My Portfolio 6 Months Into The Year

Completely Transparent

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Introduction

In this article, I’m going to give you full transparency and show you my entire portfolio of the 18 stocks that I am currently in. I won’t go into too much detail about all of them because I’ll save that for other articles/deep dives.

I’ll try to provide a bit of commentary on my current thoughts on the stock as well as details as to when I got in and my returns/losses so far.

You may notice if you follow me on X (Here's the link to my X) that there’s some stocks that were in my portfolio last month that aren’t there anymore. The big ones include Fortinet, Zoetis, Diageo, and UNH. I do think UNH still is a great hold but for the other three I just lost a bit of confidence in them especially compared to some of the other high growth stocks in my portfolio.

I do still like Fortinet, but when I compare it to SentinelOne, it doesn’t offer the high growth opportunities that I’m currently looking for in some of my portfolio.

Anyway, let’s get into my portfolio:

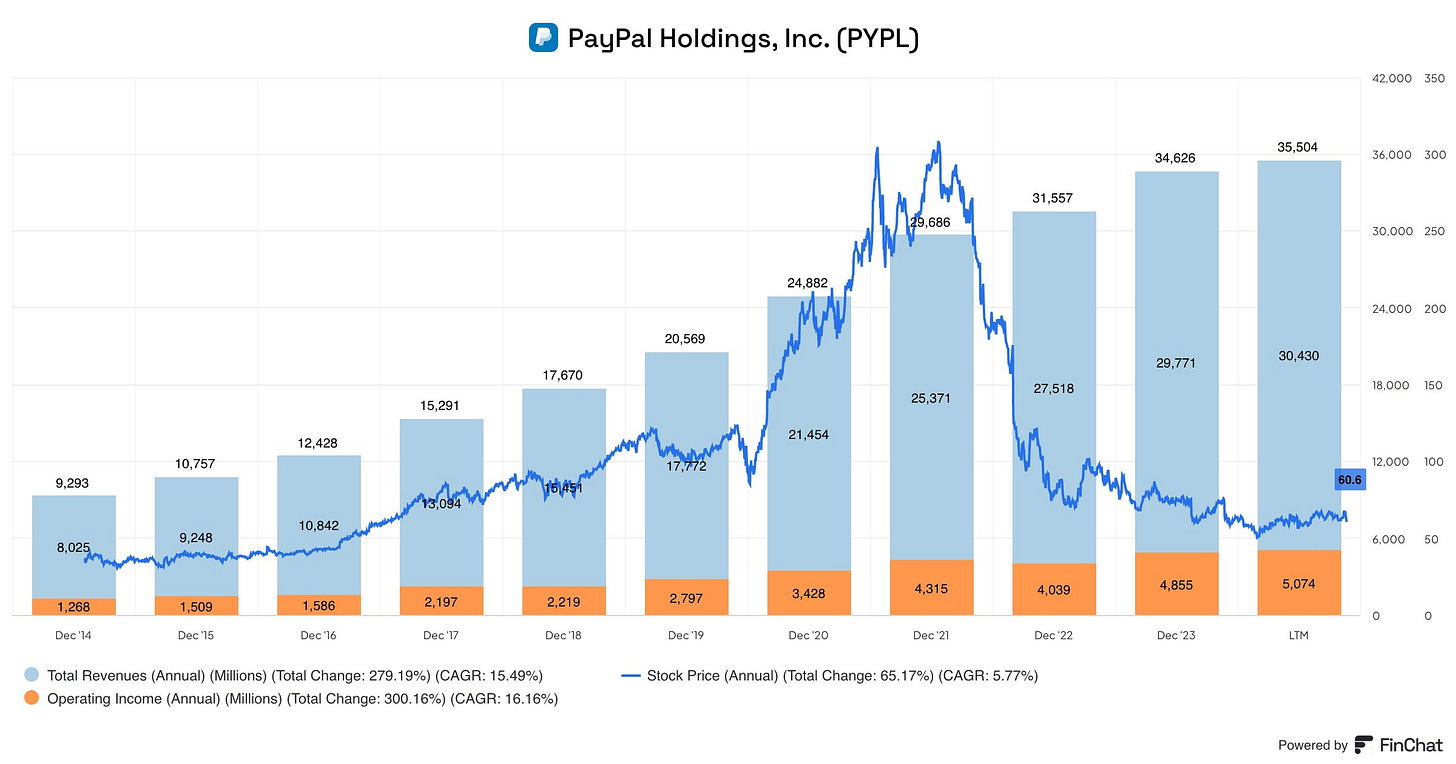

1. PayPal (PYPL)

When I bought: Multiple times starting in November 2023

Price I bought: $59 average

Price today: $58

There’s no denying PYPL’s price action has been extremely disappointing but I still have full belief in the turnaround story by new CEO Alex Chriss. Look at this chart firstly.

I’ve spoke a good amount about PYPL in other articles so far but here’s a brief rundown of my thoughts:

I don’t know why exactly the market loves to hate this stock currently but I really don’t see many reasons to be bearish, particularly at today’s prices below $60. Buying more than $5 billion of shares alone at these low prices should assist the stock price somewhat without even considering any of the other factors at play.

Here’s a brief rundown of some other points in a bullet point format for ease:

Revenue growth has slowed but it’s picking up again. Also PYPL has never had a quarter where revenue was less than the previous quarter. Revenue has grown every single quarter.

Operating expenses are falling QoQ creating a lot of leverage for management. This is all as a result of management efficiencies and layoffs.

EPS has rebounded sharply from the 2022 lows and is expected to grow at +16% on increased earnings and buybacks.

PYPL has a FCF Yield of 7.9% (as opposed to 3.3% for the S&P 500)

The problem for PYPL lies in the narrative that there is rising competition and lacking innovation meaning PYPL is “dead”. PYPL still has lots of work to do but the innovation and turnaround story is in play.

With the introduction of the advertising business, Fastlane, Xoom, Venmo, Braintree, and branded product innovations on top of the fundamentals I spoke about above, I have full confidence that PYPL’s stock price will recover.

2. SoFi Technologies (SOFI)

When I bought: Multiple times starting in March 2024

Price I bought: $7.10 average

Price today: $6.55

SoFi is another hated stock on Wall Street that I love. Bear cases are thrown around left right and center with many saying SoFi has no moat which is completely false.

SoFi is building the all-in-one financial platform. The company currently boasts:

50% CAGR in the financial services division

Stable and healthy lending business (capital ratio at 17.3% vs 10.5% minimum)

Tech revenue growing 21% YoY with expenses up just 1% YoY. If this trend continues, contribution profit for the tech segment will be up 75%.

The Galileo tech segment is one of the main bull cases for me as a SoFi investor but we need patient to see the full effects of this in the numbers. Even though management say demand is extremely high amongst “many of the top US banks”, it takes at least a quarter to sign clients up and then integration may take even longer than that, so the actual numbers may take a while to show proof of concept here.

3. Alibaba (BABA)

When I bought: November 2023

Price I bought: $78

Price today: $72

Like PYPL, BABA is one of my value plays. I talk about BABA quite a bit on X (Here's the link to my X) and the comments are very split between BABA being one of the cheapest quality companies in the entire market and BABA being “uninvestable” because they’re in China.

I fully understand the risks of investing in China but I outlined my thesis on China here:

BABA is one of the most diversified companies in the world with their core, cash flowing operations in e-commerce, and their high growth/high potential operations in Cloud (amongst many others).

Here are the facts for BABA:

BABA IPO’d in 2014 with revenue of $12.3 billion and a share price of $90.

Revenue in 2024 is $126 billion and the share price is $72.

Free cash flow over this decade has also gone from $5 billion to $24 billion.

If you take out cash, BABA trades for just below 4x free cash flow.

Is China that “univestable”?

4. Realty Income (O)

When I bought: September 2022

Price I bought: $59

Price today: $52

I’ve not spoke about Realty Income much at all but it has been a staple in my portfolio for about 2.5 years now and it’s purely an income play due to the monthly dividends they offer.

The REIT world is very extensive, and Realty Income are arguably one of the largest players out there with assets such as grocery stores, convenience stores, restaurants, health and fitness centers, automotive service companies and many more. With just under 80% of rent accounted towards the retail space it’s a fairly concentrated REIT, but it does have around 11% of income coming from the UK.

I’ll likely do a more extensive deeper dive into O at some point, but for now let’s just take a look at the trends.

Revenue in the latest quarter: $1.2 billion

Revenue in March ‘23 quarter: $925.3 million

This is a 33.5% increase in revenue over the year which mainly came from new lease contracts and acquisitions, as well as rent escalations. Realty Income bought Spirit Realty Capital over the last year which led to an additional 2,018 properties owned.

Even more positive than revenue growth, we saw noticeable improvements in profitability metrics with operating cash flow increasing from $731.2 million to $778.7 million. As a result of the positive trending fundamentals, O announced a dividend increase of 2.1% this year which is the 126th dividend increase since IPO.

5. Newmont Corporation (NEM)

When I bought: February 2024

Price I bought: $33.3

Price today: $43.3

NEM is my gold and copper play that has so far worked out extremely well. Here’s my investment thesis on NEM:

As a quick summary of the article above, gold has many bullish catalysts such as:

Macro uncertainty

Geopolitics

Central bank buying

End of interest rate hikes

They’re also increasing their exposure to copper (just over 10% now) which is needed for the decarbonization/electrification trend we are in the midst of as a society today. S&P state that demand for copper will be short by ~50 million tons by 2035.

6. Veeva Systems (VEEV)

When I bought: November 2022

Price I bought: $166

Price today: $181

Veeva isn’t talked about much online, but I believe it possesses one of the widest moats and is one of the best stable compounders in the market today. Veeva provides cloud solutions for the global life sciences industry with customers like Eli Lilly, Novartis, and Bayer. With 80% of revenue coming from annual subscriptions, and net retention rates well above 100%, this is a sign of a quality compounding giant.

7. Silvercorp Metals (SVM)

When I bought: January 2024

Price I bought: $3.14

Price today: $4.58

Silvercorp Metals is my other precious metals play (along with NEM) but this one is mainly focused on silver, gold, lead, and zinc. SVM is in the process of acquiring OreCorp, an Australian mining company that owns an 84% stake in a gold mine in Tanzania. If this acquisition is successful, then SVM will become predominantly a gold miner which as I mentioned above I am very bullish on.

The acquisition has been ongoing for quite some time now and it’s tough to tell exactly how it’s going to play out. If the acquisition is a success, then I likely will trim either NEM or SVM so that my exposure to gold is reduced. I’d like a mining portfolio that is focused on gold but with a solid weighting towards silver and copper too which I currently do have pre-acquisition.

I do believe that now is a great time to hold mining stocks and I’m anticipating some big growth over the next 2 years in metals and mining.

8. Coinbase (COIN)

When I bought: January 2022

Price I bought: $189

Price today: $226

COIN isn’t a huge position for me, but I do like it because it gives me solid exposure to crypto (even though I do own BTC and ETH directly too). COIN has a 76% market share in the United States amongst all crypto exchanges. Having this share of the market in an arguably very revolutionary industry is a huge opportunity.

9. DLocal (DLO)

When I bought: December 2023

Price I bought: $17

Price today: $8

DLO is the only stock on here where I think I have a bit of regret buying, but I’m not willing to sell my position because I still see the investment thesis. The reason I regret buying it is because I basically chose it over NU which now I see to be a much superior company (with much better stock returns).

Despite this, I still do remain positive that DLO can provide investors like myself with strong returns over the next few years. Aside from the business fundamentals, I wanted to get exposure in my portfolio to Latin America and I think DLO and MercadoLibre (MELI) are two of the best plays to do this.

Due to the higher risk nature of DLO, I never made it a huge position in my portfolio which I’m thankful for post the 40% drop recently. I haven’t added just yet to my position but I may add a bit if price action starts to align with the fundamentals and my investment thesis.

10. Evolution AB (EVO)

When I bought: July 2022

Price I bought: SEK 941

Price today: SEK 1,104

EVO is a Swedish gaming company that creates live casino games for online gambling operators. The gaming operators then market these products to the end users.

They specialize in live realer games like roulette, blackjack, and poker. I like EVO for a few reasons. Outside of the business fundamentals it gives me exposure to Europe and Nordic countries which I’m quite bullish on, especially with my concerns around the state of the US market today and where that is headed in the shorter term.

Here is the net profit margin and FCF margin for EVO over the last decade. This is a pretty strong sign of a moat.

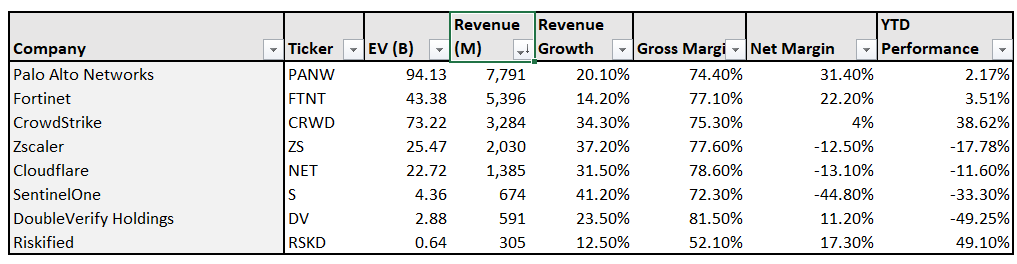

11. SentinelOne (S)

When I bought: Multiple times since March 2024

Price I bought: Average $21

Price today: $20.1

Here’s my favorite cybersecurity company that I’ve got high hopes for.

SentinelOne has struggled in 2024 but there’s early signs of a recovery in the stock price over the last 2 weeks after the stock dropped 20% post earnings and post my write up on the company which you can see below:

I bought S because I think it is one of the most fairly valued cybersecurity companies in the entire market even though it is the fastest growing company as well on a revenue basis. The reason for the low valuation is due to the unprofitability which I don’t believe investors are fully convinced S will be able to sustainably increase their margins without disrupting growth.

I disagree with this bear case. Although S doesn’t have the size and marketing expertise of CRWD yet, the products (in endpoint security) and product expansion into emerging tech are all very strong. Management are consistently winning bigger and bigger clients (particularly outside of endpoint) which is giving them the potential to become a key player in the entire cybersecurity space.

Of course the data isn’t there yet to fully back up the bullish case for S, but if it were then the stock would be considerably higher than it is today. I think at today’s prices, SentinelOne is by far the best risk to reward in the cybersecurity space.

12. Celsius Holdings (CELH)

When I bought: Multiple times since January 2024

Price I bought: Average $64

Price today: $57.4

CELH was a top performing investment for me up until the last 6 weeks or so where the stock has struggled massively and is now back down to levels as seen in February 2024.

I last gave an update on CELH at the end of May and I don’t think much fundamentally has really changed since then…aside from the stock price of course. There’s not much need for me to talk any more about CELH. CELH is a long term hold for me. I do believe it can become the size of MNST over time and be a solid compounder for years to come.

13. Uber

When I bought: May 2024

Price I bought: $66.2

Price today: $71.3

I love UBER but I think most people’s main concern with the company is the dangers that TSLA and robotaxi’s pose to the long term moat. Personally, I don’t see the danger and I do believe UBER will be a very strong competitor in the market even if TSLA is extremely successful in that venture.

I spoke a good amount about UBER in one of my latest articles (linked about in the CELH section).

14. Tesla

When I bought: June 2024

Price I bought: $170

Price today: $248.5

TSLA is a company that I’ve changed my mind on a few times over the years. I’ve never been a huge bull but I’ve never been on the bearish side either just make the vision and the possibilities for the company are pretty immense. I’ll save a deep dive on TSLA for another article, but just a brief summary on where the company is at right now is as follows:

EV adoption is up ~25% CAGR on an annual basis. I’ve tried not to look into this too much and instead try picture the vision over the next decade where EV’s likely won’t make up a big piece of the TSLA company. However, the reality today is that EV’s are still a huge part of the company and therefore we can’t lose focus on this core business yet.

EPS is starting to trend positively.

Fully self driving take rests are trending higher

Optimus production begins in FY’25.

With that being said, TSLA has been on a soar lately, pretty much straight away since I bought in. I think a lot of this move is hype and FOMO to be honest which has now led to PE ratio to be at the highest in two years. We’ve also got the ongoing regulatory risks involved with FSD and weaker earnings that don’t live up to the current TSLA hype.

I realize I’m not sounding overly bullish here compared to other companies in my portfolio. What I do strongly believe is that TSLA is an incredible risk to reward play in the $170 range where I bought in. The upside is very strong if all the hype plays out and the downside for a company like TSLA is not too bad I don’t believe.

15. Alarum Technologies (ALAR)

When I bought: April 2024

Price I bought: ILS 11.40

Price today: ILS 16.1

I was first introduced to ALAR by Kyle Adams on X (follow him).

ALAR is an Israeli company with 96% of their revenue coming from NetNut, their enterprise data collection solutions business. NetNut offers IP Proxy tools that help enterprises access websites anonymously, and scrape (extract) data from them. As the AI trend continues, so does the need to collect data.

YTD the stock is up 467.5% which is pretty mental. I haven’t managed to get triple digit returns yet, but I’m up around 70ish % which is incredible. I do think I’ll hold ALAR for at least another couple of years because the industry is arguably the most attractive industry in the market to be a part of. Holding one of the leading companies in this industry could be extremely lucrative.

16. Hims & Hers (HIMS)

When I bought: June 2024

Price I bought: $19.2

Price today: $20.5

I’m not going to write much at all on HIMS because my last article was a 24 minute deep dive on the company. Everything I’d want to write there is in this article (link below) so if you are interested give it a read:

17. Duratec (DUR)

When I bought: Multiple times since July 2023

Price I bought: AUD 0.73

Price today: AUD 1.19

DUR certainly isn’t a high growth stock in my portfolio, but it is a core holding that I believe will be a steady compounder for me. I’ve also got some higher risk holdings at the moment with the likes of ALAR, TSLA, CELH, PYPL, BABA, ONON, and S etc so I want to de-risk slightly with companies like DUR.

Duratec is an Australian listed company that is a leader in the maintenance services industry for assets like bridges, pipelines, ports, and high rise buildings. The company works in both the private and public sector and recently announced they have a very strong pipeline in the defense industry.

Revenues for the company are very predictable with 80% of all sales coming from existing clients. This means predicting future cash flows is much simpler than for other businesses in my portfolio which of course I love.

With this being said, the company is still a micro cap company and therefore room for growth is huge. Since IPO the company’s stock has increased 96% but for a company with DUR’s competitive advantage and potential, they’re still trading at a very fair valuation.

With an EV of $267.27 million and:

2025 Revenue Estimates of $603.5 million

2025 EBITDA Estimates of $52.26 million

DUR is trading at:

0.44x 2025 EV/Sales

5.11x 2025 EV/EBITDA

Very cheap for a company as competitively placed as Duratec.

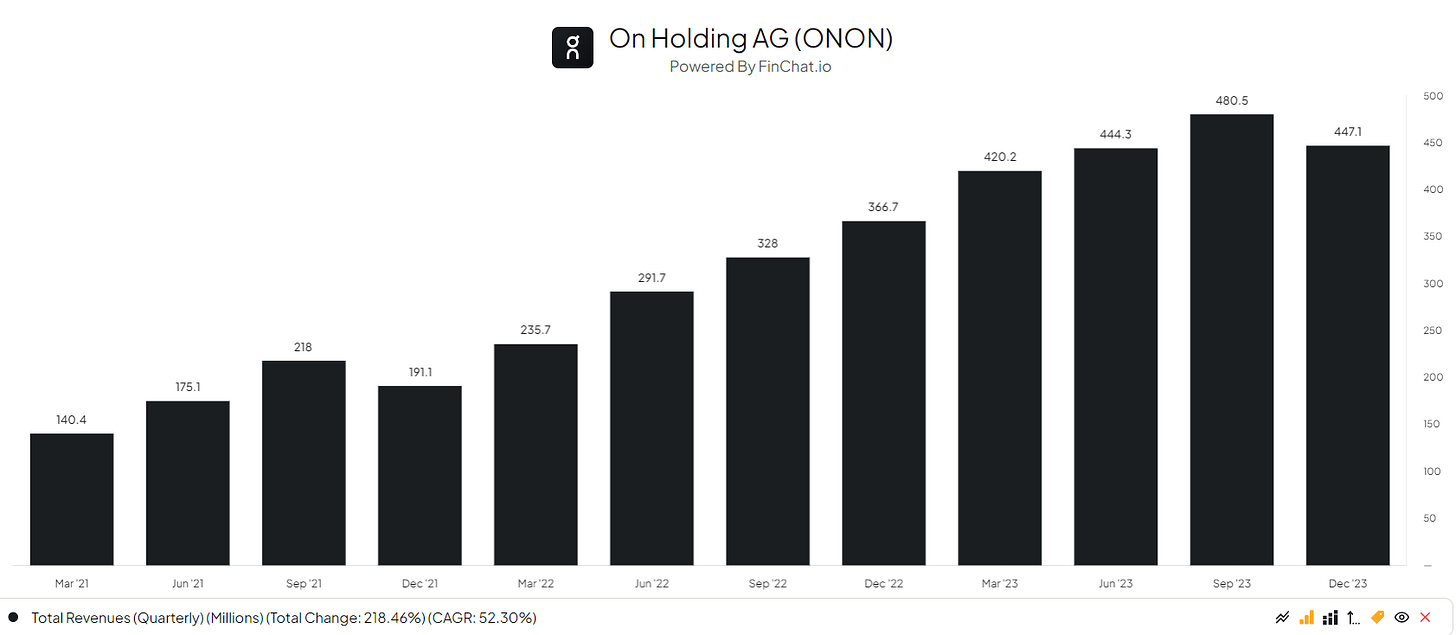

18. On Running (ONON)

When I bought: April 2024

Price I bought: $32

Price today: $36.65

I released an article on ONON in mid April where the company was trading at $32. Currently, the stock is trading at $37 after running up to $43 a couple of weeks ago so overall it’s done well so far.

I do think the company is a very good hold, and has huge potential moving forward. They are arguably the most “in” sports footwear company at the moment along with Hoka but the obvious danger is that trends move very quickly in industries like this.

ONON’s competitor NKE has had an awful year because of the likes of On Running and Hoka making competition very fierce. At current prices I’m really not sure what is a better investment between the in fashion disruptor ONON, and the huge staple Nike.

Let me know your thoughts!

Like this article?

Here’s some newsletters I’ve been loving recently:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Tesla is a volatile stock that has a lot of built-in drama. However, it has several interesting revenue sources with very high TAM. From my research, I believe Tesla is one of the best large scale manufacturers today. I suggest you investigate its energy business, which will soon surpass the auto business. In the next 2-3 years, additional revenue sources will be added with lithium refining, FSD (SaaS), cybercab and bots. Lots of growth opportunities.

Very nice portfolio! A lot of these names should break out pretty soon