UBER: A Stable High Growth Company / Q1 Earnings

A watchlist...but is it time to buy?

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Company: UBER

Ticker: UBER

Website: https://www.uber.com/global/en/sign-in/

Current Stock Price: $65.91

52-Week High: $81.30

52- Week Low: $38.14

Market Cap: $137.95B

Headquarters: San Francisco

Number of Employees: 30,700

I’ve very briefly touched on Uber before in my newsletter when I spoke about my watchlist stocks:

But I’ve never really dived into it here considering how much time I’ve spent actually researching it. So here goes…

Let’s start by saying UBER was on my watchlist when it was $31 back in March 2023, all the way up to $81 in March 2024. That’s a +160% increase that I just watched happen and never once got involved in despite the many bullish catalysts I knew about. Anyway, we don’t talk about regrets so let’s move forward…

I decided to start this write up post earnings last week and post 7% drop but I’ve only just managed to finish now. Ever since mid March UBER’s stock has been declining too so that’s potentially opened up some opportunities for it on my watchlist.

Here’s the current stock chart:

It’s been a big last year for UBER, both in the stock price and in the fundamentals. Dara (CEO) turned the company GAAP profitable in 2023 and also recently announced the first ever share buyback program of $7 billion so it’s for sure an exciting time to be an UBER shareholder.

I don’t currently own the stock but I definitely will do soon. UBER has turned from an unprofitable, high growth company into a nice mix of compounding growth and stability to add to the portfolio. The current FCF growth and the endless opportunities moving forward are perhaps the two most exciting parts of UBER for me. I’ll be discussing these throughout the article.

Uber Q1’24 Earnings Review:

1. Demand

Missed booking estimates by 0.8% and missed guidance by 0.3%. Growth was 26% on a constant currency basis.

The slower growth was blamed on strong demand in Brazil around Carnival period that did not recur in Q1’24. Secondly, management blamed Easter and Ramadan holiday timing shifts.

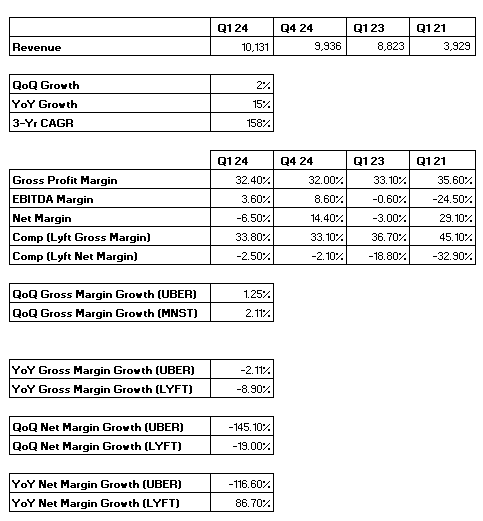

Revenue met estimates reaching of $10.3B for the quarter, up 14.8% YoY.

Met monthly active platform customer estimates (MAPC).

MAPC growth in mobility was up 17% on a YoY basis.

Audience growth rose 15% with 6% more frequency.

Discussion

UBER is at the stage now in their growth where we are more concerned with EBITDA, EPS, and FCF growth, rather than revenue growth. Top line growth is now in the mid teens, but the most promising thing is margins are expanding very quickly. More on this later.

Mobility

Mobility, UBER’s core business generated $5 billion in adjusted EBITDA in 2023. They’ve now seen 26% YoY growth and a MAPC growth of 17%. The two main drivers of this growth were new products and weekday commutes returning to normality. Weekday commutes drove a 40% YoY growth in Uber for Business. Importantly, 50% of Uber for Business users opt in to premium, a much higher margin product for UBER.

The bullish case for me here in mobility is quite clear, and quite enormous. I’ll sum it up quickly here and then write a tad more on it for those who want more detail.

🔑Concise Version

There’s still tens of billions in gross bookings opportunity for UBER in the mobility sector through growing consumer penetration in major markets, increasing consumer engagement and frequency. Further, UBER can introduce new segments of consumers like teens, businesses, or elderly, through further organic growth or through the introduction of new products. There’s the opportunity to unlock new international markets such as India which has shown incredible growth, or Spain and Germany where UBER was banned for regulatory reasons.

And finally, there’s the ongoing debate on whether the robotaxi/autonomous vehicle market will boost or burn UBER. I’m most certainly on the side the UBER will become the global network for autonomous vehicles.

📜More Detailed Version

International Markets

International revenue has grown 26% YoY compared to just 6.6% in United States & Canada. There’s still many markets internationally which have yet to be tapped into, or are still in the early stages of their growth trajectory. India recently became the 3rd market to reach 1 million mobility drivers, despite cutting incentives for those drivers.

UBER have done a brilliant job at localizing their internationalization. From Uber Moto (2-wheeled motorbike taxis in India) to on-demand speed boats in Mykonos, UBER is crushing every market they’re in. The challenge for UBER has been the regulatory headwinds such as those in Germany where they’re allowed to only operate in a select few cities and only as a regulated taxi service. Regulatory struggles are slowly becoming less and less bothersome for UBER, and as these open up further growth becomes almost guarenteed.

Consumer engagement and frequency

A large part of the growth in mobility is attributed to new products which are growing at 80% YoY, but also brining in 20% of the new customers. Key growth products are Uber for Business, Health, Reserve, Uber X etc. With the consumer network that Uber has, they have the potential to almost go after every competitor within the transport/mobility space and likely become pretty relevant quickly.

Management were keen to note that Uber for Business has been one of the key growth drivers as hybrid work is slowly trending downwards again.

Autonomous Vehicles

UBER are confident that they’ll manage to gain a large stake in the AV market when it becomes mainstream and I completely agree, although I respect everyone’s opinions on this as it’s all just smart guesses.

But here’s my opinion.

UBER has the largest consumer network in the world. They’re specialists in creating demand, planning rides, and all regulatory barriers. Companies like TSLA would massively benefit from UBER in getting the demand for their Robotaxis out there on a much wider scale. There’s therefore every likelihood that robotaxi/AV companies partner with UBER to deploy them.

The counter argument to this is that UBER’s core position is that they essentially connect humans that need a ride to humans that own a car. If you take the human away and you’re now connecting a human that needs a ride to a robot, what is UBER value proposition if a company like TSLA has a similar app? Though I do fully respect this argument, and deem it as a longer term risk, I do believe UBER is perfectly positioned to ride the wave when it comes.

These robotaxi companies, like TSLA (and many more) will potentially all have their own robotaxi platform (similar to how UBER operates but just not as good). Why would any user want to have to switch platforms from UBER to several different robotaxi platforms? UBER is in the middle. UBER has the consumer network built already and it will be highly beneficial for UBER and the AV manufacturer to join forces.

Delivery

Delivery grew slightly slower than mobility at 18% YoY vs 25%. Despite this, I may speculate that the delivery sector may eventually outgrow the mobility sector, even with all the positive outlooks for mobility that I outlined above. This is because the delivery business is moving away from purely delivering food to becoming a platform to deliver everything, with investments into Groceries & Retail of late.

For example, let’s touch on Uber Direct briefly, one of UBER’s youngest bets, but arguably the most exciting one. Uber Direct is a white-label delivery solution now active in just under 20 markets that offers parcel delivery, big item delivery, and returns. I see Uber Direct becoming a major player in the movement of goods from transportation hub to final destination.

And what’s more is Uber Direct is just one of the many bets that UBER are placing right now. The exciting part of this growth trajectory is essentially that they’re taking these big bets but are benefiting from a massive head start relative to competitors due to the UBER platform. The cross-over benefits from mobility to delivery instantly give delivery access to a wide range of consumers. That’s a huge competitive advantage.

Advertising

On top of all this, UBER started a brand new company ~4 years ago which is already approaching the $1 billion run rate milestone of what will likely be a multibillion dollar opportunity. I won’t touch too much more on advertising because it’s still extremely early but there’s huge opportunity for UBER to better incorporate advertising into their nascent grocery delivery business. With AI efficiencies, advertising could quite easily become the highest margin sector for UBER.

2. Profitability

UBER beat EBITDA estimates by 4% and beat FCF estimates by 24%.

Gross margin increased 400 bps from 32% to 32.4%.

This all led to a 765% EBITDA increase YoY and a 147% increase in FCF YoY.

The reason for the 8% drop over the last week was due to a sharp GAAP EBIT and EPS miss. But this doesn’t matter or mean anything and as usual the market overreacted to the media headlines.

Discussion

The reason for the GAAP EPS miss was because of a $527 million legal charge and a $721 million equity investment loss which effected net income. Without these one-off charges, both GAAP EPS and EBIT would have been comfortably ahead of expectations and the stock would have likely soared around 10% based on recent market movements. Since the legal issues are now resolved, and the equity loss has no relevancy to the fundamental operations, I don’t massively care. In fact, I love that the market reacted negatively as it provided me with an opportunity to buy.

The biggest margin growth over Q1 was in the delivery EBITDA margins which increased about 20% from Q4’23. This 20% increase was mainly attributed to margin expansion (but still losses) in the grocery delivery sector. Despite the negative EBITDA margin in this sector, there’s a clear trend and plan to profitability which I love to see. Management stated that 15% of all delivery users are now using UBER for the delivery of their groceries, showing the power of the platform even in the early days of grocery delivery. Secondly, advertising as aforementioned, is just in the early days (despite the $1 billion run rate…) and advertising offers very strong margins.

As a whole though, I see margin expansion as a fairly simple task for UBER simply because of the power of the platform and the efficiency gains that they’ll continue to exploit through AI. UBER has the ability to train ~20,000 models per month which is a figure nobody else in the industry could even dream of. In fact, because of these efficiencies over time management estimate a 90% FCF conversion rate by 2027 with FCF growing 40% annually.

If you forget everything else I’ve said in the article and consider this point alone, you should now be able to understand why UBER has incredible potential.

Valuation

UBER has an EV of $142.2 billion. Estimates are currently sitting at $6.36 billion in EBITDA and $4.98 billion in FCF. This means the stock is trading at a CY2024 22.3x EV/EBITDA multiple and a CY2024 28.6x EV/FCF multiple which to me seem fairly reasonable considering EBITDA is expected to grow around 35% annually and FCF at 40% annually.

For CY2025 EV/EBITDA we’re at a multiple of 16.7x EV/EBITDA and 20.2x EV/FCF. Admittedly, these aren’t low multiples, but UBER no doubt deserves a premium price.

Here’s my investment model for UBER:

This shows a potential 169.3% return through to 2030 based on some arguably quite conservative PE multiples and net cash/debt figures. This is ~28.1% return annually which I like for a company the size and maturity of UBER.

Final Take

To me, there was really nothing disappointing at all in last week’s earnings which is why as someone who doesn’t hold the stock (yet), I was extremely happy. We saw:

Further profitable compounding

Successful product launches

Incredible advertising growth

International growth

Huge FCF growth

To me, the only thing I’m half concerned about moving forward for the next 5-10 years is the AV/robotaxi argument. However, even with that I see far more benefits of UBER partnering with AV’s than not. I do understand that this is my opinion, and there’s many analysts and smart people that are in the other camp and therefore there’s no doubt it’s somewhat of a risk moving forward.

However, this is an argument that will be had for the next 3-5 years. For now, UBER is a compounding machine with endless opportunities and the availability to take bets which could turn into multi-billion dollar businesses.

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

UBER should turn into an even bigger success story once autonomous driving arrives in full force. Not sure when it'll happen but for now, UBER looks good to me.