Raytheon | RTX

Redwire | RDW

Rocket Lab | RKLB

AST SpaceMobile | ASTS

KBR | KBR

Booz Allen Hamilton | BAH

Viasat | VSAT

Iridium Communications | IRDM

General Dynamics | GD

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Brilliant. Thank you for this deep dive; you realy capture how the space economy has accellerated from a distant dream to a tangible, massive opportunity. It's exciting to see the projections for 2035 and 2050, especially with the applications like climate monitoring and global connectivity becoming so clear; it makes me wonder about the new algorithms and data challenges that will emerge.

FLY is also flying.