Edge AI: 2026 Onwards

AI will leave the Cloud

So far the big AI moment of the last few year years has been Chat GPT in 2022.

Since then, it’s been all about the AI infrastructure build out. Power, memory, optics, interconnect, grid upgrade etc. But ultimately, the end goal of this is to get AI into the real world and on to the Edge. The Edge simply means the move away from the Cloud towards devices (smart phones, smart homes, drones, robotics, AVs etc). It’s ultimately how all of this buildout gets monetized.

It’s originally been all about scale and centralized power on the Cloud. However, the clear downside of this is latency…i.e. the time it takes for data to be received from the end device, sent to the network to Cloud, and back to the device. That creates an unnecessary waiting period and unnecessary power usage. It’s now about immediate processing and immediate response without relying on this critical latency bottleneck.

Here’s some key points on the necessity of the Edge:

75% of all data is created at the Edge. Sending this data back to the Cloud is completely inefficient.

40.6B IoT devices are likely to be sold by 2034. The amount of data generated from these localized devices will be huge and the need to avoid the network inefficiencies will be even larger.

Energy and resources required by the Cloud is unsustainable. Edge lowers the energy use and cost, and increases the end value add.

This transition seems inevitable and price action over the last couple weeks in quite a volatile market has backed that thesis up nicely. SYNA is up 11% in the last 2 weeks, NXPI is up 8.5%, all whilst other high beta plays have struggled.

Looking forward, I think Edge is the fastest growing segment of the AI wave now with a 37% CAGR. Relative to the robotics market which is set to grow at 20% CAGR and the overall AI industry is set to grow at 28%…Edge’s 37% forecasts become very attractive.

In this article, I’m going to breakdown the current key players within this theme just like I’ve done with robotics and optics.

From here, I add all these stocks to my spreadsheet which paid subs have access to. This spreadsheet uses a few criteria to decipher whether I should be bullish or bearish on the stock, and from there I decide whether it’s worth diving deeper into or not.

If you want real time updates from me throughout the week and access to my spreadsheet, then consider becoming a paid subscriber. Definitely worth a try for a month and if you don’t like it you can cancel. I suspect you’ll find far more value in it than $24 a month though.

With it you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet. One of the most in-depth and helpful resources out there.

Access to the paid chat where I send ~5-20 messages per day.

Real time buy, add, trim, and sell alerts.

Weekly video recap.

Here’s the contents for this article:

Edge AI Semiconductors IP and Design Providers

Stocks to Invest In

Edge AI Processors (The Chips)

Stocks to Invest In

The Chip Builders

Stocks to Invest In

Memory

Stocks to Invest In

Networking and Connectivity Enablers

Stocks to Invest In

Edge AI Infrastructure and System Integrators

Stocks to Invest In

Edge AI Semiconductor IP and Design Providers:

These companies create the "blueprints" and specialized technology that allow devices to run AI. Instead of manufacturing the chips themselves, they own and license their IP - the high level architectural designs that allow engineers to build the end result. The business model is very high margin and scalable, though likely not as high growth as some others mentioned in this article.

Since Edge AI is so focused on power to performance ratio…as is everything but even more so in Edge… these providers focus on micro-efficiencies, always-on sensing, and security at the root.

IP & Design Provider Stocks to Invest In:

ARM

AIP

SNPS

CDNS

CEVA

RMBS

In this article, I’m not expanding on each company I list. Many of them are either big names you’ve likely heard of or are not pure Edge AI plays. I have tried to spend the most time on names you may not have heard of in the SMID cap range.

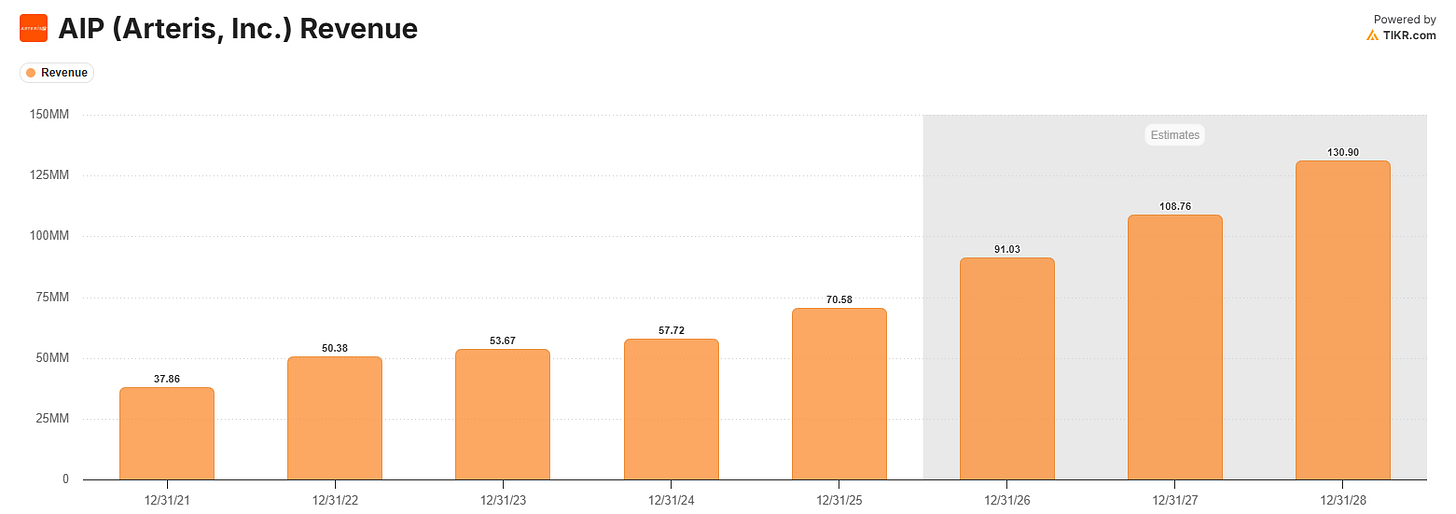

Arteris | AIP

Description:

AIP is a less well-known name at only $600M market cap, but they’re set to be a leader in Edge AI. They provide Network-on-Chip (NoC) interconnect IP - think of it like the digital plumbing for a big network of chips. They license this IP to over 300 major customers like NXPI and STM.

Recent results have been very strong with Annual Contract Value increasing 28%. They also recently acquired Cycuity, which adds $7M in revenue and creates a cybersecurity edge for them.

Numbers:

Revenue Growth: 22.3%

Gross Margin: 90.2%

Operating Margin: -47%

Valuation:

NTM EV/Revenue: 6.8x

NTM Price/FCF: 94.9x

Synopsys | SNPS

Description:

SNPS is a leader in electronic design automation (EDA) software (basically a duopoly with CDNS below), semiconductor IP, and software integrity solutions. About 30% of revenue comes from IP whilst the rest comes from EDA software making this a stable, predictable revenue stream. Companies like NVDA pay an annual fee to SNPS (and CDNS), regardless of how many chips are sold in the end. That makes these businesses robust, but of course the IP licensing division of the business fluctuates more.

They provide the AI powered design tools (like Synopsys.ai) that companies need to figure out the balance between powerful chips and energy efficient chips. They then sell this energy efficient IP which is essentially small designs specifically to run on low-power edge devices like smart cameras and wearables.

Numbers:

Revenue Growth: 15.1%

Gross Profit Margins: 81.4%

Operating Margins: 13.0%

Valuation:

NTM EV/Revenue: 9.8x

NTM EV/EBITDA: 21.6x

NTM P/E: 30.3x

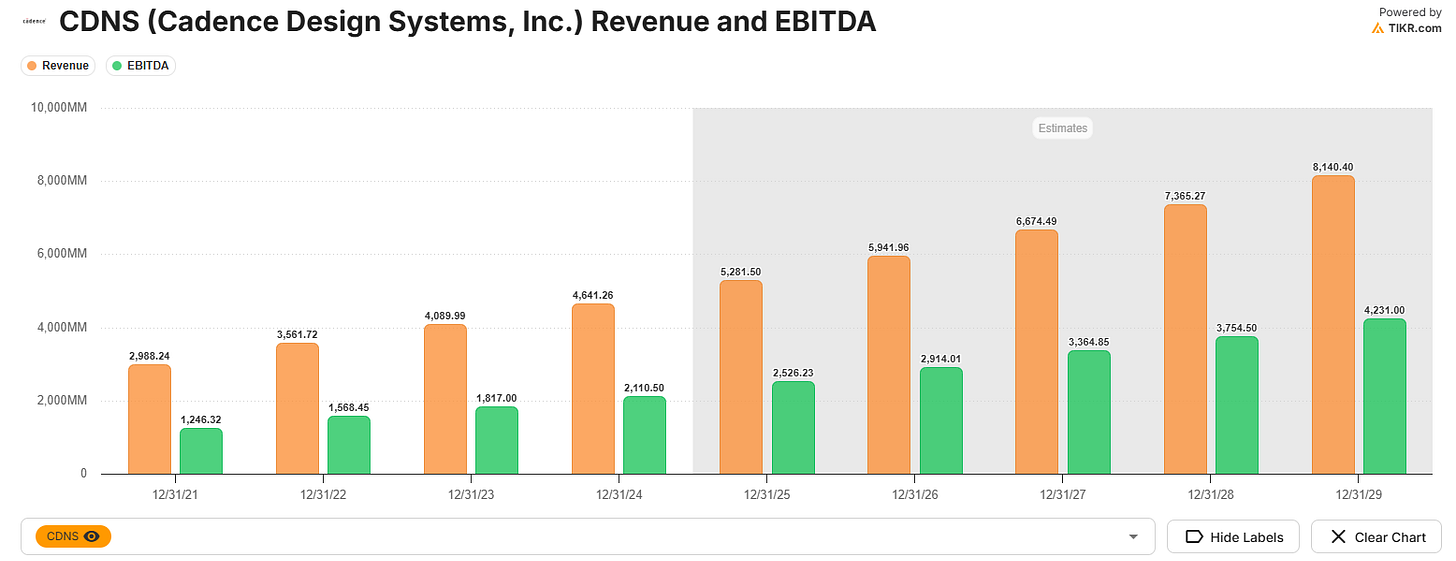

Cadence Design Systems | CDNS

Description:

CDNS acts as the other half of this duopoly with SNPS that controls the semiconductor design supply chain. They also provide EDA software - complex simulators and drafts that engineers then rely on to create the chips.

CDNS dominate specifically in the “sensory” side of Edge AI with their Tensilica chips which process audio (voice assistants), vision (drones), and radar (cars) instantly on the device. This is where their strength lies vs SNPS.

Numbers:

Revenue Growth: 13.5%

Gross Margins: 85.5%

Operating Margins: 31.9%

Valuation:

NTM EV/Revenue: 14.1x

NTM EV/EBITDA: 29.2x

NTM P/E: 38.9x

CEVA | CEVA

Description:

CEVA predominantly sells the IP for specific functions (mostly wireless connectivity and smart sensing). This makes them a critical Edge AI play because it’s their technology that is being used in many drones, or wireless devices.

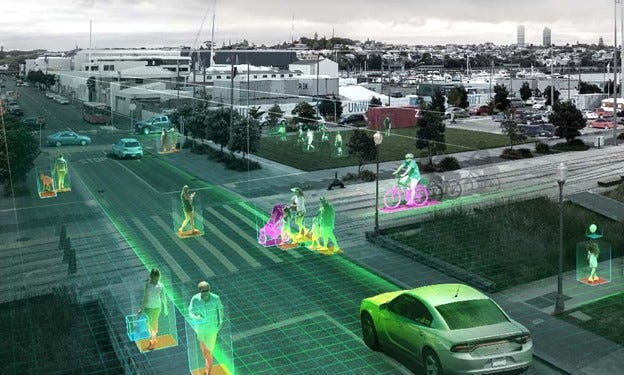

SensePro is CEVA’s DSP (Digital Signal Processor) used in many autonomous devices and it’s one of the key growth areas for CEVA at the moment. Autonomous devices (AV’s for example) receive a lot of raw data from visual data (what object is in front of them), range data (where an object is), and motion data (inertial measurements). Cleaning this data has always been a challenge and always required separate chips for separate senses. SensePro understands video, radar, LiDAR, and other data within the same chip.

Numbers:

Revenue Growth: 9.8%

Gross Margins: 87.2%

Operating Margins: -10.1%

Valuation:

NTM EV/Revenue: 3.8x

FY26 Expected Revenue Growth: 13.0%

NTM EV/EBITDA: 26.2x

FY26 Expected EBITDA Growth: 63.3%

NTM P/E: 38.4x

Edge AI Processors (The Chips)

These design the specialized processors, MCUs, SoCs with built in accelerators (NPUs, TPUs) for direct on device execution. They prioritize real time processing, low latency, and efficiency for applications like autonomous drones or smart cameras.

This is where a few of the pure plays I like are based. Massive cloud GPU’s are all about raw power but these chips are judged by Tera-Operations Per Second - the ability to perform millions of operations quickly whilst using little battery power.

Chips Stocks to Invest In:

AMBA

LSCC

SYNA

MCHP

QCOM

STM

There are a few stocks here that aren’t as well-known so I’ll be diving into them.

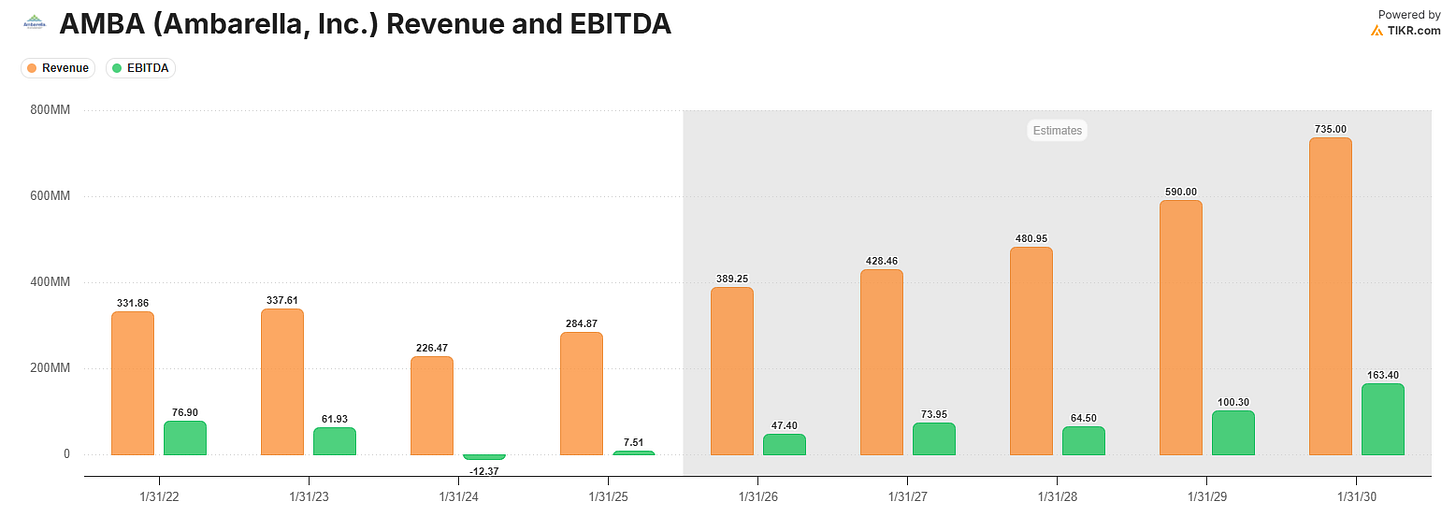

Ambarella | AMBA

Description:

AMBA provides the “visual” for edge devices, designing Systems on Chip (SOCs) that allow cameras to record video and understand it in real time. They have CVflow architecture that is designed to run object detection or terrain mapping at very low power. They currently have a core focus within security cameras, but are attempting to carve out more share in automotive vehicles, industrial robotics, and wearables.

Since management see the Edge AI demand, they’ve now transitioned so that 80% of revenue comes from Edge AI. AMBA was previously predominantly in the automotive sector, but today they’re winning share in autonomous drones, and other areas of Physical AI. AMBA’s stock has been held down because of Western OEM’s…but if AMBA can make this strategic pivot to the next generation of robotics and agentic devices I think this stock has massive potential.

Numbers:

Revenue Growth: 25.8%

Gross Margins: 59.6%

Operating Margins: -23.9%

Valuation:

NTM EV/Revenue: 6.1x

Expected FY26 Revenue Growth: 36.6%

NTM EV/EBITDA: 39.4x

Expected FY26 EBITDA Growth: 531%

Lattice Semiconductor Corporation | LSCC

Description:

LSCC is the leader in the niche of low power Field Programmable Gate Arrays. Most chips are programmed and “set in stone” during manufacturing. LSCC’s are reprogrammable after they leave the factory which makes them a critical enabler for Edge AI as companies can update their hardware to run the latest AI models without physically replacing any device.

Whilst not a 100% pure play on Edge, Edge AI is probably the catalyst driving a big portion of their stock price right now. Just like AMBA, they’re making a strategic pivot to robotics, humanoids, and autonomous vehicles. More specifically, they’re focused on applications that run under 1 watt and recently won a contract for an industrial robot in Japan. AMBA is working mainly under 2 watt, so there could be a bit of potential for LSCC to dominate this niche of Edge AI.

Numbers:

Revenue Growth: 2.7%

Gross Margins: 68.2%

Operating Margins: 2.9%

Valuation:

NTM EV/Revenue: 19.0x

FY26 Expected Revenue Growth: 33.1%

NTM EV/EBITDA: 52.3x

FY26 Expected EBITDA Growth: 38.7%

NTM P/E: 62.4x

Synaptics | SYNA

Description:

SYNA is quickly transitioning from a legacy PC interface company to a leader in Edge AI. They are designing the Astra platform which essentially allows devices to see, hear, and understand users locally as they specialize in the “senses” of the AI world. This allows smart home hubs, industrial appliances, and wearables to process complex content without the need to send data to the cloud.

The growth side of the business is the Core IoT division which is surging right now (53% YoY). Most interestingly for me, on the recent earnings report, SYNA mentioned a “major humanoid client”.

“We are now sampling silicon for pilot builds of humanoid at a major customer that’s leading the marketplace to deliver pilots this year and go into production next year. This is on the backs of our touch sensory controllers and our bridge solutions that help transport high bandwidth data effectively in the humanoid.”

Numbers:

Revenue Growth: 12.0%

Gross Margins: 43.1%

Operating Margins: -6.2%

Valuation:

NTM EV/Revenue: 3.2x

FY26 Expected Revenue Growth: 10.6%

NTM EV/EBITDA: 15.1x

FY26 Expected EBITDA Growth: 18.0%

NTM P/E: 18.9x

Microchip Technology Incorporated | MCHP

Description:

MCHP designs chips that run lightweight AI models on devices with minimal battery power, such as a factory sensor detecting a motor vibration. The vast majority of its revenue comes from standard chips to the industrial and automotive sectors but Edge is becoming a bigger piece of the pie.

Numbers:

Revenue Growth: -42.3%

Gross Margins: 55.4%

Operating Margins: 6.3%

Valuation:

NTM EV/Revenue: 8.7x

FY26 Expected Revenue Growth: 6.0%

NTM EV/EBITDA: 23.8x

FY26 Expected EBITDA Growth: 18.5%

NTM P/E: 32.3x

STMicroelectronics | STM

Description:

STM is the European giant of IoT. In Edge, they are rapidly integrating Neural Processing Units (NPUs) directly into flagship STM products to allow everyday devices to perform more complex tasks.

This means STM gives you:

Stability

Exposure outside of the US markets

Numbers:

Revenue Growth: -11.1%

Gross Margins: 33.9%

Operating Margins: 4.5%

Valuation:

NTM EV/Revenue: 2.1x

FY26 Expected Revenue Growth: 11.7%

NTM EV/EBITDA: 8.7x

FY26 Expected EBITDA Growth: 26.2%

NTM P/E: 28.8x

The Chip Builders

These are the picks and shovels plays of which most of them you will have heard of already. They provide the heavy machinery and manufacturing technology needed to physically build out this AI revolution…both on the Cloud and on the Edge.

Here’s the list of stocks. I could make this is a lot more in depth but for conciseness I decided to keep it brief. For completeness however, I wanted to include these names though as they’re still absolutely vital for the journey to the edge.

Chip Builder Stocks to Invest In:

ASML

LRCX

TER

AMKR

AEIS

AMAT

NVMI

CLS

Of this list, AMKR is probably the stock here most associated with the Edge. Although inefficient, chips in the Cloud can get away with being slightly larger and hotter. On the Edge, this isn’t feasible.

AMKR focuses on Systems-in-Package. They take multiple components (processors, sensors, memory etc) and put them together in the most efficient way. They’re the ones “miniaturizing” the technology so that we have low latency, cool, and fast chips within our devices.

AMKR is essentially the next step in “Moore’s Law”. Transistors are getting smaller but the rate of this happening is slowing down. To get more power for AI, vertical packaging (known as 3D Packaging) is becoming the necessity.

Memory

Similar to above, this isn’t pure Edge. Rather it’s simply the foundation of AI. Nevertheless, Edge AI is likely to create even bigger demand for MU and SNDK.

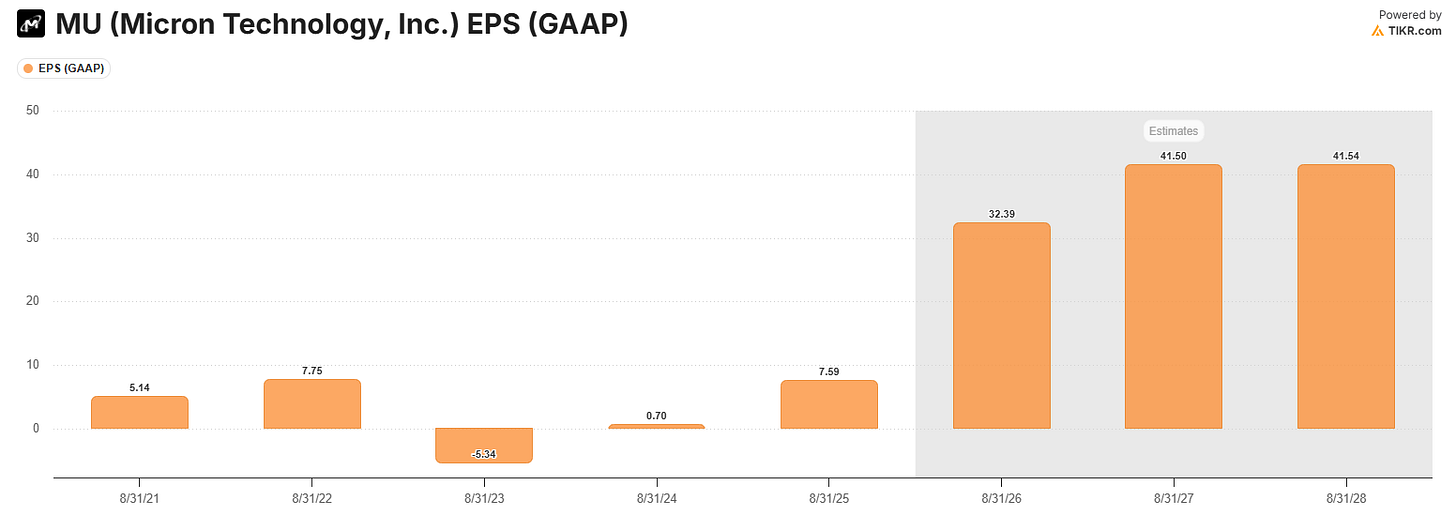

Micron Technology | MU

As AI moves from data centers to the Edge, MU is set to be the key beneficiary. RAM has historically only needed to be large enough to hold a few open apps. However, running generative AI models locally on the Edge requires holding huge amounts of active memory at all times. Devices with standard 6GB or 8GB or RAM cannot function as “AI devices” meaning next generation devices must need 12GB-16GB of RAM.

For MU, this means they have a multiplier effect. Even if the amount of end “AI devices” stays flat, the memory needed on each devices is increasing 2-3x. But it’s not just the amount of memory. MU sell LPDDR5X which is a high-performance, premium product designed to feed data to AI processors at much faster speeds than typical RAM. A multiplied amount of more memory and better memory puts MU as a stock to benefit over the long run as AI heads to the Edge.

Networking and Connectivity Enablers

These firms provide the infrastructure for seamless data transmission between edge devices and networks, including optical components, switches, and connectors. In edge AI, low-latency connectivity is key for distributed systems, such as 5G/6G integration or photonics to handle massive data flows without bottlenecks.

CSCO

AVGO

ANET

GLW

CIEN

LITE

APH

Amphenol (APH) currently shows up as “Very Bullish” on my spreadsheet.

Edge AI Infrastructure and Systems Integrators

This sub-theme covers companies building complete edge computing platforms, servers, and supporting infrastructure like cooling/power. They integrate hardware for deployable edge AI solutions in enterprise, industrial, or rugged settings, focusing on scalability and resilience beyond just chips. This remains a huge bottleneck today in Cloud, so I suspect the opportunities here on the Edge will be quite substantial.

HON

DELL

HPE

NVDA

VRT

OSS

One Stop Systems | OSS

Description:

OSS builds ruggedized, high performance computing platforms that can survive heat, shock, and vibration making them perfect for the Edge. They operate mainly with tanks, fighter jets, and autonomous mining equipment making them more of a pure play Edge AI hardware company.

Along with being a pure Edge AI play, OSS is also a critical military contractor. They’ve recently:

Secured a $5M urgent order for 61 Rugged Data Units for aircraft during Venezuelan tensions.

Delivered specialized edge computers for maritime environments used by SEAL teams.

Numbers:

Revenue Growth: -10.2%

Gross Margins: 29.0%

Operating Margins: -10.5%

Valuation:

NTM EV/Revenue: 6.2x

FY26 Expected Revenue Growth: 19.8%

NTM P/FCF: 37.9x

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Fascinating breakdown of the latency bottleneck that's driving decentralization. The fact that 75% of data gets generated at the edge but still routes through centralized infra is wild. I'veseen similiar inefficiencies in other domains where the round trip delay fundamentally limits what's possible operationally.