LMND Q4 Earnings Review: An Updated Bull Case

+$500 PT (Current share price is $61)

Lemonade (LMND) released Q4 results today.

LMND produced some of the best numbers I’ve seen, popped 13% in the pre-market, and then sold off all the way down to -6.2% on the day within the first 15 minutes of market open.

If that’s not a sign of the kind of market we are in today, then I don’t know what is.

Anyhow, let’s dive in. This is just another opportunity to buy into LMND if you are wanting to in my opinion.

Introduction

As paid subs will know, my current cost basis on LMND is $39. My entire portfolio, watchlist, and themes I’m tracking are all visible in my spreadsheet.

You can access it via the link above. If you want to see what my spreadsheet has to offer, then have a look at this article.

I’ve put out multiple articles on LMND over the last year as well. Here they are linked 👇

I’m up over 60% on my position now (it was +110% at the January highs post announcement of TSLA FSD insurance), but we’re back down to September 2025 highs right at this $60-$62 key level. Personally, I’m not going to buy anymore at the moment (aside from my biweekly DCA’s) just because the bias on the SPY and QQQ is pretty uncertain right now.

I’m not completely sure why LMND sold off today post earnings. It’s likely the market is still grouping LMND together with the wider AI/tech world which is getting sold off. More specifically, the market is assuming that AI is going to commoditize insurance.

My take on this is that an AI model is only as good as the data it is trained on. It’s quite clear looking at the numbers for LMND and the trend we’re seeing in margins, and GLRs vs legacy players who aren’t built or trained with the same quality data. More importantly, if it is a “race to the bottom”, LMND is heading quickly towards having the lowest expense ratio in the entire industry. They’re years ahead of their competition in the space.

Nevertheless, in terms of position sizing this sell off is evidence that going too big on any one theme right now is not the smartest play. Although, the AI plays I have invested in I believe will be huge beneficiaries over the long term, the market is grouping them together and selling them off. It’s why UPST is down post great earnings…it’s why LMND sold off post great earnings… it’s why SOFI struggled to catch a bid post some of the best earnings they’ve produced.

It’s a tricky market to work yourself around right now…but that doesn’t change any thesis that has a solid 3–5-year time frame. What it should change though is your mindset today. People see dips and immediately think let’s load up without considering technicals and without considering where the indexes are. That’s better than panic selling (which many also do), but it’s still not the right mindset to have.

The QQQ is currently looking quite weak on the daily and the SPY is only just holding above the 100 daily as well. This calls for caution. It’s a completely unknown market today with ~54% of SPY stocks being overbought whilst 27% of the SPY is oversold. We’re seeing aggressive buying and selling at the same time and a very rapid rotation from growth to value.

Be aware, but don’t jump into high growth names blindly. That’s just my quick sidetrack away from LMND for a minute. I’ve seen many people online get wiped out by going far too heavy into certain plays or themes…even some with leverage. They seemed like geniuses over the last 2-3 years bull market but now it’s clear they’re not.

Having strict rules and being open to change your bias quickly is how we’re working our way through this market.

Back to LMND 👇

Materials

Here’s a link to the Q4 Shareholder Letter

Here’s a link to the Q4 Earnings Call

I view most of the earnings transcripts I read through Tikr. You can view Tikr here.

Numbers

Demand

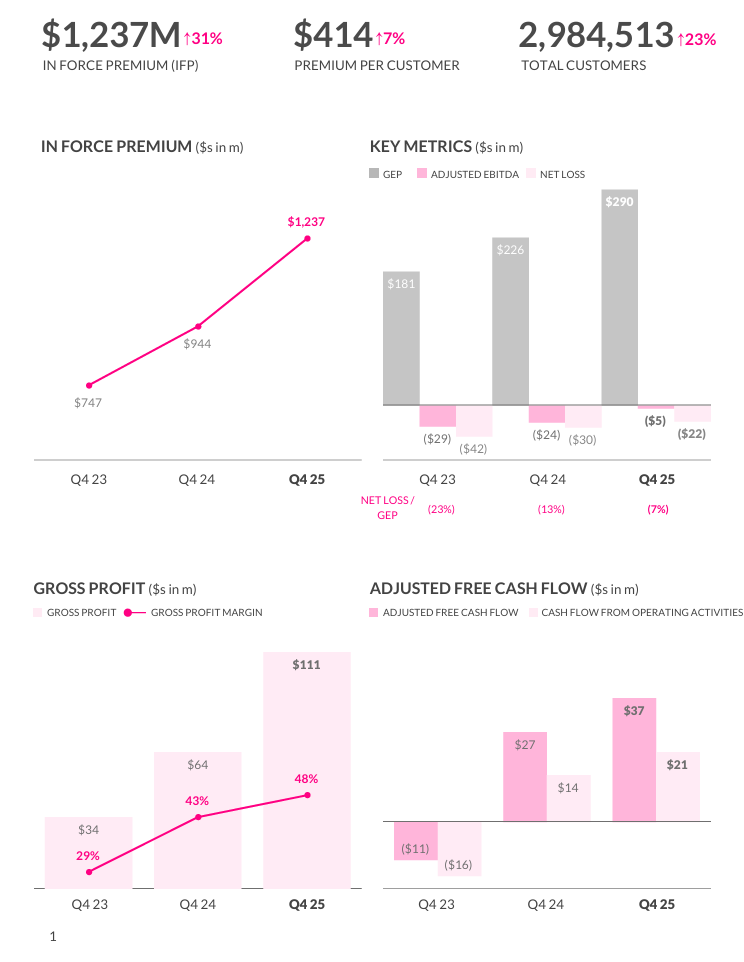

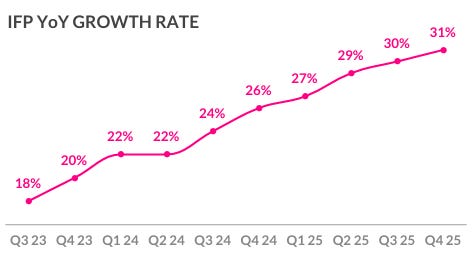

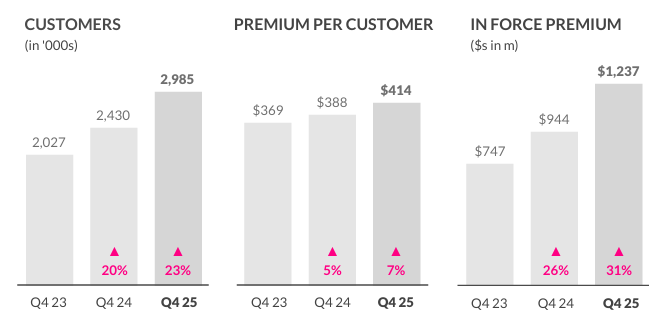

IFP YoY Growth Rate: 31% to $1.24B. This means IFP growth rate has increased for 9 consecutive quarters.

78% of this IFP comes from homeowners and pet, with car now making up ~15% of IFP.

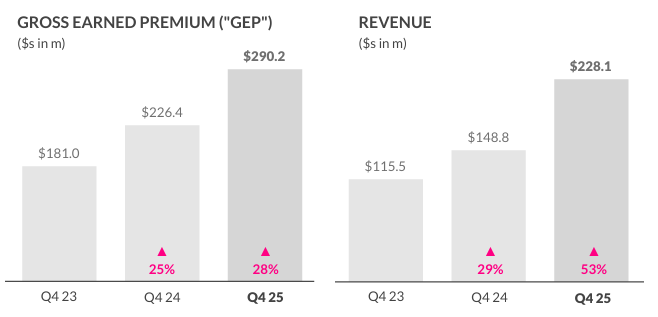

53% revenue growth.

Premium Per Customer: +7% YoY

Premium per customer is $2,021 for car and $247 and $804 for homeowners and pet respectively. Car is how LMND is set to 10x.

Just 2 quarters ago this premium per customer growth was 5.6% and now we’re at 7% and have still barely touched the surface with cross selling. FWIW, the US average for premium per customer is above $4,000 but LMND are at $414. That’s testament to the growth potential ahead for them as car continues to ramp up, but also the cost that LMND pass on to the customer.

Total customers: 2,984,513 customers

Profitability

Gross Profit Growth Rate: 73% YoY to $111 million.

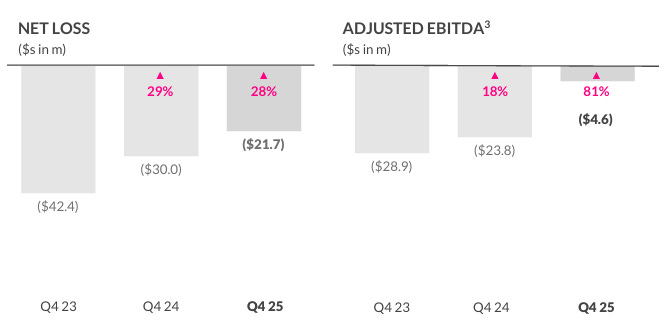

Adj. EBITDA: ($5 million).

LMND are heading very quickly towards Q4 Adj. EBITDA profitability.

Cash Flow: $37M in Adj. FCF

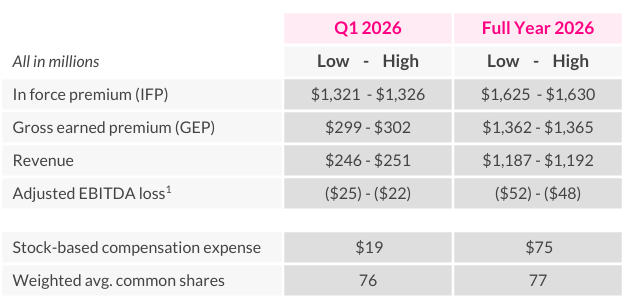

Guidance

Management reiterated Q4 positive Adj. EBITDA in 2026, with 2027 being the first full year of Adj. EBITDA profitability. Management first forecasted this timeline back in 2022 evidencing the predictability of their forecasts. For a small cap back in 2022, that’s incredible.

Opportunities

Profitability

2026 has always been the year that management have said they’ll reach their first Adj. EBITDA profitable quarter (with GAAP income profitability in 2027). This speed and stability towards EBITDA and net profitability is incredible whether you compare it to legacy insurance peers, or other high growth companies in different industries with similar market caps.

Let’s look at peers:

ALL’s operating margins have been extremely volatile YoY but have only increased 400 bps from FY21 to today. On the other hand, LMND which has been growing at multiples ahead of ALL have managed to consistently bring down operating margins from -182% in FY21 to -25% today. This stability is only going to continue with scale which means the net income potential for LMND in 2030 onwards is going to be incredibly large.

Being bearish on LMND from a profitability standpoint makes no sense. They’re a smaller cap, disruptive tech company that has been around for a decade. They’ve trended margins in the right direction with complete transparency for the last 5 years. It’s only a matter of time before these numbers turn positive.

Cross Selling

Cross selling remains the key opportunity for LMND. It’s one of the reasons to be so bullish on the company. If the LTV/CAC (Lifetime Value / Customer Acquisition Cost) can increase YoY, then you have an extremely scalable business model.

A 3:1 LTV/CAC ratio is considered an extremely good ratio for long term sustainable growth. Over the last two quarters, LMND has been above 4.0.

That’s testament mainly to more than half of car customers being existing users…i.e. coming in to car at an effectively $0 cost. Here’s why this is so key:

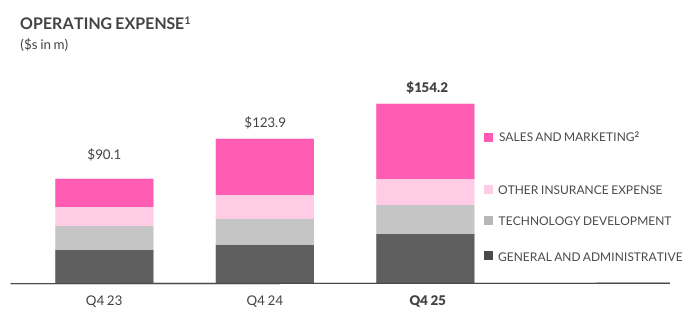

LMND’s current spending (mainly marketing spend) has a clear return on investment that is paying off predictably over time. It tells management that they can continue to safely lean into continued growth without damaging any future profitability. As I touch on in the earnings highlights, because LMND’s underwriting has been so strong recently, they’ve freed up some capital. All of this extra capital is being ploughed back into marketing, and also reinvestment into upgrading the platform and the way they cross-sell.

Car remains the huge growth engine for LMND. Pet and renters insurance are the slightly lower premium parts of the business so if LTV/CAC for these is still above 3x, imagine what the LTV/CAC ratio will be like when car is fully scaling.

Management said that by 2027, LMND’s car product will be available to the “overwhelming majority of the US population.” If you think of the timelines here, 2027 is going to be the year where LMND hit GAAP profitability and where car begins to start fully scaling. That’s two huge tailwinds for numbers of the company, but also the narrative of the company.

This is when bull cases will start to really materialize.

Europe

Europe remains a huge opportunity for LMND, though it’s still quite immaterial as a percentage of the total business right now bring in less than 5% of the IFP. It’s worth noting here that pricing, underwriting, and regulations are very different in Europe to the US. As LMND’s footprint continues to increase in Europe (IFP grew 150% YoY in the region), then the rate of AI model improvements will increase too.

Earnings Call Highlights

The Core LMND Bull Argument:

“Traditional insurers treat tech as a cost center, not their core. They rely on third-party vendors that are themselves built on legacy systems. It’s very hard for an organization like that to compete with a full-stack tech-first company.”

This is the core LMND bull case and the numbers/trends back this up completely. LMND have a structural advantage vs incumbents.

The TSLA FSD Integration:

“By integrating directly with the car’s onboard computer, we can tell which mode that car is in at any given moment…autonomously driven miles using Tesla’s FSD are priced at about 50% of the premium of the equivalent human-driven mile.”

LMND is plugging into the car’s hardware giving them a huge data advantage. The main AI bear argument is about commoditization. The moat going forward with AI is all about the quality of data. Those companies with the best data will win (hence why ZETA is also a key position for me).

But it’s not just about the data. Legacy plays like Geico or State Farm won’t have the cost efficiencies to be able to profitably offer packages for 50% below human driving rate.

Adj. EBITDA and Forward Guidance:

“Yes. So from an EBITDA, maybe two questions in there perhaps. From an EBITDA perspective, we do expect Q4 this year, '26 to be fully positive as well as the full year of '27, which would be the first full year of EBITDA positivity. While we've not indicated growth rates beyond '26, we have been consistent in our communication that a 30% plus growth rate is our goal and an accelerating growth rate each quarter is also our goal. And so I would expect that ambition to continue into '27 and beyond given the immense size of the market that we're in and the markets that we can potentially be in.”

I’d love if management gave a slightly firmer forecast on forward looking guidance, but we haven’t really had anything new just yet. Timothy did say he expects 30% plus IFP growth and QoQ acceleration to continue throughout FY26, into FY27, and beyond.

I haven’t incorporated that into my model yet to be conservative, but if LMND can continue acceleration for another 9 quarters into FY28, then this will be incredible.

Some confidence that we can take from this narrative though is that management have so far been very good at forecasting. They’ve said Adj. EBITDA profitability will happen in FY26 for ~3.5 years now.

Marketing Efficiency:

“So you saw a couple of things happening really coming together in Q4. Certainly, the underwriting or loss ratio side of the business came in very nicely. But from a growth perspective, which is really the core of the focus right now, which is how do we grow effectively? How do we maintain an LTV to CAC that we are comfortable with, number one, and excited about improving over time, number two. And how do we lean into that over time.”

This is extremely bullish.

LMND’s priority is growth at the moment. They know that underwriting and loss ratios will continue to come down over time and Q4 evidenced that in full force.

They freed up a little more capital in Q4 because of underwriting results which is all being ploughed back into additional growth because they’re so confident in maintaining an LTV/CAC ratio of +3x.

“We like what we're seeing in January and February to date. And so that guidance reflects real optimism about being able to spend more, significantly more in '26 than in '25. That's a continuing trend and to potentially see that growth rate accelerate.”

I think this is just a clear reminder that LMND remains a sub $5B company with extremely high growth rates and extremely efficient cost control. I don’t think there’s enough sub $10B company growing +30% YoY (revenue is actually much more than this) with such strong profitability trends.

If there is, let me know.

Updated Valuation

I’ll be updating my valuation model in my spreadsheet the next 24 hours post releasing this article. Here’s what my assumptions will comprise of and here’s how I still reach a 730% increase over the next decade. FWIW, I currently have ~$21,000 invested into LMND with an average cost of $39.41.

Based on this, I’m betting on that $21k turning into over a quarter of a million…and I hope that will be only 10-15% of my portfolio by then.

IFP came in a $1.273B which is a 31% growth rate. If we assume a conservative growth rate of 25% CAGR over a 10-year period, LMND will hit $11.6B IFP by 2035. That is a fairly high growth rate, but for a company that is currently still increasing their growth rate every quarter for the last 9 quarters, it seems like a realistic average over a 10-year period.

LMND’s gross loss ratio came in at 52% today. If we’re very conservative with new products and new geographies (car is currently at 70% and Europe is currently at 70%), a fair GLR by 2035 will in the region of 65%-70%. That would give gross profit in 2035 of ~$4.06B.

My model then assumes an operating margin of ~11-16% by 2035. Remember we should be positive Adj. EBITDA by Q4 26 and positive net by 2028. If we assume the bottom end of my 11-16% range, we will have $1.27B in operating profit ($11.6B IFP * 11%). At the upper end this would be, $1.856B in operating profit.

That’s then giving ~38% growth in operating profit which as per today’s multiples should result in a PE multiple of ~30x. $1.27B * 30x multiple gives a company worth $38.1B (on the upper end this would be $55.68B…again based on fairly conservative multiples).

Then from there it’s a simple share dilution. I assume 1.5% share dilution per year which would result in 81.2M shares.

$38.1B / 81.2M shares = $469 share price.

$55.68B / 81.2M shares = $685 share price.

I hope these conservative numbers give you a good idea of where LMND’s stock (currently at $61.59) is heading over the next decade,

This is completely unrelated to LMND, but just a couple quick thoughts on the trajectory of the market for the next decade. Historically, PE multiples have averaged ~16x-20x for the SPY. Is AI a margin expander or a margin compressor?

Margin expander:

The cost to serve is going to head down massively. This is the LMND bull case. If a company can grew revenues by 20% whilst reducing expenses, the business will trade like a software company. If every company can become “software like”, then every stock should be given a software like multiple.

AI will give predictability. Predictability over supply chains, consumer trends, credit defaults… everything. If AI reduces the volatility of earnings, the risk of owning stock drops. When risk goes down, equity risk premium goes down, which forces the P/E up.

AI will cause a huge amount of reinvestment. If costs continue to shrink and reinvestment goes down, companies will use cash to buy back shares at huge rates. This creates a scarcity of shares, driving up share prices.

Margin compressor:

If AI allows a tiny startup to replicate complex enterprises with human talent as a moat for a fraction of the cost, the multiples stocks trade at will be nowhere near as high. Investors pay lower multiples with weaker moats because of the fear a company may get disrupted in year 7 onwards for example.

Just a little note jotting to finish my article. Let me know if you have any interesting opinion on this. I assumed a 30x PE multiple in my model so far in 2035, and that just got me to write the above.

Let me know your thoughts.

Thanks for putting these positive earnings into the bigger picture. I think the market is very cautious atm so any short term pop on these growth plays will be sold off immediately.

Some neutral or slightly negative points I have noticed is that Lemonade for the first time increased their head count (4%) and that their home product is not growing but declining slightly. They make good arguments (home: terminating CAT, losers) why, but of course that might be excuses. I can also observe some negative sentiment about the experience (impersonal service, AI overload, surveillance, Israel connection) but that might be bias on these review sites. I will monitor that closely.

Awesome, Oliver.