ASML Deep Dive - Is The Moat As Strong As We Think?

A Deep Dive

Hi there 👋

Want to see the previous articles I wrote? Including my 2 other deep dives of 2025👇

This deep dive is on ASML. I’ve made the majority of this article free, however, the valuation section is for my paid subscribers. The paid service is only $18 a month so I kindly ask if you can spare this cost it would help me massively in turning this into a full time profession which is the ultimate goal.

In addition to my newsletter, I’m also very active with 40,000 followers. You can find me on X here.

ASML is a 4.5% position in my portfolio📊

Company: ASML

Ticker: ASML

Stock Price Today: $731.4

Stock Price High: $1,085

% drawdown from high: 29.7%

Market Cap: $289.7B

Outline

Introduction

Competitive Advantage

Financials

Opportunities

Risks

Valuation

Conclusion

Introduction

ASML are a Dutch company that play a lead role in lithography, both EUV and DUV. For those that don’t know what lithography is, it’s a core technology within the semiconductor industry to make chips. Without it, you have no mobile devices, no autonomous driving, no AI. Nothing like that.

No ASML. No EUV lithography. No complex chips.

No ASML. No TSMC, Intel or other foundries developing the worlds most advanced semiconductors.

Lithography is the process of printing circuits onto silicon wafers to make chips. There’s many different forms of lithography, some of which we will touch on in this article as risks to ASML, and some of which are more experimental.

Photolithography: This is where AMSL competes. This is broken down into DUV (Deep Ultraviolet with 193 nm light) and EUV (Extreme Ultraviolet with 13.5nm light).

Nanoimprint Lithography: I touch on this in the risks section.

Electron Beam Lithography: Uses an electron beam instead of light making it ultra precise but very slow and therefore not commercially efficient.

Ion Beam Lithography: Similar to Electron Beam Lithography but offers even more precision, and is even slower.

X-Ray Lithography: Not widely adopted. Very complex and costly.

Direct Self Assembly: I touch on this in the risks section.

In our ever digitalizing world, the demand for more chips is only going up. But the space available is obviously not increasing so the need for small (atomic dimension) chips with 100 million transistors per square millimeter is required. EUV Lithography is the technology that is making this viable and this is where ASML hold a complete monopoly globally. However, it’s not just EUV that ASML compete in.

They also compete and dominate (90% market share) in the more traditional, and less precise DUV technology which is actually how the majority of less complex (10nm and above) chips are produced.

Here’s a very basic breakdown of how EUV and DUV lithography works. This is not a technology newsletter so excuse me for the briefness here:

DUV Lithography

A silicon wafer is covered with a photoresist.

193nm DUV light shines through a mask projecting circuit patterns on to the wafer.

The exposed parts of the photoresist are dissolved, leaving the circuit design on the wafer.

Wafer is chemically etched to engrave pattern into the silicon.

This process is then repeated many times to build a chip. The chips made aren’t very small meaning multi patterning techniques are needed.

EUV Lithography

A high energy laser hits tiny tin droplets, creating a 13nm EUV light inside a vacuum chamber.

EUV light gets reflected off a patterned mask (this contains the circuit design). This light then bounces of extremely precise mirrors to focus the image.

This EUV light then transfers the pattern to a silicon wafer coated with a light-sensitive photoresist.

Exposed photoresist is removed, and pattern is etched onto the wafer.

This creates an ultra small chip in one step meaning no multi patterning is needed.

Competitive Advantage

Technical Advantage

The technology used to create ASML’s machines (mainly EUV, but also DUV) is breathtaking. It required decades of R&D and at least $10 billion in sunk costs to even get the business up and running with a good machine which was obviously a huge gamble that paid off

They’re now “at least a decade ahead of any competition” (said former CEO) but are still spending above 15% of revenue on R&D per year to keep Moore’s Law alive. 15% of revenue is ~$4.5 billion per year.

They’re spending $4.5 billion a year to get even further than 10 years ahead of any competition. Combine this with the 2,000+ EUV patents that ASML have making it legally (and technologically) impossible to enter the market as a competitor. If that’s not pure technological dominance, then I’m not sure what is.

Here’s some aspects of their technological monopoly:

Mirrors

I’ll just leave this here. It’s a snippet from Zeiss website on the mirrors used during EUV lithography:

“The illumination system for the High-NA-EUV lithography consists of around 25,000 parts and weighs more than six tons. With more than 40,000 parts, the projection optics weigh around twelve tons and ensure high-precision focusing of the light in the wafer scanner. Yet the structures on the finished microchip are only a few nanometers in size. For comparison: one nanometer corresponds to 0.0000001 centimeters. In order to image such structures, the mirrors need to be very precise. To achieve this, more than 100 extremely thin silicon and molybdenum layers are vapor-deposited onto the mirror surface – each layer only a few atomic layers thick. "The precision of the mirrors can be explained with a thought experiment: Imagine a mirror made so big it covers the surface area of Germany. At this size, the largest unevenness would be less than 100 micrometers. That's 0.01 centimeters – almost as fine as a human hair,"

Light Source

And this is from Trumpf website regarding the 13.5nm light source.

“In a vacuum chamber, a droplet generator shoots 50,000 tiny tin droplets per second. Each of these droplets is hit by one of the 50,000 laser pulses and turned into plasma. This produces EUV light, which is directed by a mirror onto the wafers to be exposed.”

Supply Chain

This is a very overlooked part of the ASML moat, and makes up the majority of the huge barriers to entry involved in replicating the ASML business model. The reason for this is because almost all of ASML’s suppliers (there’s 400,000 parts that go into an ASML machine), supply only ASML. I won’t touch on many parts here because you’ll get the picture but let’s take Trumpf as a first example.

Trumpf: The first complex step of the EUV lithography process is producing extreme EUV light with a wavelength of 13.5nm. ASML, Zeiss, and Trumpf all joined forces to make this happen. This laser is made up of more than 450,000 components showing just how hard it is to replicate. However, to make it even harder to replicate, imagine competitors cannot use Trumpf. Trumpf only sells this laser to ASML as it’s co-developed by ASML. So when you combine the technical difficulties of creating a laser 100,000 Celsius hotter than the sun, with the fact that you can’t use Trumpf, the only company in the world to product such lasers…makes this task almost impossible to compete with.

Zeiss: ASML and Zeiss have been working together for an extremely long time. Zeiss manufactures the mirrors which reflect the EUV light allowing ASML to guide it to the exact position on the wafer to print the chip. ASML and Zeiss have this saying - “two companies, one business”. Again, Zeiss does not sell their products (which are the smoothest mirrors to ever be created) to competitors.

TNO: ASML and TNO have also worked very closely on wafer stage development (moving silicon wafer with sub-nanometer accuracy), reticle positions, metrology, and more.

Cymer: ASML owns Cymer which is the only company in the world to generate plasma to create the 13.5 nm wavelength at high throughput levels. Competitors like Nikon and Canon struggle here massively because they just don’t have the efficiency that Cymer do.

In addition to the above, there’s also VDL Group, Berliner Glas, Veeco, and 5,000 other suppliers that ASML mostly control.

In short, ASML’s machines are made up of hundreds of thousands of pieces that are all engineering masterpieces requiring huge teams, huge investment, huge R&D, and huge milestones in areas like plasma physics, optics, and precision mechanics. Even if competitors were spending the time to develop a machine like ASML’s EUV machine, they would need thousands of new suppliers because ASML already owns the entire EUV ecosystem. These suppliers are contractually bound to not supply the same technology to others.

With the speed of innovation today, it’s extremely risky (not to mention extremely difficult) for competitors to spend multiple years and billions of dollars to compete with ASML who control the entire industry.

Switching Costs

The final part to understand about the AMSL moat is that integrating these machines into the production lines of foundries like TSMC and Intel is a 6+ month process and that’s even when the production lines are already integrated with other AMSL technology.

Switching to other lithography suppliers (there aren’t any) is a multi-billion dollar decision that simply isn’t a feasible option in today’s digital world where the demand for chips is very high.

Financials

Revenue💵

Q4 Revenue: $9.60B. This is a 28% increase YoY from Q4 23.

FY24 Revenue: $29.28B. This is a 2.5% increase YoY from FY23.

From a demand point of view, the end of 2024 was positive for ASML after a weak Q3. Q4 saw ASML reach record revenues. Driving these figures was a surge in lithography machines sales in Q4 shipping 132 machines. The most promising part of this is that ASML has been able to recognize revenue from their High-NA EUV machines (more on this in the Opportunity section) which will likely become the core of many advanced fabs over the next decade. However, still the vast majority of ASML’s sales in 2024 were the older DUV systems.

From a geographic point of view, for most of 2024, China was the largest national customer on a revenue basis only until Q4 where we saw these figure balance back out.

The outlook for ASML in FY25 was liked by the markets with a $33B guidance. This is an interesting figure because ASML currently have a backlog of $37.4 billion, meaning they have secured the higher end of 2025 guidance. Of course these orders may get cancelled or pushed back further, but it’s a promising number.

Gross Margin📊

Q4 Gross Margin: 51.7% which was a 30bps increase from PY.

One key thing to note here is that management expect ross margins to increase in FY25, and most definitely in Q1 25 due to fewer High-NA EUV sales. These sales although very beneficial for revenue with price tags ~$215 million, are actually below the company’s average margins and therefore will act as a margin drag until ASML can build more efficiently.

EPS 💰

FY24 EPS: $19.94 which was a 3.3% decrease YoY.

Opportunities

EUV estimated growth (ASML): 12-22% CAGR

DUV estimated growth (ASML): 15-18% CAGR

Installed base growth (ASML): 13% CAGR

ASML’s growth opportunity essentially hinges on continued fab expansions which is increasing in line with the global AI megatrend. The nanotechnology (broad field that ASML competes in) is estimated to grow at 34.3% CAGR through to 2033 reaching $74.9 billion. Similarly, the EUV lithography market is expected to grow at 20% CAGR through to 2031. These growth rates (ASML’s above and general macro trends) obviously signify a lot of strength ahead for ASML given ASML more or less completely dominate these fields, especially EUV lithography.

It’s obviously not directly correlated, but so far this earnings season we have seen numerous mega cap stocks like Meta, Google, and more come out with some extremely high CapEx spends. Just this week we had Google post a $75B FY25 anticipated CapEx spend which beat estimates by $18B. Similarly, Meta announced $60B in in CapEx. These numbers prove the biggest names in the industry are investing heavily into future innovations (AI, chiplets etc) and as long as the need for more chips at 3nm and below is high, the need for new innovations to ASML machines will remain high.

High-NA EUV Lithography

The most exciting opportunity for ASML today is High-NA EUV lithography which is the next evolution of EUV designed to print even smaller, more cost effective, more precise chips. The first shipment of these machines is expected in late 2025-2026 and will allow chipmakers to print chips 2nm or below. Management estimate that not only are they of course a lot more precise, but High-NA EUV lithography is 50% more cost effective than normal EUV lithography because multiple patterning is reduced meaning a more efficient chipmaking process.

Intel have already introduced two High-NA EUV machines from ASML in 2024, whilst TSM are being a bit more defensive on the technology stating that they likely won’t use it until 2028.

DUV Lithography

Less than 15% of machines sold last year were EUV machines meaning the vast majority are still DUV. DUV lithography is core for more mature nodes (7nm and above) used in automotive, IoT, memory chips etc. Although this is not the exciting future for ASML, this is the core revenue earner and likely will be for the next 3-4 years at least.

The DeepSeek news is likely a tailwind for this sector of ASML as DeepSeek showed that more companies can get involved into AI at cheaper costs with less compute power. This is exactly what ASML need. The demand for 7nm and above needs to stay extremely high. Investors are becoming far too focused on High-NA EUV machine sales rather than focusing on ASML’s core revenue earner today. More 7nm chip demand will lead to more demand for ASML’s DUV machines.

“We believe that AI expansion has 2 main challenges: 1) costs and power consumption, we need to see major progress of these two, and 2) Moore's law. Any technology that will contribute towards a cost reduction, is in fact good news for ASML. More applications means more chip demand. AI is a huge opportunity. Everyone wants to be in. Competition in software will be very high. Anything that will drive costs down will be a good thing for ASML in the long term”. - ASML CEO

New Technologies

Quantum Computing

2D Materials

Silicon-based chips

3D stacking

New lithography tools

The semiconductor market is very complex today, but there’s a range of avenues that ASML may go down in the next 10 years.

Risks

ASML is an incredible company, but they’re not without their risks despite what many people may think. The majority of my competitive advantage section was focused on EUV lithography, however, ~56% of ASML’s machine sales revenue are still from DUV and this is where some of the risks lie.

Lithography Alternatives

Before I get into this section, let me just state that I doubt any of these will materialize in the next 5 years meaning the ASML monopoly is likely healthy for the time being.

Markets very rarely have a complete 100% monopoly for an extended period of time meaning the industry is actively seeking alternatives. The timeline of these technologies below is quite unknown and likely years away which is bullish for ASML, but they’re definitely in the latter stages of R&D.

Nano-imprint lithography (NIL): Unlike conventional lithography that needs light, NIL does not require a light source. Circuits are formed by transferring a circuit pattern mask, called a mold, onto a coated resin on the surface of the wafer. It’s a much more simple process (compared to EUV and DUV lithography) that requires less cost (no complex mirrors or lasers etc), and less power consumption (no powerful light sources), but this of course has its limitations in increased defects, less throughput, and less precision, particularly at much smaller nanometers.

China is investing heavily into NLI and so is Japanese company, Canon. The current NLI machines that China are manufacturing are 28 nm which does make up a large part of demand today, however, this is fairly outdated. For cheaper, and more power-efficient processes like in automotive chips, budget devices with entry level GPUs, and alike, 28 nm chips may be the best move. However, for more precision in leading edge chips that the likes of INTC, AMD, NVDA, and AAPL are investing into at 3nm, NIL will likely not be a concern.

Direct Self-Assembly Lithography (DSA): DSA is quite a promising technique that lets components organize themselves to form nanoscale patterns that are beyond the limits of more traditional lithography. I won’t get into the technology here (because quite frankly I don’t understand the full complexities of it), but DSA can achieve sub-10nm commercially (sub-7nm has just been introduced in China) and sub-2nm in current research.

It’s an interesting alternative to EUV, but widely considered not to be a serious competitor yet. When the components (called block copolymers) self-organize, very minute temperature changes or other variations can cause the entire pattern to fail increasing the number of defects far beyond EUV lithography. DSA is also very limited because it can only create certain patterns which makes it considerably more difficult to integrate into standard chip manufacturing processes. It’s thought that DSA has a role to play in chiplet integration (AMD’s niche where they are a leader), but these processes are not complex enough yet for the sophisticated Ryzen AMD chips.

Again, DSA is another process that whilst research suggests it could be a legitimate alterative to ASML’s techniques, it’s not quite close yet.

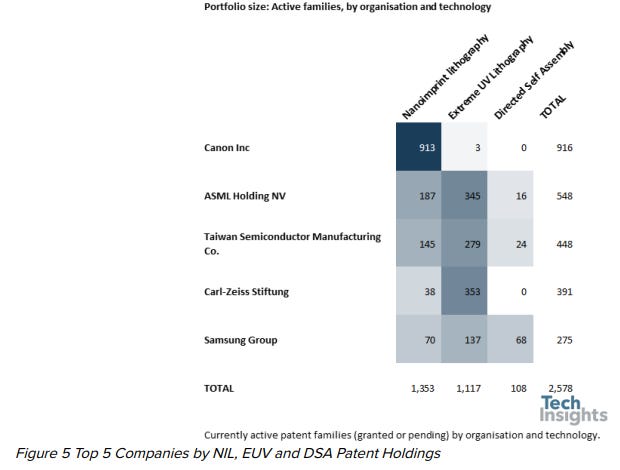

The above chart from Tech Insights shows the number of patents held by leading firms in NIL, EUV, and DSA. As you can see Canon is betting big on NIL, whilst TSM is fairly active in all techniques. Zeiss (as discussed above in the competitive advantage section) mainly is within the EUV process, but also sees slight potential in NIL.

NIL is perhaps the closest alternative to EUV, but in terms of complexity it is way off from EUV. As we’ve seen with DeepSeek last week, there’s every chance that firms will start to look for most cost-effective alternatives to the pricey EUV. However, true value lies in sub-2nm chips and below and currently the most dominant technology here is EUV by quite some distance.

Electron Beam Lithography:

Canon betting big on NIL.

TSM active in NIL and DSA

Other: As we became aware with DeepSeek, I think we have to be ready at some point over the next 5 years or so for a big surprise alternative process that may compete with some part of ASML’s moat. There’s been reports coming out from China in the last few days that there’s been big breakthroughs in China’s efforts to create a commercially efficient DUV machine. There’s been no current mention of which company has manufactured this machine.

“As homegrown lithography systems continue to mature and the applications expand gradually, it is expected that more cutting-edge chip manufacturing technologies and equipment will emerge, further raising the country's self-sufficiency rate in chipmaking and moving the semiconductor manufacturing sector toward higher-end production." - Xiang Ligang (Director of the Information Consumption Alliance)

TSMC CEO:

“For the coming 20 years, I see ways of improving the energy efficient performance of chips 3x every two years.”

TSMC are obviously ASML main customer so this is very important. Currently, ASML’s machines are the only processes that can realistically, accurately, and at scale, produce the most complex chips in the world. However, there’s going to get to a point where the energy intensive nature involved in EUV is no longer sustainable. And this is only getting more of a concern as High-NA EUV becomes more and more in demand due to considerably more laser power and cooling. ASML are making efficiency improvements, particularly in their light source technology, but EUV is one of the most energy intensive technologies in semiconductor manufacturing. DUV is also fairly energy inefficient, particularly at the precision they can currently reach.

This is where I see the risk. ASML are working on improving efficiency but there will get to a point where the power consumption needed for EUV just isn’t viable. Cheaper and more energy efficient alternatives have to find a way to market and we’d be naïve to think that there’s not some inroads that are being developed here that we just don’t know about. At the most complex level of chips which is where we are currently heading I see ASML demand being forever strong, but there’s likely going to be better alternatives for chips 12nm and more over time. It’ll become a balancing act between performance and efficiency.

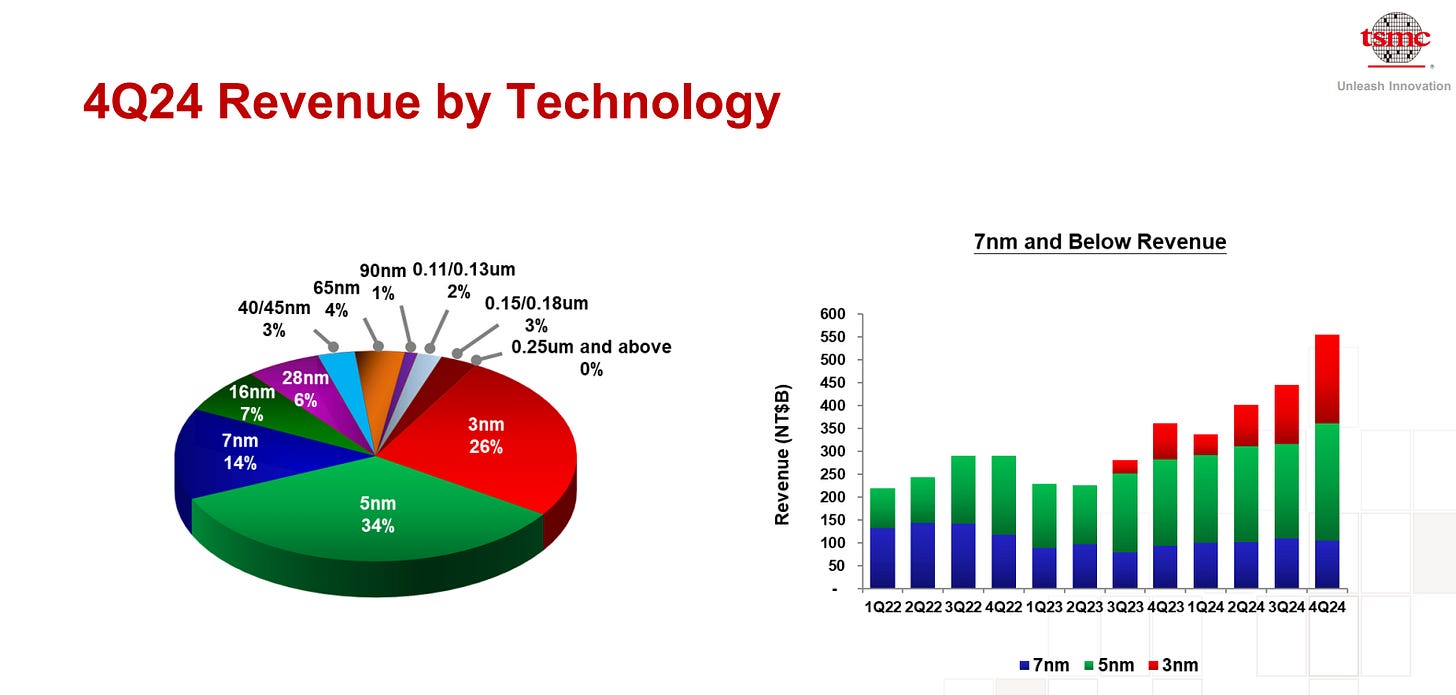

However, for now, ASML is completely dominant and there’s no argument against that. They’re even more dominant at 7nm and below which as you can see below looking at TSM’s revenue is ~74% of revenue. TSM revenue share is heading more towards 3nm, 5nm, and 7nm as well and less towards the higher nm, so ASML are in a very good position here.

Geopolitics

The US has imposed export restrictions to Chinese businesses for EUV equipment meaning ASML cannot export their machines to China. With the DeepSeek news and Alibaba’s QWEN-2.5 LLM, China have recently put themselves on the map in the AI race. There’s no way they’re sitting back and accepting the export ban, particularly with their “Made in China 2025” initiative.

The likely alternative here is that there will be a Chinese EUV solution, though we know of nothing close to ASML yet. The closest that we know of today is currently Shanghai Micro Electronics Equipment (SMEE), however to the best of my knowledge SMEE aren’t too close to the technology that ASML possess.

The other downsides to ASML for US-China tensions are:

A good portion of ASML’s revenue comes from China, particularly from DUV sales. The US ban currently only prevents EUV, but there has also been a recent ban of the more advanced DUV systems. If tensions continue to escalate, ASML could lose a significant portion (up to 20%) of their revenue if further bans are imposed on DUV systems.

Lots of key suppliers part of the ASML global supply chain are China based. Any further retaliations will disrupt the supply chain which as we discussed above is a key part of the competitive advantage.

ASML are stuck between Chinese demand, US control and intellectual property, and European trade interests. ASML’s business is extremely heavily influenced by its current autonomy and good negotiations between the Dutch government, Europe, and the US. If Europe start to get involved in the US-China issue, ASML will be stuck in a political battle. I don’t see this risk as too likely because of how core ASML are to global technology, but the issue is they’re very exposed to political interests because they are so core to global tech.

Business Model

ASML’s business model is quite overlooked because its moat is so strong. But these are important points that are clear risks to ASML:

It’s an extremely high cost, high R&D business model.

The supply chain complexities are very intense.

Only 20% of revenue is from servicing.

If they don’t innovate, they don’t sell. This is key to understand. Management sold a total of 44 EUV machines in 2024 and those 44 machines that they sold to clients won’t need to be replaced for many years, if not decades. The only reason clients like TSM will continue to purchase machines is if demand is sky high and they need more machines to fulfil contracts, or ASML can innovate and make more precise, and more efficient machines. This is not easy considering how advanced we are today.

If they don’t get more efficient, customers look for alternatives (that aren’t fully commercial today).

Valuation

Keep reading with a 7-day free trial

Subscribe to Make Money, Make Time to keep reading this post and get 7 days of free access to the full post archives.